Colorado Property Taxes

Colorado's property tax system plays a crucial role in funding essential services and infrastructure within the state. It is a vital component of the state's revenue stream, contributing to the development and maintenance of public services, schools, and local governments. The property tax structure in Colorado is unique, offering a blend of flexibility and uniformity across different jurisdictions. Understanding this system is essential for homeowners, investors, and anyone interested in real estate in Colorado.

The Basics of Colorado Property Taxes

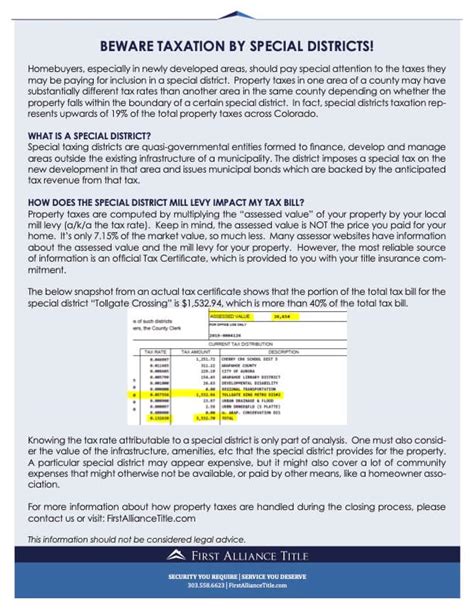

Property taxes in Colorado are primarily levied on real estate, including residential, commercial, and industrial properties. These taxes are a significant source of revenue for local governments, providing funding for vital services such as fire and police departments, schools, road maintenance, and other public amenities. The state’s property tax system is designed to ensure a fair and equitable distribution of tax burdens while maintaining local control over tax rates.

The property tax system in Colorado is based on the assessed value of a property, which is determined by the county assessor. This value is then multiplied by the tax rate set by the local government, which can vary from county to county and even between different districts within a county.

Assessment Rates and Tax Rates

Colorado employs a unique assessment rate system, known as the “Gallagher Amendment,” which aims to maintain a stable ratio between residential and non-residential property values. This amendment, adopted in 1982, ensures that residential property owners do not bear an excessive burden of the overall property tax revenue.

| Property Type | Assessment Rate |

|---|---|

| Residential | 7.2% |

| Non-Residential | 29% |

The assessment rate is applied to the actual value of the property, which is determined through regular assessments. These assessments take into account factors like property improvements, market conditions, and recent sales of similar properties. Once the assessed value is calculated, it is multiplied by the assessment rate to determine the assessed value for tax purposes.

The tax rate, set by local governments, is then applied to this assessed value to calculate the property tax liability. This tax rate varies based on the location and the type of services and amenities offered by the local government. For instance, a county with a higher level of services or a more expensive cost of living might have a higher tax rate compared to a rural area with fewer services.

The Property Tax Cycle

The property tax cycle in Colorado is an annual process that involves several key steps:

- Assessment: County assessors determine the actual value of properties within their jurisdiction.

- Assessment Notice: Property owners receive a notice of their assessed value, typically in April or May.

- Tax Rate Setting: Local governments set their tax rates, which are usually approved by voters through a mill levy.

- Tax Calculation: The assessed value is multiplied by the tax rate to determine the property tax liability.

- Billing and Payment: Property owners receive their tax bills, which are typically due in two installments, with the first due in February and the second in June.

Factors Influencing Property Taxes in Colorado

Several factors can impact the property tax landscape in Colorado, shaping the tax rates and overall revenue generation.

Economic Conditions and Property Values

The real estate market in Colorado is dynamic, influenced by economic conditions, population growth, and development trends. When property values rise, it can lead to higher assessed values, potentially increasing property tax revenue. Conversely, during economic downturns or when property values decline, property tax revenue may decrease, impacting local government budgets.

Local Government Services and Budgets

The level of services provided by local governments, such as schools, public safety, and infrastructure maintenance, directly affects the tax rate. Higher-service areas may have higher tax rates to fund these services. Additionally, local government budgets can influence tax rates, as they determine the revenue required to maintain essential services and infrastructure.

Voter-Approved Measures

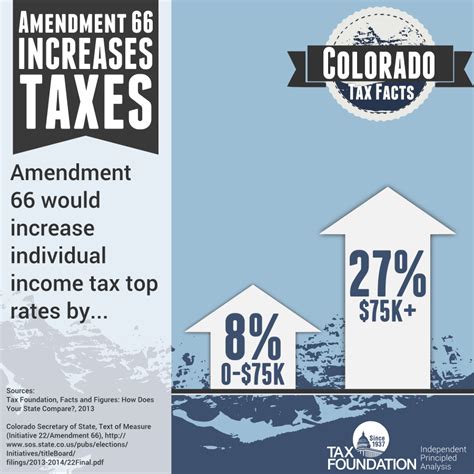

Colorado allows for voter-approved measures, such as bond issues or mill levy overrides, which can impact property taxes. These measures are typically proposed to fund specific projects or increase funding for existing services. If approved by voters, they can lead to an increase in the tax rate, resulting in higher property taxes.

Statewide Initiatives and Amendments

Statewide initiatives and amendments, like the Gallagher Amendment, can significantly impact the property tax system. These measures aim to balance the tax burden across different property types and ensure fairness in the distribution of tax revenue. However, they can also create complexities in the system, requiring regular adjustments to maintain stability.

