Philadelphia Pa Wage Tax

The Philadelphia Wage Tax is a vital component of the city's tax system, impacting a significant portion of its residents and businesses. It is a crucial revenue stream for the city, helping to fund various public services and infrastructure development. This article aims to provide an in-depth analysis of the Philadelphia Wage Tax, covering its history, structure, implications, and future prospects.

Understanding the Philadelphia Wage Tax

The Philadelphia Wage Tax is a local income tax levied on individuals earning wages, salaries, commissions, and other forms of compensation within the city limits. It is one of the primary sources of revenue for the city, accounting for a substantial portion of its annual budget. The tax is imposed on both residents and non-residents who work within the city boundaries.

The history of the Philadelphia Wage Tax dates back to the mid-20th century when the city faced financial challenges and sought stable revenue sources. It was introduced as a means to generate funds for essential public services, such as education, public safety, and infrastructure maintenance. Over the years, the tax has undergone several revisions and adjustments to keep pace with economic changes and the evolving needs of the city.

Tax Structure and Rates

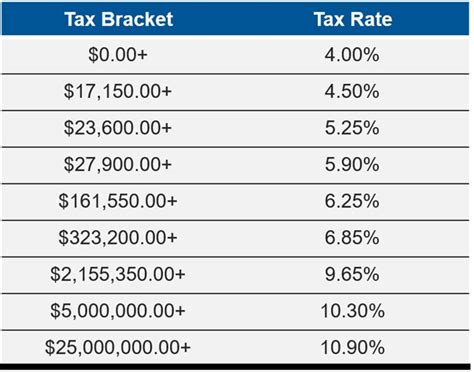

The Philadelphia Wage Tax is structured as a percentage of an individual’s earnings, with different rates applicable to residents and non-residents. As of [current year], the tax rate for Philadelphia residents is [resident rate]%, while non-residents working in the city are subject to a rate of [non-resident rate]%. These rates are subject to periodic review and adjustment by the city government to ensure adequate revenue generation.

The tax is calculated based on the total taxable income earned within the city limits. It is important to note that certain exemptions and deductions are available, such as for individuals with low incomes or those who meet specific criteria. Additionally, the tax is often combined with other local taxes, such as the Net Profits Tax for businesses, to create a comprehensive tax system.

| Tax Category | Rate |

|---|---|

| Philadelphia Resident Wage Tax | [Resident Rate]% |

| Non-Resident Wage Tax | [Non-Resident Rate]% |

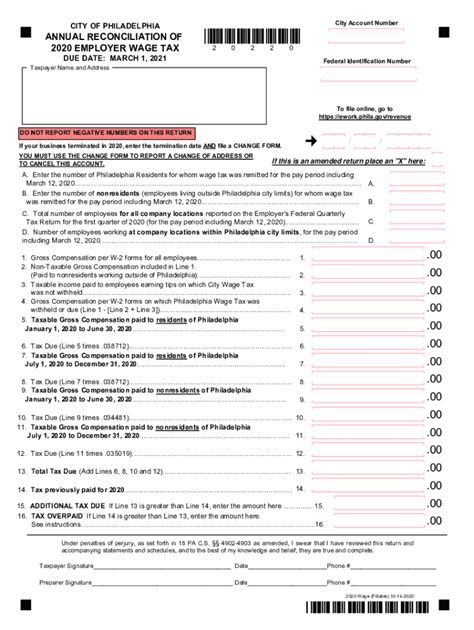

Collection and Administration

The responsibility for collecting and administering the Philadelphia Wage Tax falls on the shoulders of the Philadelphia Department of Revenue. This department ensures compliance with tax laws, processes tax returns, and conducts audits to maintain the integrity of the tax system. It also provides resources and guidance to taxpayers, helping them understand their obligations and navigate the tax filing process.

Employers play a crucial role in the collection of the Wage Tax by withholding the appropriate amount from employees' paychecks and remitting it to the city. This process ensures a steady stream of revenue for the city and simplifies the tax payment process for individuals.

Implications and Impact

The Philadelphia Wage Tax has far-reaching implications for both individuals and businesses operating within the city. It affects their financial planning, decision-making, and overall economic outlook.

Impact on Residents

For Philadelphia residents, the Wage Tax directly impacts their disposable income and financial well-being. The tax burden can be significant, especially for individuals with higher incomes. However, it is important to note that the tax also contributes to the overall prosperity of the city by funding essential services that benefit residents.

