Sales Tax For Anaheim Ca

When it comes to understanding sales tax, it's essential to know that it can vary from state to state and even within different cities and counties. In the case of Anaheim, California, a vibrant city known for its world-famous attractions, there are specific sales tax rates and regulations that businesses and consumers alike should be aware of. This comprehensive guide aims to delve into the sales tax landscape of Anaheim, providing a detailed analysis of the rates, their structure, and the impact they have on the local economy.

Understanding Sales Tax in Anaheim, California

Sales tax in Anaheim, like the rest of California, is a consumption tax levied on the sale of goods and certain services. It is a crucial source of revenue for the state and local governments, contributing to essential public services and infrastructure development. The sales tax rate is composed of various components, including state, county, and city rates, each playing a significant role in the overall tax structure.

State Sales Tax Rate

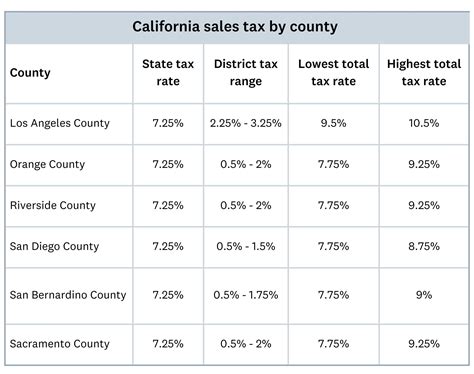

California’s state sales tax rate is a fundamental component of the overall tax structure. As of the latest information, the state sales tax rate in California stands at 7.25%. This rate is applied uniformly across the state, including Anaheim, and forms the base for the total sales tax calculation.

| Category | Sales Tax Rate |

|---|---|

| State Sales Tax | 7.25% |

County Sales Tax Rate

The County of Orange, where Anaheim is located, imposes an additional sales tax on top of the state rate. As of our last update, the Orange County sales tax rate stands at 0.25%. This county-level tax is added to the state tax, creating a cumulative tax burden for consumers.

| Category | Sales Tax Rate |

|---|---|

| Orange County Sales Tax | 0.25% |

City Sales Tax Rate

Anaheim, as a city within Orange County, also has its own sales tax rate. This city-specific rate is applied on top of the state and county rates, further increasing the total sales tax obligation. The current sales tax rate for Anaheim is 0.50%, making it a significant contributor to the city’s revenue stream.

| Category | Sales Tax Rate |

|---|---|

| Anaheim City Sales Tax | 0.50% |

Calculating the Total Sales Tax in Anaheim

To calculate the total sales tax in Anaheim, one must aggregate the state, county, and city rates. By adding these rates together, we can determine the effective sales tax rate applicable to transactions within the city.

The total sales tax rate in Anaheim is calculated as follows:

| Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Orange County Sales Tax | 0.25% |

| Anaheim City Sales Tax | 0.50% |

| Total Sales Tax | 8% |

Therefore, the total sales tax rate in Anaheim is 8%, which means that for every dollar spent on taxable goods or services, consumers pay an additional eight cents in sales tax.

Impact on Local Businesses and Consumers

The sales tax structure in Anaheim has a significant impact on both local businesses and consumers. For businesses, the sales tax can influence pricing strategies, as they must factor in the tax when setting their retail prices. Additionally, businesses must ensure accurate tax collection and remittance to the appropriate tax authorities, which can be a complex process, especially for those operating in multiple jurisdictions.

For consumers, the sales tax directly affects their purchasing power and overall spending. A higher sales tax rate can deter consumers from making certain purchases, especially if they have the option to shop in nearby jurisdictions with lower tax rates. On the other hand, a well-managed sales tax system can provide stability and funding for essential local services, benefiting the community as a whole.

Sales Tax Exemptions and Special Considerations

While the standard sales tax rate applies to most goods and services, there are certain exemptions and special considerations in Anaheim. These exemptions are crucial for businesses and consumers alike, as they can significantly impact the overall tax liability.

Exemptions for Specific Goods and Services

Certain goods and services are exempt from sales tax in Anaheim. These exemptions can vary depending on state and local laws, but some common examples include:

- Prescription medications

- Groceries and certain food items

- Certain agricultural products

- Residential rents

- Certain medical devices

Businesses selling these exempt items do not need to collect sales tax on those specific transactions. However, it's essential to stay updated with the latest tax regulations, as exemptions can change over time.

