Property Taxes In St Johns County

Understanding property taxes is crucial for homeowners and prospective buyers alike, as they represent a significant financial obligation and can greatly impact an individual's or family's overall budget. In this comprehensive guide, we will delve into the intricacies of property taxes in St. Johns County, Florida, providing you with the knowledge to make informed decisions and navigate this complex yet essential aspect of homeownership.

The Basics of Property Taxes in St. Johns County

St. Johns County, located in the picturesque northeastern corner of Florida, boasts a unique blend of historic charm and modern development. As one of the fastest-growing counties in the state, it has become a popular destination for residents and businesses alike, leading to a dynamic property market and a correspondingly complex tax landscape.

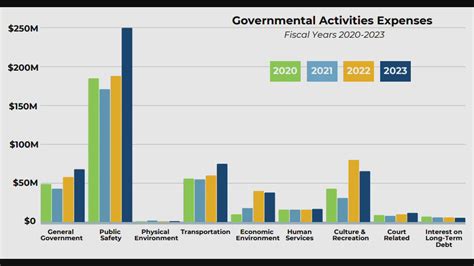

Property taxes in St. Johns County, like in many other parts of the United States, serve as a primary source of revenue for local governments. These taxes fund essential services and infrastructure, including schools, emergency services, road maintenance, and more. Understanding how property taxes work and how they are calculated is, therefore, not just a financial concern but also a civic responsibility.

Assessed Value and Tax Rates

The foundation of property tax calculation lies in the assessed value of a property. In St. Johns County, the Property Appraiser’s Office is responsible for determining this value, which is based on a combination of factors including the property’s location, size, improvements, and recent sales data.

Once the assessed value is determined, it is multiplied by the tax rate, which is set by various taxing authorities within the county. These authorities include the county government, local municipalities, school districts, and special districts like fire and water management districts. Each of these entities has a unique millage rate, which is the number of dollars in tax for every $1,000 of the assessed value.

For instance, if your property has an assessed value of $300,000 and the combined millage rate is 10 mills (0.01), your annual property tax would be $3,000 ($300,000 x 0.01). This calculation provides a straightforward understanding of the tax burden, but it's important to note that the millage rate can vary significantly depending on the specific location of the property within the county.

Taxable Value and Exemptions

The taxable value of a property is not necessarily the same as its assessed value. In St. Johns County, as in many other places, certain exemptions can reduce the taxable value, thereby lowering the property tax bill. These exemptions can be for various reasons, including:

- Homestead Exemption: Available to permanent residents, this exemption can significantly reduce taxable value. In St. Johns County, the first $25,000 of a property's assessed value is exempt from taxation for homeowners who qualify and apply for this exemption.

- Senior Exemption: Residents aged 65 or older may be eligible for an additional exemption of up to $50,000, further reducing their taxable value.

- Military Exemptions: Active-duty military personnel and veterans may qualify for exemptions based on their service status and disability.

- Other Exemptions: There are various other exemptions, such as for widows or widowers, people with disabilities, and non-profit organizations, each with its own set of qualifications and application processes.

Understanding the Property Tax Notice

Every year, property owners in St. Johns County receive a Truth in Millage (TRIM) Notice, which provides detailed information about their property’s assessed value, taxable value, and the calculated property taxes. This notice is typically mailed out in late summer or early fall and serves as a crucial document for property owners to review and understand.

The TRIM Notice breaks down the millage rates and the corresponding tax amounts for each taxing authority, allowing homeowners to see exactly where their tax dollars are going. It also provides an opportunity for property owners to appeal the assessed value if they believe it is inaccurate or unfair.

The Impact of Property Taxes on Homeownership

Property taxes can significantly influence a homeowner’s financial planning and decision-making. For prospective buyers, understanding the potential tax burden is crucial when determining if a property is affordable and sustainable in the long term. Existing homeowners, on the other hand, must consider property taxes as an ongoing expense that can fluctuate based on changes in the property’s value or tax rates.

Budgeting and Financial Planning

Property taxes are typically paid in two installments, with due dates typically falling in March and September. These payments are often bundled with mortgage payments, creating a substantial monthly or semi-annual financial commitment. Therefore, it is essential for homeowners to budget effectively to ensure they can meet these obligations.

Financial planners and mortgage advisors often suggest setting aside a portion of monthly income into a dedicated savings account to cover property tax payments. This strategy helps ensure that homeowners have the necessary funds available when the tax bills are due, preventing any potential financial strain.

The Role of Property Taxes in Real Estate Transactions

When buying or selling a property, property taxes play a significant role in the transaction. For buyers, understanding the current property tax rate and the potential for future increases can influence their decision to purchase. Sellers, on the other hand, may need to factor in property taxes when setting their asking price, especially if they have enjoyed a lower tax rate due to exemptions or other factors.

