Tax Attorney Nyc

In the bustling metropolis of New York City, tax laws and regulations can be complex and often overwhelming for individuals and businesses alike. Navigating the intricate web of federal, state, and local tax requirements demands expertise and a deep understanding of the ever-evolving legal landscape. This is where tax attorneys in NYC step in, offering invaluable guidance and representation to ensure compliance and optimize financial strategies.

The Role of Tax Attorneys in NYC

Tax attorneys in New York City play a crucial role in helping clients navigate the intricate world of taxation. With their extensive knowledge of tax laws and regulations, these legal professionals provide invaluable services to individuals, businesses, and even governmental entities. Their expertise ensures that their clients understand their tax obligations, make informed decisions, and avoid potential legal pitfalls.

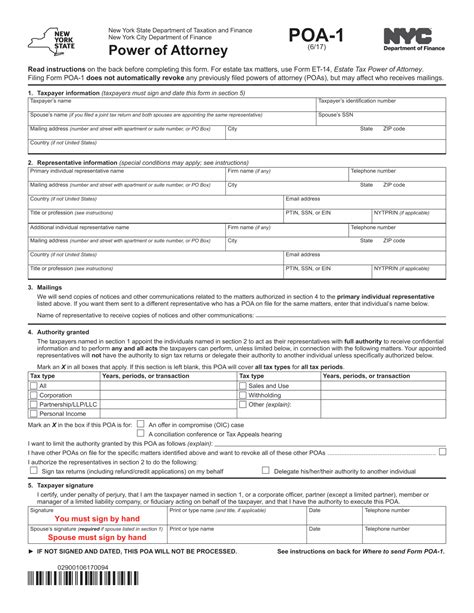

The scope of a tax attorney's work in NYC is broad and diverse. They assist clients in various tax-related matters, including income tax preparation and filing, estate and gift tax planning, international tax compliance, and even resolving tax disputes with the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance.

Expertise in Complex Tax Laws

One of the primary strengths of tax attorneys is their deep understanding of complex tax laws. New York City, being a major financial hub, attracts a diverse range of businesses and individuals with unique tax situations. Tax attorneys are equipped to handle these complexities, ensuring that their clients’ tax obligations are met accurately and efficiently.

For instance, tax attorneys can provide guidance on tax incentives and credits that businesses or individuals may be eligible for. They can also assist in structuring transactions to minimize tax liabilities while remaining compliant with the law. Their expertise extends to tax research, keeping clients updated on the latest tax law changes and how these changes may impact their financial strategies.

| Area of Expertise | Description |

|---|---|

| Individual Tax Planning | Tailored strategies for effective tax management for high-net-worth individuals and families. |

| Corporate Tax Compliance | Ensuring businesses meet their tax obligations while optimizing tax efficiency. |

| International Tax | Assisting clients with cross-border tax issues, including offshore accounts and international transactions. |

| Tax Dispute Resolution | Representing clients in tax audits, appeals, and litigation, aiming for favorable outcomes. |

Choosing the Right Tax Attorney in NYC

With a myriad of tax attorneys practicing in NYC, selecting the right professional for your specific needs is essential. Here are some key considerations when making your choice:

Experience and Specialization

Look for a tax attorney with substantial experience in the area of tax law that most closely aligns with your needs. For instance, if you require assistance with complex estate planning, you’ll want an attorney who has a proven track record in this field. Similarly, if your business operates in a unique industry with specific tax considerations, choose an attorney who has experience working with similar businesses.

Reputation and Track Record

Research the attorney’s reputation and track record. Check online reviews, testimonials, and case studies to get an understanding of their success rate and the quality of their services. Consider asking for references from past clients to get a more personal perspective on their work.

Communication and Approachability

Tax law can be complex, so it’s important to choose an attorney who communicates effectively and in a way that you understand. During your initial consultation, assess whether the attorney takes the time to explain things clearly and addresses your concerns thoroughly. A good tax attorney should be approachable and willing to answer your questions, ensuring you feel comfortable throughout the process.

Fees and Payment Structures

Tax attorneys in NYC may charge by the hour, offer flat-rate fees for specific services, or work on a contingency basis for certain cases. Understand the attorney’s fee structure and ensure it aligns with your budget and expectations. Also, inquire about any potential additional costs or expenses that may arise during the course of your representation.

Licensing and Credentials

Ensure that the tax attorney you choose is licensed to practice law in New York State and is in good standing with the New York State Bar Association. Additionally, consider whether they have any specialized certifications or accreditations relevant to your specific tax needs. For instance, a Certified Tax Law Specialist designation may indicate a higher level of expertise in tax law.

