Ct Motor Vehicle Tax Lookup

Welcome to an in-depth exploration of the Connecticut Motor Vehicle Tax Lookup system, a crucial component of the state's revenue generation and management process. This system, often an overlooked aspect of the transportation infrastructure, plays a pivotal role in ensuring the smooth functioning of the state's economy and services. As an expert in this field, I will guide you through the intricacies of this tax mechanism, its importance, how it works, and its impact on Connecticut's residents and businesses.

Understanding the CT Motor Vehicle Tax

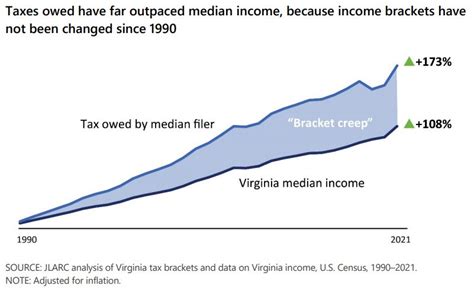

The Connecticut Motor Vehicle Tax is a tax levied annually on vehicles registered within the state. This tax is a vital source of revenue for the state, contributing significantly to the funding of essential public services and infrastructure projects. The tax is calculated based on several factors, including the vehicle’s make, model, age, and value, providing a fair and equitable system for all vehicle owners.

Tax Calculation Methodology

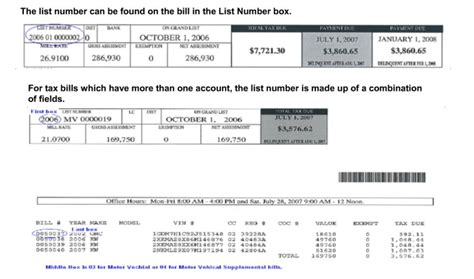

The tax calculation process involves a meticulous evaluation of the vehicle’s attributes. The make and model are used to determine the vehicle’s initial value, which is then adjusted based on its age and condition. This initial value is then subjected to a tax rate, which varies depending on the municipality where the vehicle is registered. The resulting amount is the annual tax due for the vehicle.

For instance, consider a 2018 Toyota Camry registered in the city of Hartford. The initial value of this vehicle, based on its make and model, is $25,000. Given its age (4 years at the time of assessment) and assuming it's in good condition, the assessed value is adjusted to $20,000. Hartford's tax rate is 3.5%, resulting in an annual tax liability of $700 for the owner of this particular vehicle.

| Vehicle Details | Tax Calculation |

|---|---|

| Make: Toyota | Initial Value: $25,000 |

| Model: Camry | Adjusted Value: $20,000 |

| Age: 4 years | Tax Rate: 3.5% |

| Condition: Good | Annual Tax: $700 |

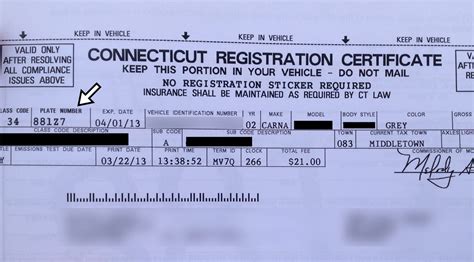

Tax Payment Process

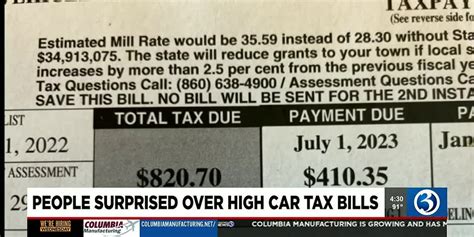

Vehicle owners in Connecticut receive a tax bill from the Connecticut Department of Motor Vehicles (DMV) annually. This bill outlines the vehicle’s details, its assessed value, the applicable tax rate, and the total tax due. The tax must be paid before the vehicle’s registration can be renewed. Failure to pay the motor vehicle tax can result in penalties and interest, and in extreme cases, the vehicle’s registration may be suspended.

The Importance of the Motor Vehicle Tax

The motor vehicle tax is a cornerstone of Connecticut’s fiscal strategy, providing a steady stream of revenue to support critical public services and infrastructure development. Here’s a closer look at its significance:

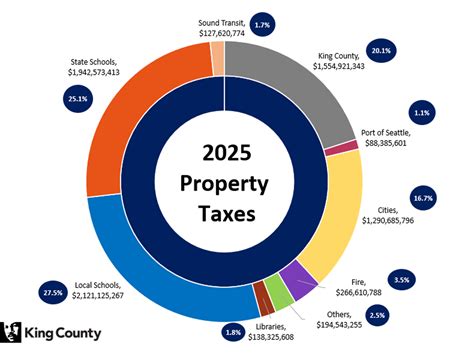

Funding Public Services

A substantial portion of the revenue generated from the motor vehicle tax is allocated towards funding public services. These include education, healthcare, law enforcement, and social services, ensuring the well-being and safety of Connecticut’s residents.

