Texas Franchise Tax Due Date

The Texas Franchise Tax is an annual tax obligation for businesses operating in the state. This tax, also known as the Texas Margin Tax, is a gross receipts tax calculated based on the entity's taxable margin. Understanding the franchise tax due date is crucial for businesses to stay compliant and avoid penalties.

Understanding the Texas Franchise Tax

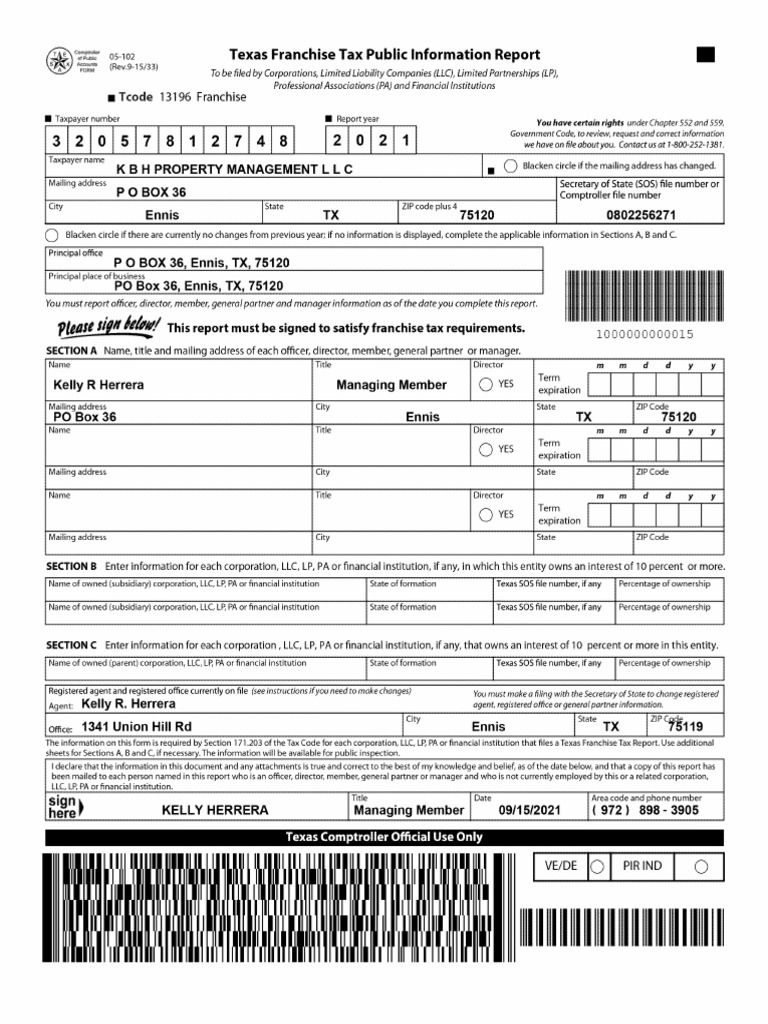

The Texas Franchise Tax is unique in that it is not based on net income but rather on the entity’s revenue and cost of goods sold. This method of taxation aims to ensure that businesses contribute to the state’s revenue regardless of their profitability. The tax is applicable to most types of businesses, including corporations, limited liability companies (LLCs), partnerships, and business trusts.

The taxable margin is calculated differently for each entity type, with varying deductions and exclusions. For example, wholesale and retail businesses calculate their taxable margin based on total revenue minus cost of goods sold. Service businesses, on the other hand, have a different formula that considers compensation paid to employees and owners.

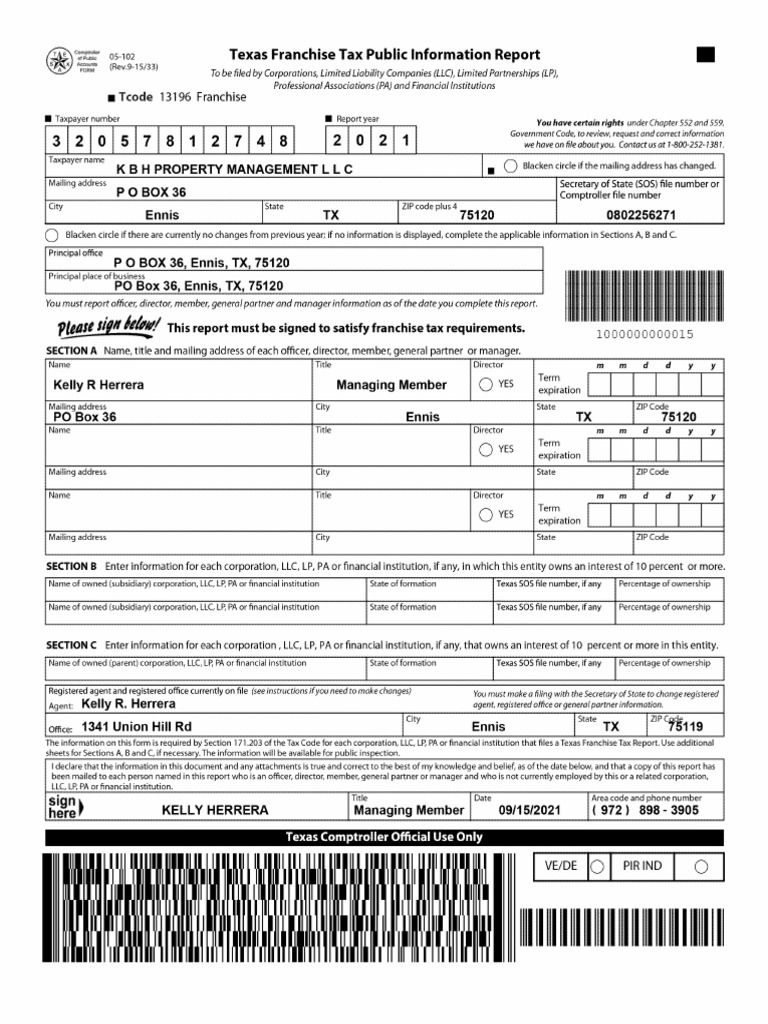

Businesses are required to register for the franchise tax with the Texas Comptroller of Public Accounts, which involves obtaining a tax permit and providing essential business information. This registration process is critical, as it allows the state to track business activities and assess tax obligations accurately.

