Tax Receipt

Welcome to a comprehensive guide on understanding and maximizing the benefits of tax receipts. In a world where financial transactions and tax obligations are an inevitable part of life, it's crucial to grasp the intricacies of tax receipts and their impact on your financial health. This expert-level article aims to demystify tax receipts, offering a deep dive into their purpose, structure, and the myriad ways they influence your financial standing. From real-world examples to industry insights, we'll navigate the complexities of tax receipts, ensuring you leave with a clear understanding and the tools to make the most of your financial obligations.

Understanding the Purpose of Tax Receipts

At their core, tax receipts serve as a vital record of financial transactions, providing an essential link between taxpayers and the governing bodies responsible for collecting and allocating tax revenues. These receipts offer a transparent view of the financial interactions between individuals, businesses, and the government, ensuring accountability and fostering trust in the financial system.

The primary purpose of a tax receipt is to acknowledge the payment of taxes, providing a detailed breakdown of the transaction. This includes the type of tax paid, the amount, the tax period, and often, the specific purpose or allocation of the tax revenue. For instance, a tax receipt for property tax might include details such as the assessed value of the property, the applicable tax rate, and any exemptions or deductions applied.

Moreover, tax receipts play a crucial role in financial planning and budgeting. They offer a historical record of tax payments, allowing individuals and businesses to track their financial obligations over time. This historical perspective is invaluable for identifying trends, optimizing tax strategies, and ensuring compliance with tax laws and regulations.

In addition to their practical uses, tax receipts also carry a significant symbolic value. They represent the citizen's contribution to the collective well-being, serving as a tangible reminder of the social contract between the governed and the governing body. This symbolic aspect underscores the importance of tax receipts in fostering a sense of civic duty and social responsibility.

Real-World Application: Tax Receipts in Action

Consider the scenario of a small business owner, Sarah, who operates a local bakery. Each year, Sarah pays various taxes, including income tax, payroll tax, and sales tax. When she receives her tax receipts, she carefully reviews the details, ensuring accuracy and understanding the breakdown of her tax obligations. This process not only helps her manage her finances but also allows her to plan for future tax payments and explore potential deductions or credits.

In another example, imagine a homeowner, John, who receives a tax receipt for his property taxes. The receipt provides a detailed overview of the assessed value of his home, the applicable tax rate, and any exemptions he qualifies for. By understanding these details, John can make informed decisions about his financial strategies, such as considering a tax appeal if he believes the assessed value is inaccurate.

| Tax Type | Receipt Details |

|---|---|

| Income Tax | Tax Year, Filing Status, Adjusted Gross Income, Tax Amount |

| Sales Tax | Transaction Date, Itemized Purchases, Tax Rate, Total Tax Paid |

| Property Tax | Assessed Value, Tax Rate, Exemptions, Deductions, Total Tax Due |

