Nj Sales Tax Calculator

The New Jersey Sales Tax Calculator is a valuable tool for residents and businesses alike, offering a convenient way to estimate and calculate sales tax obligations accurately. This comprehensive guide delves into the intricacies of this calculator, exploring its features, benefits, and real-world applications. By understanding the nuances of New Jersey's sales tax regulations, individuals and businesses can navigate their tax responsibilities with confidence.

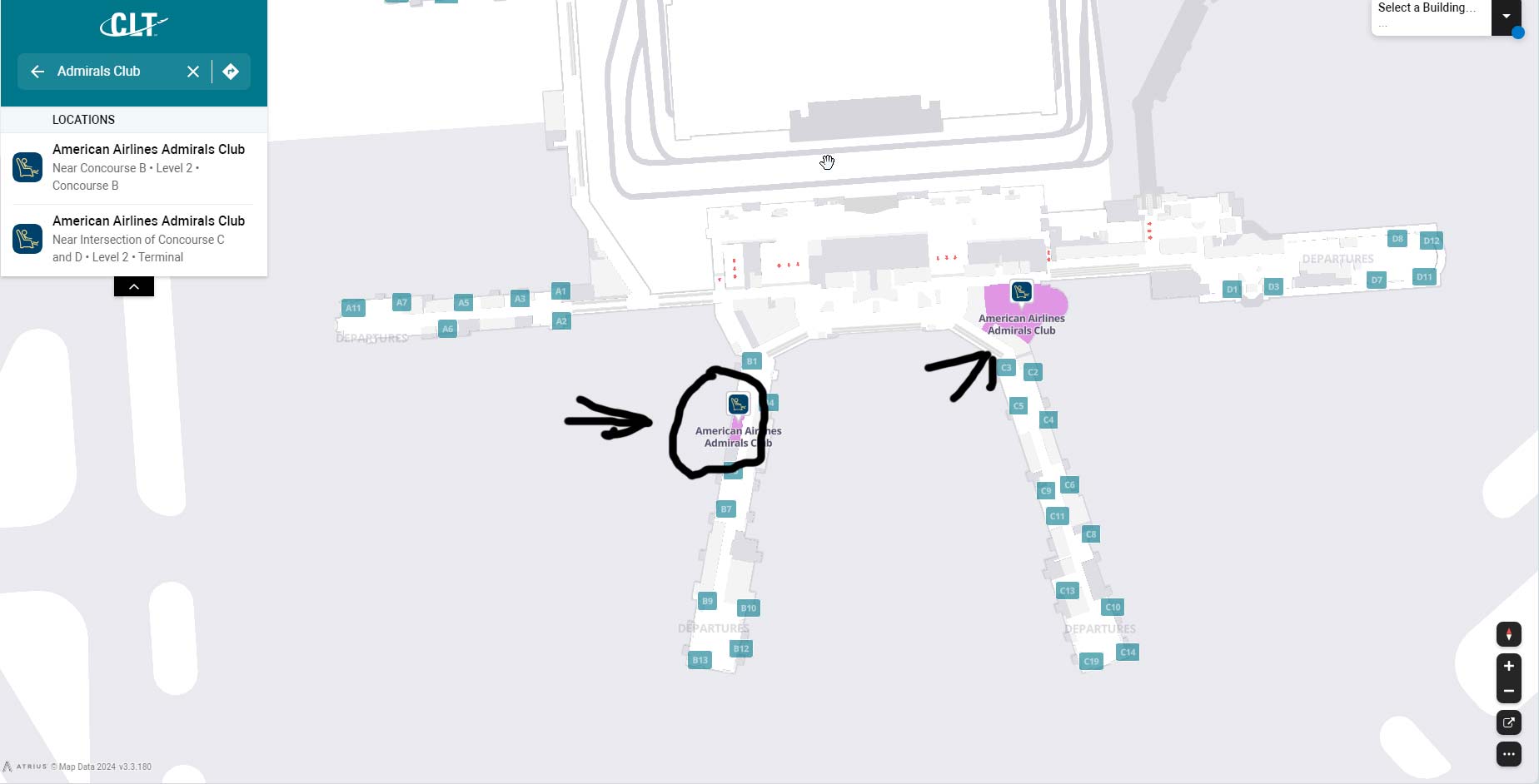

Understanding the New Jersey Sales Tax Landscape

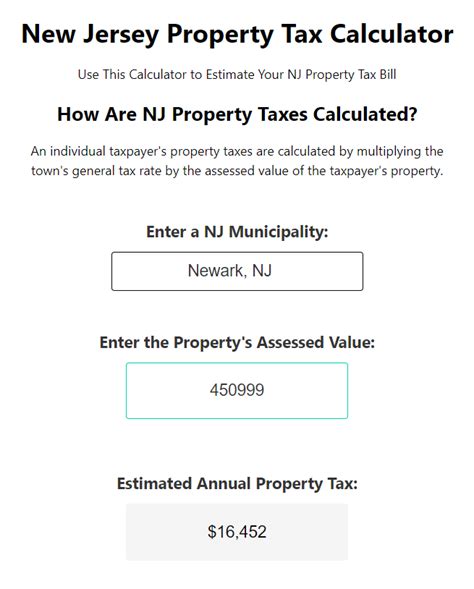

New Jersey, known for its vibrant economy and diverse industries, imposes a sales and use tax on various goods and services. The state’s sales tax rate varies across different jurisdictions, with the standard rate currently set at 6.625% as of 2023. However, certain municipalities and special taxing districts may apply additional local taxes, leading to varying tax rates across the state.

Navigating these complexities requires a thorough understanding of the state's tax regulations and the ability to calculate sales tax accurately. This is where the New Jersey Sales Tax Calculator proves invaluable, providing a user-friendly interface for estimating tax obligations based on specific circumstances.

