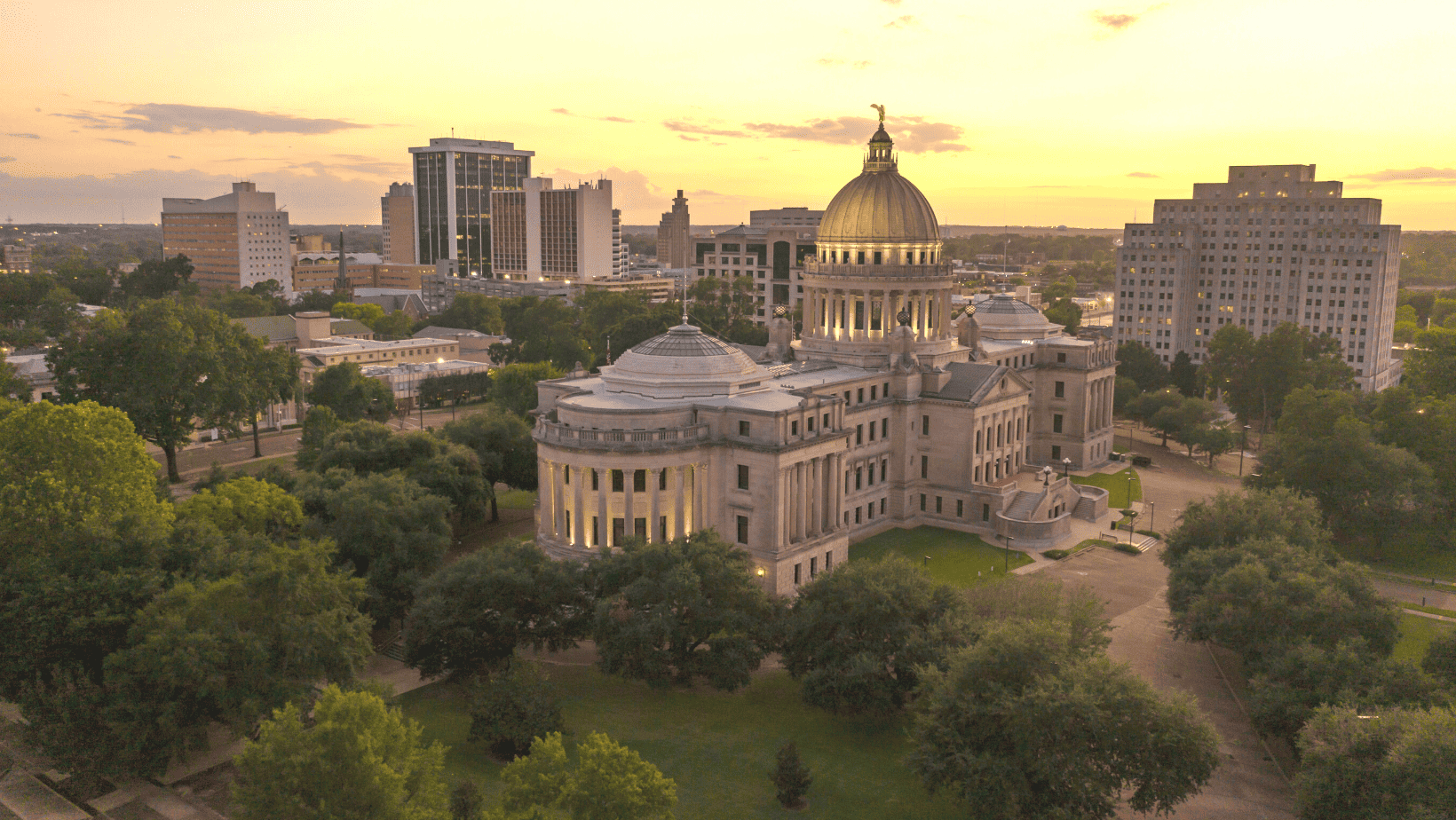

State Tax In Mississippi

The state of Mississippi, located in the southern region of the United States, has a unique tax system that impacts its residents and businesses. With a focus on fostering economic growth and providing essential services, Mississippi's tax policies play a crucial role in shaping the state's financial landscape. In this comprehensive article, we will delve into the specifics of Mississippi's state tax system, exploring its key features, rates, and the implications it holds for individuals and businesses alike.

