Harris County Texas Tax Office

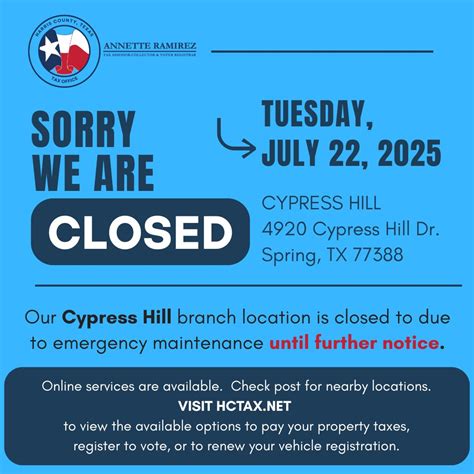

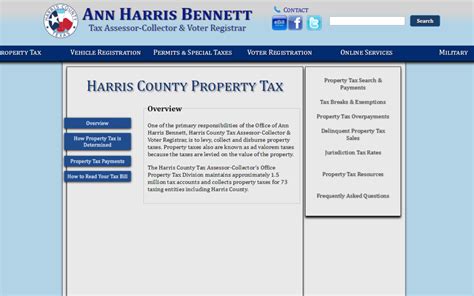

The Harris County Tax Office in Texas is an essential government entity that plays a pivotal role in the administration of property taxes, vehicle registration, and various other vital services for the residents and businesses within the county. Located in the heart of Houston, Texas, the largest city in Harris County, this tax office is responsible for ensuring that all property owners and vehicle owners comply with the state's tax regulations and laws.

The Harris County Tax Office: An Overview

Harris County, with its diverse population and thriving economy, is one of the most populous counties in the United States. The tax office, headed by the elected County Tax Assessor-Collector, oversees a vast array of responsibilities to maintain the county’s financial stability and integrity. Let’s delve into the key functions and services provided by this essential governmental department.

Property Tax Administration

Property tax is a significant source of revenue for Harris County, and the tax office plays a crucial role in this process. They are responsible for the following tasks:

- Property Appraisal: The office maintains accurate records of all properties within the county, ensuring that the property values are assessed fairly and accurately. This process involves regular inspections and updates to property records.

- Tax Billing and Collection: Once property values are determined, the tax office generates tax bills and collects payments from property owners. This process includes issuing reminders, accepting various payment methods, and providing assistance to taxpayers.

- Property Tax Exemptions and Appeals: The tax office also manages applications for property tax exemptions, such as those for seniors, veterans, and individuals with disabilities. Additionally, they handle appeals for property owners who wish to contest their assessed values.

| Property Tax Metrics | Harris County Data |

|---|---|

| Number of Properties Taxed | Over 1.8 million |

| Average Property Tax Rate | 2.21% (as of 2022) |

| Total Property Tax Revenue | $3.2 billion (2021) |

Vehicle Registration and Titling

In addition to property taxes, the Harris County Tax Office is also responsible for vehicle registration and titling. This includes:

- Vehicle Registration: The office processes vehicle registrations, including issuing license plates and registration certificates. They also handle renewals and changes of ownership.

- Vehicle Titling: For new vehicles or those purchased from out-of-state, the tax office facilitates the titling process, ensuring that all necessary documents are in order and registering the vehicle with the state.

- Specialty Plates: Residents can apply for specialty license plates, such as personalized plates or plates supporting various causes, through the tax office.

Other Services and Responsibilities

The Harris County Tax Office offers a range of additional services to the community, including:

- Voter Registration: Residents can register to vote or update their voter registration information at the tax office.

- Notary Services: The office provides notary public services for various legal documents.

- Motorcycle Safety Courses: In collaboration with the Texas Department of Public Safety, the tax office offers information and resources for motorcycle safety courses.

- Business Services: The tax office assists businesses with registration, licensing, and tax compliance.

Innovations and Digital Transformation

The Harris County Tax Office has embraced technological advancements to streamline its services and enhance the taxpayer experience. They have implemented various online platforms and digital tools, such as:

- Online Property Tax Payments: Taxpayers can now pay their property taxes online, offering a convenient and secure method.

- Digital Vehicle Registration: The office has introduced an online platform for vehicle registration, allowing residents to complete the process remotely.

- Mobile Apps: They have developed mobile applications to provide quick access to tax information, payment options, and other essential services.

- Electronic Document Management: The tax office has implemented an electronic document management system to improve efficiency and reduce paper waste.

Community Engagement and Outreach

Recognizing the importance of community engagement, the Harris County Tax Office actively participates in various outreach programs and initiatives. They organize tax workshops, provide educational resources, and collaborate with local organizations to ensure that residents understand their tax obligations and rights. Additionally, the office hosts events and campaigns to promote tax compliance and awareness.

Conclusion: A Vital County Department

The Harris County Tax Office is a vital department that plays a critical role in the financial stability and growth of the county. By effectively managing property taxes, vehicle registrations, and various other services, they contribute significantly to the county’s prosperity and well-being. With a commitment to innovation and community engagement, the tax office continues to enhance its services, ensuring a brighter future for Harris County.

How can I pay my property taxes in Harris County?

+You can pay your property taxes online through the Harris County Tax Office website, by mail, or in person at any of their locations. The office also offers various payment plans and options to assist taxpayers.

What are the vehicle registration requirements in Harris County?

+To register your vehicle in Harris County, you’ll need to provide proof of insurance, a valid title, and a completed registration application. You can complete this process online or at any tax office location.

How often do I need to renew my vehicle registration?

+Vehicle registration in Texas is typically valid for one year. You’ll receive a renewal notice prior to the expiration date, and you can renew online or at the tax office.

Can I apply for a property tax exemption online?

+Yes, the Harris County Tax Office provides online applications for various property tax exemptions, such as the Over 65 Exemption and the Disability Exemption. You can access these applications through their website.

How does the tax office handle property tax appeals?

+If you wish to appeal your property tax assessment, you can submit an application for protest to the Harris County Appraisal District. The tax office provides guidance and resources to assist taxpayers through this process.