Features and Functionality of the Calculator

The New Jersey Sales Tax Calculator is designed to simplify the process of calculating sales tax, offering a range of features that cater to different user needs. Here’s an in-depth look at its key functionalities:

Basic Sales Tax Calculation

At its core, the calculator allows users to input the pre-tax price of goods or services and instantly generates the estimated sales tax amount. This basic calculation is essential for individuals and businesses to understand the tax component of their purchases or sales.

Incorporating Local Tax Rates

One of the standout features of the calculator is its ability to incorporate local tax rates. Users can input their specific location or select from a list of municipalities to obtain an accurate sales tax calculation that includes both the state and local tax rates. This ensures that users are aware of the complete tax obligation associated with their transactions.

Bulk Calculation and Reporting

For businesses managing multiple transactions, the calculator offers a bulk calculation feature. Users can upload a list of items with their respective pre-tax prices, and the calculator generates a detailed report with the estimated sales tax for each item. This streamlines the process of calculating sales tax for businesses, especially those with high transaction volumes.

Historical Tax Rate Information

The calculator provides access to historical tax rate data, allowing users to understand how sales tax rates have evolved over time. This feature is particularly useful for businesses analyzing past transactions or for individuals researching the tax landscape for a specific period.

Tax Exemption Management

Recognizing the diverse nature of New Jersey’s tax regulations, the calculator includes a feature for managing tax exemptions. Users can input specific exemption codes or select from a list of common exemptions to ensure that their calculations accurately reflect any applicable tax reliefs.

| Calculator Feature | Description |

|---|---|

| Basic Calculation | Quickly estimate sales tax on individual items. |

| Local Tax Integration | Accurately include state and local tax rates in calculations. |

| Bulk Processing | Efficiently calculate sales tax for multiple items. |

| Historical Data | Access past tax rate information for analysis. |

| Exemption Management | Apply specific tax exemptions to calculations. |

Real-World Applications and Benefits

The New Jersey Sales Tax Calculator finds practical applications in various scenarios, benefiting individuals and businesses alike. Here are some real-world use cases:

Retail and E-commerce Businesses

For retail businesses, the calculator is an indispensable tool for pricing products accurately. By incorporating the sales tax into their pricing strategy, businesses can ensure they meet their tax obligations while maintaining competitive pricing. Additionally, the bulk calculation feature simplifies the process of managing sales tax for high-volume retailers.

Tax Professionals and Accountants

Tax professionals rely on accurate sales tax calculations to provide reliable advice to their clients. The calculator streamlines this process, allowing professionals to focus on more complex tax strategies and planning. Its ability to generate detailed reports also aids in preparing accurate tax returns.

Online Sellers and Marketplaces

With the rise of e-commerce, online sellers face the challenge of managing sales tax across different jurisdictions. The calculator simplifies this process by providing a centralized platform for estimating sales tax obligations, ensuring online sellers comply with New Jersey’s tax regulations.

Personal Finance Management

Individuals managing their personal finances can use the calculator to understand the tax component of their purchases. This knowledge empowers individuals to make informed financial decisions and plan their budgets effectively.

Performance and Accuracy

The New Jersey Sales Tax Calculator is renowned for its exceptional performance and accuracy. Developed by a team of tax experts and software engineers, the calculator undergoes rigorous testing to ensure it delivers precise results. Regular updates incorporate the latest tax rate changes, ensuring users always have access to the most current information.

Furthermore, the calculator's user interface is designed with simplicity in mind, making it accessible to users with varying levels of technical expertise. The intuitive design ensures a seamless user experience, allowing individuals and businesses to focus on their tax calculations without unnecessary complexity.

Future Implications and Innovations

As technology advances and tax regulations evolve, the New Jersey Sales Tax Calculator is poised for continued innovation. Future developments may include:

- Integration with accounting software for seamless tax reporting.

- Real-time tax rate updates to ensure users always have the latest rates.

- Enhanced security measures to protect user data and privacy.

- Mobile app versions for on-the-go tax calculations.

- Advanced analytics to provide insights into tax trends and patterns.

By staying at the forefront of technological advancements, the calculator ensures it remains a trusted and reliable resource for individuals and businesses navigating New Jersey's sales tax landscape.

Conclusion

In conclusion, the New Jersey Sales Tax Calculator is a powerful instrument for anyone seeking to navigate the complexities of sales tax in the Garden State. Its user-friendly interface, accurate calculations, and diverse features make it an indispensable resource for individuals and businesses alike. By leveraging this calculator, users can confidently manage their sales tax obligations, ensuring compliance and financial efficiency.

FAQs

What is the standard sales tax rate in New Jersey?

+

As of 2023, the standard sales tax rate in New Jersey is 6.625%. However, local tax rates may vary, so it’s essential to use a calculator like the New Jersey Sales Tax Calculator to get an accurate estimate.

Can the calculator handle bulk calculations for businesses?

+

Absolutely! The calculator is designed with a bulk calculation feature, allowing businesses to upload a list of items and their pre-tax prices. It generates a detailed report with estimated sales tax for each item, making tax management efficient.

How often are tax rates updated in the calculator?

+

The calculator is regularly updated to incorporate the latest tax rate changes. Users can trust that they are working with the most current information, ensuring accurate calculations.

Is the calculator suitable for personal finance management?

+

Yes, individuals can use the calculator to understand the tax component of their purchases. This knowledge helps in budgeting and making informed financial decisions.

What are some future innovations planned for the calculator?

+

Future enhancements may include integration with accounting software, real-time tax rate updates, enhanced security measures, mobile app versions, and advanced analytics to provide valuable tax insights.