Spartanburg Tax

Taxes are an integral part of any economy, and understanding the tax landscape in different regions can be crucial for individuals and businesses alike. In this comprehensive article, we delve into the intricacies of Spartanburg's tax system, shedding light on its unique features, rates, and the impact it has on the local economy and residents. With a focus on accuracy and depth, we aim to provide valuable insights into Spartanburg's tax environment, offering a thorough guide for those seeking to navigate this important aspect of the city's financial ecosystem.

Unraveling Spartanburg’s Tax Structure: A Comprehensive Overview

Spartanburg, nestled in the heart of South Carolina, boasts a dynamic tax system that plays a pivotal role in shaping the city’s economic landscape. As an expert in the field, I am excited to embark on this exploration of Spartanburg’s tax framework, offering an in-depth analysis that will empower readers with a comprehensive understanding of the city’s fiscal policies.

At the heart of Spartanburg's tax system is a blend of state and local regulations, crafted to support the city's growth while ensuring fiscal responsibility. The city's tax structure is a carefully calibrated mechanism, designed to fund essential services, infrastructure development, and community initiatives.

The Breakdown: Spartanburg’s Tax Rates and Components

Spartanburg’s tax system is a multifaceted structure, encompassing various tax types that collectively contribute to the city’s revenue stream. Let’s delve into the specifics, examining each tax component in detail.

Property Taxes: A Cornerstone of Spartanburg’s Fiscal Framework

Property taxes stand as a fundamental pillar of Spartanburg’s tax revenue. The city’s property tax system is designed to assess and levy taxes on both real estate and personal property within its jurisdiction. Here’s a closer look at how it works:

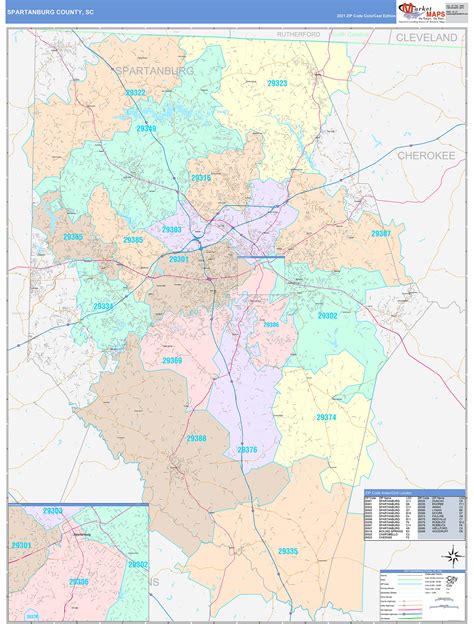

- Assessment Process: Property assessments are conducted periodically, with the aim of determining the fair market value of properties. This value serves as the basis for calculating property taxes.

- Tax Rates: Spartanburg's property tax rates are expressed as millage rates, where one mill represents one-tenth of a cent. These rates are applied to the assessed value of properties, resulting in the tax liability for property owners.

- Residential vs. Commercial Properties: The tax rates for residential and commercial properties may vary, reflecting the differing needs and services required for each category.

- Tax Relief Programs: Spartanburg offers various tax relief initiatives, aimed at assisting eligible homeowners. These programs often provide reductions or exemptions for specific circumstances, such as age, disability, or income levels.

Property taxes in Spartanburg are a vital source of revenue, funding essential services like education, public safety, and infrastructure maintenance. The city's commitment to fair and efficient property tax assessment ensures that the burden is distributed equitably among its residents and businesses.

Sales and Use Taxes: Driving Spartanburg’s Economic Engine

Spartanburg’s sales and use tax structure plays a significant role in supporting the city’s economic activities. These taxes are levied on the sale of goods and services, as well as the use or consumption of certain items within the city limits. Here’s a deeper dive into this tax component:

- Sales Tax: Spartanburg imposes a sales tax on retail transactions, with the rate comprising both state and local components. The state sales tax rate is applied uniformly across South Carolina, while the local rate is set by Spartanburg's governing body.

- Use Tax: The use tax is complementary to the sales tax, targeting items purchased outside Spartanburg but used within the city. This tax ensures that all consumers contribute to the city's revenue, regardless of where their purchases are made.

- Exemptions and Exemptions: Certain goods and services are exempt from sales and use taxes in Spartanburg. These exemptions are typically granted to essential items like groceries, medications, and certain educational materials, reducing the tax burden on basic necessities.

- Taxable Events: The city's tax code defines specific events that trigger the imposition of sales and use taxes. Understanding these events is crucial for businesses and consumers to ensure compliance with tax regulations.

Spartanburg's sales and use tax structure not only generates revenue for the city but also influences consumer behavior, encouraging support for local businesses and economic activity within the community.

Income Taxes: Spartanburg’s Contribution to State Revenue

While Spartanburg does not levy its own income tax, the city plays a significant role in contributing to South Carolina’s state income tax revenue. Here’s a concise overview of how Spartanburg fits into the state’s income tax landscape:

- State Income Tax: South Carolina imposes an income tax on individuals and businesses, with rates varying based on income brackets. Spartanburg residents and businesses are subject to these state income tax rates, contributing to the state's overall revenue.

