What Is The Sales Tax In Georgia

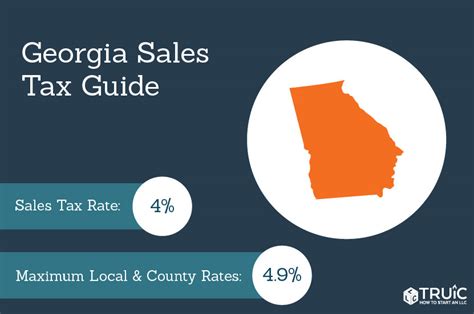

In the state of Georgia, sales tax is a crucial aspect of the tax system, impacting businesses and consumers alike. Understanding the sales tax structure and rates is essential for anyone conducting business transactions or making purchases within the state. This comprehensive guide aims to delve into the specifics of sales tax in Georgia, providing a detailed analysis of the rates, exemptions, and implications for both businesses and consumers.

The Basics of Sales Tax in Georgia

Sales tax in Georgia operates as a state-wide tax, with a statewide base rate of 4%, which applies to most tangible personal property and certain services. However, it is important to note that local municipalities have the authority to levy additional sales taxes, creating a unique tax landscape across the state.

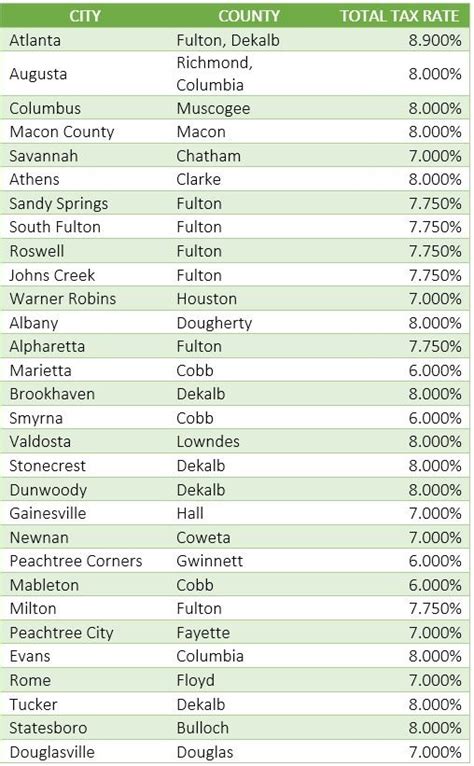

Local Sales Tax Rates

In addition to the statewide base rate, local sales taxes can range from 1% to 9% depending on the jurisdiction. These local taxes are typically used to fund specific projects or services within a community, such as transportation infrastructure or public safety initiatives.

| County | Local Sales Tax Rate |

|---|---|

| Fulton County | 3% |

| DeKalb County | 2% |

| Cobb County | 1% |

| Gwinnett County | 4% |

| Cherokee County | 6% |

These local sales tax rates can significantly impact the overall tax burden for consumers and businesses, especially when conducting transactions across county lines.

Exemptions and Special Considerations

While the majority of goods and services are subject to sales tax in Georgia, there are certain exemptions and special considerations to be aware of. For instance, groceries and food products are exempt from sales tax, providing a significant relief for consumers’ grocery budgets.

Additionally, certain types of services are also exempt, including medical and dental services, professional services like legal advice, and educational services. These exemptions aim to reduce the tax burden on essential services and encourage access to healthcare, legal support, and education.

The Impact on Businesses

For businesses operating in Georgia, understanding the sales tax landscape is crucial for effective financial planning and compliance. The varying rates across the state can present challenges when it comes to pricing strategies and tax compliance.

Pricing Strategies and Tax Inclusion

When setting prices, businesses often face the decision of whether to include sales tax in the advertised price or display it as a separate line item. Incorporating sales tax into the price can provide transparency for consumers, but it may also lead to higher perceived prices.

On the other hand, displaying sales tax separately allows businesses to showcase the actual cost of the product or service, but it may require more complex calculations at the point of sale.

Sales Tax Compliance and Reporting

Businesses are responsible for collecting and remitting sales tax to the appropriate tax authorities. This process involves accurate record-keeping, timely filing of tax returns, and proper allocation of sales tax revenue between state and local governments.

To ensure compliance, businesses often utilize sales tax software or accounting systems that can automatically calculate and track sales tax liabilities based on the products sold and the customer's location. These tools simplify the reporting process and reduce the risk of errors.

The Consumer Perspective

From a consumer standpoint, understanding sales tax rates is essential for making informed purchasing decisions and budgeting effectively. The varying rates across the state can impact the overall cost of goods and services, especially for those living or shopping in areas with higher local sales taxes.

Budgeting and Price Comparisons

When planning purchases, consumers should consider the sales tax rate in their specific location. Comparing prices between different stores or online retailers can be more complex due to varying tax rates, especially when shopping across county lines or online.

For instance, a consumer in Cherokee County, where the local sales tax rate is 6%, will pay significantly more in sales tax than someone in Cobb County with a 1% local rate, even for the same product.

Online Shopping and Sales Tax

With the rise of e-commerce, sales tax collection for online purchases has become a significant consideration. In Georgia, online retailers are required to collect sales tax based on the destination principle, meaning the tax rate is determined by the customer’s shipping address.

This means that consumers should expect to pay the sales tax rate of their location for online purchases, even if the retailer is based in a different county or state. However, there may be exceptions for certain types of purchases or for retailers with specific tax exemptions.

The Future of Sales Tax in Georgia

As the tax landscape continues to evolve, the future of sales tax in Georgia holds several potential implications and considerations.

Potential Rate Changes

While the statewide base rate of 4% has remained consistent, there is always a possibility of rate changes or adjustments in the future, whether at the state or local level. These changes could be influenced by economic factors, budget considerations, or political decisions.

Technological Advancements in Tax Collection

The rise of e-commerce and digital transactions has prompted the development of advanced tax collection systems, including automated tax calculation and reporting tools. These technologies aim to streamline the sales tax collection process, reducing the burden on both businesses and tax authorities.

Exemption Review and Reform

The list of exempt items and services in Georgia is subject to periodic review and potential reform. Changes in the exemption landscape could impact the tax burden on consumers and businesses, affecting the overall tax structure and revenue generation.

How often are sales tax rates updated in Georgia?

+Sales tax rates in Georgia are typically updated annually, with any changes taking effect on January 1st of the new year. These updates are based on legislative decisions and economic considerations.

Are there any online tools to help calculate sales tax in Georgia?

+Yes, there are several online calculators and tax rate databases available to assist with sales tax calculations in Georgia. These tools can provide accurate rates based on the specific location of the transaction.

What happens if a business fails to collect or remit sales tax correctly in Georgia?

+Businesses that fail to comply with sales tax regulations in Georgia may face penalties, interest charges, and even legal consequences. It is crucial for businesses to stay informed about their tax obligations and seek professional advice if needed.