What Is The California Use Tax

The California Use Tax is an important component of the state's tax system, designed to ensure fairness and compliance in taxation. It plays a crucial role in maintaining the state's revenue and ensuring that businesses and individuals contribute their fair share to support public services and infrastructure.

In this comprehensive article, we will delve into the intricacies of the California Use Tax, exploring its definition, purpose, calculation, and its impact on both businesses and consumers. By understanding this tax, we can better navigate our financial obligations and contribute effectively to the state's economic health.

Understanding the California Use Tax

The California Use Tax is a tax imposed on the storage, use, or consumption of tangible personal property in the state, when no sales tax was paid at the time of purchase. In essence, it bridges the gap in taxation for goods acquired from out-of-state vendors or online retailers, ensuring that all goods used or consumed in California are subject to the appropriate tax.

This tax is distinct from the sales tax, which is charged at the point of sale by retailers, and is typically included in the price of goods and services. The Use Tax, on the other hand, is the responsibility of the consumer or business, and must be self-reported and paid to the California Department of Tax and Fee Administration (CDTFA) directly.

Legal Framework and History

The California Use Tax has its origins in the McDermott v. S.F. case of 1924, which established the state’s authority to tax the use of property within its borders, regardless of where the purchase occurred. This principle was further solidified in the landmark McGrath v. Maryland case of 1964, which upheld the constitutionality of use taxes as a means to prevent tax evasion and ensure fiscal equity.

Today, the Use Tax is governed by the California Revenue and Taxation Code, specifically Section 6201 et seq., which outlines the tax's application, calculation, and reporting requirements. The CDTFA is responsible for administering and enforcing this tax, ensuring compliance through audits, penalty assessments, and other enforcement actions.

Who is Affected by the California Use Tax

The California Use Tax applies to a broad range of entities, including individuals, businesses, and organizations. Here’s a breakdown of who is typically subject to this tax:

- Individuals: Residents of California who purchase goods from out-of-state vendors or online retailers are responsible for paying the Use Tax on these transactions. This includes items purchased for personal use, gifts, or business purposes.

- Businesses: California-based businesses that acquire goods or services from out-of-state suppliers without paying sales tax must pay the Use Tax. This applies to a wide range of industries, from retail to manufacturing, and includes purchases of equipment, inventory, and supplies.

- Organizations: Non-profit organizations, government entities, and other groups based in California are also subject to the Use Tax if they acquire goods or services from out-of-state sources without paying sales tax. This ensures that all entities, regardless of their status, contribute to the state's revenue.

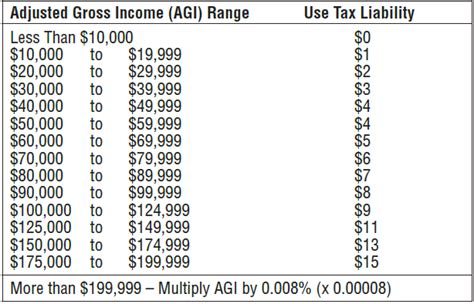

Calculating the California Use Tax

The calculation of the California Use Tax is straightforward, mirroring the sales tax rate applicable in the buyer’s jurisdiction. The tax is assessed on the purchase price of the goods, including any shipping or handling charges, and is typically calculated as a percentage of the total value.

For example, if an individual in San Francisco purchases a laptop from an out-of-state retailer for $1,000, and the local sales tax rate is 8.75%, the Use Tax would be calculated as follows:

| Purchase Price | Sales Tax Rate | Use Tax |

|---|---|---|

| $1,000 | 8.75% | $87.50 |

It's important to note that the Use Tax is not a flat rate across the state. California is divided into various tax jurisdictions, each with its own sales tax rate. The applicable Use Tax rate depends on the location where the goods are used or stored, ensuring that the tax aligns with local tax structures.

Exemptions and Special Considerations

While the California Use Tax is broad in its application, there are certain exemptions and special considerations that may reduce or eliminate the tax liability. These include:

- Exempt Items: Certain goods are exempt from the Use Tax, such as prescription medications, most food items, and some clothing and footwear. These exemptions vary by jurisdiction and are outlined in the California Revenue and Taxation Code.

- Resale Exemption: Businesses that purchase goods for resale are typically exempt from the Use Tax, as they will collect sales tax from the final consumer. This exemption ensures that the tax burden is not passed on to businesses that serve as intermediaries in the supply chain.

- Manufacturing Exemption: Manufacturers may be exempt from the Use Tax on certain raw materials, components, and supplies used in the production process. This exemption is designed to encourage manufacturing activities within the state and promote economic growth.

- Non-Profit Exemption: Non-profit organizations may be exempt from the Use Tax on certain purchases, provided they meet specific criteria and maintain proper documentation. This exemption supports the vital work of these organizations and helps reduce their administrative burden.

