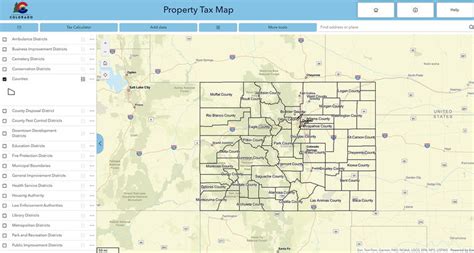

Colorado State Tax Refund Status

In Colorado, managing your tax refund is an essential part of your financial planning, especially when considering the state's unique tax system. The Colorado Department of Revenue offers various methods to check the status of your tax refund, ensuring that taxpayers can stay informed and manage their finances effectively.

Understanding the Colorado Tax Refund Process

The Colorado tax refund process begins with the submission of your state income tax return. Once you have filed your return, the Department of Revenue’s processing timeline begins. Generally, it takes up to 60 days to process individual income tax returns and issue refunds.

However, this timeline can vary based on several factors, including the complexity of your return, errors or corrections needed, and the volume of returns being processed. It's important to note that refunds for electronically filed returns are often processed more quickly than paper returns.

Checking Your Colorado State Tax Refund Status Online

The Colorado Department of Revenue provides an online tool called Where’s My Refund to help taxpayers track the status of their refunds. This user-friendly platform offers real-time updates on the processing of your tax refund, giving you an accurate picture of where your refund stands.

To use this tool, you'll need to provide some basic information, including your Social Security Number, your filing status (single, married filing jointly, etc.), and the exact amount of your expected refund. This information helps the system match your inquiry to your tax return, ensuring a secure and accurate process.

The Where's My Refund tool provides three status updates: "Return Received", indicating that your tax return has been successfully filed; "Return Approved", meaning your return has been processed and approved for a refund; and "Refund Sent", which signifies that your refund has been issued and is on its way to you.

The tool is regularly updated, so you can check the status of your refund as often as needed without worrying about overwhelming the system. It's a quick and efficient way to stay informed about your tax refund status.

Colorado Tax Refund Status by Phone

If you prefer not to use the online tool, you can also check the status of your Colorado tax refund by phone. The Department of Revenue has a dedicated toll-free number for this purpose: 1-800-365-8922.

When you call, you'll be guided through a series of prompts to enter your Social Security Number and the amount of your expected refund. This automated system provides real-time information about your refund status, similar to the online tool. It's available 24/7, making it a convenient option for those who prefer a voice-guided system.

However, it's important to note that due to the high volume of calls during tax season, you may experience longer wait times when calling. In such cases, the online tool might be a quicker and more efficient way to check your refund status.

Colorado Tax Refund Payment Methods

Once your Colorado tax refund has been approved, you have a few options for receiving your refund. The Department of Revenue offers several payment methods to ensure that taxpayers can choose the option that best suits their preferences and needs.

Direct Deposit

The most common and fastest way to receive your Colorado tax refund is through direct deposit. When filing your tax return, you’ll be asked to provide your banking information, including your account and routing numbers. This method is secure and efficient, with refunds typically arriving within a few days after approval.

Direct deposit is especially convenient as it eliminates the need to wait for a paper check in the mail. It's also a more secure option, as there's no risk of a check being lost or stolen during transit.

Paper Check

For those who prefer a more traditional method, the Colorado Department of Revenue also offers the option of receiving a paper check. If you choose this method, your refund check will be mailed to the address you provided on your tax return. It’s important to ensure that your address is accurate and up-to-date to avoid any delays or issues with delivery.

While paper checks can take a bit longer to arrive compared to direct deposit, they provide a physical record of your refund, which some taxpayers prefer for their records.

Colorado Cash Refund Card

Colorado offers an innovative payment method called the Colorado Cash Refund Card. This prepaid debit card is an electronic option for receiving your tax refund, especially beneficial for those without a traditional bank account.

The card comes with several advantages, including immediate access to your refund funds, the ability to make purchases wherever debit cards are accepted, and the convenience of being able to withdraw cash from ATMs. It's a secure and flexible option, and the best part is that there are no fees associated with using the card.

If you opt for the Colorado Cash Refund Card, you'll receive an activation kit in the mail, which will guide you through the simple process of activating and using your card.

Timely Updates and Tips for Your Colorado Tax Refund

To ensure a smooth tax refund process in Colorado, it’s important to keep yourself informed and follow some best practices.

Timely Filing and Accurate Information

First and foremost, filing your tax return on time is crucial. Late filings can result in delays and penalties, which can complicate the refund process. Ensure that you have all the necessary documents and information before filing to avoid errors or corrections that might slow down the process.

Using the Correct Filing Status

When filing your tax return, it’s essential to use the correct filing status. The status you choose (single, married filing jointly, head of household, etc.) can significantly impact your tax liability and refund amount. Double-check your status to ensure it aligns with your personal circumstances.

Electronic Filing and Direct Deposit

Opting for electronic filing and direct deposit is generally the fastest and most efficient way to receive your refund. Electronic filing reduces the risk of errors and speeds up the processing time, while direct deposit ensures your refund is deposited securely and promptly into your bank account.

Stay Informed with Official Sources

To stay updated on the latest tax refund information and changes, it’s best to rely on official sources. The Colorado Department of Revenue’s website and social media channels are excellent resources for the latest news, updates, and tips related to tax refunds. They also provide helpful tools and resources to guide you through the process.

Avoid Scams and Phishing Attempts

During tax season, it’s crucial to be vigilant about potential scams and phishing attempts. The Colorado Department of Revenue will never call or email you to ask for personal or financial information. If you receive such a call or email, it’s likely a scam. Hang up or delete the email, and report it to the appropriate authorities.

Conclusion: Your Colorado Tax Refund Journey

Navigating the Colorado tax refund process can be a breeze with the right tools and information. Whether you choose to check your refund status online or by phone, and whether you opt for direct deposit, a paper check, or the Colorado Cash Refund Card, the key is to stay informed and utilize the resources provided by the Colorado Department of Revenue.

By following these steps and staying aware of potential pitfalls, you can ensure a smooth and timely tax refund process. Remember, planning and preparation are key to a successful tax season, so stay informed and take advantage of the resources available to you.

When will I receive my Colorado state tax refund?

+The timeline for receiving your Colorado state tax refund can vary based on several factors, including the complexity of your return, errors or corrections needed, and the volume of returns being processed. Generally, it takes up to 60 days to process individual income tax returns and issue refunds. However, refunds for electronically filed returns are often processed more quickly.

What if I haven’t received my refund after the estimated timeline?

+If you haven’t received your refund after the estimated timeline, it’s recommended to first check the status of your refund using the Where’s My Refund tool or by calling the dedicated toll-free number. This will provide you with an updated status of your refund. If the issue persists, you can contact the Colorado Department of Revenue’s taxpayer assistance line for further assistance.

How can I ensure my tax refund is deposited into the correct account?

+To ensure your tax refund is deposited into the correct account, it’s crucial to provide accurate banking information when filing your tax return. Double-check your account and routing numbers to avoid any errors. If you’re using direct deposit, it’s also a good idea to periodically check your account activity to ensure the deposit has been received.