York County Online Taxes

In today's digital age, many jurisdictions are embracing online platforms to streamline tax-related processes, offering convenience and efficiency to taxpayers. York County, Pennsylvania, is no exception, providing residents with an intuitive online tax system. This article delves into the intricacies of York County's online tax system, exploring its features, benefits, and the impact it has on the community.

Revolutionizing Tax Payments: York County's Online Platform

York County's transition to an online tax payment system marks a significant step towards modernizing its tax administration. The platform, designed with user experience in mind, offers a seamless and secure process for taxpayers to manage their tax obligations remotely.

Key Features and Benefits

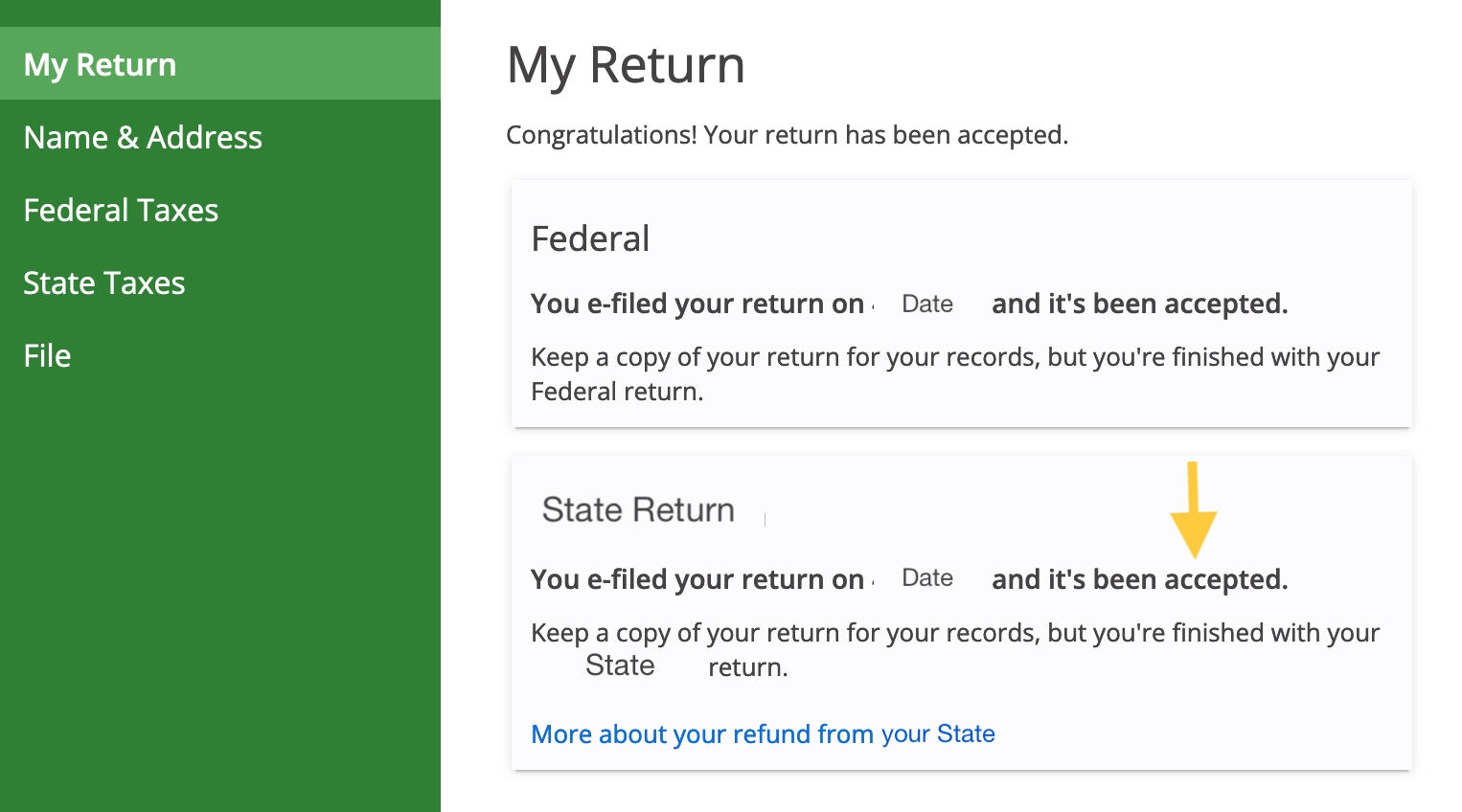

The online tax system in York County boasts a range of features that simplify the tax payment process. Taxpayers can expect a user-friendly interface, allowing them to easily navigate through various tax categories and view their tax liabilities. One of the standout features is the ability to make secure online payments, eliminating the need for in-person visits or mailing checks.