Understanding Property Tax Exemptions and Discounts

Colorado offers various exemptions and discounts on property taxes, designed to provide relief to specific groups of property owners. These exemptions can significantly reduce the tax burden for eligible individuals.

Senior Citizen and Disability Exemptions

Senior citizens and individuals with disabilities may be eligible for exemptions or discounts on their property taxes. These exemptions are based on income and age, providing relief to those who meet the criteria. For instance, the Senior Homestead Exemption offers a reduction in property taxes for homeowners aged 65 and older, with income below a certain threshold.

Veteran Exemptions

Veterans and active-duty military personnel may also qualify for property tax exemptions. These exemptions are typically based on disability status or length of service, providing financial relief to those who have served their country.

Agricultural and Open Space Exemptions

Colorado encourages the preservation of agricultural land and open spaces through specific exemptions. Property owners can apply for these exemptions if their land is used for agricultural purposes or if they maintain open spaces, providing environmental and community benefits.

Other Exemptions and Discounts

There are additional exemptions and discounts available for certain types of properties or situations, such as historic properties, renewable energy systems, and certain types of affordable housing. These exemptions aim to encourage specific behaviors or support particular sectors, such as renewable energy development or affordable housing initiatives.

Comparative Analysis: Property Taxes in Colorado vs. Other States

Colorado’s property tax system stands out among other states due to its unique assessment rate system and the flexibility it offers to local governments. While the overall tax burden in Colorado is relatively moderate compared to some states, there are variations across different counties and districts.

For instance, in a comparison with other states, Colorado's effective property tax rate (the rate as a percentage of home value) is slightly lower than the national average. However, this can vary significantly depending on the location within the state. Urban areas with higher property values and a greater demand for services may have higher effective tax rates compared to rural areas.

Additionally, Colorado's assessment rate system, which maintains a stable ratio between residential and non-residential properties, is unique. This system ensures that residential property owners do not disproportionately bear the tax burden, which is a common issue in many other states.

The Impact of Assessment Rates

The assessment rates in Colorado have a significant impact on the overall tax burden. The lower assessment rate for residential properties means that homeowners pay a lower tax rate compared to owners of commercial or industrial properties. This system promotes fairness and ensures that residential property owners are not overburdened by property taxes.

Future Implications and Potential Changes

The property tax landscape in Colorado is subject to change, influenced by economic trends, demographic shifts, and legislative decisions. As the state continues to grow and develop, the demand for services and infrastructure will likely increase, potentially leading to higher tax rates or the need for additional revenue streams.

One potential area of change is the assessment rate system. While the Gallagher Amendment has been successful in maintaining a stable ratio between residential and non-residential properties, it has also led to a decrease in the overall tax base over time. This could potentially impact the state's revenue and require adjustments to the assessment rates or tax system as a whole.

Furthermore, the state's population growth and changing demographics may lead to increased demand for services, particularly in education and healthcare. This could put pressure on local governments to increase tax rates or explore alternative revenue sources to fund these services effectively.

Conclusion

Colorado’s property tax system is a complex yet essential component of the state’s revenue stream, funding vital services and infrastructure. The unique assessment rate system and local control over tax rates provide a level of flexibility and fairness in the distribution of tax burdens. However, the system is not without its challenges, and ongoing monitoring and adjustments are necessary to ensure its sustainability and effectiveness.

As Colorado continues to grow and evolve, the property tax system will likely face new challenges and opportunities. Staying informed about these changes and actively participating in the decision-making process can help ensure that the system remains equitable and responsive to the needs of the state's residents and communities.

How often are property values assessed in Colorado?

+Property values in Colorado are typically assessed every odd-numbered year. However, some counties may conduct additional assessments or adjust values based on market conditions.

Can property owners appeal their assessment value?

+Yes, property owners have the right to appeal their assessment value if they believe it is inaccurate or unfair. The process involves submitting an appeal to the county assessor’s office, providing evidence to support the claim, and potentially attending a hearing.

How can property owners stay informed about tax rate changes?

+Property owners can stay informed by regularly checking their county’s website or subscribing to local news sources. Many counties also provide notification services for tax rate changes and other important updates.

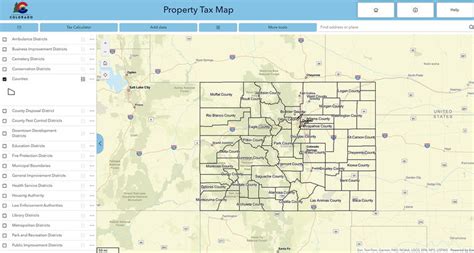

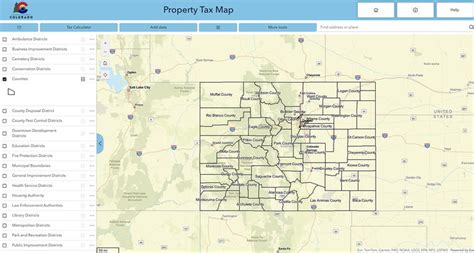

Are there any online resources to help calculate property taxes in Colorado?

+Yes, several online calculators and tools are available to estimate property taxes based on the assessed value and tax rate. These resources can provide a rough estimate and help property owners budget for their tax liabilities.

What happens if property taxes are not paid on time?

+Unpaid property taxes can result in penalties, interest, and potential legal consequences. In some cases, the property may be subject to a tax lien or even a tax sale if the taxes remain unpaid for an extended period.