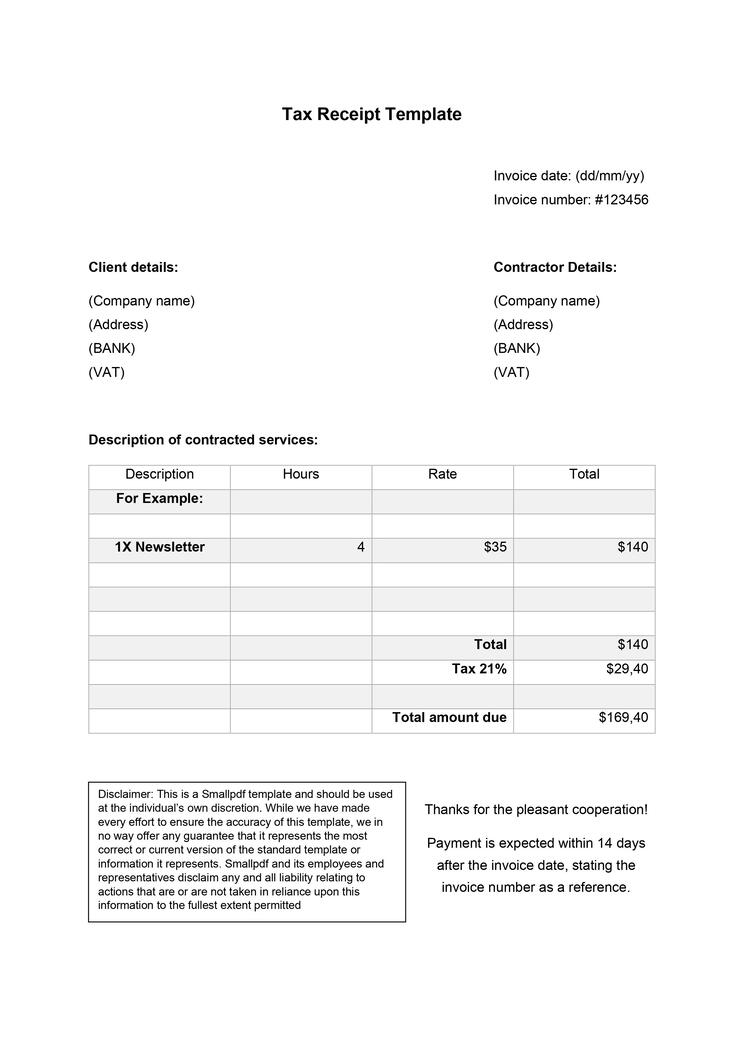

The Structure and Components of Tax Receipts

Tax receipts, though varying in format and content across jurisdictions, typically share a common structure that includes key components essential for transparency and accountability. Understanding these components is crucial for taxpayers to effectively navigate their financial obligations and ensure compliance with tax regulations.

Key Components of Tax Receipts

The following are the fundamental elements typically found on a tax receipt:

- Taxpayer Information: This includes the name, address, and tax identification number of the taxpayer. It ensures the receipt is personalized and linked to the correct taxpayer.

- Tax Type and Period: The type of tax paid, such as income tax, sales tax, or property tax, along with the specific tax period or year to which the payment applies.

- Amount Paid: The total amount of tax paid, often broken down into different categories or sub-amounts, providing a detailed overview of the taxpayer's financial obligations.

- Payment Details: Information about how the tax was paid, including the payment method (e.g., check, credit card, or electronic transfer) and the date of payment.

- Transaction Reference: A unique identifier or reference number for the tax payment, which can be used for future inquiries or to track the payment's status.

- Tax Authority Details: The name and contact information of the tax authority or government body that received the payment. This ensures transparency and provides a direct link for any inquiries or disputes.

- Acknowledgement of Receipt: A clear statement acknowledging the receipt of the tax payment, often with a signature or electronic confirmation.

These components collectively form a comprehensive record of the tax transaction, offering transparency and accountability for both the taxpayer and the tax authority. By understanding these elements, taxpayers can effectively manage their financial obligations, track their payments, and ensure compliance with tax regulations.

Comparative Analysis: Tax Receipt Formats

While the core components of tax receipts remain consistent, the format and presentation can vary significantly across different tax jurisdictions. Some tax authorities opt for a more simplified approach, focusing on essential details like the tax type, amount paid, and payment method. In contrast, others may provide a detailed breakdown of the tax calculation, including the bases for deductions, exemptions, or credits applied.

For instance, consider the following comparative analysis of tax receipt formats between two different countries:

| Country A | Country B |

|---|---|

| Simplified Format: Focuses on key details like tax type, amount, and payment method. | Detailed Format: Includes a breakdown of tax calculation, deductions, and exemptions. |

| Emphasizes ease of understanding for taxpayers. | Offers transparency and allows taxpayers to review the tax calculation process. |

| May lack specific details for complex tax situations. | Can be more complex and require taxpayer familiarity with tax terminology. |

Maximizing Benefits: Strategies for Tax Receipts

Tax receipts are more than just acknowledgments of financial obligations; they are powerful tools that can help individuals and businesses maximize their financial benefits. By understanding the intricacies of tax receipts and employing strategic approaches, taxpayers can optimize their financial planning, leverage deductions and credits, and ensure compliance with tax regulations.

Financial Planning with Tax Receipts

Tax receipts offer a wealth of information that can be leveraged for effective financial planning. By analyzing past tax receipts, individuals and businesses can identify trends, patterns, and areas of improvement in their financial strategies. For instance, reviewing income tax receipts can reveal opportunities to optimize tax deductions, credits, or even tax-efficient investment strategies.

Furthermore, tax receipts provide a clear picture of the taxpayer's financial obligations, allowing for better budgeting and financial forecasting. By understanding the breakdown of tax payments, taxpayers can allocate their resources more efficiently and plan for future financial goals, whether it's saving for retirement, investing in a business, or managing personal finances.

Leveraging Deductions and Credits

Tax receipts are a gateway to exploring and understanding the various deductions and credits available to taxpayers. By carefully reviewing the details on their tax receipts, individuals can identify potential opportunities to reduce their tax liability. For example, homeowners can review property tax receipts to understand the impact of mortgage interest deductions or real estate tax credits.