Moreover, the platform provides a comprehensive history of tax payments, offering transparency and ease of reference. Taxpayers can quickly access previous transactions, view due dates, and stay updated on their tax status. This feature not only promotes accountability but also empowers taxpayers to plan their finances effectively.

For those who prefer a more personalized approach, the system offers a dedicated support team. Taxpayers can reach out for assistance with any queries or issues they may encounter. This level of support ensures that users receive the guidance they need, fostering a positive experience with the online tax system.

| Feature | Description |

|---|---|

| User-Friendly Interface | An intuitive design that simplifies tax navigation and management. |

| Secure Online Payments | A safe and convenient method to settle tax liabilities. |

| Tax Payment History | A detailed record of past transactions, due dates, and tax status. |

| Dedicated Support | A team of experts ready to assist with any tax-related queries. |

Impact on the Community

The introduction of the online tax platform has had a positive impact on the York County community. Firstly, it has improved accessibility, allowing taxpayers to manage their taxes regardless of their physical location or mobility. This is particularly beneficial for individuals with busy schedules or those living in remote areas, ensuring equal access to tax services.

Secondly, the platform has contributed to increased efficiency in tax administration. With online payments and automated processes, the county can process transactions swiftly, reducing administrative burdens and potential errors. This efficiency translates to faster tax refunds and a more streamlined tax experience for residents.

Additionally, the online system has fostered a sense of engagement and transparency between the county and its residents. Taxpayers can actively participate in the tax process, staying informed and involved. This transparency builds trust and encourages a culture of responsible tax management within the community.

Security and Data Protection

A critical aspect of any online tax system is the security of sensitive financial information. York County's online platform prioritizes data protection, employing robust security measures to safeguard taxpayer data. The system utilizes encryption protocols to ensure that personal and financial details remain secure during online transactions.

Furthermore, the platform adheres to strict privacy policies, ensuring that taxpayer information is used solely for tax administration purposes. York County's commitment to data protection aligns with industry best practices, giving taxpayers peace of mind when using the online system.

Future Prospects and Innovations

As technology advances, York County's online tax platform is poised for further enhancements. The county plans to integrate new features, such as real-time tax calculation tools and interactive tax guides, to provide an even more comprehensive user experience.

Additionally, the platform may explore the integration of emerging technologies like blockchain for enhanced security and transparency. These future developments will continue to shape the tax landscape in York County, offering residents a modern and efficient tax management system.

Conclusion

York County's online tax system represents a significant advancement in tax administration, offering convenience, security, and transparency to taxpayers. By embracing digital technology, the county has not only streamlined its tax processes but also empowered its residents to actively participate in tax management. As the platform continues to evolve, York County remains at the forefront of innovative tax administration, setting a benchmark for other jurisdictions to follow.

How do I register for the online tax system in York County?

+

To register, visit the official York County website and navigate to the online tax portal. Follow the registration process, which typically involves providing basic personal and tax-related information. Ensure you have your tax identification details handy to streamline the process.

What payment methods are accepted through the online system?

+

York County’s online tax system accepts a variety of payment methods, including credit and debit cards, e-checks, and online banking transfers. The platform offers flexibility to accommodate different preferences and financial situations.

Can I access my tax records from previous years on the online platform?

+

Absolutely! The online tax system provides a comprehensive tax history, allowing taxpayers to access and review their tax records from previous years. This feature ensures transparency and ease of reference for long-term tax planning.

What security measures are in place to protect my data on the online platform?

+

York County’s online tax platform employs advanced encryption technologies to secure your data. Additionally, the system adheres to strict privacy policies, ensuring that your information is protected and used solely for tax administration purposes.