Ca Orange County Sales Tax

Welcome to a comprehensive exploration of the sales tax landscape in Orange County, California. This insightful article aims to provide an in-depth understanding of the sales tax structure, rates, and implications for businesses and consumers in the vibrant region of Orange County. As one of the most dynamic and economically significant counties in the state, Orange County's sales tax policies play a crucial role in shaping its economic landscape and the experiences of those who live, work, and invest here.

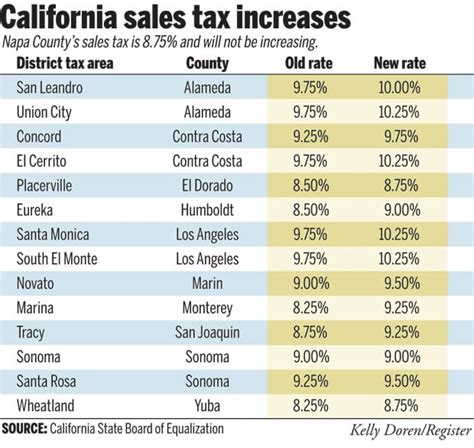

Unraveling the Sales Tax System in Orange County

Sales tax in Orange County is a multifaceted topic, influenced by various factors such as state, county, and city regulations. Understanding this intricate system is essential for businesses to ensure compliance and for consumers to make informed purchasing decisions. Let’s delve into the specifics of Orange County’s sales tax.

State Sales Tax

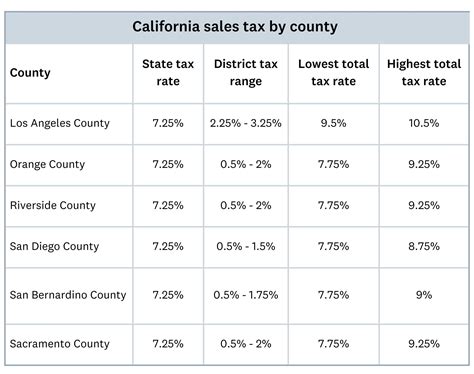

California, known for its robust economy and diverse tax system, imposes a state sales tax rate of 7.25%. This rate is applied uniformly across the state and serves as the foundation for the sales tax structure in Orange County.

County Sales Tax

In addition to the state sales tax, Orange County levies its own county sales tax, currently set at 1.25%. This supplementary tax contributes to the overall sales tax burden in the county and is crucial for understanding the total sales tax rate applicable to various transactions.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | 7.25% |

| Orange County | 1.25% |

The combined state and county sales tax rate in Orange County totals 8.50%, making it an important consideration for businesses operating in the county and consumers making purchases.

City Sales Tax

The sales tax landscape in Orange County becomes even more complex with the introduction of city-specific sales taxes. Many cities within the county have their own unique sales tax rates, often referred to as local option taxes, which are added on top of the state and county sales taxes. These local taxes are implemented to fund specific city initiatives and projects.

Here's a glimpse at the sales tax rates in some prominent cities within Orange County:

| City | Sales Tax Rate |

|---|---|

| Anaheim | 0.75% |

| Irvine | 1.50% |

| Newport Beach | 1.25% |

| Santa Ana | 0.75% |

| Tustin | 1.00% |

It's important to note that these rates are subject to change and may vary depending on the specific city and the purpose of the tax. Businesses operating in multiple cities within Orange County must be vigilant in keeping up with these variations to ensure accurate tax calculations and compliance.

Special Tax Districts

Orange County also houses various special tax districts, each with its own unique sales tax rate. These districts are typically established to address specific needs, such as transportation infrastructure or community development projects. The sales tax rates in these districts can further add to the overall tax burden on businesses and consumers.

For instance, the Orange County Transportation Authority (OCTA) administers a special sales tax of 1.00% in certain areas of the county to fund transportation improvements. This tax is in addition to the state, county, and city sales taxes, highlighting the complexity of the sales tax system in Orange County.

The Impact on Businesses and Consumers

The sales tax structure in Orange County has significant implications for both businesses and consumers. For businesses, understanding and managing sales tax obligations is crucial for compliance and financial health. On the consumer side, sales tax can influence purchasing decisions, especially for high-value items or frequent purchases.

Business Considerations

Businesses operating in Orange County must navigate a complex sales tax environment. This involves registering with the appropriate tax authorities, collecting and remitting sales tax accurately, and staying updated on any changes to tax rates or regulations. Failure to comply with sales tax obligations can result in penalties and legal consequences.

To simplify sales tax management, businesses can leverage modern tax software and accounting tools. These solutions automate tax calculations, ensuring accuracy and reducing the risk of errors. Additionally, staying informed about tax changes through industry associations or tax consultant services can help businesses stay ahead of any shifts in the sales tax landscape.

Consumer Perspective

For consumers, the sales tax rates in Orange County can impact their purchasing power and overall shopping experience. Higher sales tax rates can make certain items or services more expensive, especially for those making frequent purchases or buying high-value products. On the other hand, lower sales tax rates can encourage spending and support local businesses.

When making purchasing decisions, consumers should factor in the total sales tax applicable to their transaction. This can be particularly important for larger purchases, where even a small difference in tax rates can translate into significant savings. Additionally, understanding the sales tax structure can help consumers advocate for themselves when disputing tax charges or seeking refunds.

Economic Implications

The sales tax system in Orange County not only affects individual businesses and consumers but also has broader economic implications. Sales tax revenue contributes significantly to the county’s budget, funding essential services such as education, healthcare, and infrastructure development. Additionally, sales tax can influence the competitiveness of local businesses and the overall economic climate in the county.

