Orange County Property Tax Rate

The Orange County Property Tax rate is a crucial aspect of financial planning and homeownership for residents and prospective buyers in the region. Understanding the tax structure and rates is essential to making informed decisions about property purchases and investments. In this comprehensive guide, we will delve into the specifics of the Orange County Property Tax Rate, exploring its composition, calculation methods, and the various factors that influence it.

Understanding the Orange County Property Tax Rate

Orange County, located in the vibrant state of California, boasts a diverse range of cities and neighborhoods, each with its unique character and charm. From the bustling city of Santa Ana to the picturesque coastal towns, property ownership in Orange County offers a wide array of opportunities and lifestyles. However, with the privilege of owning property comes the responsibility of paying property taxes, which are essential for funding local services and infrastructure.

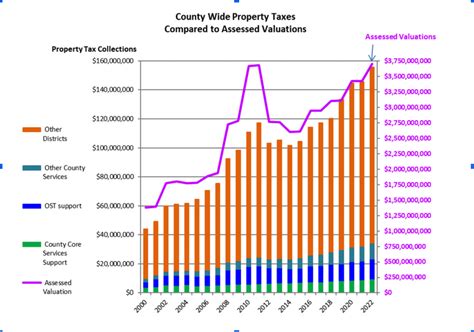

The property tax rate in Orange County is determined by a combination of factors, including the assessed value of the property, the tax rate area, and any applicable exemptions or assessments. It is a crucial component of the county's revenue system, ensuring the maintenance and development of essential services such as schools, fire departments, and public works projects.

Key Components of the Property Tax Rate

The property tax rate in Orange County is primarily composed of two main elements: the ad valorem tax and the non-ad valorem assessments. Let’s explore each of these components in detail:

1. Ad Valorem Tax

The ad valorem tax is the primary source of revenue for local governments and special districts in Orange County. It is calculated based on the assessed value of the property and the applicable tax rate. Here’s a breakdown of how it works:

- Assessed Value: The assessed value of a property is determined by the Orange County Assessor’s Office. It represents the property’s fair market value and is typically based on recent sales data and property characteristics.

- Tax Rate: The tax rate, also known as the tax rate area, is set by the local government and can vary depending on the specific location of the property. It is expressed as a percentage of the assessed value.

- Calculation: To calculate the ad valorem tax, the assessed value is multiplied by the applicable tax rate. For example, if a property has an assessed value of 500,000 and the tax rate is 1%, the ad valorem tax would be 5,000.

2. Non-Ad Valorem Assessments

In addition to the ad valorem tax, property owners in Orange County may also be subject to non-ad valorem assessments. These assessments are typically used to fund specific services or infrastructure projects that benefit the community. Here’s what you need to know about non-ad valorem assessments:

- Purpose: Non-ad valorem assessments are levied to finance improvements or services that directly impact the property or the community. These can include flood control projects, mosquito abatement programs, or special assessments for neighborhood improvements.

- Basis of Assessment: Unlike the ad valorem tax, non-ad valorem assessments are not directly tied to the assessed value of the property. Instead, they are based on the specific benefit received by the property or the cost of the project being funded.

- Calculation: The amount of non-ad valorem assessment varies depending on the nature of the project and the property’s relationship to it. It is typically calculated based on a predetermined formula or rate structure.

Factors Influencing Property Tax Rates

The property tax rate in Orange County can vary significantly depending on several factors. Understanding these factors can help property owners anticipate their tax obligations and make more informed financial decisions. Here are some key factors that influence the property tax rate:

1. Location

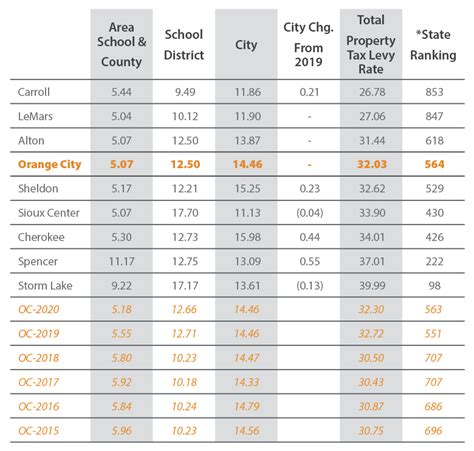

The location of a property within Orange County plays a significant role in determining the tax rate. Different cities, school districts, and special assessment areas may have varying tax rates. For instance, properties located in highly desirable areas or within specific school districts might face higher tax rates to fund local education and infrastructure projects.

2. Property Type

The type of property also affects the tax rate. Residential properties, commercial properties, and vacant land may be subject to different tax rates and assessment methodologies. For example, commercial properties often have higher tax rates to account for the increased demand for services and infrastructure in business districts.

3. Proposition 13

California’s Proposition 13, passed in 1978, has a significant impact on property taxes in the state, including Orange County. Proposition 13 limits the annual increase in the assessed value of a property to 2% or the inflation rate, whichever is lower. This means that even if a property’s market value increases substantially, the assessed value for tax purposes grows at a much slower rate.

4. Special Assessments

Special assessments are additional charges levied on properties to fund specific improvements or services. These assessments can be imposed by local governments, special districts, or homeowner associations. They are typically tied to a specific project or service and are added to the property tax bill.

Calculating Your Property Tax Bill

Understanding how your property tax bill is calculated is essential for accurate financial planning. The process involves several steps, and it’s crucial to consider all applicable taxes and assessments. Here’s a step-by-step guide to calculating your Orange County property tax bill:

Step 1: Determine Your Property’s Assessed Value

The first step is to obtain the assessed value of your property from the Orange County Assessor’s Office. This value represents the fair market value of your property and serves as the basis for calculating your ad valorem tax.

