Texas Car Tax Calculator

Are you a resident of the Lone Star State and wondering how to calculate your car tax obligations? Understanding the intricacies of car taxation in Texas is crucial for both new and seasoned drivers alike. In this comprehensive guide, we'll delve into the world of Texas car taxes, providing you with a detailed breakdown of the calculation process and shedding light on the factors that influence your tax bill.

Unraveling the Texas Car Tax Landscape

The Texas car tax system operates on a unique framework that considers various aspects of vehicle ownership. Unlike some states that impose an annual registration fee based on the vehicle’s age and model, Texas takes a more nuanced approach. Here, the car tax is calculated based on the vehicle’s purchase price, making it essential to have a precise understanding of the tax rules to ensure compliance and avoid any unnecessary financial burdens.

Whether you're a first-time buyer or an experienced car owner, navigating the intricacies of car taxation can be a complex task. This guide aims to simplify the process, offering a step-by-step breakdown of how to calculate your Texas car tax accurately. By the end, you'll have a clear understanding of the factors that influence your tax bill and the steps required to ensure timely and accurate payment.

The Fundamentals of Texas Car Taxation

Texas car taxes are primarily governed by the Vehicle Sales Tax, a percentage-based levy applied to the purchase price of a vehicle. This tax is collected by the Texas Comptroller of Public Accounts and varies depending on the county in which the vehicle is registered. Understanding this fundamental aspect is crucial for accurate tax calculation and compliance with state regulations.

Additionally, it's important to note that Texas offers a Sales Tax Exemption for certain types of vehicles, such as those purchased by active-duty military personnel stationed in the state. This exemption can significantly reduce the tax liability for eligible individuals, making it a key consideration when calculating car taxes in Texas.

Step-by-Step Guide: Calculating Your Texas Car Tax

-

Determine the Purchase Price of Your Vehicle

The first step in calculating your Texas car tax is to establish the actual purchase price of your vehicle. This is typically the amount you paid for the car, including any additional fees or charges associated with the transaction. It’s essential to have an accurate record of this price to ensure an error-free tax calculation.

-

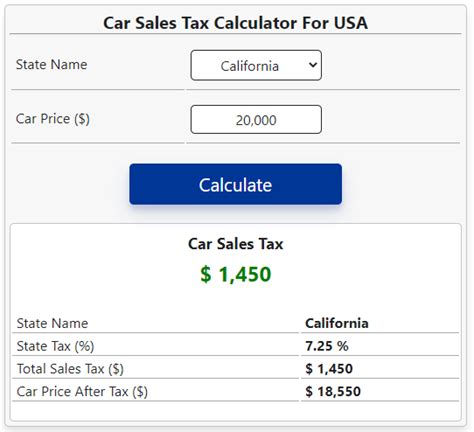

Identify the Applicable Tax Rate

The next step involves identifying the specific tax rate that applies to your vehicle. This rate can vary based on the county where you register your car. To determine the correct rate, you can refer to the Texas Comptroller’s website, which provides a comprehensive list of county-specific tax rates. By inputting your county of residence, you’ll be able to obtain the precise tax rate applicable to your vehicle.

-

Calculate the Tax Amount

Once you have the purchase price and the applicable tax rate, you can proceed to calculate the tax amount. This is a straightforward calculation: Tax Amount = Purchase Price x Tax Rate. For instance, if you purchased a vehicle for 25,000 and the tax rate in your county is 6.25%, the tax amount would be 1,562.50 ($25,000 x 0.0625). This calculation provides you with the exact tax liability for your vehicle.

-

Consider Any Exemptions or Credits

Texas offers various exemptions and credits that can reduce your car tax liability. As mentioned earlier, active-duty military personnel may be eligible for a sales tax exemption. Additionally, Texas provides a Vehicle Sales Tax Credit for certain circumstances, such as when a vehicle is purchased outside the state and subsequently registered in Texas. It’s crucial to research and understand any applicable exemptions or credits to ensure you’re taking full advantage of the available tax benefits.

-

Prepare for Tax Payment

With the tax amount calculated and any applicable exemptions or credits considered, you’re now ready to prepare for tax payment. Texas offers several options for tax payment, including online payment through the Windows on Texas platform, over-the-counter payment at authorized locations, or payment by mail. Ensure you have the necessary documentation, such as your vehicle registration and proof of insurance, ready for the payment process.

