State Of Michigan Tax Forms

The State of Michigan, like many other states in the United States, has its own tax system and requirements. Understanding the tax forms and processes specific to Michigan is crucial for individuals and businesses operating within the state. This comprehensive guide aims to provide an in-depth analysis of the Michigan tax forms, their purposes, and the key considerations for accurate and timely tax filing.

Navigating Michigan’s Tax Landscape

Michigan’s tax system encompasses various forms and regulations, catering to different entities and tax categories. From individual income tax to business taxes and property assessments, the state offers a comprehensive framework for tax compliance. Let’s delve into the intricacies of these tax forms and their implications.

Individual Income Tax Forms

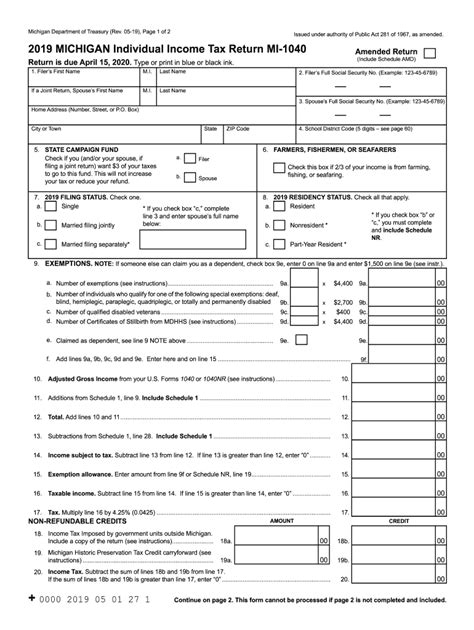

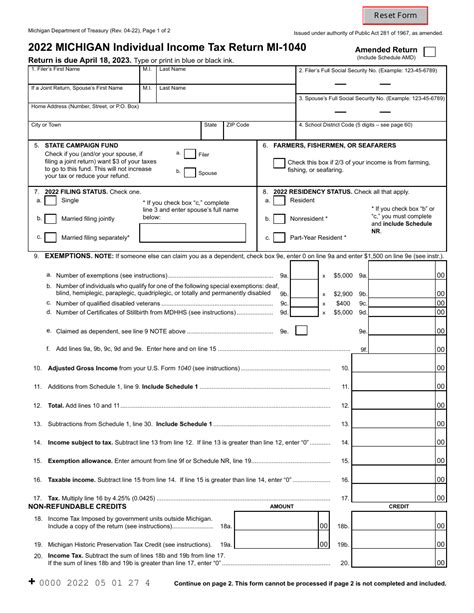

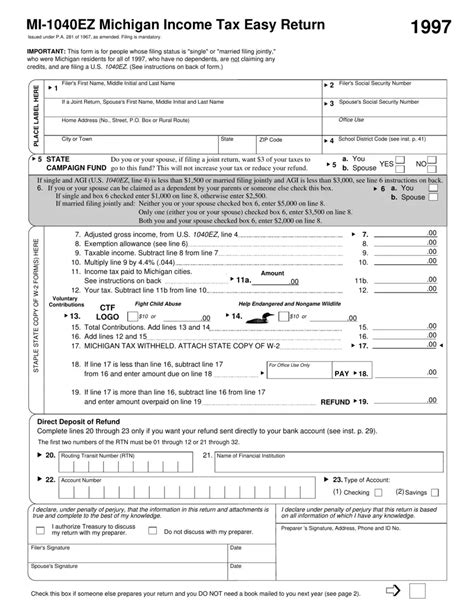

For Michigan residents and individuals earning income within the state, the Form MI-1040 is the primary tax return document. This form allows taxpayers to report their income, claim deductions and credits, and calculate their state tax liability. The MI-1040 includes schedules for specific tax situations, such as Schedule 1 for additional income and Schedule 2 for itemized deductions.

