Taxes Quotes

The adage "Nothing is certain except death and taxes" is as true today as it was when it was first coined. Taxes are an integral part of our economic system, and understanding their impact and implications is crucial for individuals and businesses alike. This article aims to delve into the world of taxes, exploring the various aspects, quotes, and insights that shed light on their significance and complexities.

The Complexity of Taxes: A Quote-Filled Journey

Taxes, often seen as a necessary evil, have sparked numerous debates, discussions, and, of course, witty quotes. Let’s embark on a journey through the world of taxation, unraveling its intricacies and highlighting some memorable quotes that capture the essence of this complex topic.

The Historical Perspective: Taxes Throughout Time

Taxation has a long and fascinating history, dating back to ancient civilizations. From the tribute systems of ancient Egypt to the intricate tax laws of the Roman Empire, taxes have shaped societies and economies throughout the ages. Here’s a glimpse into the historical context:

- In ancient China, the Silk Road trade routes brought immense wealth to the ruling dynasties, leading to the establishment of complex tax systems to manage this prosperity.

- The Medieval European tax systems were diverse, ranging from feudal taxes on land to taxes on goods and services, with the Tithes being a notable example of religious taxation.

- The American Revolution was, in part, sparked by taxation without representation, with the iconic "No taxation without representation" slogan becoming a rallying cry.

Throughout history, taxes have been a driving force behind political movements, economic policies, and societal changes. They have shaped the course of nations and continue to do so today.

Taxation in the Modern Era: A Complex Web

In today’s globalized world, taxation has become an intricate web of laws, regulations, and strategies. The modern tax landscape is characterized by:

- Income Taxes: The backbone of most tax systems, income taxes vary widely across countries, with different rates and exemptions.

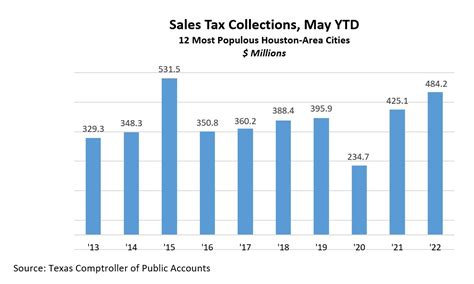

- Sales Taxes: Applied to the purchase of goods and services, sales taxes can be regressive, impacting lower-income individuals more heavily.

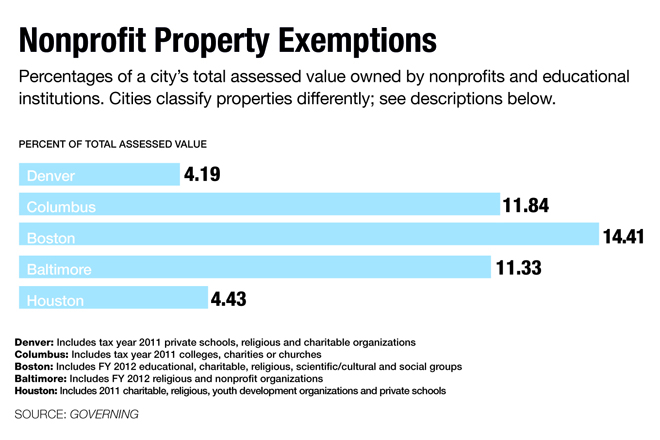

- Property Taxes: Levied on the ownership of real estate, property taxes are a significant source of revenue for local governments.

- Corporate Taxes: Businesses face a unique set of tax challenges, with corporate tax rates and regulations varying globally.

The complexity of modern taxation often leads to innovative tax planning strategies and, at times, controversies. Here are some quotes that capture the essence of this complexity:

| Quote | Author |

|---|---|

| "The only difference between death and taxes is that death doesn't get worse every time Congress meets." | Will Rogers |

| "Taxes are what we pay for civilized society." | Oliver Wendell Holmes Jr. |

| "The hardest thing in the world to understand is the income tax." | Albert Einstein |

The Impact of Taxation on Society

Taxes are not merely a bureaucratic process; they have a profound impact on society as a whole. They shape income distribution, fund public services, and influence economic growth. Here’s a deeper look at these impacts:

- Income Redistribution: Progressive tax systems aim to reduce income inequality by taxing higher incomes at higher rates, redistributing wealth to support social programs.

- Public Services: Taxes are the primary source of funding for essential services like education, healthcare, infrastructure, and social safety nets.

- Economic Growth: Well-designed tax policies can stimulate economic growth by encouraging investment, innovation, and job creation. However, excessive taxation can hinder growth.

The delicate balance between taxation and economic growth is a continuous challenge for policymakers, as evidenced by the following quotes:

- "A government which robs Peter to pay Paul can always depend on the support of Paul."