From a policy perspective, sales tax rates and their distribution among different tax jurisdictions can be a subject of debate and analysis. Stakeholders, including business owners, policymakers, and community leaders, often engage in discussions to balance the need for revenue with the desire to maintain a competitive business environment and support consumer spending.

Sales Tax in Action: Real-World Scenarios

To illustrate the practical application of sales tax in Orange County, let’s consider a few real-world scenarios that highlight the importance of understanding and managing sales tax obligations.

Online Retailers

With the rise of e-commerce, online retailers face unique challenges when it comes to sales tax. In Orange County, online retailers must determine the applicable sales tax rate based on the shipping destination of the goods. This can become complex when orders are shipped to multiple cities or when the retailer has a physical presence in the county.

To comply with sales tax regulations, online retailers often utilize tax automation software that integrates with their e-commerce platforms. This software helps calculate the correct sales tax based on the destination of the order, ensuring accurate tax collection and reporting.

Retail Stores

Traditional retail stores in Orange County must also navigate the intricate sales tax system. For brick-and-mortar businesses, sales tax compliance involves understanding the rates applicable to their specific location and ensuring accurate tax collection at the point of sale. This includes training staff on sales tax regulations and using POS systems that integrate sales tax calculations.

Retailers often work closely with tax professionals or accounting firms to stay updated on any changes to sales tax rates and regulations. This ensures that their sales tax practices remain compliant and accurate, minimizing the risk of audits or penalties.

Service Providers

Sales tax obligations extend beyond traditional retail sales. Service providers, such as consultants, freelancers, and contractors, may also be subject to sales tax depending on the nature of their services and the location of their clients. In Orange County, service providers must determine whether their services are taxable and, if so, at what rate.

For instance, a consultant providing services to a client in Irvine would need to charge sales tax at the combined state, county, and city rate applicable to Irvine. Understanding these nuances is crucial for service providers to ensure compliance and provide accurate billing to their clients.

Future Outlook and Trends

As Orange County continues to evolve economically, the sales tax landscape is likely to undergo changes and adaptations. Here are some key trends and factors that could influence the future of sales tax in the county:

- Economic Growth and Development: As Orange County's economy expands and diversifies, sales tax revenue is expected to increase. This growth can provide additional funding for public services and infrastructure projects, benefiting the community.

- Technological Advancements: The continued adoption of technology, such as tax automation software and e-commerce platforms, will streamline sales tax compliance for businesses. This can reduce the administrative burden and minimize errors in tax calculations.

- Policy Changes: Sales tax rates and regulations are subject to policy decisions at the state and local levels. Changes in political leadership or economic conditions can lead to alterations in tax policies, impacting businesses and consumers alike.

- Consumer Behavior: Shifts in consumer preferences and spending habits can influence the sales tax landscape. For instance, increased online shopping or a shift towards experience-based purchases could impact the distribution of sales tax revenue across different sectors.

- Competition and Business Dynamics: The competitive business environment in Orange County can drive businesses to explore innovative ways to manage sales tax obligations. This could include leveraging technology, seeking tax incentives, or exploring alternative pricing strategies to remain competitive.

Navigating the Future of Sales Tax

To thrive in the evolving sales tax landscape, businesses in Orange County should stay informed about emerging trends and changes in tax regulations. This involves actively monitoring industry news, engaging with tax professionals, and adopting innovative tax management solutions.

Additionally, fostering strong relationships with local tax authorities and community leaders can provide valuable insights into potential policy changes and their impact on businesses. By staying proactive and adaptable, businesses can navigate the complexities of sales tax and contribute to the economic growth of Orange County.

Conclusion

The sales tax system in Orange County is a multifaceted and dynamic component of its economic landscape. From state and county taxes to city-specific rates and special tax districts, understanding the intricacies of sales tax is essential for businesses and consumers alike.

As Orange County continues to evolve, businesses must embrace technology, stay informed, and adapt to changing tax regulations. By doing so, they can ensure compliance, optimize their tax strategies, and contribute to the vibrant and thriving economic ecosystem of Orange County.

Frequently Asked Questions (FAQ)

How often do sales tax rates change in Orange County?

+

Sales tax rates in Orange County can change periodically, typically as a result of policy decisions made at the state or local level. While there is no set schedule for these changes, businesses and consumers should stay informed about any proposed or enacted tax rate adjustments to ensure compliance.

Are there any sales tax holidays in Orange County?

+

Yes, Orange County, along with other parts of California, observes sales tax holidays. These are designated periods when certain items, such as clothing or school supplies, are exempt from sales tax. The specific dates and eligible items vary each year, so it’s important to stay updated on these tax-free shopping opportunities.

How can businesses stay compliant with sales tax obligations in Orange County?

+

Businesses can ensure compliance with sales tax obligations by registering with the appropriate tax authorities, collecting and remitting sales tax accurately, and staying updated on any changes to tax rates or regulations. Utilizing tax automation software and seeking guidance from tax professionals can also help businesses navigate the complex sales tax landscape.

What happens if a business fails to comply with sales tax obligations in Orange County?

+

Failure to comply with sales tax obligations in Orange County can result in penalties, interest charges, and legal consequences. Businesses that intentionally evade sales tax or make significant errors in their tax calculations may face audits, fines, and even criminal charges in severe cases. It is crucial for businesses to take sales tax compliance seriously to avoid these adverse outcomes.

Are there any sales tax exemptions or discounts for certain businesses or consumers in Orange County?

+

Yes, there are certain sales tax exemptions and discounts available in Orange County. For instance, non-profit organizations and certain government entities may be exempt from sales tax. Additionally, there may be specific programs or initiatives that offer sales tax discounts or waivers for qualifying businesses or consumers. It’s important to research and understand these exemptions to take advantage of any applicable benefits.