Understanding Nebraska Income Tax: How It Affects Your Finances

When contemplating the financial landscape for Nebraska residents, one element often overlooked yet profoundly impactful is the state income tax system. As a day-in-the-life perspective, understanding how Nebraska income tax functions, how it influences personal and business finances, and what strategies might optimize fiscal health forms the crux of this exploration. For those navigating payroll, enterprise management, or personal wealth accumulation within the Cornhusker State, grasping these dynamics isn't just beneficial—it's essential for making informed financial decisions that align with long-term goals.

Nebraska Income Tax: An In-Depth Breakdown of Its Structure and Impact

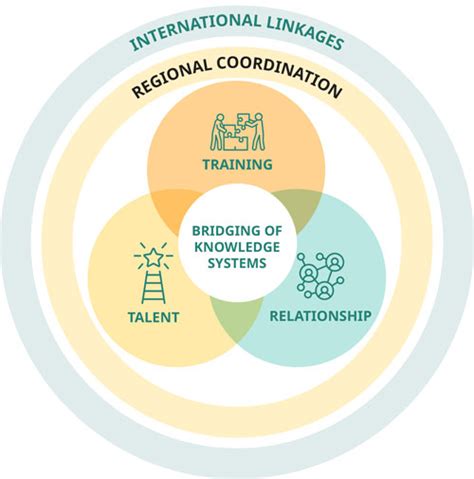

Nebraska’s income tax system is characterized by a progressive structure, combining multiple tax brackets with a host of deductions and credits tailored to support residents across income spectrums. The state’s tax rates have undergone several reforms over the past decade, aligning with economic shifts and policy adjustments that aim to balance revenue needs with taxpayer fairness. These adjustments influence everything from paycheck withholding to corporate planning, making it imperative for individuals and business owners alike to stay updated on current rates, thresholds, and incentives.

Understanding Nebraska’s Tax Brackets and Rates

The state’s top marginal income tax rate currently hovers around 6.84% for income exceeding specific thresholds—about $31,750 for single filers in 2023, with adjustments for filing status. This tiered approach means lower-income brackets enjoy reduced rates, sometimes as low as 2.46%, affording a degree of relief that varies with income levels. The structure reflects Nebraska’s effort to maintain a balanced tax system that funds vital services while remaining competitive compared to neighboring states.

| Relevant Category | Substantive Data |

|---|---|

| Top Marginal Rate | 6.84% for income over $31,750 (2023) |

| Lowest Marginal Rate | 2.46% for income below approximately $3,290 |

| Tax Bracket Thresholds | Ranging from $3,290 to over $31,750 depending on filing status |

Daily Realities of Payroll Withholding and Tax Planning in Nebraska

For employees working within Nebraska, understanding how the state income tax integrates with federal withholding frames daily paycheck management. Employers are mandated to withhold estimated taxes based on current rates and personal exemptions. This process influences disposable income and planning for expenses, savings, or investments. Meanwhile, freelancers, contractors, or business owners must navigate quarterly estimated payments, tax credits, and possible deductions.

Implications for Personal Finances

Withholding calculations based on Nebraska’s tax brackets ensure that most residents meet their tax obligations without incurring significant liabilities during tax season. Yet, miscalculations or life changes—such as marriage, home purchase, or career shift—can impact withholding needs. Proper adjustments can prevent overpayment or underpayment, both of which carry tangible consequences, including potential interest penalties or missed savings opportunities.

| Relevant Category | Substantive Data |

|---|---|

| Average Withholding Rate | Approximately 4%–6% depending on income level and allowances (2023) |

| Estimated Tax Payment Frequency | Quarterly, aligned with federal deadlines |

| Common Deductions & Credits | Standard deduction ($8,900 single, $16,800 married filing jointly), Child Tax Credit, Education Credits |

Business Taxation: HowNebraska’s Income Tax Influences Corporate and Small Business Finances

Operating within Nebraska’s tax environment involves more than personal withholding; business stakeholders face a series of obligations and opportunities. The state’s corporation income tax rate is distinct from individual rates, currently set at a flat 5.84% for taxpayers classified as C-corporations. Small and medium-sized businesses often benefit from credits, incentive programs, and accelerated depreciation options that can mitigate overall tax liabilities.

Tax Strategies for Small Business Owners

Business owners must carefully plan their revenue recognition, expense deductions, and employment practices to optimize tax efficiency. For instance, utilizing Nebraska’s research and development credits, or leveraging expedited depreciation under IRS 168(k) provisions, can lower taxable income significantly. Pay attention also to state-specific employment credits aimed at encouraging rural or underserved area investments.

| Relevant Category | Substantive Data |

|---|---|

| Corporate Income Tax Rate | 5.84% flat for C-corporations |

| Business Tax Credits | Research & Development, Job Creation, Rural Incentives |

| Estimated Small Business Impact | Tax reduction opportunities up to 10-15% on taxable income through incentives |

Long-term Financial Planning amidst Nebraska’s Tax Policies

For those contemplating retirement, investment, or estate transfer, Nebraska’s income tax policies shape decision pathways. State tax considerations influence the timing of asset liquidation, IRA distributions, or gifting strategies. Recognizing the thresholds at which additional income prompts higher tax rates helps in structuring withdrawals and estate plans to minimize tax burdens and maximize legacy preservation.

Impact of Tax Policies on Retirement and Wealth Transfer

Nebraska offers several tools, such as the Nebraska Education Savings Plan (529) and other tax-advantaged accounts, to facilitate wealth preservation. However, understanding how distributions from qualified plans are taxed—especially when exceeding thresholds—is key for optimizing income streams during retirement. Additionally, estate and inheritance taxes, though currently moderate, may influence succession planning.

| Relevant Category | Substantive Data |

|---|---|

| Retirement Income Taxation | IRA, 401(k) distributions taxed as ordinary income; thresholds influence tax rates |

| Estate Tax Threshold | $11.2 million exemption (federally, as of 2023), but state may have separate clauses |

| Tax-Advantaged Accounts | State-sponsored 529 plans with tax-free growth and withdrawals for education expenses |

Frequently Asked Questions About Nebraska Income Tax

How does Nebraska’s income tax compare to neighboring states?

+Nebraska’s top rate of 6.84% is moderate compared to states like California, with rates exceeding 13%, but higher than states like Wyoming or South Dakota, which have no state income taxes. The state’s gradual brackets and specific credits position it as a balanced intermediary—offering flexibility for residents and entrepreneurs.

What deductions can I claim on my Nebraska state return?

+Common deductions include the standard deduction (8,900 single or 16,800 married filing jointly in 2023), itemized expenses, and certain business expenses if applicable. Credits such as the Child Care Credit and earned income credits also lower tax liability.

Are there any unique Nebraska tax incentives for businesses?

+Yes, Nebraska offers incentives like the Nebraska Advantage Act, providing tax credits for job creation and investment in targeted industries or regions, especially rural areas. These programs are designed to stimulate economic growth and diversify the state’s tax base.