Nj Tax Records

Welcome to this in-depth exploration of NJ Tax Records, a vital component of the New Jersey state's financial infrastructure. This article aims to shed light on the intricacies of tax record management, its impact on the state's economy, and the various aspects that make it a crucial aspect of governance and citizen engagement.

The Significance of NJ Tax Records

Tax records in New Jersey play a pivotal role in shaping the state’s fiscal landscape. These records encompass a wide array of information, from individual and corporate tax filings to property tax assessments, offering a comprehensive view of the state’s financial health and economic activities.

The management and analysis of these records are not merely bureaucratic tasks but strategic endeavors. They provide a foundation for sound decision-making, influencing policy formulation, economic planning, and resource allocation. Moreover, tax records are essential for ensuring compliance, maintaining fairness in taxation, and fostering trust between the government and its citizens.

Key Components of NJ Tax Records

NJ tax records comprise a diverse set of data, each with its own significance and impact. Here’s a closer look at some of the key components:

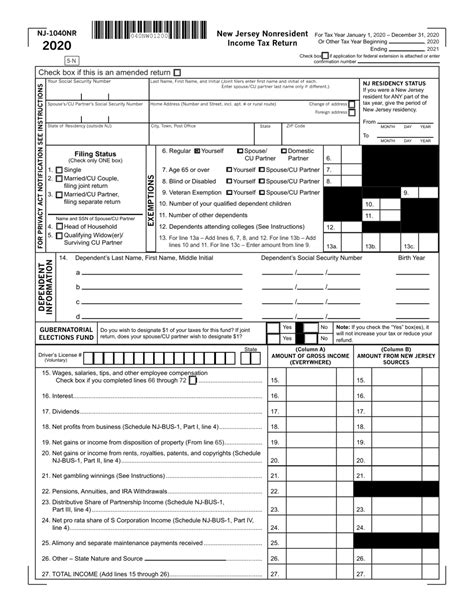

- Individual Income Tax Records: These records detail the tax obligations and contributions of individuals, capturing income sources, deductions, and credits. They are crucial for understanding the financial circumstances of citizens and for ensuring equitable tax distribution.

- Corporate Tax Records: Corporate entities' tax records offer insights into business activities, profits, and contributions to the state's revenue. They are essential for evaluating the economic impact of businesses and for fostering a business-friendly environment.

- Property Tax Records: Property tax assessments are a critical component, influencing real estate values and local government funding. These records ensure that property owners pay their fair share and contribute to essential community services.

- Sales and Use Tax Records: Sales and use tax records track transactions and ensure compliance with tax laws. They are vital for understanding consumer behavior, monitoring economic trends, and generating revenue for the state.

- Estate and Gift Tax Records: These records manage the transfer of wealth, ensuring that appropriate taxes are paid on inheritances and gifts. They play a role in maintaining a balanced distribution of wealth and supporting state programs.

Each of these components contributes uniquely to the overall picture of New Jersey's economic health and its ability to provide essential services to its residents.

NJ Tax Records: A Comprehensive Analysis

Let’s delve deeper into the world of NJ tax records, exploring the systems, processes, and impacts that make this area of governance so vital.

The NJ Tax System

The NJ tax system is a complex yet well-organized framework designed to efficiently collect and manage taxes. It is governed by a set of laws and regulations, ensuring fairness, transparency, and compliance. The system encompasses various tax types, each with its own unique characteristics and implications.

| Tax Type | Description |

|---|---|

| Income Tax | Levied on individual and corporate incomes, this tax is a primary source of state revenue, with rates varying based on income brackets. |

| Property Tax | Assessed on real estate properties, this tax funds local governments and school districts, making it a crucial aspect of community development. |

| Sales Tax | Applied to most goods and services, sales tax is a significant revenue generator, influencing consumer behavior and economic trends. |

| Estate and Gift Tax | These taxes ensure equitable distribution of wealth by imposing levies on inherited or gifted assets, contributing to state funds. |

The efficient management of these tax types is vital for the state's financial stability and its ability to provide essential services to its residents.

