Sales Tax In Oklahoma

Oklahoma, the Sooner State, is known for its vibrant cities, stunning landscapes, and thriving businesses. As an integral part of the American economy, Oklahoma has a robust tax system that contributes significantly to its economic growth and development. One of the key components of this system is sales tax, which plays a vital role in generating revenue for the state and its municipalities.

Understanding Sales Tax in Oklahoma

Sales tax in Oklahoma is a state-level tax imposed on the sale of goods and certain services. It is a consumption tax, meaning that it is paid by the end consumer rather than the business. The primary purpose of sales tax is to raise funds for essential government services, such as education, infrastructure development, and public safety, while also supporting local communities.

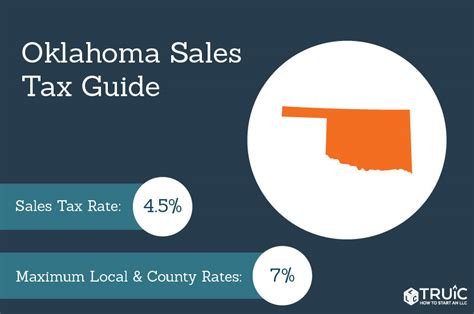

The sales tax rate in Oklahoma is determined by a combination of state and local taxes. As of [most recent data available], the state sales tax rate stands at 4.5%, which is one of the lower rates compared to other states. However, this rate can vary depending on the location and the specific goods or services being purchased.

In addition to the state sales tax, various municipalities in Oklahoma have the authority to impose additional sales taxes, known as local option taxes. These local taxes can significantly impact the overall sales tax rate, leading to variations across different regions within the state. For instance, while some cities may have a combined sales tax rate close to the state average, others could have rates as high as 9% or more.

Local Option Taxes: A Closer Look

Local option taxes are a unique feature of Oklahoma’s sales tax system, allowing municipalities to address their specific financial needs and fund local projects. These taxes are typically approved through local ballot initiatives or legislative actions and are dedicated to specific purposes, such as supporting education, public transportation, or economic development initiatives.

| City | Combined Sales Tax Rate | Local Option Taxes |

|---|---|---|

| Oklahoma City | 8.5% | 0.5% for Capital Improvement and 0.5% for Public Safety |

| Tulsa | 8.5% | 1% for Capital Improvement and 0.5% for Public Safety |

| Norman | 8.75% | 1% for Economic Development |

| Broken Arrow | 8.5% | 1% for Economic Development |

| Edmond | 8% | 0.5% for General Fund |

It's important to note that these rates are subject to change, and new local option taxes may be introduced over time. As of [most recent data], these are the prevailing sales tax rates in some of Oklahoma's major cities.

Sales Tax Exemptions and Special Considerations

While sales tax is applied to most goods and services, Oklahoma, like many other states, provides exemptions and special considerations for certain items and situations. These exemptions are designed to support specific industries, promote economic development, and provide relief to consumers.

Exemptions for Food and Groceries

One notable exemption in Oklahoma is the food and groceries sales tax exemption. Many essential food items, including groceries, are exempt from sales tax, providing a significant benefit to consumers. This exemption is especially beneficial for low-income households and helps alleviate the tax burden on basic necessities.

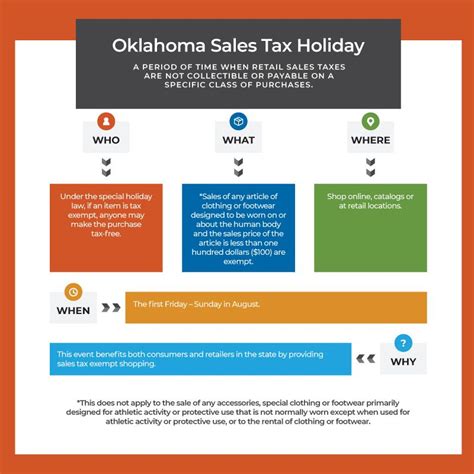

Sales Tax Holidays

Oklahoma also participates in sales tax holidays, which are designated periods when specific items are exempt from sales tax. These holidays often occur around major shopping events, such as back-to-school season or holiday sales. During these periods, consumers can save money on essential purchases, and businesses can benefit from increased sales.

Taxable Services

In addition to sales tax on goods, Oklahoma imposes sales tax on certain services. These taxable services include professional services, repairs, and certain recreational activities. The taxability of services can vary depending on the specific nature of the service and the industry involved.