Texas Franchise Tax Due Date: When is it?

The due date for the Texas Franchise Tax is a critical deadline for businesses to be aware of. This tax is typically due on May 15th of each year, which means that businesses must have their tax calculations and filings ready by this date.

For example, for the tax year 2023, the franchise tax would be due on May 15, 2024. This deadline is consistent each year, providing a clear and predictable timeline for businesses to manage their tax obligations.

It's worth noting that the due date is not affected by the entity's fiscal year. Regardless of whether a business operates on a calendar year or a fiscal year basis, the franchise tax deadline remains the same.

However, it's essential to be aware of potential exceptions and extensions. For instance, if the due date falls on a weekend or a state holiday, the deadline is extended to the next business day. Additionally, certain types of businesses, such as S corporations and limited partnerships, may have slightly different due dates for their franchise tax returns.

Extension Options

In cases where a business is unable to meet the May 15th deadline, it is possible to request an extension. The Texas Comptroller’s office offers a 90-day extension, which means businesses can postpone their filing until August 15th. However, it’s crucial to note that while the extension allows for more time to file the return, the tax payment is still due on the original deadline.

To request an extension, businesses must submit Form 05-111, the Application for Extension of Time to File Franchise Tax Report. This form must be filed before the original due date to avoid penalties and interest charges. It's important to remember that an extension of time to file does not extend the time to pay the tax.

Penalty and Interest Charges

Failure to meet the franchise tax due date can result in penalties and interest charges. Late payments and late filings are subject to these additional costs, which can quickly accumulate and become a significant burden for businesses.

The Texas Comptroller's office imposes a penalty of 5% of the unpaid tax for each month or part of a month that the tax remains unpaid, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax at a rate of 1% per month or part of a month, compounding daily.

| Penalty and Interest Charges | Amount |

|---|---|

| Penalty (per month) | 5% of Unpaid Tax |

| Maximum Penalty | 25% |

| Interest Rate | 1% per month |

How to Prepare for the Texas Franchise Tax Due Date

Preparing for the franchise tax due date requires careful planning and organization. Here are some key steps to ensure a smooth process:

-

Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and any supporting documentation. Ensure that all records are accurate and up-to-date.

-

Calculate Taxable Margin: Use the appropriate formula for your business type to calculate the taxable margin. This calculation is crucial for determining the franchise tax amount.

-

Review Tax Obligations: Understand your specific tax obligations based on your business type and structure. Some entities may have additional requirements or exemptions to consider.

-

File the Return: Use the designated forms provided by the Texas Comptroller's office to file your franchise tax return. Ensure that all information is accurate and complete.

-

Pay the Tax: Make the tax payment by the due date. You can pay online, by mail, or through other approved methods. Keep a record of your payment for future reference.

Online Filing Options

The Texas Comptroller’s office provides an online filing system, MyCPA, which offers a convenient and secure way to file franchise tax returns. This system allows businesses to submit their returns electronically, ensuring accuracy and timely submission.

Additionally, MyCPA provides a range of tools and resources to assist with the filing process, including tax calculators, form instructions, and the ability to track the status of your return.

Common Mistakes to Avoid

To ensure a smooth filing process, it’s essential to avoid common mistakes. Here are some pitfalls to watch out for:

-

Incorrect Taxable Margin Calculation: Miscalculating the taxable margin can lead to errors in the franchise tax amount. Double-check your calculations and use the appropriate formula for your business type.

-

Late Filing: Failing to meet the franchise tax due date can result in penalties and interest charges. Plan ahead and allow sufficient time for the filing process.

-

Inaccurate Information: Providing incorrect or incomplete information on the tax return can lead to delays and potential audits. Ensure that all details are accurate and supported by your financial records.

Conclusion

The Texas Franchise Tax due date is a critical deadline for businesses operating in the state. By understanding the tax calculation, staying informed about due dates, and preparing well in advance, businesses can ensure compliance and avoid unnecessary penalties.

With careful planning and the use of available resources, such as the MyCPA online filing system, businesses can navigate the franchise tax process with ease and focus on their core operations.

Frequently Asked Questions

Can I pay the franchise tax after the due date without penalties?

+

No, if you miss the due date, you will be subject to penalties and interest charges. It’s crucial to pay the tax by the deadline to avoid these additional costs.

What happens if I miss the due date and don’t file an extension request?

+

Failure to file an extension request before the due date may result in late filing penalties. It’s important to communicate with the Texas Comptroller’s office to resolve any issues.

Are there any businesses exempt from the franchise tax?

+

Yes, certain types of entities, such as nonprofit organizations and government entities, are exempt from the franchise tax. However, it’s essential to verify your specific situation with the Comptroller’s office.

Can I pay the franchise tax in installments?

+

The Texas Comptroller’s office does not offer an installment plan for the franchise tax. However, if you are facing financial difficulties, you can request a payment plan or explore other options with the Comptroller’s office.

How long does it take to process a franchise tax return?

+

The processing time for a franchise tax return can vary. Generally, it takes several weeks to process the return and update your account. However, if you have any concerns, you can contact the Comptroller’s office for an update.