The Role of Technology in Tax Record Management

In today’s digital age, technology plays a pivotal role in streamlining tax record management. The New Jersey Division of Taxation has embraced innovative solutions to enhance efficiency, accuracy, and security.

One notable example is the NJ Tax Online platform, a web-based system that allows taxpayers to file and manage their tax obligations digitally. This platform offers a user-friendly interface, enabling taxpayers to navigate the complex world of tax filing with ease. It provides real-time updates, secure data storage, and efficient record-keeping, making tax management a simpler and more transparent process.

Additionally, the division has implemented advanced data analytics tools to gain deeper insights from tax records. These tools enable the identification of trends, anomalies, and potential areas of concern, facilitating better decision-making and ensuring compliance.

Impact on State Economy and Policy

NJ tax records are a powerful tool for understanding the state’s economic landscape and shaping future policies. They provide a wealth of data that can be analyzed to identify economic trends, evaluate the effectiveness of tax policies, and inform future strategic decisions.

For instance, by analyzing income tax records, policymakers can gain insights into the distribution of wealth, identify areas of economic growth or decline, and make informed decisions about tax rates and incentives. Similarly, property tax records can highlight regional disparities, guiding decisions on infrastructure development and resource allocation.

Moreover, tax records play a crucial role in budget planning and forecasting. They provide a reliable estimate of revenue, enabling the state to plan for essential services, investments, and potential deficits. This proactive approach ensures the state's fiscal health and stability.

Future Implications and Trends

As we look to the future, the landscape of NJ tax records is poised for significant changes and advancements. Here are some key trends and developments to watch:

- Digital Transformation: The continued adoption of digital technologies will shape the future of tax record management. Expect further enhancements in online filing systems, mobile applications, and blockchain-based solutions, ensuring faster, more secure transactions.

- Data Analytics and AI: Advanced data analytics and AI technologies will play a pivotal role in tax record management. These tools will enable more sophisticated trend analysis, fraud detection, and tax policy evaluation, enhancing efficiency and compliance.

- Tax Reform and Policy Changes: The state may consider tax reform initiatives to address economic challenges and social priorities. These reforms could include changes in tax rates, incentives, and the introduction of new tax types, impacting the overall tax landscape.

- Citizen Engagement and Transparency: There is a growing emphasis on taxpayer engagement and transparency. The state may explore innovative ways to communicate tax obligations and benefits, fostering a culture of compliance and trust.

These future developments highlight the dynamic nature of tax record management and its role in shaping the state's economic trajectory.

Conclusion

NJ tax records are more than just a collection of financial data; they are a vital tool for governance, economic planning, and citizen engagement. By understanding the significance of these records and the systems that manage them, we can appreciate the intricate dance between taxation and the well-being of the state and its residents.

As we navigate the complex world of tax record management, it's essential to recognize the role of technology, data analysis, and strategic planning in ensuring a fair, efficient, and transparent system. The future of NJ tax records is bright, with digital advancements and innovative solutions poised to enhance the overall taxpayer experience.

For more insights and updates on NJ tax records and their impact, stay tuned to our platform. We are committed to providing you with the latest information and expert analysis on this crucial aspect of state governance.

How can I access my NJ tax records online?

+To access your NJ tax records online, you can visit the NJ Tax Online platform. Here, you’ll need to create an account and provide necessary identification details. Once logged in, you can view and manage your tax records, including filings, payments, and any outstanding obligations.

What security measures are in place for NJ tax records?

+The NJ Division of Taxation employs robust security measures to protect tax records. These include encryption protocols, multi-factor authentication, and regular security audits. The platform also adheres to strict data privacy laws to ensure the confidentiality of taxpayer information.

How are NJ tax records used to shape policy decisions?

+NJ tax records provide valuable insights for policymakers. They can analyze trends, identify economic disparities, and evaluate the effectiveness of tax policies. This data-driven approach informs decisions on tax rates, incentives, and budget allocations, ensuring a more equitable and efficient tax system.