Texas Vehicle Tax Calculator

The Texas Vehicle Tax Calculator is a valuable tool for residents of the Lone Star State, providing an accurate and efficient way to estimate and manage vehicle-related taxes. This comprehensive guide will delve into the intricacies of the calculator, shedding light on its functionality, benefits, and how it can assist Texans in navigating the complex world of vehicle taxation.

Understanding the Texas Vehicle Tax Calculator

The Texas Vehicle Tax Calculator is an online tool designed to assist vehicle owners in calculating and understanding the various taxes and fees associated with owning and operating a vehicle in the state of Texas. It is a user-friendly platform that simplifies the often-confusing process of determining tax liabilities, ensuring compliance with state regulations, and helping individuals plan their financial obligations effectively.

The calculator takes into account a range of factors, including the type of vehicle, its purchase price or market value, the county of registration, and the specific tax rates applicable to that region. By inputting these details, users can obtain a precise estimate of their annual vehicle tax liability, including the base tax, any additional fees, and any applicable discounts or exemptions.

Key Features and Benefits

The Texas Vehicle Tax Calculator offers several advantages to vehicle owners, making it an indispensable resource:

- Accuracy and Precision: The calculator utilizes official tax rates and formulas, ensuring that the estimated tax amounts are accurate and up-to-date. This precision helps individuals avoid underpaying or overpaying their taxes.

- Convenience and Time-Saving: By providing an online platform, the calculator eliminates the need for manual calculations or visits to tax offices. Users can quickly and conveniently obtain tax estimates from the comfort of their homes or offices.

- Transparency and Awareness: The calculator promotes transparency by breaking down the tax calculation process step-by-step. Users can understand how each factor, such as vehicle value or location, impacts their tax liability, fostering a better understanding of the tax system.

- Planning and Budgeting: With precise tax estimates, individuals can plan their finances more effectively. They can factor in vehicle taxes when budgeting for other expenses, ensuring they have sufficient funds to meet their obligations.

- Compliance Assurance: By using the calculator, vehicle owners can ensure they are complying with Texas tax laws. This reduces the risk of penalties or legal issues associated with non-compliance.

Calculator Functionality and Inputs

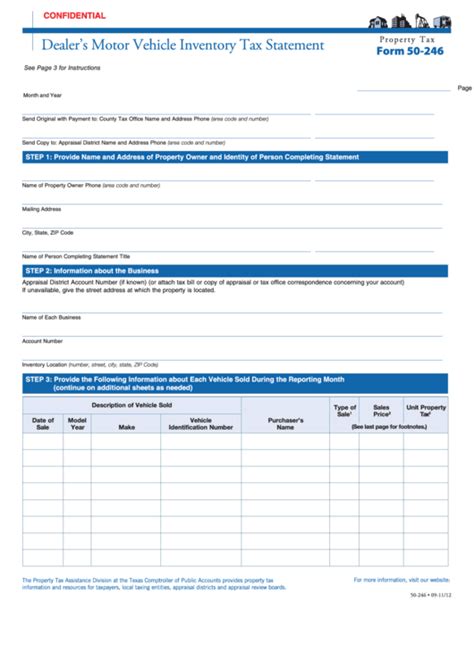

The Texas Vehicle Tax Calculator is designed with user-friendliness in mind. It typically requires the following information to generate an accurate tax estimate:

- Vehicle Information: Users need to provide details about their vehicle, including the make, model, year, and VIN (Vehicle Identification Number). This information helps determine the vehicle’s value and tax category.

- Purchase Price or Market Value: The calculator requires the purchase price if the vehicle is new or the current market value if it is a used vehicle. This value is crucial for calculating the base tax amount.

- Registration County: Texas has varying tax rates across different counties. The calculator needs the county of registration to apply the correct tax rate.

- Additional Fees and Exemptions: Depending on the vehicle and its usage, there might be additional fees (e.g., registration fees) or exemptions (e.g., for certain disability-related modifications). The calculator considers these factors to provide a comprehensive estimate.

Tax Calculation Process

The tax calculation process involves several steps, each contributing to the final tax estimate. Here’s a simplified breakdown:

- Base Tax Calculation: The calculator determines the base tax amount by applying a tax rate (varying by county) to the vehicle’s value. This rate is typically a percentage of the vehicle’s market value.

- Additional Fees: Certain vehicles or situations might attract additional fees, such as a registration fee or an emission control surcharge. These fees are added to the base tax.

- Discounts and Exemptions: The calculator also considers any applicable discounts or exemptions. For example, some counties offer discounts for hybrid or electric vehicles, and certain individuals (e.g., veterans) may be eligible for tax exemptions.

- Final Tax Estimate: After accounting for all these factors, the calculator provides a total tax estimate, including any applicable penalties or late fees if the vehicle’s registration is overdue.

Real-World Example

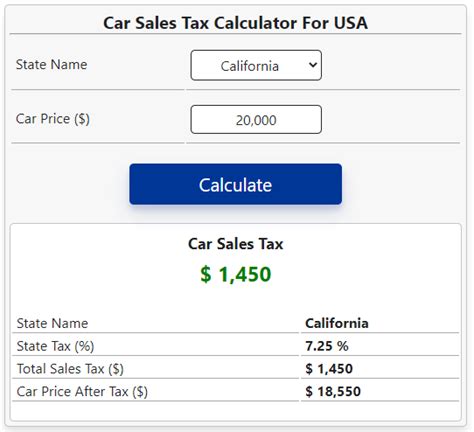

Let’s illustrate the calculator’s functionality with a practical example. Imagine a resident of Harris County, Texas, owns a 2022 Toyota Camry with a purchase price of 25,000. Using the calculator, they input the vehicle's details, including its make, model, year, and county of registration. The calculator applies the county's tax rate of 1.5% to the vehicle's value, resulting in a base tax of 375.

