Lamar County Tax

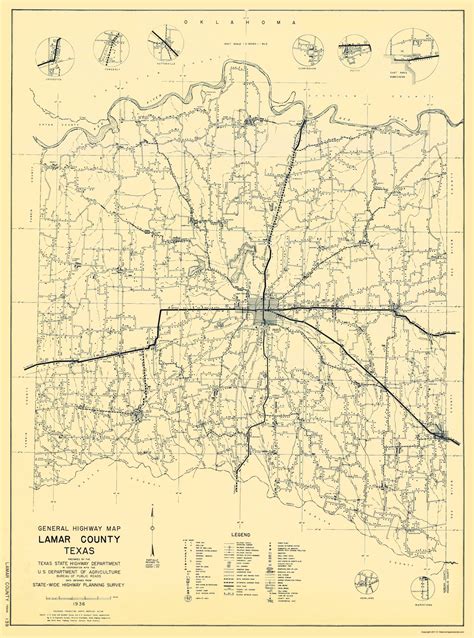

Welcome to a comprehensive exploration of the Lamar County Tax system, a critical component of the local economy and an essential aspect of understanding the financial landscape for residents and businesses alike. Lamar County, with its vibrant communities and diverse economic activities, presents a unique tax structure that deserves an in-depth analysis. This article aims to demystify the complexities of Lamar County's tax system, providing valuable insights and a thorough understanding of its intricacies.

Understanding the Lamar County Tax System

Lamar County’s tax system is a meticulously designed framework that governs the collection of revenues to support the county’s operations and development. It encompasses a range of taxes, each serving a specific purpose and contributing to the overall financial health of the county.

Property Taxes: A Cornerstone of County Revenue

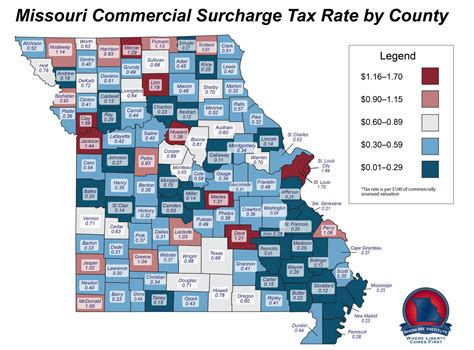

Property taxes form the backbone of Lamar County’s revenue stream. The county assesses property values based on various factors, including location, size, and usage. These assessments determine the tax liability for property owners, with rates varying depending on the type of property and its designated use. For instance, residential properties, commercial establishments, and agricultural lands are subject to different tax rates, reflecting the unique characteristics and value of each category.

To illustrate, consider a hypothetical scenario where a residential property located in a desirable neighborhood of Lamar County is assessed at $250,000. Applying the county's residential property tax rate of 1.75%, the annual property tax liability for the owner would amount to $4,375. This calculation demonstrates how property taxes contribute significantly to the county's budget, enabling essential services such as infrastructure development, public safety, and education.

| Property Type | Assessment Value | Tax Rate | Annual Tax Liability |

|---|---|---|---|

| Residential | $250,000 | 1.75% | $4,375 |

| Commercial | $500,000 | 2.25% | $11,250 |

| Agricultural | $150,000 | 1.25% | $1,875 |

It's important to note that Lamar County offers various exemptions and deductions to alleviate the tax burden on specific categories of property owners. For example, elderly residents with limited incomes may be eligible for a homestead exemption, reducing their taxable property value and, consequently, their tax liability. Similarly, agricultural lands are often assessed at a lower rate, recognizing their unique contribution to the county's economy and promoting sustainable land use.

Sales and Use Taxes: Supporting Local Businesses and Consumer Activities

In addition to property taxes, Lamar County relies on sales and use taxes to generate revenue. These taxes are levied on the sale of goods and services within the county, as well as on the use or consumption of certain products and services. The county’s sales tax rate is typically combined with state and local sales tax rates, creating a cumulative tax burden for consumers.