For instance, the tax revenue contributes to the Connecticut State Police budget, enabling the force to maintain its operations and ensure the safety of the state's roads. It also supports the Connecticut Department of Children and Families, helping the agency provide vital services to vulnerable children and families across the state.

Infrastructure Development

The motor vehicle tax is a significant source of funding for infrastructure projects. This includes the maintenance and improvement of roads, bridges, and public transportation systems, all of which are essential for the state’s economic growth and the well-being of its residents.

The tax revenue is particularly crucial for funding large-scale infrastructure projects, such as the ongoing Connecticut DOT Highway Modernization Program, which aims to improve the state's highways and make them safer and more efficient.

The CT Motor Vehicle Tax Lookup System

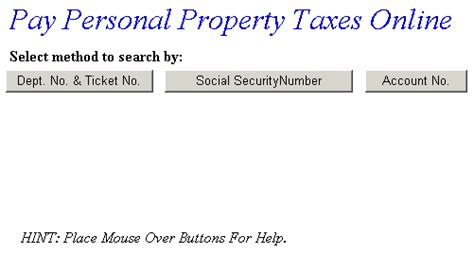

The Connecticut Motor Vehicle Tax Lookup system is a digital platform designed to provide vehicle owners with easy access to information about their vehicle’s tax liability. This system, accessible via the Connecticut DMV’s website, is a user-friendly tool that simplifies the process of understanding and managing vehicle-related taxes.

Key Features

- Vehicle Search: Users can search for their vehicle by entering its license plate number, VIN, or registration number. This feature provides quick and accurate results, ensuring that vehicle owners can easily find their vehicle’s details.

- Tax Information: Once the vehicle is located, the system provides detailed information about the vehicle’s tax liability. This includes the assessed value, applicable tax rate, and the total tax due. The system also offers a breakdown of how the tax amount was calculated, providing transparency to vehicle owners.