Understanding Mississippi’s State Tax Structure

Mississippi operates under a comprehensive tax system that includes various components, each designed to generate revenue for the state’s operations and support its diverse range of services. Here’s an overview of the key tax categories in Mississippi:

- Income Tax: Mississippi levies an income tax on both individuals and businesses. The state's income tax structure is progressive, meaning that higher income brackets are taxed at a higher rate. This ensures a fair distribution of tax responsibilities among residents and businesses.

- Sales and Use Tax: Sales tax is a significant revenue generator for Mississippi. The state imposes a sales tax on most goods and certain services, with rates varying based on the jurisdiction. Additionally, Mississippi has a use tax, applicable to out-of-state purchases, ensuring that residents pay tax on goods regardless of where they are purchased.

- Property Tax: Property taxes are a crucial source of revenue for local governments in Mississippi. These taxes are assessed on real estate properties, including land and buildings, and are primarily used to fund local services such as schools, fire departments, and infrastructure maintenance.

- Franchise Tax: Corporations doing business in Mississippi are subject to a franchise tax. This tax is based on the corporation's net worth and is designed to contribute to the state's general fund.

- Excise Taxes: Mississippi imposes excise taxes on specific goods and activities. These taxes are often levied on items such as gasoline, tobacco products, and alcohol. Excise taxes provide dedicated funding for specific programs or initiatives, such as road maintenance or healthcare.

- Inheritance and Estate Taxes: Mississippi previously had an estate tax, but it was repealed in 2020. However, an inheritance tax remains in place, applicable to certain estates, depending on the relationship between the deceased and the beneficiary.

Income Tax in Mississippi: A Progressive Approach

Mississippi’s income tax system follows a progressive structure, which means that as income increases, the tax rate applied to that income also increases. This approach aims to ensure that those with higher earning capabilities contribute a larger share of their income to the state’s revenue stream.

| Income Bracket | Tax Rate |

|---|---|

| 0 - $5,000 | 3% |

| $5,001 - $10,000 | 4% |

| $10,001 - $25,000 | 5% |

| $25,001 and above | 5% |

It's important to note that these tax rates are subject to change, and residents should refer to the latest tax guidelines for accurate information. Additionally, various deductions, credits, and exemptions are available to reduce the overall tax liability for individuals and businesses.

Sales and Use Tax: Supporting Local Economies

Sales and use taxes are a significant source of revenue for Mississippi, contributing to the state’s overall financial stability. The sales tax rate in Mississippi is set at 7%, with additional local taxes varying across different jurisdictions. This variation in local taxes is a strategy employed by municipalities to address their unique funding needs.

For instance, Jackson, the state's capital city, imposes a local sales tax of 2.5%, resulting in a combined sales tax rate of 9.5% within the city limits. On the other hand, smaller towns like Greenwood have a lower local sales tax rate of 1%, leading to a combined rate of 8% in those areas.

The use tax, often overlooked, is equally important. It ensures that residents pay taxes on goods purchased online or from out-of-state retailers, preventing the erosion of local tax bases due to e-commerce growth.

Property Taxes: Funding Essential Services

Property taxes in Mississippi are primarily administered by local governments, with rates varying across counties and municipalities. These taxes are a crucial source of funding for local services, including education, emergency response, and infrastructure development.

For example, in Jackson County, the property tax rate is set at 35 mills, while in Harrison County, it is slightly higher at 37 mills. Mills are a unit of measurement for property tax rates, with each mill representing $1 of tax for every $1,000 of assessed property value.

| County | Property Tax Rate (Mills) |

|---|---|

| Jackson County | 35 |

| Harrison County | 37 |

| Hinds County | 42 |

Property taxes in Mississippi are assessed based on the fair market value of the property, with assessments conducted by local tax assessors. Homeowners can often benefit from various exemptions and deductions to reduce their tax liability.

Franchise Tax: Supporting the State’s General Fund

The franchise tax in Mississippi is a levy on corporations doing business within the state. This tax is calculated based on the corporation’s net worth, providing a steady stream of revenue to the state’s general fund. The franchise tax rate is currently set at 0.25% of the corporation’s net worth.