For instance, when a consumer purchases a new television set from a local retailer in Lamar County, they are subject to the county's sales tax rate, which might be 2% in addition to the state sales tax. This means that for a television priced at $1,000, the consumer would pay an extra $20 in sales tax, contributing to the county's revenue stream. This tax is crucial for funding public services, infrastructure projects, and economic development initiatives within the county.

| Product/Service | Sales Tax Rate | Amount Purchased | Sales Tax Liability |

|---|---|---|---|

| Electronics | 2% | $1,000 | $20 |

| Clothing | 1.5% | $500 | $7.50 |

| Groceries | 0% | $200 | $0 |

Lamar County also imposes a use tax on certain transactions, ensuring that all purchases made by county residents, regardless of where the sale occurs, are subject to taxation. This measure prevents residents from avoiding sales taxes by making purchases outside the county. By enforcing a use tax, Lamar County ensures a fair and equitable tax system, promoting economic stability and growth within its boundaries.

Business Taxes: Fostering Economic Development

To encourage economic growth and support local businesses, Lamar County has implemented a range of business taxes and incentives. These measures aim to create a conducive environment for entrepreneurship and investment, attracting new businesses and retaining existing ones.

One notable business tax is the corporate income tax, which applies to the profits earned by corporations operating within the county. The tax rate is typically progressive, with higher rates for larger corporations, ensuring a fair distribution of the tax burden. For instance, a corporation with annual profits exceeding $1 million might be subject to a 6% tax rate, while smaller businesses with lower profits enjoy a more favorable tax rate of 3%. This progressive structure promotes fairness and supports the growth of small and medium-sized enterprises.

| Business Type | Annual Profits | Tax Rate | Tax Liability |

|---|---|---|---|

| Large Corporation | $1,500,000 | 6% | $90,000 |

| Small Business | $250,000 | 3% | $7,500 |

| Start-up Enterprise | $50,000 | 2% | $1,000 |

In addition to corporate income tax, Lamar County offers various tax incentives to attract new businesses and support existing ones. These incentives may include tax abatements, tax credits, or reduced tax rates for specific industries or businesses meeting certain criteria. For example, a manufacturing company investing in renewable energy technologies might be eligible for a reduced tax rate, encouraging sustainable practices and job creation within the county.

Navigating the Lamar County Tax System

Understanding the intricacies of Lamar County’s tax system is crucial for both residents and businesses. By comprehending the various taxes and their implications, individuals and organizations can make informed financial decisions and effectively manage their tax liabilities.

Tax Filing and Payment Processes

Lamar County provides a user-friendly online platform for tax filing and payment, making the process more accessible and efficient. Residents and businesses can register on the county’s website, access their tax accounts, and complete their tax obligations from the comfort of their homes or offices. The platform offers a range of payment options, including credit card, e-check, and direct debit, ensuring convenience and flexibility.

For those who prefer traditional methods, the county also accepts tax payments through mail or in-person at designated tax offices. Taxpayers can obtain payment forms and instructions from the county's website or by visiting the tax office. It's important to note that timely payment of taxes is essential to avoid penalties and interest charges, which can accumulate over time.

Tax Assistance and Support

Recognizing that tax matters can be complex and overwhelming, Lamar County offers a range of support services to assist taxpayers. The county’s tax office provides guidance and resources to help individuals and businesses understand their tax obligations, navigate the filing process, and resolve any issues or disputes. Taxpayers can access informative guides, attend workshops, or schedule appointments with tax specialists to receive personalized assistance.

Additionally, Lamar County partners with community organizations and volunteer groups to offer free tax preparation services to eligible residents. These initiatives aim to ensure that all taxpayers, regardless of their income level or financial background, have access to the support they need to comply with their tax obligations. By providing assistance and resources, the county fosters a culture of tax compliance and empowers residents to take an active role in contributing to the community's well-being.

Appeals and Dispute Resolution

In cases where taxpayers disagree with their tax assessments or believe they have been subjected to unfair tax practices, Lamar County provides a comprehensive appeals process. Taxpayers can file an appeal within a specified timeframe, outlining their reasons for dispute and presenting relevant evidence to support their case. The county’s tax board carefully reviews each appeal, ensuring a fair and impartial evaluation.

If a taxpayer's appeal is successful, the tax assessment may be adjusted, reducing their tax liability. Alternatively, the tax board may uphold the original assessment, providing a detailed explanation of its decision. In cases where taxpayers remain dissatisfied with the outcome, they have the option to seek further review through the county's appellate process or explore legal avenues for resolution.