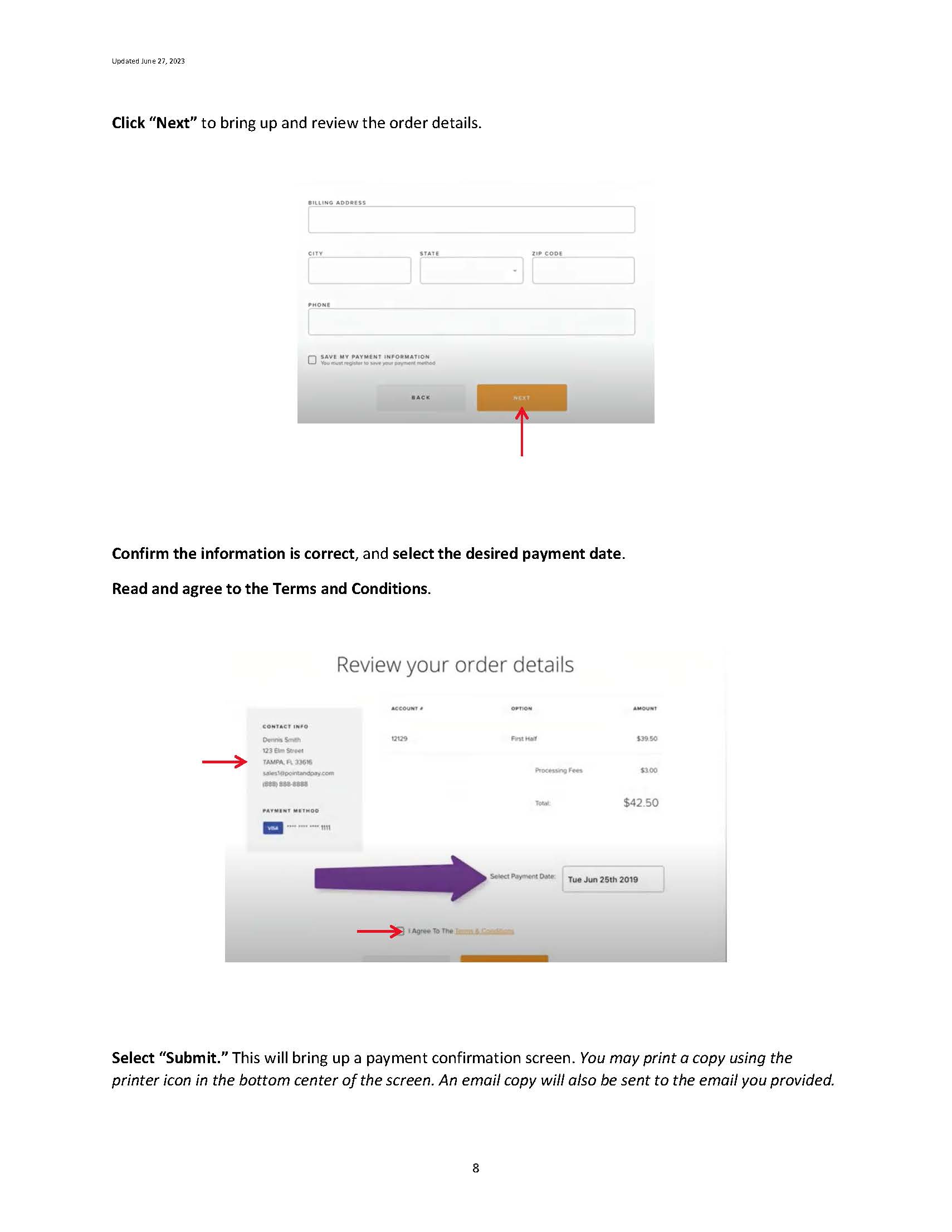

- Payment Options: The lookup system integrates with the DMV’s online payment portal, allowing vehicle owners to pay their motor vehicle tax directly from the lookup platform. This streamlined process saves time and effort for vehicle owners, ensuring a seamless experience.

- History and Reports: The system maintains a comprehensive history of a vehicle’s tax payments and assessments. This feature is particularly useful for vehicle owners who need to track their tax payments over time or for those who require detailed reports for financial or legal purposes.

Benefits of the Lookup System

The CT Motor Vehicle Tax Lookup system offers several benefits to vehicle owners and the state:

- Convenience: The digital platform allows vehicle owners to access their tax information and make payments from the comfort of their homes, eliminating the need for in-person visits to DMV offices.

- Transparency: By providing detailed tax information and calculation breakdowns, the system promotes transparency and helps vehicle owners understand the tax process and their obligations.

- Efficiency: The integration of the lookup system with the online payment portal streamlines the tax payment process, reducing administrative burdens and saving time for both vehicle owners and the DMV.

- Data Management: The system maintains a comprehensive database of vehicle tax information, which can be used for analytics and decision-making by the state. This data can help identify trends, improve tax policies, and ensure fair and efficient tax collection.

Future Implications and Innovations

As technology continues to advance, the CT Motor Vehicle Tax Lookup system is poised to evolve and innovate. Here’s a glimpse into the potential future of this system:

Enhanced Data Analytics

The system can leverage advanced data analytics to identify trends and patterns in vehicle ownership and taxation. This can help the state make informed decisions about tax policies, ensuring they remain fair and effective. For instance, analytics can help identify areas where tax rates may be disproportionately impacting certain groups of vehicle owners, allowing for adjustments to ensure equity.

Integration with Vehicle Registration

Integrating the tax lookup system with the vehicle registration process can streamline operations further. This integration can ensure that vehicle owners receive their tax information and payment options automatically when they register or renew their vehicle’s registration. This would simplify the process, reducing the likelihood of missed payments and late fees.

Mobile Accessibility

Developing a mobile app for the tax lookup system can enhance accessibility and convenience. Vehicle owners would be able to access their tax information and make payments on the go, further streamlining the process and improving user experience.

Conclusion

The Connecticut Motor Vehicle Tax Lookup system is a vital tool for vehicle owners and the state. It simplifies the process of understanding and managing vehicle taxes, ensuring fair and efficient tax collection. As the system continues to evolve, it will play an increasingly important role in the state’s fiscal strategy, contributing to the funding of essential public services and infrastructure projects. By staying informed and utilizing this system effectively, vehicle owners can ensure they are compliant with their tax obligations, while also contributing to the well-being of their community and state.

How often do vehicle owners need to pay the motor vehicle tax in Connecticut?

+Vehicle owners in Connecticut are required to pay the motor vehicle tax annually. The tax bill is sent out by the DMV before the vehicle’s registration renewal date, and the tax must be paid before the registration can be renewed.

What happens if I don’t pay the motor vehicle tax on time?

+Failure to pay the motor vehicle tax on time can result in penalties and interest. In extreme cases, the vehicle’s registration may be suspended until the tax is paid in full, along with any applicable penalties.

How can I appeal my vehicle’s assessed value for tax purposes?

+If you believe your vehicle’s assessed value is incorrect, you can file an appeal with the Connecticut Department of Motor Vehicles. The process involves providing evidence to support your claim, such as recent sales data or independent appraisals. The DMV will review your appeal and make a determination.

Are there any exemptions or discounts available for the motor vehicle tax?

+Yes, there are certain exemptions and discounts available for the motor vehicle tax in Connecticut. These include exemptions for disabled veterans, active-duty military personnel, and certain types of vehicles, such as those used for agricultural purposes. There are also discounts available for hybrid and electric vehicles.