- "Taxation is the price we pay for a civilized society."

- "The art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest possible amount of hissing."

Global Tax Trends and Challenges

In an increasingly interconnected world, global tax policies and trends play a significant role. The rise of multinational corporations and digital economies has led to a series of challenges and innovations in taxation.

- Corporate Tax Avoidance: Multinational corporations often engage in tax planning strategies to minimize their tax liabilities, leading to debates on tax fairness and corporate social responsibility.

- Digital Taxation: The rise of digital economies has sparked discussions on how to tax tech giants fairly, with countries like France and the UK introducing digital services taxes.

- Tax Evasion and Compliance: Tax evasion remains a significant issue, with governments investing in advanced technologies and data analytics to improve compliance.

The complexities of global taxation often give rise to thought-provoking quotes:

- "Taxes are what we pay for civilized society, and the only thing that money can't buy. It's the cost of membership in good society."

- "In this world, nothing is certain, except death and taxes."

Tax Strategies and Planning for Individuals

For individuals, understanding tax strategies and planning can make a significant difference in their financial well-being. Here are some key considerations:

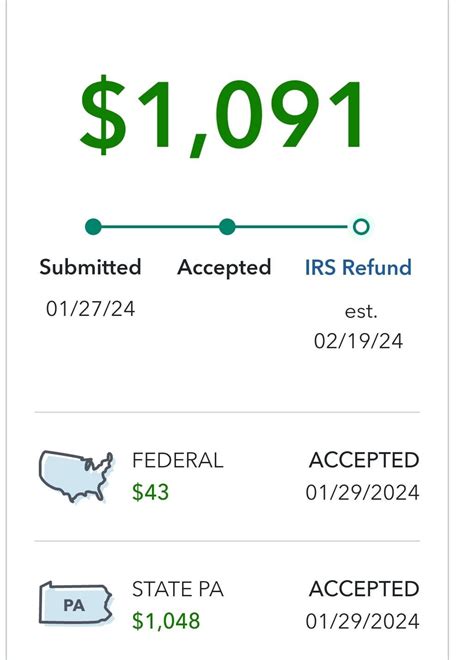

- Tax Deductions and Credits: Taking advantage of available deductions and credits can reduce your tax liability, making it essential to stay informed about the latest tax laws.

- Retirement Planning: Contributions to retirement accounts like 401(k)s or IRAs often offer tax benefits, providing an incentive for long-term savings.

- Investment Strategies: Certain investment vehicles, such as municipal bonds or real estate, offer tax advantages that can enhance your overall returns.

The world of tax planning is a delicate dance, as illustrated by the following quote:

"There are two certainties in life: death and taxes. Unfortunately, death doesn't pay any taxes."

The Future of Taxation: Technological Disruption

As technology continues to advance, it is poised to disrupt the traditional tax landscape. Blockchain technology, artificial intelligence, and data analytics are already transforming tax processes.

- Blockchain: The decentralized nature of blockchain can enhance transparency and security in tax records, reducing fraud and improving compliance.

- AI and Data Analytics: Advanced analytics can identify patterns and anomalies in tax data, aiding in the detection of tax evasion and improving tax administration efficiency.

The future of taxation is an exciting prospect, but it also presents challenges. Here's a quote that captures this sentiment:

"The future of taxation is not about reducing rates but about simplifying the system, harnessing technology, and ensuring fairness for all."

Conclusion

Taxes are an essential, albeit complex, aspect of our economic and social systems. From their historical roots to the modern challenges and future innovations, taxes have shaped the world we live in. The quotes explored in this article provide a glimpse into the wit, wisdom, and complexities surrounding taxation. As we navigate the ever-evolving tax landscape, understanding these nuances is crucial for individuals, businesses, and policymakers alike.

Frequently Asked Questions

What is the primary purpose of taxes in a society?

+Taxes are primarily used to fund public services and infrastructure, redistribute wealth, and promote economic growth and stability.

How do taxes impact the economy and businesses?

+Taxes can influence economic growth by affecting investment, consumption, and business profitability. Well-designed tax policies can encourage economic activity, while excessive taxation may hinder growth.

What are some common challenges faced in tax administration and compliance?

+Common challenges include tax evasion, complex tax laws, changing regulations, and the need for advanced technologies to improve compliance and efficiency.

How can individuals effectively plan their taxes to maximize benefits?

+Individuals can benefit from understanding tax deductions, credits, and retirement planning strategies. Consulting with tax professionals can help optimize tax planning.

What role does technology play in the future of taxation?

+Technology, such as blockchain and AI, has the potential to revolutionize tax administration, improving transparency, compliance, and efficiency.