The Impact of Lamar County Taxes on the Community

Lamar County’s tax system plays a pivotal role in shaping the community’s economic landscape and overall well-being. The revenues generated through taxes fund essential services, infrastructure projects, and initiatives that enhance the quality of life for residents.

Investing in Community Development

A significant portion of Lamar County’s tax revenues is allocated to community development projects. These initiatives encompass a wide range of areas, including education, healthcare, public safety, and infrastructure. By investing in these critical sectors, the county aims to create a thriving and resilient community, offering its residents opportunities for growth and prosperity.

For instance, tax revenues are directed towards improving the county's educational facilities, ensuring that students have access to modern classrooms, advanced technology, and well-equipped libraries. This investment in education not only benefits current students but also attracts families and professionals, contributing to the county's long-term economic growth.

Additionally, tax funds support healthcare initiatives, such as the expansion of medical facilities, the recruitment of specialized healthcare professionals, and the implementation of community health programs. These efforts enhance the overall health and well-being of residents, fostering a healthy and productive workforce.

Supporting Local Businesses and Job Creation

Lamar County’s tax system is designed to encourage economic growth and support local businesses. By providing a conducive environment for entrepreneurship and investment, the county attracts new businesses and fosters the expansion of existing ones. This, in turn, leads to job creation and economic prosperity, benefiting the entire community.

The county's business tax incentives, such as tax abatements and credits, play a crucial role in attracting and retaining businesses. These incentives not only reduce the tax burden for businesses but also signal the county's commitment to fostering a business-friendly environment. As a result, businesses are more likely to invest in the community, creating jobs and contributing to the local economy.

Furthermore, Lamar County's tax system promotes economic diversity by supporting a range of industries. From manufacturing and technology to agriculture and tourism, the county's diverse economic landscape ensures a resilient and stable economy. By investing in various sectors, the county minimizes its reliance on a single industry, reducing the impact of economic downturns and fostering long-term sustainability.

Ensuring Fiscal Responsibility and Transparency

Lamar County is committed to fiscal responsibility and transparency in its tax practices. The county’s budget process is open and accessible, with public meetings and hearings providing opportunities for residents to engage and voice their concerns. This transparency fosters trust and accountability, ensuring that tax revenues are utilized efficiently and effectively to benefit the community.

The county's financial reports and budgets are publicly available, providing residents with a clear understanding of how their tax dollars are being allocated. This transparency promotes confidence in the tax system and encourages active participation in community affairs. By involving residents in the budgeting process, Lamar County demonstrates its commitment to serving the needs and aspirations of its citizens.

Conclusion

In conclusion, Lamar County’s tax system is a well-designed framework that supports the county’s economic growth, community development, and fiscal sustainability. By understanding the intricacies of this system, residents and businesses can actively contribute to the county’s prosperity and well-being. Through a combination of property taxes, sales and use taxes, and business taxes, Lamar County generates the revenues necessary to fund essential services, infrastructure projects, and initiatives that enhance the quality of life for all.

What is the average property tax rate in Lamar County?

+

The average property tax rate in Lamar County is approximately 1.75%. However, it’s important to note that the actual tax rate can vary depending on the type of property and its designated use. For example, commercial properties may have a higher tax rate compared to residential properties.

Are there any tax incentives for businesses in Lamar County?

+

Yes, Lamar County offers a range of tax incentives to attract and support businesses. These incentives may include tax abatements, tax credits, or reduced tax rates for specific industries or businesses that meet certain criteria. It’s recommended to consult with the county’s tax office or economic development department for more detailed information.

How can I file my taxes in Lamar County?

+

Lamar County provides an online platform for tax filing, making the process convenient and accessible. You can register on the county’s website, access your tax account, and complete your tax obligations online. Additionally, you can also file your taxes through mail or in-person at designated tax offices.

What happens if I disagree with my tax assessment?

+

If you disagree with your tax assessment, you have the right to appeal. Lamar County offers a comprehensive appeals process where you can file an appeal within a specified timeframe. The tax board will carefully review your case, and if your appeal is successful, your tax assessment may be adjusted.

How does Lamar County ensure fiscal transparency and accountability?

+

Lamar County is committed to fiscal transparency and accountability. The county’s budget process is open to the public, with public meetings and hearings allowing residents to participate and provide input. Financial reports and budgets are publicly available, ensuring transparency and confidence in the tax system.