Inheritance Tax Maryland

Inheritance tax is a crucial aspect of estate planning and can significantly impact individuals and families in Maryland. This article aims to provide an in-depth analysis of inheritance tax in the state, covering its definition, applicability, rates, exemptions, and other relevant factors. By understanding the intricacies of Maryland's inheritance tax laws, individuals can make informed decisions when planning their estates and ensuring a smooth transition of assets to their beneficiaries.

Understanding Inheritance Tax in Maryland

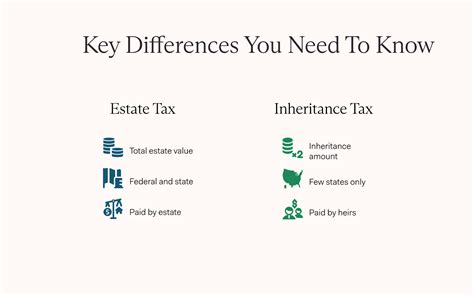

Inheritance tax, often referred to as an estate tax, is a tax levied on the transfer of assets from a deceased person’s estate to their beneficiaries. In Maryland, the inheritance tax is imposed on the recipients of the estate, unlike some other states where it is paid by the estate itself. This distinction is crucial as it affects the tax liability of the beneficiaries and influences estate planning strategies.

The state of Maryland aims to ensure that estates are fairly distributed and that beneficiaries, especially those receiving substantial assets, contribute their share to the state's revenue. Inheritance tax laws in Maryland are designed to achieve this goal while providing certain exemptions and allowances to minimize the tax burden on smaller estates and close family members.

Who Pays Inheritance Tax in Maryland?

Inheritance tax in Maryland is not a universal tax; it is applicable only to specific beneficiaries who inherit assets from an estate. The tax is paid by the recipient of the inheritance, not by the estate or the executor. This means that the burden of inheritance tax falls on the individuals who receive assets from the deceased’s estate.

The tax is imposed on various types of assets, including real estate, personal property, cash, stocks, bonds, and other financial instruments. It is important to note that the inheritance tax in Maryland is separate from the federal estate tax, which is a tax levied on the transfer of a deceased person's assets at the federal level.

Inheritance Tax Rates in Maryland

Maryland’s inheritance tax rates vary depending on the relationship between the deceased and the beneficiary. The state has established different tax rates for different classes of beneficiaries, ensuring that close family members are taxed at lower rates than distant relatives or non-relatives.

| Beneficiary Relationship | Inheritance Tax Rate |

|---|---|

| Spouse or Domestic Partner | 0% |

| Child or Grandchild | 4.5% |

| Parent, Sibling, or Grandparent | 7.5% |

| Other Relatives or Non-Relatives | 10% |

These rates are applied to the value of the inherited assets, and the tax is calculated accordingly. It's important to note that Maryland's inheritance tax rates are subject to change, and individuals should consult the latest tax regulations to ensure accuracy.

Exemptions and Deductions

Maryland provides certain exemptions and deductions to reduce the inheritance tax burden on beneficiaries. These exemptions and deductions vary based on the relationship between the deceased and the beneficiary and the value of the inherited assets.

- Spouse Exemption: Spouses or domestic partners are completely exempt from inheritance tax in Maryland. This means that assets transferred between spouses are not subject to the state's inheritance tax, ensuring that married couples can pass their assets freely without tax implications.

- Child and Grandchild Exemption: Children and grandchildren of the deceased also benefit from a significant exemption. The first $10,000 of inherited assets from a parent or grandparent is exempt from inheritance tax. This exemption helps reduce the tax burden on families and encourages the transfer of wealth within close familial circles.

- Other Relatives and Non-Relatives: For other relatives and non-relatives, there is a basic exemption of $1,000. This means that the first $1,000 of inherited assets from a relative outside the immediate family or from a non-relative is exempt from inheritance tax. While this exemption is lower than that for closer relatives, it still provides some relief for smaller inheritances.

In addition to these exemptions, Maryland also allows for certain deductions. These deductions can be applied to reduce the value of the taxable estate, further lowering the inheritance tax liability. Common deductions include funeral expenses, administration costs, and certain charitable contributions made from the estate.