Compliance and Reporting

Compliance with the California Use Tax is a shared responsibility between taxpayers and the CDTFA. Taxpayers are required to self-report and pay the Use Tax on a periodic basis, typically annually or quarterly, depending on their tax liability and business structure.

The CDTFA provides a range of resources and tools to assist taxpayers in complying with their Use Tax obligations. These include:

- Use Tax Return Forms: The CDTFA provides specific forms for filing Use Tax returns, such as Form CTD-400 for businesses and Form CTD-100 for individuals. These forms guide taxpayers through the reporting process, ensuring accurate and complete submissions.

- Online Filing and Payment: Taxpayers can file their Use Tax returns and make payments electronically through the CDTFA's online portal. This streamlines the process, reduces administrative burdens, and provides a convenient, secure method for managing tax obligations.

- Audit and Enforcement: The CDTFA conducts audits to ensure compliance with the Use Tax. These audits may involve reviewing records, conducting interviews, and analyzing financial data to verify tax liability. Non-compliance may result in penalties, interest charges, and other enforcement actions.

Tips for Compliance

To ensure compliance with the California Use Tax, taxpayers should consider the following best practices:

- Record-Keeping: Maintain detailed records of all purchases, including the date, amount, and purpose of each transaction. This documentation is crucial for accurate reporting and can assist in resolving any discrepancies or disputes.

- Regular Review: Periodically review your tax obligations and ensure that you are complying with all applicable laws and regulations. Stay informed about changes to tax rates, exemptions, and reporting requirements to avoid surprises and potential penalties.

- Seek Professional Advice: For complex tax situations or large tax liabilities, consider seeking advice from a tax professional or accountant. They can provide specialized guidance, help navigate the tax code, and ensure that your obligations are met accurately and efficiently.

Impact and Future Considerations

The California Use Tax has a significant impact on both the state’s revenue and the behavior of taxpayers. By ensuring that all goods used or consumed within the state are subject to tax, the Use Tax promotes fiscal equity and prevents tax evasion. This, in turn, supports public services, infrastructure, and economic development across the state.

Looking ahead, the future of the California Use Tax is closely tied to the evolving landscape of e-commerce and remote sales. As online shopping continues to grow, the challenge of enforcing the Use Tax on remote transactions becomes increasingly complex. The state and the CDTFA will need to adapt their strategies and technologies to ensure compliance in this dynamic environment.

Additionally, the ongoing debate around sales tax fairness and simplification may impact the future of the Use Tax. Some proponents argue for a unified sales tax system, while others advocate for maintaining the distinction between sales and Use Tax to prevent tax evasion and support local jurisdictions. The outcome of these discussions will shape the future of taxation in California and across the nation.

Conclusion

In conclusion, the California Use Tax is a critical component of the state’s tax system, ensuring that all goods used or consumed within its borders are subject to the appropriate tax. By understanding the legal framework, calculation methods, and compliance requirements, taxpayers can effectively manage their obligations and contribute to the state’s fiscal health.

As the landscape of commerce continues to evolve, the California Use Tax will play an increasingly important role in maintaining fiscal equity and supporting the state's thriving economy. By staying informed and engaged, taxpayers can navigate this tax with confidence and contribute to a fair and sustainable tax system.

What is the difference between the California Use Tax and the Sales Tax?

+The California Sales Tax is charged at the point of sale by retailers and is typically included in the price of goods and services. The Use Tax, on the other hand, is imposed on the storage, use, or consumption of tangible personal property when no sales tax was paid at the time of purchase. In essence, the Sales Tax is collected by retailers, while the Use Tax is self-reported and paid directly to the CDTFA.

Who is responsible for paying the California Use Tax?

+The California Use Tax is the responsibility of the consumer or business that acquires goods or services from out-of-state vendors or online retailers without paying sales tax. This includes individuals, businesses, and organizations based in California.

How is the California Use Tax calculated?

+The California Use Tax is calculated as a percentage of the purchase price of the goods, including shipping and handling charges. The tax rate mirrors the sales tax rate applicable in the buyer’s jurisdiction, ensuring that the tax aligns with local tax structures.

Are there any exemptions or special considerations for the California Use Tax?

+Yes, there are several exemptions and special considerations for the California Use Tax. These include exemptions for certain goods (e.g., prescription medications, most food items), the resale exemption for businesses, the manufacturing exemption, and the non-profit exemption. These exemptions vary by jurisdiction and are outlined in the California Revenue and Taxation Code.

How can I comply with my California Use Tax obligations?

+To comply with your California Use Tax obligations, maintain detailed records of all purchases, stay informed about tax rates and regulations, and consider seeking professional advice for complex tax situations. Regularly review your tax obligations and utilize the resources provided by the CDTFA, including online filing and payment options, to ensure accurate and timely reporting.