The tax system in Philadelphia aims to strike a balance between generating revenue and supporting economic growth. By investing in public services, the city creates an environment conducive to business development and attracts residents with a range of amenities and opportunities.

Business Perspective

From a business standpoint, the Philadelphia Wage Tax is a key consideration when evaluating the city as a potential location for operations. The tax rate can influence decisions related to hiring practices, employee compensation, and overall business costs. Businesses must carefully assess the tax implications to ensure their operations remain competitive and sustainable.

The city recognizes the importance of maintaining a business-friendly environment and has implemented measures to support economic growth. These include tax incentives, development initiatives, and a focus on infrastructure improvements to enhance the overall business climate.

Social and Economic Development

The revenue generated from the Philadelphia Wage Tax is invested back into the community, supporting various social and economic development initiatives. This includes funding for education, healthcare, public transportation, and other vital services. By investing in these areas, the city aims to create a thriving and inclusive environment for its residents and businesses.

The tax revenue also contributes to the city's infrastructure, ensuring the maintenance and development of roads, bridges, and public spaces. These improvements not only enhance the quality of life for residents but also attract tourists and investors, further boosting the local economy.

Future Prospects and Challenges

As Philadelphia continues to evolve and adapt to changing economic landscapes, the future of the Wage Tax system remains a topic of discussion and strategic planning.

Tax Reform and Modernization

The city recognizes the need to periodically review and modernize its tax system to remain competitive and responsive to the needs of its residents and businesses. Tax reform initiatives aim to simplify the tax structure, improve efficiency, and ensure fairness for all taxpayers.

One key aspect of tax reform is exploring alternative revenue streams to reduce the reliance on the Wage Tax. This may involve diversifying the tax base, implementing new taxes on specific activities or services, or finding innovative ways to generate revenue without placing an excessive burden on individuals and businesses.

Economic Growth and Job Creation

A thriving economy is essential for the long-term success of Philadelphia, and the Wage Tax plays a role in fostering economic growth. By investing in education, skills development, and entrepreneurship, the city aims to create a diverse and resilient economy. This, in turn, attracts businesses, generates jobs, and improves the overall financial outlook for residents.

The city is actively working to create an environment that encourages business expansion and start-up ventures. This includes offering incentives, providing support for small businesses, and promoting innovation through various initiatives.

Equity and Social Justice

In recent years, there has been a growing focus on ensuring tax equity and addressing social justice concerns. Philadelphia aims to create a tax system that is fair and accessible to all, regardless of income or background. This involves analyzing the impact of the Wage Tax on different demographic groups and implementing measures to mitigate any potential disparities.

The city is committed to promoting social justice and economic equality, and the tax system is one tool to achieve these goals. By carefully examining the distribution of tax burdens and providing support to vulnerable communities, Philadelphia aims to create a more equitable society.

Conclusion

The Philadelphia Wage Tax is a complex yet vital component of the city’s financial landscape. It serves as a primary source of revenue, funding essential public services and contributing to the overall economic health of the city. As Philadelphia continues to evolve, the tax system will play a crucial role in shaping its future, impacting residents, businesses, and the community as a whole.

Understanding the intricacies of the Philadelphia Wage Tax is essential for individuals and businesses alike. By staying informed and engaged, taxpayers can actively contribute to the city's growth and development while navigating the tax system with confidence.

How often are Wage Tax rates reviewed and adjusted?

+

Wage Tax rates are typically reviewed annually or biannually by the city government. Adjustments are made based on various factors, including the city’s financial needs, economic conditions, and the need to maintain a competitive tax environment.

Are there any exemptions or deductions available for the Wage Tax?

+

Yes, certain exemptions and deductions are available for the Wage Tax. These may include exemptions for low-income individuals, senior citizens, or individuals with specific disabilities. Additionally, certain deductions are allowed for expenses related to employment, such as transportation costs.

How does the Wage Tax impact business operations in Philadelphia?

+

The Wage Tax can influence business operations by affecting labor costs and overall operational expenses. Businesses must carefully consider the tax implications when making hiring decisions and budgeting for employee compensation. However, the city also offers various incentives and support programs to attract and retain businesses, mitigating some of the tax-related challenges.

What steps has Philadelphia taken to address tax equity concerns?

+

Philadelphia has implemented several measures to promote tax equity. This includes conducting comprehensive studies to analyze the impact of taxes on different demographic groups, adjusting tax structures to reduce disparities, and providing targeted support to underserved communities. The city aims to ensure that the tax system is fair and accessible to all residents.