Inheritance Tax Planning Strategies

Understanding Maryland’s inheritance tax laws is crucial for effective estate planning. Individuals can employ various strategies to minimize the tax burden on their beneficiaries and ensure a more efficient transfer of assets.

Gifts and Lifetime Transfers

One effective strategy to reduce inheritance tax liability is to make gifts or transfers during one’s lifetime. In Maryland, gifts to family members are generally not subject to inheritance tax. By transferring assets to beneficiaries while still alive, individuals can reduce the size of their taxable estate and potentially lower the inheritance tax owed by their beneficiaries.

However, it's important to consider the federal gift tax implications. While Maryland does not have a state gift tax, the federal government does. Large gifts may trigger federal gift tax liability, so individuals should consult with tax professionals to navigate these complexities effectively.

Utilizing Exemptions and Deductions

Maximizing the use of exemptions and deductions is another crucial aspect of inheritance tax planning. By structuring the distribution of assets carefully, individuals can ensure that beneficiaries receive their inheritances tax-free or with minimal tax implications.

For example, individuals can consider distributing assets to multiple beneficiaries to make full use of the available exemptions. Splitting assets among children, grandchildren, and other relatives can ensure that each beneficiary receives their share within the exemption limits, reducing the overall tax burden.

Trusts and Estate Planning Tools

Trusts and other estate planning tools can be powerful instruments to manage and transfer assets while minimizing tax liability. In Maryland, various types of trusts can be established to protect assets and provide flexibility in inheritance planning.

- Revocable Living Trusts: These trusts allow individuals to retain control over their assets during their lifetime while also providing a smooth transition of assets to beneficiaries upon their death. Assets held in a revocable living trust are not subject to probate, which can save time and reduce potential tax implications.

- Irrevocable Trusts: Irrevocable trusts are designed to remove assets from an individual's estate permanently. By transferring assets into an irrevocable trust, individuals can reduce the value of their taxable estate and potentially lower inheritance tax liability. However, once assets are transferred, the grantor loses control over them.

- Charitable Trusts: Charitable trusts can be an effective way to reduce tax liability while supporting a worthy cause. By establishing a charitable trust, individuals can make contributions to charity while also benefiting their heirs. The charitable deduction can lower the taxable value of the estate, reducing inheritance tax obligations.

Conclusion

Inheritance tax in Maryland is a complex yet essential aspect of estate planning. By understanding the state’s tax rates, exemptions, and planning strategies, individuals can make informed decisions to protect their assets and ensure a smooth transition to their beneficiaries. Effective estate planning can minimize tax burdens, providing peace of mind for both the individual and their loved ones.

What is the difference between inheritance tax and estate tax in Maryland?

+Inheritance tax in Maryland is paid by the beneficiaries who receive assets from an estate, while estate tax is levied on the estate itself. Inheritance tax varies based on the beneficiary’s relationship to the deceased, while estate tax is calculated based on the total value of the estate.

Are there any ways to reduce inheritance tax liability in Maryland?

+Yes, individuals can employ various strategies to minimize inheritance tax, such as making gifts during their lifetime, utilizing exemptions and deductions, and establishing trusts to manage and transfer assets efficiently.

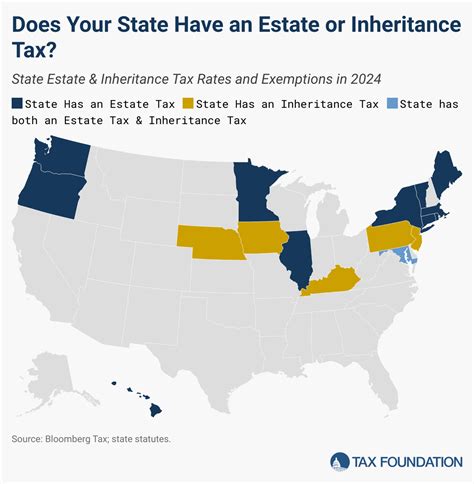

Do all states have inheritance tax laws similar to Maryland’s?

+No, inheritance tax laws vary significantly from state to state. Some states have inheritance taxes similar to Maryland, while others have estate taxes, and some have no inheritance or estate taxes at all. It’s essential to understand the specific laws of the state where you reside or plan to distribute assets.