Sales Tax Collection and Compliance

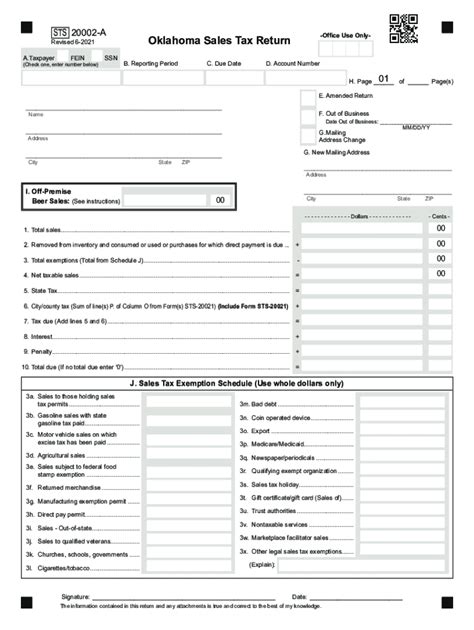

Sales tax collection is a critical aspect of Oklahoma’s tax system. Businesses are responsible for collecting and remitting sales tax to the Oklahoma Tax Commission. This process involves accurate record-keeping, tax calculation, and timely filing of tax returns.

To ensure compliance, the Oklahoma Tax Commission provides businesses with resources and guidance on sales tax collection. This includes tax rate tables, exemption guidelines, and registration processes. Additionally, the commission conducts audits to verify compliance and may impose penalties for non-compliance.

Online Sales and Remote Sellers

With the rise of e-commerce, online sales have become a significant part of Oklahoma’s economy. The state has implemented laws and regulations to ensure that sales tax is collected on online transactions, even when the seller is located out of state. This includes the requirement for remote sellers to register with the Oklahoma Tax Commission and collect sales tax on their Oklahoma sales.

Impact on Businesses and Consumers

Sales tax in Oklahoma has a significant impact on both businesses and consumers. For businesses, sales tax is an essential revenue stream that contributes to their overall profitability. It also plays a role in shaping pricing strategies and can influence a business’s competitive advantage.

For consumers, sales tax is a visible cost added to their purchases. While it may not significantly impact their day-to-day spending, it becomes more noticeable during large purchases or when buying luxury items. However, the sales tax exemption on essential goods, such as groceries, provides a welcome relief for households.

Strategies for Businesses

Businesses in Oklahoma can employ various strategies to manage sales tax effectively. One approach is to incorporate sales tax into their pricing strategies, ensuring that the tax is included in the advertised price. This simplifies the purchasing process for consumers and reduces the likelihood of sticker shock at the checkout.

Another strategy is to leverage sales tax holidays and exemptions to promote sales and attract customers. By offering discounts or special promotions during these periods, businesses can encourage consumer spending and boost their revenue.

The Future of Sales Tax in Oklahoma

As Oklahoma’s economy continues to evolve, so too will its sales tax system. The state’s tax policies are subject to ongoing review and potential changes to adapt to the changing economic landscape and the needs of its citizens.

One potential area of focus is the continued growth of e-commerce and the challenges it presents for sales tax collection. Oklahoma, like many other states, will need to address the complexities of taxing online sales and ensuring a level playing field for brick-and-mortar businesses.

Additionally, the state may explore opportunities to simplify its sales tax system, potentially by reducing the number of local option taxes or harmonizing tax rates across regions. This could make tax compliance more straightforward for businesses and reduce administrative burdens.

Conclusion

Sales tax in Oklahoma is a vital component of the state’s tax system, contributing to its economic growth and development. With a combination of state and local taxes, Oklahoma’s sales tax structure provides revenue for essential services while also offering exemptions and special considerations to support specific industries and consumers.

As Oklahoma continues to thrive, its sales tax system will play a crucial role in shaping the state's economic future. By staying informed and compliant with sales tax laws, businesses and consumers can contribute to a vibrant and sustainable economy in the Sooner State.

What is the current state sales tax rate in Oklahoma?

+As of [most recent data available], the state sales tax rate in Oklahoma is 4.5%.

How do local option taxes impact the overall sales tax rate in Oklahoma?

+Local option taxes, imposed by municipalities, can significantly increase the overall sales tax rate in Oklahoma. These taxes are dedicated to specific purposes and can vary greatly between different cities.

Are there any sales tax exemptions in Oklahoma?

+Yes, Oklahoma provides exemptions for certain goods and services. One notable exemption is for essential food items and groceries, which are not subject to sales tax.

How can businesses effectively manage sales tax in Oklahoma?

+Businesses can incorporate sales tax into their pricing strategies and leverage sales tax holidays and exemptions to promote sales. Staying informed about tax laws and regulations is crucial for compliance.

What is the impact of online sales on sales tax collection in Oklahoma?

+Online sales have presented challenges for sales tax collection, especially with remote sellers. Oklahoma has implemented laws to ensure sales tax is collected on online transactions, but the state may continue to address these complexities in the future.