City Of Knoxville Property Tax

Understanding property taxes is crucial for homeowners and prospective buyers alike. This comprehensive guide will delve into the specifics of property taxes in Knoxville, shedding light on the assessment process, rates, and the factors that influence these taxes. Whether you're a current resident or considering a move to Knoxville, Tennessee, this article will provide valuable insights into the city's property tax landscape.

Navigating Knoxville’s Property Tax System

Property taxes in Knoxville, like in many other cities, are a vital source of revenue for local governments. These taxes contribute to the maintenance of public services and infrastructure, making them an essential aspect of civic life. The process begins with an assessment, where the property’s value is determined, and this value then forms the basis for the calculation of property taxes.

Assessment and Valuation

In Knoxville, property assessments are conducted by the Knox County Assessor of Property, an office responsible for appraising all real property within the county. This includes residential, commercial, and industrial properties. The assessment process involves a thorough evaluation of various factors such as:

- Location and neighborhood characteristics.

- Property size and dimensions.

- The age and condition of the structure.

- Recent sales data of comparable properties.

- Improvement or renovation history.

The assessor’s office aims to ensure that all properties are assessed fairly and accurately. Properties are typically assessed every four years, although new construction or significant improvements may trigger a reassessment.

Tax Rates and Calculations

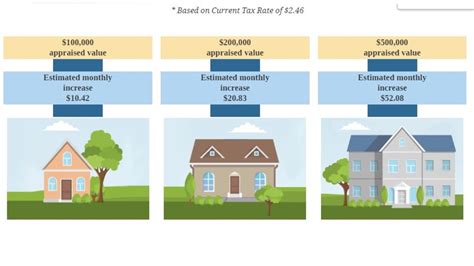

Once a property’s value has been determined, the applicable tax rate is applied to calculate the property tax liability. In Knoxville, the tax rate is set by the local government and can vary depending on the specific area within the city. Tax rates are expressed in mills, with one mill representing a tax liability of 1 for every 1,000 of assessed value.

For instance, if a property is assessed at $250,000 and the tax rate is 250 mills, the property tax calculation would be as follows:

| Property Value | Tax Rate (Mills) | Property Tax |

|---|---|---|

| $250,000 | 250 | $6,250 |

This means the property owner would owe $6,250 in property taxes for that year.

Tax Exemptions and Discounts

Knoxville, like many other cities, offers various tax exemptions and discounts to eligible property owners. These can significantly reduce the overall tax burden. Some common exemptions and discounts include:

- Homestead Exemption: Provides a reduction in taxable value for homeowners who use the property as their primary residence.

- Senior Citizen Discount: Offers a reduction in tax liability for homeowners aged 65 or older.

- Veteran’s Exemption: Provides tax relief for active-duty military personnel and veterans.

- Greenbelt Program: Encourages the preservation of agricultural and forested lands by assessing these properties based on their use rather than market value.

It's important for property owners to research and understand the eligibility criteria for these exemptions, as they can provide substantial savings.

Factors Influencing Property Taxes

Several factors can influence the amount of property taxes owed in Knoxville. Understanding these factors can help homeowners anticipate potential changes and plan their finances accordingly.

Market Conditions

The real estate market plays a significant role in determining property values. During periods of high demand and rising property prices, assessments may increase, leading to higher property taxes. Conversely, in a slow market, assessments might decrease, resulting in lower taxes.

Local Government Budgets

Property tax rates are often influenced by the local government’s budget needs. If the city or county requires additional revenue to fund projects or services, they may increase tax rates. Understanding the local government’s financial plans and priorities can provide insights into potential tax rate changes.

Infrastructure and Service Upgrades

Major infrastructure projects or improvements in public services can impact property taxes. For example, the construction of a new road or the expansion of a school district might result in higher taxes to cover these costs. Keeping abreast of local development plans can help homeowners anticipate such changes.

Economic Climate

The overall economic climate can also affect property taxes. During economic downturns, governments might seek additional revenue to balance their budgets, potentially leading to tax rate increases. Conversely, in a strong economy, tax rates might remain stable or even decrease if the government has sufficient funds.