Similarly, businesses can use tax receipts to identify deductions for business expenses, research and development credits, or even tax incentives for specific industries or sectors. By staying informed about the deductions and credits available, taxpayers can optimize their financial strategies and potentially reduce their tax burden.

| Deduction/Credit Type | Description |

|---|---|

| Mortgage Interest Deduction | Allows homeowners to deduct the interest paid on their mortgage loans, reducing taxable income. |

| Business Expense Deduction | Businesses can deduct ordinary and necessary expenses incurred in the operation of their business, reducing their taxable income. |

| Research and Development Credit | Encourages businesses to invest in research and development by offering a tax credit for qualified expenses. |

The Future of Tax Receipts: Technological Advancements

As technology continues to evolve, the landscape of tax receipts is also transforming, offering new opportunities for efficiency, security, and accessibility. The integration of digital technologies and innovative solutions is revolutionizing the way tax receipts are generated, distributed, and utilized, enhancing the overall tax experience for both taxpayers and tax authorities.

Digital Tax Receipts: The New Normal

The shift towards digital tax receipts is gaining momentum, with many tax authorities embracing electronic solutions for issuing and managing tax receipts. Digital tax receipts offer numerous advantages, including enhanced security, improved data integrity, and increased convenience for taxpayers.

With digital tax receipts, taxpayers can receive their receipts instantly, often via secure online portals or email. This eliminates the need for physical storage and reduces the risk of loss or damage. Additionally, digital receipts can be easily integrated into accounting software or financial management systems, streamlining the process of tracking and analyzing tax obligations.

Furthermore, digital tax receipts often come with enhanced security features, such as digital signatures, encryption, and tamper-proof mechanisms, ensuring the integrity and authenticity of the information. This not only protects taxpayers' data but also simplifies the process of verifying and authenticating tax receipts when needed.

Blockchain Technology: Revolutionizing Tax Receipt Security

Blockchain technology, known for its immutable and decentralized nature, is increasingly being explored for its potential in securing and streamlining tax receipt processes. By leveraging blockchain, tax authorities can create a transparent and tamper-proof record of tax transactions, enhancing trust and accountability in the tax system.

With blockchain-based tax receipts, each transaction is recorded on a distributed ledger, creating a permanent and transparent record. This technology ensures that tax receipts cannot be altered or manipulated, providing an added layer of security and trust. Additionally, blockchain can facilitate real-time tracking of tax payments, improving efficiency and reducing the administrative burden on both taxpayers and tax authorities.

| Digital Tax Receipt Benefits |

|---|

| Instant delivery and access, reducing wait times. |

| Enhanced security with digital signatures and encryption. |

| Easy integration with accounting software for efficient record-keeping. |

| Improved data integrity and reduced risk of loss or damage. |

Conclusion: The Impact and Importance of Tax Receipts

In conclusion, tax receipts are more than just bureaucratic necessities; they are powerful tools that shape our financial landscape and influence our economic decisions. By understanding the purpose, structure, and potential of tax receipts, individuals and businesses can navigate the complex world of taxes with confidence and strategic advantage.

From providing a transparent record of financial transactions to offering opportunities for financial planning and maximizing deductions, tax receipts are a cornerstone of our tax system. As technology continues to advance, the future of tax receipts looks promising, with digital solutions and blockchain technology poised to enhance security, efficiency, and accessibility.

As we move forward, it is essential to stay informed about the evolving landscape of tax receipts and their impact on our financial lives. By embracing these advancements and leveraging the insights gained from tax receipts, we can make informed decisions, optimize our financial strategies, and contribute to a more transparent and accountable tax system.

What is the primary purpose of a tax receipt?

+The primary purpose of a tax receipt is to acknowledge the payment of taxes and provide a detailed breakdown of the transaction, including the type of tax paid, the amount, the tax period, and the specific purpose or allocation of the tax revenue.

How can tax receipts be used for financial planning?

+Tax receipts can be used for financial planning by analyzing past receipts to identify trends, patterns, and areas of improvement. This helps in optimizing tax strategies, budgeting, and financial forecasting.

What are some common deductions or credits taxpayers can leverage from tax receipts?

+Common deductions and credits include mortgage interest deductions for homeowners, business expense deductions, and research and development credits for businesses. Taxpayers can identify these opportunities by carefully reviewing their tax receipts.