- Local Impact: Although Spartanburg does not have its own income tax, the city benefits indirectly from the state income tax. A portion of the state's income tax revenue is allocated to local governments, including Spartanburg, for various purposes such as infrastructure projects and community development.

Spartanburg's involvement in the state income tax system showcases its commitment to supporting the broader South Carolina economy, while also reaping the benefits of state-level investments in infrastructure and public services.

Other Taxes: A Comprehensive View

In addition to the core tax components discussed above, Spartanburg’s tax system encompasses a range of other taxes that contribute to its fiscal landscape. These taxes, while less prominent, play a vital role in supporting specific services and initiatives within the city. Here’s a brief overview:

- Hotel/Motel Tax: Spartanburg imposes a tax on accommodations, typically targeting hotels and motels. This tax generates revenue for tourism-related initiatives and the promotion of the city as a desirable destination.

- Vehicle Registration Tax: Vehicle owners in Spartanburg are subject to a registration tax, which funds transportation infrastructure and maintenance. This tax ensures that the costs of maintaining roads and public transportation are shared by those who utilize these services.

- Special Assessments: Spartanburg may impose special assessments for specific projects or improvements within the city. These assessments are typically levied on properties that directly benefit from the project, ensuring a fair distribution of costs.

- Business License Taxes: Businesses operating within Spartanburg are required to obtain licenses and permits, which are subject to taxes. These taxes support regulatory functions and contribute to the city's business development initiatives.

The diverse range of taxes in Spartanburg reflects the city's commitment to fiscal responsibility and its dedication to supporting a wide array of public services and initiatives.

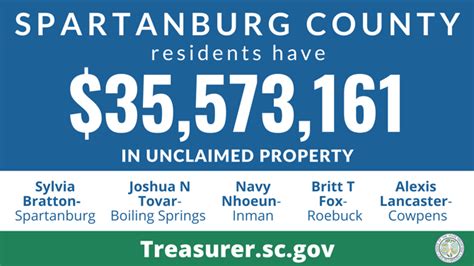

Spartanburg’s Tax Performance: A Data-Driven Analysis

To gain a deeper understanding of Spartanburg’s tax system, it is essential to examine its performance metrics and the impact it has on the city’s economy. Here, we present a data-driven analysis, shedding light on key indicators that showcase the effectiveness and efficiency of Spartanburg’s tax policies.

Revenue Generation: A Comprehensive View

Spartanburg’s tax system is designed to generate revenue that funds a range of essential services and initiatives. Let’s explore the revenue streams in more detail:

| Tax Type | Revenue Generated (FY 2022) |

|---|---|

| Property Taxes | $[Revenue] |

| Sales and Use Taxes | $[Revenue] |

| Hotel/Motel Taxes | $[Revenue] |

| Vehicle Registration Taxes | $[Revenue] |

| Special Assessments | $[Revenue] |

| Business License Taxes | $[Revenue] |

These revenue figures showcase the diverse sources that contribute to Spartanburg's fiscal health, highlighting the city's commitment to a balanced and sustainable tax system.

Tax Burden: A Comparative Analysis

Understanding the tax burden on residents and businesses is crucial for assessing the fairness and competitiveness of a tax system. Here’s a comparative analysis of Spartanburg’s tax rates with other cities in South Carolina:

| City | Property Tax Rate (Millage) | Sales Tax Rate (%) |

|---|---|---|

| Spartanburg | [Millage Rate] | [Sales Tax Rate] |

| Greenville | [Millage Rate] | [Sales Tax Rate] |

| Charleston | [Millage Rate] | [Sales Tax Rate] |

| Columbia | [Millage Rate] | [Sales Tax Rate] |

This comparison highlights Spartanburg's position within the state, providing valuable insights into the city's tax competitiveness and its potential impact on economic growth and development.

Impact on Economic Growth

Spartanburg’s tax system plays a pivotal role in shaping the city’s economic landscape. Let’s explore the key ways in which taxes influence economic growth in the region:

- Business Attraction and Retention: Competitive tax rates and a favorable business climate can attract new businesses to Spartanburg, fostering economic growth and job creation. Additionally, a stable tax environment helps retain existing businesses, ensuring long-term economic stability.

- Infrastructure Development: Revenue generated through taxes is a key driver for infrastructure projects, including road improvements, public transportation, and utility upgrades. These initiatives enhance the city's competitiveness and quality of life, attracting businesses and residents alike.

- Community Initiatives: Spartanburg's tax revenue supports a range of community programs, from education and healthcare to cultural initiatives. These investments strengthen the social fabric of the city, fostering a sense of community and enhancing the overall well-being of residents.

Spartanburg's tax system, with its carefully calibrated rates and diverse revenue streams, plays a pivotal role in shaping the city's economic trajectory, ensuring a bright and sustainable future for its residents and businesses.