Real estate agents and brokers often provide prospective buyers with information about the current property tax rate and any potential exemptions that the buyer may be eligible for. This information can be a deciding factor for buyers, especially when comparing similar properties in different areas of the county.

Navigating Property Tax Challenges

While property taxes are a necessary part of homeownership, they can present challenges for some homeowners. Whether it’s due to a sudden increase in the property’s assessed value, changes in tax rates, or difficulties in qualifying for exemptions, understanding how to navigate these challenges is essential for maintaining financial stability.

Appealing Assessed Value

If a homeowner believes that their property’s assessed value is incorrect or unfairly high, they have the right to appeal. In St. Johns County, the Property Appraiser’s Office provides a formal process for appealing assessed values. This process typically involves submitting evidence, such as recent sales data of similar properties, to support the claim that the assessed value is inaccurate.

Appeals can be complex and time-consuming, so it is often beneficial for homeowners to seek guidance from professionals, such as tax advisors or attorneys, who specialize in property tax appeals. These experts can help navigate the appeal process, ensuring that all necessary steps are taken and increasing the chances of a successful outcome.

Exemption Eligibility and Application

Understanding which exemptions a homeowner is eligible for and completing the application process can be another challenge. Each exemption has its own set of qualifications and documentation requirements. For instance, the Homestead Exemption requires the homeowner to reside on the property as their primary residence, while the Senior Exemption has age and residency requirements.

Staying informed about the various exemptions and keeping track of application deadlines is crucial. Missing a deadline or submitting incomplete documentation can result in the denial of an exemption, leading to a higher tax burden. It is often beneficial to consult with the Property Appraiser's Office or a tax professional to ensure that all requirements are met and the application process is completed accurately.

Tax Rate Changes and Their Impact

Tax rates can fluctuate from year to year based on the budgetary needs of the various taxing authorities within St. Johns County. While these changes are typically small, they can still have a noticeable impact on a homeowner’s tax bill. For instance, if the county government decides to increase its millage rate to fund a new infrastructure project, this increase will be reflected in the property tax bills of all homeowners within the county.

Staying informed about potential tax rate changes is crucial for financial planning. Homeowners can monitor local news and attend public meetings to understand the budgetary decisions that may impact their tax burden. Additionally, consulting with tax professionals can provide insights into potential changes and their potential financial implications.

The Future of Property Taxes in St. Johns County

As St. Johns County continues to grow and develop, the landscape of property taxes is likely to evolve as well. With new infrastructure projects, changing demographics, and potential shifts in local governance, property taxes will need to adapt to meet the changing needs of the community.

One potential future development is the increasing use of technology to streamline the property tax process. From online tax payment portals to digital platforms for exemption applications and appeals, technology can enhance efficiency and accessibility for homeowners. Additionally, as data becomes more readily available, the process of assessing property values may become more transparent and accurate.

Furthermore, as the county's population grows and diversifies, there may be calls for tax reform to ensure that the burden of property taxes is distributed fairly. This could involve reevaluating the current exemption system, adjusting tax rates, or exploring alternative revenue sources to fund essential services.

Staying informed about these potential changes and participating in local governance processes can ensure that homeowners have a say in the future of property taxes in St. Johns County. By actively engaging with local officials and staying updated on proposed changes, homeowners can influence the direction of tax policy and ensure that their interests are represented.

How are property taxes calculated in St. Johns County?

+Property taxes in St. Johns County are calculated by multiplying the property’s assessed value by the combined millage rate, which is set by various taxing authorities within the county.

What is the role of the Property Appraiser’s Office in St. Johns County?

+The Property Appraiser’s Office is responsible for determining the assessed value of properties in the county. This value forms the basis for calculating property taxes.

How can I reduce my property tax burden in St. Johns County?

+Homeowners can reduce their property tax burden by applying for exemptions for which they are eligible, such as the Homestead Exemption or Senior Exemption. Additionally, appealing an assessed value that is believed to be inaccurate can potentially lower the taxable value.

What is the Truth in Millage (TRIM) Notice, and why is it important?

+The TRIM Notice is an annual document that provides property owners with detailed information about their property’s assessed value, taxable value, and the calculated property taxes. It is crucial for understanding the tax burden and for identifying potential errors or changes.

How can I stay informed about potential changes to property taxes in St. Johns County?

+Staying informed about potential changes to property taxes involves monitoring local news, attending public meetings, and consulting with tax professionals or local government officials. These sources can provide insights into proposed changes and their potential impacts.