Exploring Advanced Scenarios: Additional Considerations

While the basic car tax calculation is straightforward, certain scenarios may require additional considerations. Here are some advanced scenarios and the factors to keep in mind:

Leased Vehicles

If you lease a vehicle in Texas, the car tax calculation process differs slightly. Instead of paying the tax upfront, you’ll typically pay the tax as part of your monthly lease payments. The tax amount is usually included in the overall lease cost, making it a convenient option for those who prefer a more streamlined payment process.

Vehicle Trade-Ins

When trading in a vehicle, the purchase price for tax calculation purposes may be adjusted to reflect the trade-in value. This adjustment can impact the overall tax liability, so it’s crucial to understand how trade-ins are treated in the context of car taxation. Consult with your dealer or tax advisor to ensure an accurate calculation in such scenarios.

Online Vehicle Purchases

With the rise of online vehicle sales, it’s essential to understand how car taxes apply to these transactions. Texas has specific regulations for online vehicle purchases, and the tax calculation process may vary depending on the platform used and the location of the seller. Ensure you’re familiar with the tax implications of online purchases to avoid any surprises when it comes time to register your vehicle.

| Vehicle Type | Tax Rate (%) |

|---|---|

| Passenger Vehicles | 6.25 |

| Trucks and SUVs | 6.25 |

| Motorcycles | 6.25 |

| Classic Cars | Varies by County |

The Impact of Car Taxation on Texas Drivers

Car taxation in Texas has a significant impact on the state’s residents, affecting their financial obligations and overall cost of vehicle ownership. The tax system, with its county-specific rates and exemptions, influences the financial planning and budgeting of car owners across the state. Understanding these impacts is essential for individuals to make informed decisions about vehicle purchases and maintenance.

Financial Planning and Budgeting

Texas car taxes are an essential consideration in financial planning for vehicle owners. The tax amount can vary significantly based on the vehicle’s purchase price and the applicable tax rate. For instance, a higher-priced vehicle in a county with a higher tax rate could result in a substantial tax liability. This factor influences the overall cost of vehicle ownership and impacts an individual’s financial planning and budgeting for vehicle-related expenses.

Vehicle Maintenance and Upkeep

The car tax system in Texas also affects vehicle maintenance and upkeep. As vehicles age, their value typically decreases, which can lead to lower tax liabilities in subsequent years. This aspect of the tax system encourages car owners to maintain their vehicles properly, as well-maintained vehicles often retain their value better over time. Consequently, the tax system indirectly promotes responsible vehicle ownership and maintenance practices.

Economic Impact on the State

The Texas car tax system also has broader economic implications for the state. The tax revenue generated from vehicle sales contributes significantly to the state’s overall economic health. It funds various public services and infrastructure projects, benefiting the community as a whole. Additionally, the tax system encourages vehicle sales and ownership, which in turn supports the automotive industry and related businesses within the state.

Frequently Asked Questions (FAQ)

Are there any ways to reduce my Texas car tax liability?

+Yes, Texas offers several avenues to reduce car tax liability. These include sales tax exemptions for active-duty military personnel and the Vehicle Sales Tax Credit for certain circumstances. Additionally, leasing a vehicle may provide a more convenient payment option, as the tax is typically included in the monthly lease payments.

What happens if I fail to pay my Texas car tax on time?

+Failure to pay your Texas car tax on time can result in penalties and interest charges. The state may also suspend your vehicle registration, which could lead to additional fees and legal consequences. It’s essential to stay informed about the tax due dates and make timely payments to avoid these issues.

Can I apply for a tax refund if I overpay my Texas car tax?

+Yes, if you overpay your Texas car tax, you may be eligible for a refund. The process typically involves submitting a request for a refund to the Texas Comptroller’s office, along with the necessary documentation. It’s important to keep records of your tax payments to facilitate the refund process if needed.

How often do Texas car tax rates change, and how can I stay updated?

+Texas car tax rates can change periodically, and it’s essential to stay informed about any updates. The Texas Comptroller’s office regularly publishes information on tax rate changes and other relevant updates on their website. You can also subscribe to their email updates or follow their social media channels to receive timely notifications.

In conclusion, understanding the Texas car tax system is crucial for residents to comply with state regulations and manage their financial obligations effectively. By following the step-by-step guide provided in this article, you can calculate your car tax accurately and stay informed about the factors influencing your tax liability. Whether you’re a new driver or an experienced car owner, staying updated on Texas car taxes ensures a seamless and compliant vehicle ownership experience.