The Impact of Property Taxes on Knoxville’s Residents

Property taxes are a significant financial obligation for Knoxville’s residents. These taxes not only contribute to the city’s development and maintenance but also impact individual household budgets. Understanding the tax landscape is crucial for financial planning and can influence decisions such as home purchases, renovations, and long-term residency.

Homeownership and Property Tax Planning

For prospective homebuyers, understanding property taxes is essential when considering a property purchase. These taxes should be factored into the overall cost of homeownership, along with mortgage payments, insurance, and maintenance expenses. Being aware of the tax burden can help buyers make informed decisions and budget effectively.

Property Tax Appeals and Challenges

In cases where property owners believe their assessment is inaccurate or unfair, they have the right to appeal. The appeal process allows homeowners to present evidence and arguments to support their case for a lower assessment. While the process can be complex, it offers a mechanism for ensuring fair taxation.

Community Engagement and Tax Transparency

Knoxville’s local government prioritizes transparency and community engagement when it comes to property taxes. Regular town hall meetings, public forums, and online resources provide residents with opportunities to voice their concerns, ask questions, and stay informed about tax-related matters. This engagement fosters a sense of trust and understanding between the government and its citizens.

Future Outlook and Potential Changes

As Knoxville continues to grow and develop, its property tax landscape is likely to evolve. Factors such as population growth, economic trends, and infrastructure needs will influence future tax rates and assessment processes. Staying informed about these potential changes is essential for residents and businesses alike.

Technological Advancements in Assessment

Advancements in technology are transforming the assessment process. Knoxville is exploring innovative methods such as aerial imaging and data analytics to improve accuracy and efficiency. These tools can provide more detailed and up-to-date assessments, potentially leading to fairer tax distributions.

Potential Tax Reform and Policy Changes

There is ongoing discussion about tax reform at both the state and local levels. Proposals include revising tax rates, reevaluating exemption programs, and exploring alternative revenue streams. While these changes aim to improve the tax system’s fairness and efficiency, they can also bring uncertainty for taxpayers.

Economic Development and Tax Incentives

Knoxville is committed to attracting new businesses and fostering economic growth. As part of this strategy, the city may offer tax incentives to encourage investment and job creation. These incentives could take the form of tax breaks, abatements, or other benefits for qualifying businesses. Understanding these incentives can be advantageous for both existing and prospective businesses.

Conclusion: Navigating Knoxville’s Property Tax Landscape

Understanding property taxes in Knoxville is an essential part of being a responsible homeowner or business owner in the city. By staying informed about assessment processes, tax rates, and potential changes, residents and businesses can make informed decisions and effectively manage their financial obligations.

As Knoxville continues to thrive and evolve, its property tax system will adapt to meet the needs of a growing and changing community. By engaging with the local government, attending public meetings, and staying updated on tax-related news, residents can actively participate in shaping the city's future while managing their tax responsibilities effectively.

How often are properties assessed for taxes in Knoxville?

+Properties in Knoxville are typically assessed every four years. However, new construction or significant improvements may trigger a reassessment before the four-year mark.

What are the current tax rates in Knoxville for residential properties?

+As of [current year], the tax rate for residential properties in Knoxville is [current tax rate] mills. This rate can vary depending on the specific area within the city.

Are there any online resources to help me estimate my property taxes in Knoxville?

+Yes, the Knox County Assessor of Property website provides a Property Tax Estimator tool. This tool allows you to input your property’s details and get an estimate of your potential tax liability.

How can I appeal my property assessment if I believe it’s inaccurate?

+If you wish to appeal your property assessment, you can contact the Knox County Assessor’s Office to initiate the process. They will guide you through the necessary steps and provide information on the appeal deadline and required documentation.

Are there any upcoming changes to Knoxville’s property tax system that I should be aware of?

+While specific changes cannot be predicted, it’s always a good idea to stay informed about local government initiatives and proposed tax reforms. You can check the Knox County Budget and Finance website for updates and announcements related to property taxes.