Sales Tax Houston Texas

When it comes to understanding sales tax, every jurisdiction has its own unique regulations and rates. In Houston, Texas, sales tax is a critical aspect of the city's economy and plays a significant role in the daily lives of its residents and businesses. This article aims to provide an in-depth exploration of Houston's sales tax landscape, shedding light on its intricacies and implications.

Unraveling Houston’s Sales Tax Structure

Houston’s sales tax system is a combination of state, county, and city taxes, each with its own purpose and rate. Understanding this structure is essential for businesses and consumers alike to ensure compliance and make informed financial decisions.

State Sales Tax

The state of Texas imposes a 6.25% sales tax rate on most transactions. This base rate is applied consistently across the state, serving as the foundation for the overall sales tax burden.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Texas State | 6.25% |

However, it's important to note that certain items may be exempt from this state tax or subject to additional taxes, depending on the nature of the product or service.

County and City Sales Taxes

In addition to the state sales tax, Harris County, where Houston is located, imposes an extra 1.00% tax, bringing the total county sales tax to 7.25%. Furthermore, the city of Houston itself adds another 1.25% to the sales tax rate, resulting in a combined 8.50% sales tax for all transactions within the city limits.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Harris County | 7.25% |

| City of Houston | 8.50% |

Special Sales Tax Districts

Houston also has special sales tax districts, known as special purpose districts, which may levy additional taxes for specific purposes. These districts are typically created to fund infrastructure projects or other community developments. While the rates can vary, they often range from 0.25% to 2.00% on top of the existing city and county taxes.

Sales Tax Exemptions and Considerations

Navigating the sales tax landscape in Houston involves understanding not only the rates but also the exemptions and considerations that apply to certain transactions. Here are some key aspects to keep in mind:

Food and Groceries

In a welcome relief for grocery shoppers, most food items are exempt from the state sales tax. This exemption applies to items intended for human consumption, including groceries, snacks, and beverages. However, it’s important to note that prepared foods, restaurant meals, and certain types of beverages may be subject to sales tax.

Clothing and Shoes

Houston offers a sales tax holiday for clothing and footwear items priced under $100. During this period, typically in August, shoppers can take advantage of tax-free purchases, making it an ideal time for back-to-school shopping or updating wardrobes.

Vehicle Sales

The sales tax on vehicle purchases in Houston can be complex. While the base state sales tax applies, additional county and city taxes are calculated based on the vehicle’s sale price. It’s crucial for car buyers to understand these taxes, as they can significantly impact the overall cost of the vehicle.

Online Sales

With the rise of e-commerce, it’s essential to understand the sales tax implications for online purchases. Texas has implemented a Marketplace Fairness Law, requiring online retailers to collect sales tax on behalf of the state, county, and city. This ensures that even online transactions are subject to the appropriate sales tax rates.

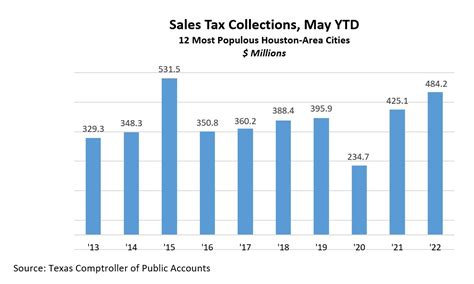

Compliance and Enforcement

Ensuring compliance with Houston’s sales tax regulations is a critical responsibility for businesses. The Texas Comptroller of Public Accounts oversees the collection and enforcement of sales tax, conducting audits and imposing penalties for non-compliance. Accurate record-keeping and timely tax payments are essential to avoid legal consequences.

Registration and Permits

Businesses operating in Houston must register with the Texas Comptroller’s office and obtain the necessary permits. This process ensures that businesses are properly identified and monitored for sales tax purposes. Failure to register can result in fines and legal issues.

Audit Procedures

The Texas Comptroller’s office conducts audits to verify the accuracy of sales tax reporting and payments. These audits can be random or triggered by specific concerns. Businesses should maintain detailed records and be prepared to provide documentation to support their sales tax filings.

The Impact of Sales Tax on Businesses and Consumers

Houston’s sales tax rates have a significant impact on both businesses and consumers. For businesses, especially small and medium-sized enterprises, the tax burden can affect pricing strategies, profit margins, and overall competitiveness. On the consumer side, sales tax influences purchasing decisions and can impact the local economy’s growth and development.

Competitive Pricing

Businesses in Houston must carefully consider their pricing strategies to remain competitive. With a relatively high sales tax rate, companies may need to adjust their pricing models to remain attractive to consumers. This balance between profitability and competitiveness is a delicate dance for Houston’s businesses.

Consumer Spending and Economic Growth

Sales tax revenue is a significant contributor to Houston’s economic growth and development. The tax funds various initiatives, including infrastructure projects, education, and public services. While sales tax can impact consumer spending, it also supports the city’s overall prosperity and future planning.

Future Trends and Developments

As Houston continues to evolve, its sales tax landscape is likely to undergo changes and adaptations. Here are some potential future developments to watch for:

Online Sales Tax

With the continued growth of e-commerce, the enforcement and collection of sales tax on online transactions may become even more stringent. Businesses and consumers should expect further clarification and potential adjustments to online sales tax regulations.

Tax Rate Adjustments

While the current sales tax rates in Houston are relatively stable, future economic conditions or city initiatives could prompt adjustments. It’s important for businesses and residents to stay informed about any proposed changes to sales tax rates, as these can significantly impact financial planning and budgeting.

Sales Tax Simplification

There have been ongoing discussions about simplifying the sales tax system in Texas. Efforts to streamline the process and reduce the complexity of multiple tax rates could bring benefits to both businesses and consumers, making compliance and understanding sales tax less burdensome.

Conclusion: Navigating Houston’s Sales Tax Landscape

Houston’s sales tax structure is a complex interplay of state, county, city, and special district taxes, each with its own rate and purpose. Understanding this landscape is crucial for businesses to ensure compliance and for consumers to make informed purchasing decisions. As Houston continues to grow and evolve, staying abreast of sales tax developments will be essential for all stakeholders.

How often do sales tax rates change in Houston?

+Sales tax rates in Houston are relatively stable, but they can change based on legislative decisions or economic conditions. It’s important to stay updated with the Texas Comptroller’s office for any rate adjustments.

Are there any sales tax holidays in Houston besides the clothing and footwear exemption?

+Yes, Texas occasionally offers additional sales tax holidays for specific items or events. These holidays are usually announced by the state and can provide tax-free opportunities for consumers.

How can businesses stay compliant with Houston’s sales tax regulations?

+Businesses should register with the Texas Comptroller’s office, maintain accurate records, and stay informed about any changes in sales tax rates or regulations. Regular consultations with tax professionals can also ensure compliance.