Mo State Sales Tax

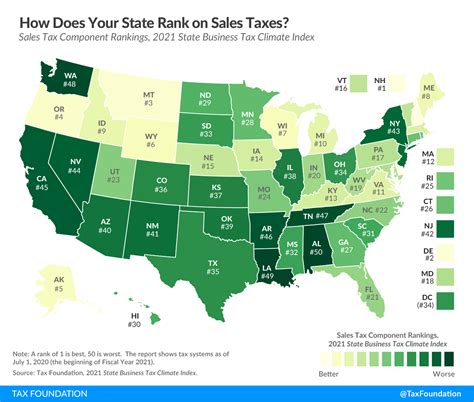

In the United States, sales tax is a common form of taxation levied on the sale of goods and services. Each state has its own sales tax laws and rates, and these can vary significantly, impacting businesses and consumers alike. This article delves into the specifics of Missouri's state sales tax, providing an in-depth analysis of its rates, applicability, and impact on the state's economy.

Understanding Missouri’s Sales Tax Landscape

Missouri, known for its diverse economy and vibrant cultural scene, has a sales tax system that plays a crucial role in funding state initiatives and services. As of [last updated date], the state sales tax rate in Missouri stands at 4.225%, which is among the lower rates in the country. However, this state-level rate is just the beginning, as Missouri’s sales tax system is more intricate than it might initially seem.

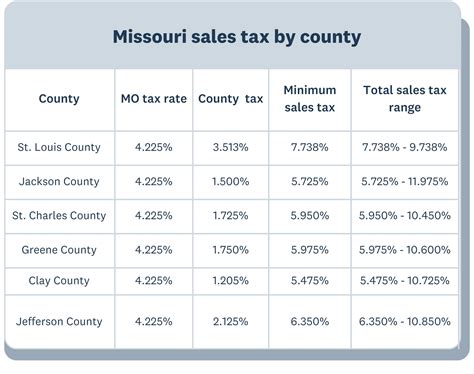

Missouri allows its 114 local jurisdictions to levy additional sales taxes, leading to a complex web of varying tax rates across the state. These local taxes can range from 0.5% to 3.75%, with an average of 1.19%, bringing the total average combined rate to 5.415%. This means that the sales tax a consumer pays can vary significantly depending on their location within the state.

Local Sales Tax Rates in Missouri

The diversity of local sales tax rates in Missouri is vast. For instance, in the city of St. Louis, the total sales tax is 9.625%, comprising the state rate and a 5.4% local tax. In contrast, the city of Kansas City has a lower total rate of 8.575%, with a local tax of 4.35%. These variations can significantly impact the prices consumers pay for goods and services, and they also influence business decisions on where to locate within the state.

Here's a table showcasing the sales tax rates for some of Missouri's major cities:

| City | State Tax | Local Tax | Total Tax |

|---|---|---|---|

| St. Louis | 4.225% | 5.4% | 9.625% |

| Kansas City | 4.225% | 4.35% | 8.575% |

| Springfield | 4.225% | 2.275% | 6.5% |

| Columbia | 4.225% | 2.5% | 6.725% |

| Joplin | 4.225% | 2.1% | 6.325% |

These local taxes fund various municipal projects and services, including infrastructure development, public transportation, and local education. For businesses, navigating this complex tax landscape requires careful consideration and often the assistance of tax professionals to ensure compliance and minimize tax liabilities.

Exemptions and Special Considerations

While the majority of goods and services in Missouri are subject to sales tax, there are several notable exemptions. These include sales tax holidays, which Missouri has implemented in the past to boost consumer spending. During these designated periods, certain items like school supplies, computers, or energy-efficient appliances are exempt from sales tax.

Additionally, Missouri offers specific sales tax exemptions for qualifying businesses. For instance, manufacturers and producers of goods may be eligible for manufacturing exemptions, which allow for tax-free purchases of certain materials and equipment used directly in the manufacturing process. This exemption can significantly reduce the tax burden for businesses operating in these sectors.