Step 2: Identify Your Tax Rate Area

Identify the tax rate area in which your property is located. This information can be obtained from the Assessor’s Office or through online property search tools. The tax rate area determines the applicable tax rate for your property.

Step 3: Calculate the Ad Valorem Tax

Multiply your property’s assessed value by the applicable tax rate to calculate the ad valorem tax. This calculation provides the primary component of your property tax bill.

| Assessed Value | Tax Rate | Ad Valorem Tax |

|---|---|---|

| $500,000 | 1% | $5,000 |

Step 4: Add Non-Ad Valorem Assessments

Identify any non-ad valorem assessments that apply to your property. These assessments may be related to special projects, services, or improvements. Add the total amount of these assessments to your ad valorem tax.

Step 5: Calculate Your Property Tax Bill

The sum of your ad valorem tax and non-ad valorem assessments represents your total property tax bill. This amount is due to the county on an annual or semi-annual basis.

Tax Relief and Exemptions

Orange County offers several tax relief programs and exemptions to eligible property owners. These programs aim to reduce the tax burden for specific groups or provide incentives for certain types of properties. Here are some notable tax relief options in Orange County:

1. Homeowner’s Property Tax Exemption

The Homeowner’s Property Tax Exemption is available to eligible homeowners who use their property as their primary residence. This exemption reduces the assessed value of the property by a fixed amount, resulting in a lower property tax bill. To qualify, homeowners must meet certain income and residency requirements.

2. Veterans’ Property Tax Exemption

Orange County provides property tax exemptions for qualified veterans and their surviving spouses. This exemption can significantly reduce the assessed value of the property, offering financial relief to those who have served our country. Eligibility is determined based on military service and other criteria.

3. Disabled Veterans’ Property Tax Exemption

Disabled veterans who meet specific criteria may be eligible for an additional property tax exemption. This exemption further reduces the assessed value of the property, providing additional financial support to veterans with service-connected disabilities.

4. Senior Citizens’ Property Tax Deferral

Orange County offers a property tax deferral program for senior citizens who meet certain age and income requirements. This program allows eligible seniors to defer their property taxes until a later date, providing a financial cushion during retirement.

Future Implications and Trends

The property tax landscape in Orange County is constantly evolving, influenced by various factors such as economic conditions, infrastructure needs, and demographic changes. Here are some key trends and implications to consider:

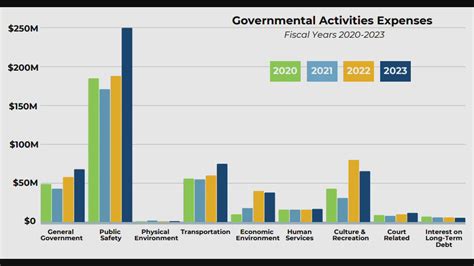

1. Infrastructure Development

As Orange County continues to grow and develop, the demand for improved infrastructure, such as roads, schools, and public transportation, increases. This can lead to higher property tax rates to fund these essential projects. Stay informed about local infrastructure plans and their potential impact on your tax obligations.

2. Housing Market Dynamics

The housing market in Orange County is dynamic, with fluctuating prices and demand. Rising property values can result in higher assessed values, potentially increasing property tax bills. On the other hand, a cooling market may provide some relief to homeowners.

3. Proposition 13 Reform

There have been ongoing discussions and proposals to reform Proposition 13, which could have significant implications for property taxes in California. Any changes to this landmark legislation could affect the assessed value and tax rates for properties across the state, including Orange County.

4. Special Assessments and Fees

Local governments and special districts may propose new special assessments or increase existing ones to fund specific projects or services. Stay engaged with your community and local government to understand these proposals and their potential impact on your property taxes.

FAQs

How often are property taxes assessed in Orange County?

+Property taxes in Orange County are assessed annually. The assessed value of your property is determined based on its value as of January 1st of each year. However, it’s important to note that the tax rate and applicable assessments can change annually as well.

Can I appeal my property’s assessed value?

+Yes, if you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal. The Orange County Assessor’s Office provides a process for appealing property assessments. It’s important to gather supporting evidence and follow the required procedures to ensure a successful appeal.

Are there any tax relief programs for low-income homeowners in Orange County?

+Yes, Orange County offers several tax relief programs for low-income homeowners. These programs aim to provide financial assistance to eligible homeowners by reducing their property tax burden. Income and residency requirements vary, so it’s recommended to research and apply for the specific programs that match your circumstances.

Can I pay my property taxes online in Orange County?

+Absolutely! Orange County provides convenient online payment options for property taxes. You can visit the Orange County Tax Collector’s website to make secure online payments, set up automatic payments, or explore other payment methods.

What happens if I fail to pay my property taxes on time in Orange County?

+Late payment of property taxes can result in penalties and additional fees. If you are unable to pay your property taxes on time, it’s essential to communicate with the Orange County Tax Collector’s Office. They may offer payment plans or provide information on hardship exemptions to help you manage your tax obligations.

Understanding the Orange County Property Tax Rate is essential for property owners and prospective buyers in the region. By familiarizing yourself with the components of the tax rate, calculation methods, and available tax relief options, you can make more informed decisions about property ownership and financial planning. Stay engaged with local government and community initiatives to stay abreast of any changes that may impact your property taxes.