Additionally, the calculator informs the user of a $50 registration fee and a $25 emission control surcharge, bringing the total tax estimate to $450. The calculator also highlights a potential $50 discount for hybrid vehicles, which the user can apply if their Camry meets the criteria. Finally, the calculator provides a breakdown of the tax estimate, helping the user understand the components of their vehicle tax liability.

| Component | Amount |

|---|---|

| Base Tax | $375 |

| Registration Fee | $50 |

| Emission Control Surcharge | $25 |

| Total Tax Estimate | $450 |

Exploring Advanced Features and Considerations

While the Texas Vehicle Tax Calculator provides a comprehensive overview of vehicle taxes, there are additional factors and scenarios that users should be aware of to make informed decisions.

Special Tax Scenarios

Texas has specific tax rules for various vehicle categories, including:

- Classic and Antique Vehicles: These vehicles often have reduced tax rates based on their age and historical significance. The calculator may have specific fields to input details about classic cars, ensuring accurate tax estimates.

- Electric and Hybrid Vehicles: Texas offers incentives for eco-friendly vehicles, such as reduced tax rates or exemptions. The calculator should consider these benefits, especially for vehicles that meet the criteria.

- Commercial Vehicles: Trucks, buses, and other commercial vehicles might have different tax structures based on their weight and usage. The calculator should provide options to input commercial vehicle details for precise tax calculations.

Tax Exemptions and Discounts

Texas provides tax exemptions and discounts to certain individuals and vehicles. These include:

- Disability-Related Exemptions: Vehicles modified for disabled individuals or organizations that serve the disabled may be eligible for tax exemptions. The calculator should prompt users to input details about disability-related modifications to apply these exemptions.

- Veteran and Military Exemptions: Active-duty military personnel, veterans, and their families may qualify for tax exemptions or discounts. The calculator should have provisions to verify military status and apply these benefits.

- County-Specific Discounts: Some counties offer discounts for various reasons, such as early registration or hybrid vehicle ownership. The calculator should be updated with the latest county-specific discounts to provide accurate estimates.

Registration and Payment Options

The Texas Vehicle Tax Calculator should integrate with the state’s registration and payment systems. This allows users to not only estimate their taxes but also initiate the registration process and make payments online, streamlining the entire vehicle ownership experience.

Additionally, the calculator could provide information on late fees and penalties for overdue registrations, helping users avoid additional costs and legal complications.

Data Security and Privacy

Given the sensitive nature of vehicle and personal information, the calculator platform must adhere to strict data security protocols. Encryption, secure servers, and user authentication measures should be in place to protect user data from unauthorized access.

Privacy policies should be clearly stated, informing users about data collection, storage, and usage practices. Users should have control over their data and the option to opt out of non-essential data collection.

Future Developments and Enhancements

As technology advances and user needs evolve, the Texas Vehicle Tax Calculator can be enhanced with new features and improvements. These could include:

- Mobile App Integration: Developing a mobile app version of the calculator would enhance accessibility, allowing users to estimate taxes on the go.

- AI-Powered Recommendations: Artificial intelligence could be used to provide personalized tax optimization strategies based on user profiles and vehicle details.

- Real-Time Tax Updates: Integrating with state tax databases would ensure the calculator always provides the most up-to-date tax rates and regulations.

- User Feedback and Support: Implementing a feedback system and live chat support would enhance user experience and address any concerns or queries promptly.

Conclusion

The Texas Vehicle Tax Calculator is a powerful tool that empowers Texans to navigate the complexities of vehicle taxation with ease and confidence. By offering accurate estimates, user-friendly design, and valuable insights, the calculator ensures that vehicle owners can make informed decisions, comply with state regulations, and manage their financial obligations effectively.

As the calculator continues to evolve and adapt to changing tax landscapes and user needs, it remains a vital resource for vehicle owners across the state. With its advanced features and commitment to data security and privacy, the Texas Vehicle Tax Calculator is poised to remain a trusted companion for Texans in their vehicle ownership journey.

How often should I use the Texas Vehicle Tax Calculator?

+It’s recommended to use the calculator annually, especially when registering or renewing your vehicle’s registration. However, you can use it at any time to estimate your tax liability, especially if you’re considering purchasing a new or used vehicle.

Can I trust the tax estimates provided by the calculator?

+Yes, the calculator utilizes official tax rates and formulas, ensuring the estimates are accurate. However, it’s essential to verify the information you provide, as any inaccuracies in your vehicle details or registration status can affect the estimate.

Are there any penalties for underestimating my vehicle tax liability?

+Yes, underpaying your vehicle taxes can result in penalties and interest charges. It’s crucial to use the calculator accurately and pay the estimated amount to avoid additional costs and potential legal issues.

Can I use the calculator for multiple vehicles?

+Absolutely! The calculator is designed to handle multiple vehicle estimates. You can input details for each vehicle and obtain separate tax estimates, making it convenient for individuals with a fleet of vehicles.