How Much Is California Gas Tax

The California gas tax is a crucial component of the state's transportation funding, contributing to the maintenance and improvement of its extensive road network. The gas tax rate in California has been a subject of much discussion and debate, as it directly impacts the wallets of residents and businesses alike. In this comprehensive article, we delve into the intricacies of the California gas tax, exploring its history, current rates, and the factors influencing its fluctuations. We aim to provide an expert-level analysis, shedding light on this vital aspect of the state's infrastructure funding.

Unraveling the California Gas Tax

California’s gas tax, officially known as the Motor Vehicle Fuel Tax (MVFT), has a rich history dating back to the early 20th century. It was first implemented to fund the construction and upkeep of the state’s growing highway system. Over the years, the gas tax has undergone various adjustments to meet the evolving needs of California’s transportation infrastructure.

Historical Perspective

The California gas tax was initially introduced in 1923 at a rate of 1 cent per gallon. This rate remained unchanged for nearly two decades until 1941 when it was increased to 2 cents per gallon. Subsequent adjustments were made in the following years, with the most significant increase occurring in 2017 as part of the Road Repair and Accountability Act (SB1). This act raised the gas tax by 12 cents per gallon and imposed additional fees and taxes to generate revenue for road repairs and transportation projects.

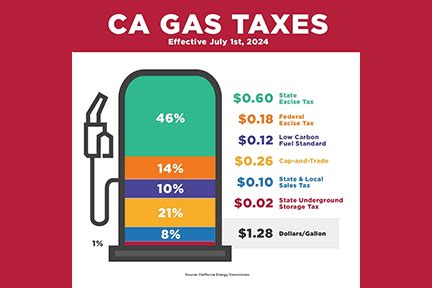

Current Gas Tax Rates

As of [current year], the California gas tax consists of several components. The base gas tax rate is set at [base rate] cents per gallon, which is a statewide uniform rate. However, this is just the beginning, as various additional taxes and fees are applied on top of this base rate.

| Tax/Fee | Rate |

|---|---|

| Motor Vehicle Fuel Tax | [MVFT rate] cents/gallon |

| Underground Storage Tank Fee | [USTF rate] cents/gallon |

| Air Quality Improvement Fee | [AQIF rate] cents/gallon |

| Local Sales and Use Tax | Varies by county |

| State Sales and Use Tax | [State rate]% |

| Road Improvement Fee | [RIF rate] cents/gallon |

| Transportation Improvement Fee | [TIF rate] cents/gallon |

These rates are subject to change based on legislative decisions and the needs of the transportation system. It's important to note that the total tax paid at the pump can vary significantly depending on the location within the state, as local sales taxes are levied on top of the state-level taxes.

The Impact of Gas Tax Revenue

The revenue generated from the California gas tax plays a pivotal role in funding various transportation-related projects and initiatives. Here’s a breakdown of how the funds are typically allocated:

- Road Maintenance and Repair: A significant portion of the gas tax revenue is dedicated to repairing and maintaining California's vast network of highways, roads, and bridges. This includes routine maintenance, resurfacing, and emergency repairs.

- Public Transportation: Gas tax funds contribute to the development and improvement of public transit systems, such as buses, trains, and light rail. These investments aim to provide efficient and accessible transportation options for residents.

- Active Transportation: California has allocated a portion of the gas tax revenue for active transportation projects, including the construction and maintenance of bike lanes, pedestrian pathways, and safe crossing infrastructure.

- Congestion Relief: Some of the funds are used to implement strategies that alleviate traffic congestion, such as improving traffic signal timing, expanding road capacity, and promoting alternative transportation modes.

- Environmental Initiatives: A share of the gas tax revenue is directed towards initiatives that promote sustainable transportation practices, including the development of electric vehicle charging infrastructure and incentives for cleaner vehicles.

Fluctuations and Challenges

The California gas tax is not immune to fluctuations, and several factors influence its rate and effectiveness. Here are some key considerations:

- Fuel Prices: The price of gasoline at the pump directly impacts the amount of tax collected. When fuel prices rise, the tax revenue generated from each gallon sold increases proportionally.

- Economic Factors: Economic conditions, such as recessions or periods of high inflation, can affect the state's ability to collect gas tax revenue. During economic downturns, fuel consumption may decrease, impacting the overall tax collection.

- Vehicle Technology: The shift towards more fuel-efficient vehicles and the adoption of electric vehicles can reduce the state's gas tax revenue over time. This challenge has led to discussions about alternative funding mechanisms for transportation infrastructure.

- Political Landscape: The California gas tax is a politically sensitive issue, and any changes to the tax rate or allocation of funds require legislative approval. The political climate and public opinion play a significant role in shaping the future of the gas tax.

Comparative Analysis: California vs. Other States

To provide a broader perspective, let’s compare California’s gas tax with those of other states. While each state has its unique tax structure, understanding these comparisons can offer valuable insights.

| State | Gas Tax Rate (cents/gallon) | Additional Taxes/Fees |

|---|---|---|

| California | [California rate] | Underground Storage Tank Fee, Air Quality Fee, Sales Tax, etc. |

| Texas | [Texas rate] | State Sales Tax, Motor Fuels Tax, Fuel Permit Fee |

| New York | [New York rate] | Excise Tax, Motor Fuel Sales Tax, County Sales Tax |

| Florida | [Florida rate] | State Sales Tax, Local Option Gas Tax, Fuel Impact Fee |

| Illinois | [Illinois rate] | Motor Fuel Tax, Regional Transportation Authority Tax, County Sales Tax |

These comparisons highlight the variations in gas tax structures across different states. While California's gas tax is relatively high, it is important to consider the specific needs and priorities of each state's transportation system.

Looking Ahead: Future Implications

As California continues to invest in its transportation infrastructure, the gas tax will remain a vital funding source. However, the state must also explore innovative solutions to address the challenges posed by changing fuel consumption patterns and evolving transportation technologies.

One potential solution is the implementation of a vehicle miles traveled (VMT) tax, which would charge drivers based on the actual miles driven rather than the amount of fuel consumed. This approach could provide a more sustainable and equitable funding mechanism for transportation infrastructure. Additionally, the state may consider diversifying its revenue streams by exploring alternative funding options, such as public-private partnerships or toll roads.

In conclusion, the California gas tax is a complex and essential component of the state's transportation funding strategy. It has undergone significant changes over the years, adapting to the evolving needs of California's infrastructure. While the tax provides crucial revenue for road maintenance and transportation projects, the state must stay agile and explore innovative funding solutions to ensure the long-term sustainability of its transportation network.

How often is the California gas tax rate adjusted?

+The California gas tax rate is typically adjusted through legislative action. While there is no set schedule, adjustments are made when there is a need to address funding gaps or when significant changes in transportation infrastructure requirements arise.

Are there any tax exemptions for certain vehicles or fuel types in California?

+Yes, California offers exemptions for specific fuel types and vehicles. For instance, certain alternative fuel vehicles, such as electric or hydrogen-powered vehicles, may be exempt from certain taxes or fees. Additionally, off-road vehicles used for agricultural or construction purposes may have different tax rates.

How is the gas tax revenue distributed among different transportation projects?

+The distribution of gas tax revenue is guided by state legislation and priorities. Typically, a significant portion goes towards road maintenance and repair, while other allocations are made for public transportation, active transportation, congestion relief, and environmental initiatives.