For example, a corporation with a net worth of $10 million would pay a franchise tax of $25,000. This tax is a crucial component of Mississippi's revenue generation, ensuring that businesses contribute to the state's overall financial stability.

Excise Taxes: Targeted Funding for Specific Initiatives

Mississippi imposes excise taxes on various goods and activities to fund specific programs and initiatives. These taxes are often targeted at goods considered harmful or luxury items, providing dedicated funding for important causes.

- Gasoline Tax: Mississippi imposes a tax of $0.186 per gallon on gasoline, with the revenue primarily allocated to road maintenance and transportation infrastructure projects.

- Tobacco Tax: The state levies a tax of $0.68 per pack of cigarettes, with the proceeds supporting healthcare programs and initiatives.

- Alcoholic Beverage Tax: Mississippi's alcohol tax varies based on the type of beverage. Beer is taxed at $0.20 per gallon, while wine and spirits have a higher tax rate, providing funding for law enforcement and public safety initiatives.

Inheritance and Estate Taxes: Legacy Planning Considerations

While Mississippi repealed its estate tax in 2020, the state still has an inheritance tax in place. This tax is applicable to certain estates, with the rate depending on the relationship between the deceased and the beneficiary. Spouses and lineal descendants, such as children and grandchildren, are exempt from the inheritance tax.

However, collateral heirs, such as siblings, aunts, uncles, and cousins, are subject to an inheritance tax. The tax rate for collateral heirs is set at 10% for estates valued at $500,000 or less and 15% for estates valued above $500,000.

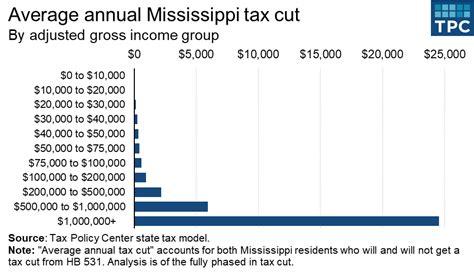

The Impact of Mississippi’s Tax System on Residents and Businesses

Mississippi’s tax system has a profound impact on both residents and businesses within the state. For residents, the progressive income tax structure ensures that higher-income earners contribute a larger share, promoting economic fairness. Additionally, the sales and use tax system supports local economies and provides funding for essential services.

Businesses, on the other hand, benefit from a relatively low corporate income tax rate, which can make Mississippi an attractive location for business operations. However, the franchise tax and excise taxes should be considered when evaluating the overall tax burden for corporations.

Mississippi's tax system is designed to strike a balance between generating sufficient revenue for state operations and providing a competitive environment for businesses. This delicate equilibrium aims to foster economic growth while ensuring the state can provide vital services to its residents.

Conclusion: Navigating Mississippi’s Tax Landscape

Mississippi’s state tax system is a complex yet essential component of the state’s financial ecosystem. From income and sales taxes to property and franchise taxes, each element plays a vital role in funding the state’s operations and supporting local communities. Understanding these taxes is crucial for residents and businesses alike, as they navigate the financial obligations and opportunities within Mississippi.

As the state continues to evolve and adapt to changing economic landscapes, its tax system will likely undergo further refinements to meet the evolving needs of its residents and businesses. Staying informed about these tax policies is key to making informed financial decisions and contributing to Mississippi's economic growth.

What is the current sales tax rate in Mississippi?

+The current sales tax rate in Mississippi is 7%, with additional local taxes varying across different jurisdictions.

Are there any income tax deductions or credits available in Mississippi?

+Yes, Mississippi offers various deductions and credits to reduce income tax liability. These include deductions for federal income taxes paid, contributions to certain retirement plans, and credits for childcare expenses.

How often do property tax assessments occur in Mississippi?

+Property tax assessments in Mississippi typically occur every four years. However, if there are significant changes to a property, such as improvements or damage, an assessment may be conducted sooner.

Are there any tax incentives for businesses in Mississippi?

+Yes, Mississippi offers several tax incentives for businesses, including tax credits for job creation, research and development, and investment in certain industries. These incentives are designed to attract and retain businesses within the state.