Key considerations for individual taxpayers include understanding the state's tax brackets, which are progressive and vary based on filing status and income levels. Michigan also offers various tax credits, such as the Homestead Property Tax Credit and the Earned Income Tax Credit, which can significantly reduce tax liabilities for eligible individuals.

| Tax Form | Description |

|---|---|

| MI-1040 | Individual Income Tax Return |

| MI-1040EZ | Simplified version for eligible taxpayers |

| MI-1040CR | Claim for Homestead Property Tax Credit |

| MI-1040X | Amended Return for previous years |

Business Tax Forms

Michigan imposes taxes on various business entities, including corporations, partnerships, and sole proprietorships. The specific tax forms and requirements depend on the business structure and the type of income generated.

- Corporations are required to file Form 500 (Corporate Income Tax Return) to report their profits and calculate tax liabilities. This form covers both resident and non-resident corporations operating in Michigan.

- Partnerships utilize Form 502 (Partnership Return of Income) to report partnership income and allocate it to the individual partners. Partners then report their share on their personal tax returns.

- Sole Proprietorships and self-employed individuals include their business income on Schedule C of the MI-1040, as their business income is considered personal income.

Additionally, businesses in Michigan may need to register for various tax programs, such as the Sales and Use Tax, Withholding Tax, or Unemployment Insurance Tax. Each program has its own set of forms and requirements, ensuring compliance with the state's tax laws.

Property Tax Forms

Michigan’s property tax system is handled at the local level, with counties and municipalities assessing property values and determining tax rates. While the state provides guidelines and oversight, the actual tax forms and processes may vary across different regions.

Homeowners and property owners in Michigan receive annual tax bills, which outline the assessed value of their property, the applicable tax rate, and the calculated tax amount. Property tax payments are typically due in two installments, with specific due dates set by the local taxing authority.

For those seeking property tax exemptions or credits, Michigan offers various programs, such as the Homestead Property Tax Credit mentioned earlier, which can provide relief for eligible homeowners.

Michigan Tax Resources and Assistance

Navigating Michigan’s tax system can be complex, especially for those new to the state or those with unique tax situations. Fortunately, the Michigan Department of Treasury provides a wealth of resources to assist taxpayers.

- The Michigan Taxpayer Guide offers a comprehensive overview of the state's tax system, including forms, instructions, and tax rates. It serves as a valuable reference for both individuals and businesses.

- The Michigan Department of Treasury's website provides an extensive collection of tax forms, publications, and guides. Taxpayers can download forms, access online filing services, and find answers to frequently asked questions.

- For specific tax-related queries, taxpayers can reach out to the Michigan Taxpayer Assistance Center (MTAC). MTAC offers personalized assistance, helping taxpayers understand their obligations and resolving any tax-related issues.

Conclusion: Michigan’s Tax System Simplified

Understanding and complying with Michigan’s tax system is essential for individuals and businesses operating within the state. By familiarizing themselves with the relevant tax forms, taxpayers can ensure accurate reporting and take advantage of the various tax credits and incentives available. The Michigan Department of Treasury’s resources and assistance programs further simplify the tax process, making it more accessible for all taxpayers.

Frequently Asked Questions

What is the deadline for filing Michigan income tax returns?

+

The deadline for filing Michigan income tax returns typically aligns with the federal tax deadline, which is April 15th. However, it’s important to note that this deadline may be extended in certain circumstances, such as during tax season extensions or for specific tax situations.

Are there any online filing options for Michigan taxes?

+

Yes, Michigan offers online filing through its official website. Taxpayers can access the online filing system, enter their tax information, and submit their returns electronically. This method is secure, convenient, and often includes built-in error checks to ensure accurate filing.

Can I claim the Homestead Property Tax Credit if I rent my home?

+

No, the Homestead Property Tax Credit is designed for homeowners. It provides relief for those who own and occupy their primary residence. Renters are not eligible for this specific tax credit in Michigan.

What are the tax rates for corporations in Michigan?

+

The tax rate for corporations in Michigan is 6.00% on taxable income. This rate applies to both resident and non-resident corporations. However, there are certain exceptions and incentives that may impact the effective tax rate for specific corporations.

Can I file an amended tax return if I made a mistake on my original filing?

+

Yes, if you discover errors or need to make changes to your original tax return, you can file an amended return. In Michigan, you would use Form MI-1040X to correct mistakes on your individual income tax return. Ensure you follow the instructions carefully and include any supporting documentation.