The Benefits of Working with a Tax Attorney

Engaging the services of a tax attorney in NYC can bring a range of benefits to individuals and businesses. Here are some key advantages:

Compliance and Peace of Mind

Tax attorneys ensure that their clients remain compliant with all applicable tax laws and regulations. This peace of mind is invaluable, especially given the severe penalties that can result from non-compliance. By working with a tax attorney, you can be confident that your tax obligations are being met accurately and on time.

Strategic Tax Planning

Tax attorneys are experts in developing tax strategies that align with their clients’ financial goals. They can help structure transactions, optimize tax efficiency, and identify opportunities for tax savings. Whether it’s minimizing tax liabilities, maximizing deductions, or planning for future tax obligations, a tax attorney can provide valuable guidance.

Representation in Tax Disputes

Should you find yourself facing a tax audit or involved in a tax dispute, a tax attorney can provide invaluable representation. They are skilled in negotiating with tax authorities and can advocate on your behalf to resolve issues favorably. Their knowledge of tax law and procedures gives them the tools to challenge incorrect assessments and protect your financial interests.

Estate and Business Succession Planning

Tax attorneys play a crucial role in estate planning, helping individuals and families minimize tax liabilities when transferring assets. They can also assist business owners in developing succession plans that address tax considerations, ensuring a smooth transition of ownership while minimizing tax impacts.

The Future of Tax Law in NYC

The field of tax law is ever-evolving, and tax attorneys in NYC must stay abreast of the latest developments to provide effective representation. Here are some key trends and considerations for the future of tax law in NYC:

Digital Transformation

The digital age has brought significant changes to the way tax information is collected, processed, and shared. Tax attorneys must adapt to these technological advancements, utilizing digital tools and platforms to enhance their practice. This includes leveraging data analytics to identify tax savings opportunities and streamline compliance processes.

International Tax Considerations

With NYC being a global financial center, tax attorneys must stay informed about international tax laws and regulations. As businesses continue to expand globally, tax attorneys will play a crucial role in helping clients navigate cross-border tax issues, including transfer pricing, foreign tax credits, and the implications of international tax treaties.

Changing Tax Policies

Tax policies at the federal, state, and local levels are subject to change, often with little notice. Tax attorneys must stay updated on these changes to provide accurate advice and guidance to their clients. This includes understanding the impact of new tax laws, such as the Tax Cuts and Jobs Act, and how these changes affect their clients’ tax obligations and strategies.

Collaborative Practice

The future of tax law in NYC will likely involve more collaborative practice. Tax attorneys will continue to work closely with other professionals, such as CPAs, financial planners, and estate planners, to provide comprehensive services to their clients. This collaborative approach ensures that all aspects of a client’s financial situation are considered when developing tax strategies.

Conclusion

Tax attorneys in NYC are essential professionals, providing invaluable expertise and guidance in the complex world of taxation. Whether you’re an individual seeking effective tax planning or a business navigating the intricacies of corporate tax compliance, a tax attorney can offer tailored solutions to meet your unique needs. With their knowledge, experience, and commitment to staying updated on the latest tax laws, tax attorneys in NYC are your trusted partners in ensuring compliance and optimizing your financial strategies.

What are the primary services offered by tax attorneys in NYC?

+Tax attorneys in NYC offer a wide range of services, including tax planning and compliance for individuals and businesses, assistance with tax disputes and audits, estate planning and wealth transfer strategies, and guidance on international tax matters. They ensure clients understand their tax obligations and provide strategies to minimize liabilities while remaining compliant.

How can I find a reputable tax attorney in NYC?

+To find a reputable tax attorney in NYC, consider referrals from trusted sources such as financial advisors or other professionals. You can also research online reviews and check the attorney’s licensing and credentials. Ensure they have experience in the specific area of tax law that concerns you and schedule a consultation to assess their expertise and approach.

What should I expect during my initial consultation with a tax attorney?

+During your initial consultation, a tax attorney will typically gather information about your financial situation, tax history, and specific concerns. They will explain their services, provide an overview of potential strategies, and discuss their fee structure. It’s an opportunity for you to ask questions and gauge whether the attorney is a good fit for your needs.

How can a tax attorney help me with tax dispute resolution?

+Tax attorneys are skilled in representing clients in tax disputes with the IRS or state tax authorities. They can help negotiate settlements, file appeals, and, if necessary, represent you in tax court. Their knowledge of tax law and procedures gives them the expertise to challenge incorrect assessments and protect your financial interests.