Special Tax Rates for Specific Industries

In some cases, specific industries or sectors may be subject to special tax rates. For instance, businesses engaged in the hospitality industry, such as hotels and restaurants, might face different tax structures. These special rates can impact the pricing strategies and overall financial planning for businesses in these sectors.

Tax Incentives and Rebates

To promote economic development and support specific industries, Anaheim, like many other jurisdictions, may offer tax incentives or rebates. These incentives can take various forms, such as tax holidays, tax credits, or reduced tax rates for a specific period. Businesses should explore these opportunities to optimize their tax obligations and contribute to the local economy.

Sales Tax Compliance and Reporting

Sales tax compliance is a critical aspect for businesses operating in Anaheim. Accurate tax collection, remittance, and reporting are essential to avoid legal consequences and maintain a positive relationship with tax authorities. Here’s an overview of the key considerations for sales tax compliance in Anaheim:

Registration and Permits

Businesses operating in Anaheim must obtain the necessary permits and registrations to conduct sales transactions. This typically involves registering with the California Department of Tax and Fee Administration (CDTFA) and obtaining a Seller’s Permit. The permit allows businesses to collect and remit sales tax on behalf of the state and local governments.

Tax Collection and Remittance

Businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is then held in trust until it is remitted to the tax authorities. The frequency of remittance can vary, with some businesses required to remit taxes monthly, quarterly, or annually, depending on their tax liability and business volume.

Sales Tax Returns

Businesses must file sales tax returns, which detail the total sales, taxable sales, and the corresponding tax collected during a specific period. These returns are typically due on a monthly or quarterly basis and must be filed accurately to avoid penalties and interest charges. The sales tax returns provide transparency and accountability for both the business and the tax authorities.

Record-Keeping and Audits

Maintaining accurate and organized records is crucial for sales tax compliance. Businesses should keep detailed records of sales transactions, including the tax collected, to facilitate easy reference during audits. Tax authorities may conduct audits to ensure compliance, and proper record-keeping can simplify this process and demonstrate a business’s commitment to tax integrity.

Conclusion: Navigating the Sales Tax Landscape in Anaheim

Understanding the sales tax structure in Anaheim is vital for both businesses and consumers. The cumulative sales tax rate of 8% is a significant consideration for pricing strategies and consumer spending decisions. Additionally, the various exemptions, special rates, and incentives can provide opportunities for businesses to optimize their tax obligations and contribute to the local economy.

For businesses, navigating the sales tax landscape requires careful planning, accurate record-keeping, and timely compliance with tax regulations. By staying informed and proactive, businesses can ensure they meet their tax obligations while contributing to the vibrant economic ecosystem of Anaheim. Consumers, too, benefit from understanding the sales tax structure, as it empowers them to make informed purchasing decisions and support the local businesses and services they value.

Frequently Asked Questions (FAQ)

Are there any additional sales tax rates for specific areas within Anaheim?

+No, Anaheim has a uniform sales tax rate throughout the city. There are no additional sales tax rates for specific areas within Anaheim.

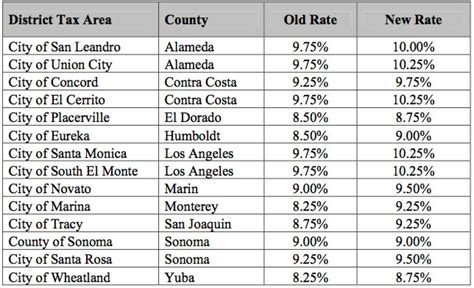

How often do sales tax rates change in Anaheim?

+Sales tax rates can change periodically due to various factors, including legislative changes and local initiatives. It’s advisable to stay updated with the latest tax rates to ensure compliance.

Are there any online resources to calculate sales tax in Anaheim?

+Yes, several online tools and calculators are available to help estimate sales tax. These tools can provide quick estimates based on the latest tax rates, making it easier for businesses and consumers to understand their tax obligations.

Can I claim a refund for overpaid sales tax in Anaheim?

+In certain cases, you may be eligible for a refund if you have overpaid sales tax. It’s essential to review the refund policies and procedures outlined by the California Department of Tax and Fee Administration to understand the requirements and process for claiming a refund.

Are there any tax incentives for new businesses in Anaheim?

+Anaheim, like many cities, may offer tax incentives to attract and support new businesses. These incentives can include tax breaks, grants, or reduced tax rates for a specific period. It’s beneficial for new businesses to explore these opportunities and consult with local authorities or tax professionals for guidance.