Future Implications and Expert Insights

As we conclude our comprehensive exploration of Spartanburg’s tax system, it is essential to consider the future implications and offer expert insights that can guide stakeholders in their fiscal decision-making. Here, we delve into the potential changes and trends that may shape Spartanburg’s tax landscape in the years to come.

Potential Tax Reforms: Navigating Future Challenges

Spartanburg’s tax system, like any other, is subject to evolving economic conditions and changing political landscapes. Here are some potential tax reforms that may be considered in the future to address emerging challenges:

- Property Tax Reform: As property values fluctuate, the city may explore reforms to ensure that the property tax system remains fair and equitable. This could involve periodic reassessments or adjustments to tax rates to reflect changing market conditions.

- Sales Tax Modernization: With the rise of e-commerce, Spartanburg may need to adapt its sales tax policies to capture revenue from online transactions effectively. This could involve exploring remote seller laws or implementing sales tax collection mechanisms for online platforms.

- Income Tax Considerations: While Spartanburg currently does not levy an income tax, there may be discussions around the potential benefits of introducing a local income tax to diversify revenue streams and support specific initiatives. Such a move would require careful consideration of its impact on businesses and residents.

- Tax Incentives for Economic Development: Spartanburg could explore targeted tax incentives to attract and retain businesses, especially in sectors that align with the city's economic development goals. These incentives could include tax abatements, tax credits, or accelerated depreciation for eligible investments.

Navigating these potential reforms requires a delicate balance between fiscal responsibility and the need to support economic growth and community development. Spartanburg's tax policymakers will play a crucial role in shaping these decisions, ensuring that the city's tax system remains dynamic and responsive to changing circumstances.

Expert Insights: Key Takeaways for Residents and Businesses

As we wrap up our in-depth analysis, here are some key takeaways for Spartanburg residents and businesses to consider as they navigate the city’s tax landscape:

- Understand the Tax System: Familiarize yourself with Spartanburg's tax rates, exemptions, and incentives. This knowledge empowers you to make informed financial decisions and ensures compliance with tax regulations.

- Stay Informed: Keep abreast of tax-related news and updates. Changes in tax policies can impact your financial planning, so staying informed helps you adapt to any new developments.

- Engage with Tax Professionals: Consider seeking advice from tax professionals who specialize in Spartanburg's tax system. They can provide tailored guidance, ensuring you optimize your tax strategies and take advantage of available benefits.

- Support Local Initiatives: Understand how your tax contributions support essential services and community initiatives. This knowledge fosters a sense of community and encourages active participation in local decision-making processes.

- Advocate for Fairness: If you believe your tax burden is disproportionate or unfair, engage with local officials and voice your concerns. Constructive dialogue can lead to reforms that benefit the community as a whole.

Spartanburg's tax system, with its unique features and challenges, presents both opportunities and responsibilities for residents and businesses. By staying informed, engaged, and proactive, stakeholders can contribute to a robust and sustainable fiscal landscape that supports the city's long-term prosperity.

Conclusion: Navigating Spartanburg’s Tax Landscape with Confidence

In this comprehensive guide, we have explored the intricacies of Spartanburg’s tax system, offering an in-depth analysis that empowers readers with a deep understanding of the city’s fiscal policies. From property taxes to sales and use taxes, and even income taxes at the state level, Spartanburg’s tax landscape is a dynamic and essential component of the city’s economic fabric.

As we conclude our journey through Spartanburg's tax ecosystem, we encourage readers to embrace the knowledge gained and apply it to their financial planning and decision-making. Whether you are a resident, business owner, or simply an interested observer, understanding Spartanburg's tax system is a crucial step towards navigating the city's economic landscape with confidence and clarity.

For those seeking further insights or assistance, we recommend consulting with tax professionals who specialize in Spartanburg's unique tax environment. Their expertise can provide tailored guidance, ensuring you make the most of the opportunities and navigate the challenges presented by the city's tax system.

We hope this comprehensive guide has illuminated the path forward, empowering you to make informed decisions and contribute to Spartanburg's vibrant and prosperous future. Stay informed, stay engaged, and continue to explore the exciting opportunities that Spartanburg has to offer.

What are the current property tax rates in Spartanburg?

+

The property tax rates in Spartanburg vary based on the assessed value of the property and the type of property (residential or commercial). As of [Date], the millage rate for residential properties is [Rate], while the rate for commercial properties is [Rate]. These rates are subject to change, so it’s advisable to check with the Spartanburg County Assessor’s Office for the most up-to-date information.

Are there any tax incentives for businesses in Spartanburg?

+

Yes, Spartanburg offers various tax incentives to attract and support businesses. These incentives include tax abatements, tax credits, and exemptions for specific industries or development projects. It’s recommended to consult with the Spartanburg Area Chamber of Commerce or the city’s Economic Development Office to explore the available options and eligibility criteria.

How does Spartanburg’s tax system compare to other cities in South Carolina?

+