Sales Tax Holidays in Missouri

Sales tax holidays in Missouri have been a strategic initiative to stimulate consumer spending and provide temporary relief from the sales tax burden. In recent years, the state has organized these holidays around back-to-school shopping, offering tax-free days for specific items such as clothing, school supplies, and computers. For example, in 2023, Missouri’s sales tax holiday was held from August 4th to August 6th, providing a boost to local economies and easing the financial burden on families preparing for the new school year.

However, it's important to note that these holidays are not without controversy. Some critics argue that they lead to unnecessary consumption and complicate the tax system, while proponents highlight their positive economic impact, especially for low-income families.

The Impact on Businesses and Consumers

Missouri’s sales tax system has a profound impact on both businesses and consumers within the state. For businesses, especially those with multiple locations or those considering expansion, understanding and managing the varying sales tax rates is crucial. It influences pricing strategies, tax compliance, and even business location decisions.

From a consumer perspective, the varying sales tax rates can lead to confusion and unexpected costs. Shoppers may find that the same item carries a different price tag depending on the store's location, which can impact their purchasing decisions and loyalty to certain retailers. However, for those who live or shop in areas with lower sales tax rates, there can be significant savings over time.

Online Sales and Remote Sellers

The rise of e-commerce has added another layer of complexity to Missouri’s sales tax landscape. With many consumers now shopping online, the state has implemented laws to ensure that out-of-state sellers also collect and remit sales tax on goods sold to Missouri residents. This is known as economic nexus, and it means that even online retailers with no physical presence in Missouri must often collect and remit sales tax if their sales exceed a certain threshold.

This shift has been a boon for the state's revenue collection, ensuring that online retailers contribute their fair share. However, it also presents challenges for these businesses, which must now navigate the complexities of Missouri's sales tax system, often with the help of specialized software or tax professionals.

Missouri’s Sales Tax Future: Trends and Projections

Looking ahead, several trends and potential policy changes could shape the future of Missouri’s sales tax system. One notable trend is the increasing focus on online sales and the continued development of laws and systems to capture tax revenue from this growing sector.

Additionally, there is ongoing debate about the fairness and efficacy of the current sales tax system, particularly regarding the impact of varying local tax rates. Some advocate for a more uniform sales tax rate across the state, while others suggest expanding the range of tax-exempt items or implementing a sales tax base broadening strategy to include currently untaxed services.

Potential Policy Changes

One proposed policy change is the introduction of a use tax, which would apply to goods purchased out of state and brought into Missouri. This could level the playing field between in-state and out-of-state retailers, ensuring that all businesses are subject to similar tax obligations. However, the implementation of such a tax would require careful consideration and planning to ensure it does not place an undue burden on consumers or businesses.

Another potential shift is the movement towards a value-added tax (VAT) system, which is more common in other parts of the world. A VAT would apply to each stage of production and distribution, offering a more comprehensive approach to taxation. While this system has its advantages, it would represent a significant departure from the current sales tax structure and would require substantial legislative and administrative changes.

As Missouri's economy continues to evolve, so too will its sales tax system. The state's leaders and policymakers will need to carefully consider these potential changes, weighing their potential benefits against the complexities and challenges they may present.

What is the current state sales tax rate in Missouri?

+As of [last updated date], the state sales tax rate in Missouri is 4.225%.

How do local sales taxes work in Missouri?

+Missouri’s 114 local jurisdictions are allowed to levy additional sales taxes, ranging from 0.5% to 3.75%, with an average of 1.19%. This adds to the state sales tax rate, resulting in varying total sales tax rates across the state.

Are there any sales tax holidays in Missouri?

+Yes, Missouri has organized sales tax holidays in the past, often around back-to-school shopping. These holidays provide tax-free days for specific items like clothing, school supplies, and computers.

How do online sales impact Missouri’s sales tax collection?

+Missouri has implemented laws to ensure that out-of-state sellers also collect and remit sales tax on goods sold to Missouri residents. This is known as economic nexus and has increased revenue collection from online retailers.

What are some potential future changes to Missouri’s sales tax system?

+Potential future changes include the introduction of a use tax, which would apply to goods purchased out of state and brought into Missouri, and the potential shift towards a value-added tax (VAT) system.