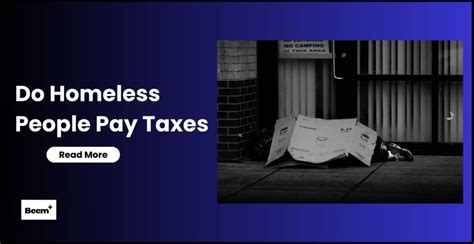

Do Homeless People Pay Taxes

The question of whether homeless individuals are subject to taxation is a complex and multifaceted issue that warrants a thorough examination. While it may seem counterintuitive to consider taxing individuals without stable housing or regular income, the reality is that the tax system often applies to various aspects of an individual's financial situation, regardless of their housing status.

In this article, we will delve into the intricate world of taxation as it pertains to homeless individuals, exploring the legal frameworks, potential obligations, and the unique challenges they face in navigating the tax system. By shedding light on this often-overlooked aspect of homelessness, we aim to provide a comprehensive understanding of the intersection between homelessness and taxes.

Understanding the Tax Obligations of Homeless Individuals

When discussing tax obligations, it is crucial to acknowledge that homelessness does not exempt individuals from the reach of the tax system. While their circumstances may present unique challenges, the legal framework surrounding taxation applies to all citizens and residents, regardless of their housing situation.

Income Tax and Homelessness

Income tax is a fundamental component of the tax system, and it is based on the principle that individuals should contribute to the government’s revenue based on their earnings. For homeless individuals, the concept of income tax can be complex, as their sources of income may differ significantly from those with stable housing.

Many homeless individuals rely on various sources of income, such as:

- Government benefits and social assistance programs.

- Income from odd jobs or temporary employment.

- Donations and charitable contributions.

- Support from family or friends.

- Sales of personal belongings or handmade items.

The tax treatment of these income sources can vary, and it is essential for homeless individuals to understand their obligations. For instance, government benefits and social assistance are generally taxable, while donations and certain charitable contributions may be exempt.

Tax Compliance and Challenges

Compliance with tax regulations can pose significant challenges for homeless individuals. They often face obstacles in accessing essential tax-related services, such as:

- Difficulty in obtaining a permanent mailing address for tax correspondence.

- Limited access to technology and online tax filing platforms.

- Lack of financial resources to hire professional tax advisors.

- Inability to provide required documentation, such as proof of income or identification.

- Complexities in filing taxes for multiple jurisdictions, especially for those who are mobile.

These challenges can lead to non-compliance, which may result in penalties and further financial burdens for homeless individuals.

Tax Benefits and Exemptions for Homeless Individuals

While homeless individuals face tax obligations, there are also specific tax benefits and exemptions designed to provide some financial relief.

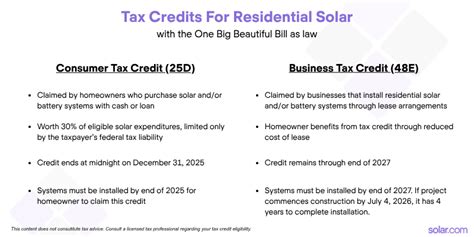

Tax Credits and Refunds

Certain tax credits and refunds are available to homeless individuals, depending on their circumstances and the jurisdiction they reside in. These credits and refunds aim to support those with low incomes and can significantly impact their financial stability.

For example, in some countries, there are tax credits specifically designed for individuals with low incomes, which can reduce their tax burden or even result in a refund. Additionally, homeless individuals may be eligible for various refundable tax credits, such as those related to healthcare expenses or education.

Housing-Related Tax Benefits

Homelessness itself may qualify individuals for certain housing-related tax benefits. These benefits are often designed to encourage and support affordable housing initiatives.

One such example is the Low-Income Housing Tax Credit (LIHTC) program in the United States, which provides tax incentives to developers and investors who create affordable housing units. This program aims to increase the supply of low-cost housing, benefiting both tenants and the broader community.

Exemptions for Specific Income Sources

As mentioned earlier, some income sources for homeless individuals may be exempt from taxation. Understanding these exemptions can help homeless individuals maximize their financial resources.

For instance, in many jurisdictions, certain charitable donations and gifts are tax-exempt, which can be beneficial for homeless individuals who receive support from charities or community organizations. Additionally, income generated from specific government-funded programs, such as workfare or training initiatives, may also be exempt from taxation.

The Impact of Tax Policies on Homelessness

Tax policies and regulations can significantly influence the lives of homeless individuals, both positively and negatively. It is essential to analyze how tax policies interact with homelessness to identify areas for improvement and ensure a fair and equitable system.

Tax Policies as a Barrier to Housing

In some cases, tax policies can inadvertently create barriers to housing for homeless individuals. For example, certain tax regulations may discourage landlords from renting to homeless individuals or those with unstable housing situations.

Landlords may be hesitant to rent to individuals without a stable income or a permanent address, fearing non-compliance with tax obligations. This can perpetuate the cycle of homelessness, making it even more challenging for individuals to secure stable housing.

Tax Reform for Homeless Support

On the other hand, tax reforms and targeted initiatives can play a crucial role in supporting homeless individuals and providing pathways to stable housing.

Some governments and organizations have implemented tax-based strategies to address homelessness, such as:

- Providing tax incentives for developers to create supportive housing units.

- Offering tax credits to businesses that hire homeless individuals or provide training programs.

- Establishing tax-funded programs to support homeless individuals' transition to stable housing.

- Allocating tax revenue to fund homeless shelters and support services.

Addressing Inequality and Fairness

Tax policies should aim to promote fairness and equality, ensuring that the tax system does not disproportionately burden vulnerable populations, including homeless individuals.

One critical aspect is the progressive tax system, which taxes higher incomes at a higher rate. This system can help redistribute wealth and provide more resources for social safety nets, including support for homeless individuals.

Additionally, efforts should be made to simplify tax regulations and provide accessible tax services for homeless individuals, ensuring they can navigate the system without undue hardship.

Conclusion: Navigating the Complex World of Homelessness and Taxes

The relationship between homelessness and taxes is intricate and multifaceted, presenting both challenges and opportunities. While homeless individuals face unique obstacles in navigating the tax system, there are also supportive tax policies and benefits in place to assist them.

As we continue to address the issue of homelessness, it is essential to recognize the role of taxation and its potential impact on individuals' lives. By understanding the complexities and advocating for fair and equitable tax policies, we can work towards a society where everyone, regardless of their housing status, has the support they need to thrive.

| Income Source | Tax Treatment |

|---|---|

| Government Benefits | Generally taxable |

| Odd Jobs/Employment | Subject to income tax |

| Donations/Charitable Contributions | May be exempt or taxable, depending on the jurisdiction |

| Support from Family/Friends | Generally not taxable for the recipient |

| Sales of Personal Belongings | May be subject to capital gains tax |

How can homeless individuals access tax-related services without a permanent address?

+

Homeless individuals can access tax-related services through community organizations, homeless shelters, or mobile tax assistance programs. Many cities have dedicated tax clinics or outreach programs specifically designed to assist those without a permanent address.

Are there any specific tax credits for homeless individuals?

+

Yes, some countries offer tax credits specifically for individuals with low incomes, which can benefit homeless individuals. Additionally, there may be tax credits related to housing, healthcare, or education that they may be eligible for.

How can tax policies help address homelessness?

+

Tax policies can provide incentives for affordable housing development, support homeless individuals’ transition to stable housing, and fund essential services. Progressive tax systems can also help redistribute wealth, benefiting vulnerable populations.