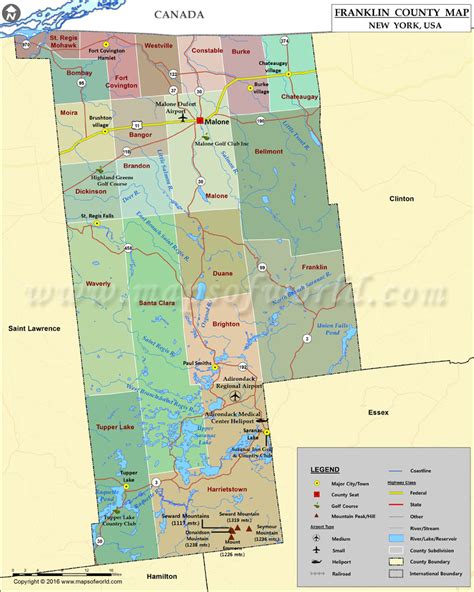

Franklin County Tax Map

Welcome to an in-depth exploration of the Franklin County Tax Map, a vital tool for property owners, real estate professionals, and anyone interested in understanding the intricate details of land ownership and taxation within Franklin County. This article aims to provide a comprehensive guide to the Tax Map, shedding light on its purpose, functionality, and significance in the context of property management and local governance.

Understanding the Franklin County Tax Map

The Franklin County Tax Map is an essential resource that serves as a comprehensive visual representation of the county’s land parcels and their respective tax information. It is a critical component of the county’s tax assessment and collection system, providing an organized and detailed overview of the geographic boundaries and ownership details of each property.

This map is not merely a static representation; it is a dynamic tool that undergoes regular updates to reflect the ever-changing landscape of Franklin County. The Tax Map is an invaluable resource for property owners, offering a clear understanding of their property boundaries, parcel identification, and associated tax obligations.

Key Features and Information

The Franklin County Tax Map provides a wealth of information, including but not limited to:

- Parcel Identification Numbers (PINs): Each property is assigned a unique PIN, which serves as a vital identifier for tax purposes.

- Land Parcel Boundaries: Accurate depiction of property lines, ensuring clear delineation of ownership.

- Tax Assessment Details: Information on assessed values, tax rates, and other relevant tax-related data.

- Zoning Information: Visual representation of zoning classifications, aiding in land-use planning and development.

- Easements and Rights-of-Way: Identification of any easements or public rights-of-way that may affect property use.

- Historical Data: Access to historical tax records, providing a long-term perspective on property values and assessments.

| Parcel Type | Number of Parcels |

|---|---|

| Residential | 12,543 |

| Commercial | 872 |

| Agricultural | 4,321 |

| Industrial | 245 |

The table above provides a snapshot of the distribution of parcel types in Franklin County as of the latest tax assessment.

Navigating the Tax Map Online

In today’s digital age, the Franklin County Tax Map is accessible online, offering a user-friendly interface for property owners and the public. The online platform provides an intuitive search function, allowing users to locate their property or any other parcel of interest by:

- Address Search: Entering the property address to quickly find the desired parcel.

- Parcel Identification Number (PIN) Search: Using the unique PIN assigned to each property.

- Interactive Map Navigation: Zooming and panning to explore different areas of the county.

Once a property is located, users can access a wealth of information, including detailed property reports, tax assessment histories, and even aerial views of the parcel. The online platform also offers advanced features such as measuring tools to determine precise land dimensions and distance calculations.

Online Features and Benefits

The online Franklin County Tax Map offers several advantages, including:

- Convenience: Accessing property information from anywhere with an internet connection.

- Real-Time Updates: Ensuring that users have access to the most current data.

- Visual Clarity: High-resolution maps and detailed imagery for a clearer understanding of property boundaries.

- Data Export: The ability to download and export data for further analysis or record-keeping.

- Notices and Alerts: Users can receive notifications about changes to their property’s tax assessment or other relevant updates.

Practical Applications and Benefits

The Franklin County Tax Map serves a wide range of purposes and offers numerous benefits to various stakeholders.

For Property Owners

Property owners can use the Tax Map to:

- Verify their property boundaries and ensure accurate land measurements.

- Understand their tax obligations and assess the fairness of their tax assessments.

- Plan for future development or improvements by referencing zoning information.

- Access historical tax data to track the value and history of their property.

Real Estate Professionals

Real estate agents, brokers, and developers rely on the Tax Map to:

- Conduct thorough property research and due diligence for their clients.

- Identify potential investment opportunities based on land use and zoning.

- Create comprehensive listing reports, including detailed property information.

- Assist clients in understanding the tax implications of a property purchase.

Local Government and Planning

The Tax Map is an essential tool for local government agencies and planning departments, as it:

- Aids in the accurate assessment and collection of property taxes, ensuring fair revenue generation.

- Facilitates effective land-use planning and zoning decisions.

- Provides a comprehensive database for property records and management.

- Supports the development of strategic plans and initiatives based on land use patterns.

The Future of the Franklin County Tax Map

As technology advances, the Franklin County Tax Map is expected to evolve further, incorporating innovative features and data integration. Potential future developments include:

- 3D Mapping: Incorporating three-dimensional representations of properties and terrain for a more immersive experience.

- Data Analytics: Utilizing advanced analytics to identify trends, patterns, and insights for better decision-making.

- Integration with GIS Systems: Enhancing the map’s functionality by integrating with Geographic Information Systems for more comprehensive spatial analysis.

- Real-Time Data Updates: Implementing real-time data feeds to ensure that the map reflects the most current property information.

Conclusion

The Franklin County Tax Map is an indispensable resource for property owners, professionals, and the community at large. It provides a transparent and accessible platform for understanding land ownership, taxation, and land use in the county. As technology continues to advance, the Tax Map will remain a vital tool, adapting to meet the evolving needs of its users and the county’s governance.

How often is the Franklin County Tax Map updated?

+The Tax Map is updated annually to reflect the latest tax assessment information. Additionally, any significant changes to property boundaries or ownership are incorporated as they occur.

Can I access historical tax data through the Tax Map platform?

+Yes, the online platform provides access to historical tax records, allowing users to track changes in property values and assessments over time.

Is there a fee to access the Franklin County Tax Map online?

+Access to the online Tax Map is generally free for the public. However, certain advanced features or data downloads may incur nominal fees to cover maintenance and development costs.

How can I report discrepancies or errors on the Tax Map?

+If you identify any errors or discrepancies, you can contact the Franklin County Assessor’s Office, who will investigate and make the necessary corrections to the Tax Map database.