New Hampshire Sales Tax

In the world of finance and taxation, understanding the intricacies of sales tax is crucial, especially for businesses and consumers alike. This article aims to provide an in-depth analysis of the New Hampshire Sales Tax, offering valuable insights into its structure, rates, exemptions, and implications for both local and online businesses.

Unraveling the Complexity of New Hampshire Sales Tax

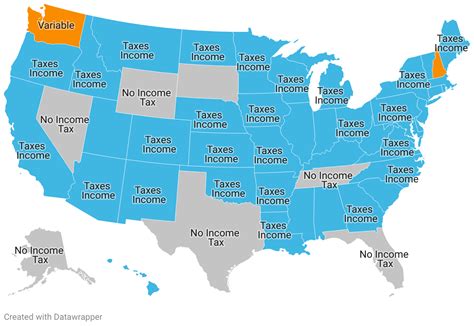

New Hampshire, often referred to as the “Granite State,” boasts a unique sales tax system that sets it apart from many other states in the United States. Unlike most states, New Hampshire imposes a strictly limited sales tax, primarily focused on specific goods and services. This approach has significant implications for businesses and consumers, shaping the state’s economic landscape and influencing purchasing behaviors.

The Structure of New Hampshire Sales Tax

At its core, the New Hampshire Sales Tax is a transaction-based tax, levied on the sale of tangible personal property and certain services. It is a consumption tax, meaning the burden of payment falls on the consumer, while the responsibility of collection and remittance rests with the seller.

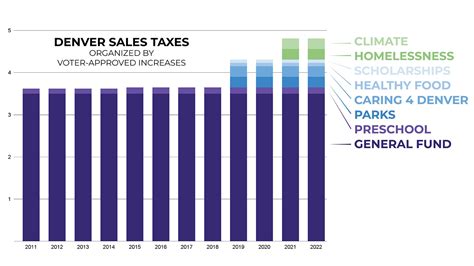

The state's sales tax system is characterized by its simplified structure, with a single general sales tax rate applicable across most goods and services. However, it is important to note that New Hampshire's sales tax is not a straightforward flat tax. The state has implemented a two-tiered system, where certain items are subject to different tax rates, adding a layer of complexity to the taxation process.

| Tax Category | Rate |

|---|---|

| General Sales Tax Rate | 0% |

| Meals and Food Tax Rate | 9% |

The general sales tax rate of 0% is a notable feature of New Hampshire's tax system. This absence of a general sales tax on most goods and services sets the state apart and provides a competitive advantage for businesses, especially those engaged in e-commerce and online sales.

However, the state does impose a 9% tax on meals and food, which includes prepared food, meals served in restaurants, and certain food products. This tax is a significant source of revenue for the state and impacts both local businesses and tourists alike.

Exemptions and Special Considerations

While New Hampshire’s sales tax is relatively straightforward, it does include a range of exemptions and special considerations that businesses and consumers should be aware of. These exemptions are crucial in understanding the applicability of sales tax in various scenarios.

- Clothing and Footwear: New Hampshire exempts clothing and footwear from sales tax, providing a significant advantage for shoppers, especially those seeking fashion and apparel items.

- Groceries: Similar to many states, New Hampshire exempts groceries from sales tax, making essential food items more affordable for residents.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax, ensuring that healthcare-related purchases are not burdened with additional taxes.

- Manufacturing and Wholesale Sales: New Hampshire has a robust manufacturing sector, and sales tax exemptions for wholesale transactions support the growth and competitiveness of these industries.

It is important to note that while these exemptions provide benefits to consumers and certain industries, they also create a unique challenge for businesses, particularly those operating across state lines. The varying tax rates and exemptions can complicate tax compliance and reporting, especially for online retailers serving customers in multiple states.

The Impact of New Hampshire Sales Tax on Businesses

The absence of a general sales tax in New Hampshire has a significant impact on the state’s business landscape. For local businesses, especially those in the retail sector, the lack of a sales tax burden can be a double-edged sword. On one hand, it allows them to offer competitive pricing, attracting customers from neighboring states. On the other hand, it also means that they may face increased competition from online retailers, who can offer similar products without the added tax.

For online businesses, particularly e-commerce platforms and digital retailers, New Hampshire's sales tax structure presents a unique opportunity. The absence of a general sales tax means that their products can be priced more competitively, especially when compared to states with higher sales tax rates. This can lead to increased sales and market share for these businesses, as consumers seek out tax-free shopping experiences.

Compliance and Reporting Challenges

Despite the advantages, the unique sales tax structure in New Hampshire also presents compliance and reporting challenges for businesses. The two-tiered tax system, with different rates for meals and food, requires careful record-keeping and categorization of sales. Businesses must ensure that they accurately apply the correct tax rate to each transaction, especially when dealing with complex orders that may include both taxable and exempt items.

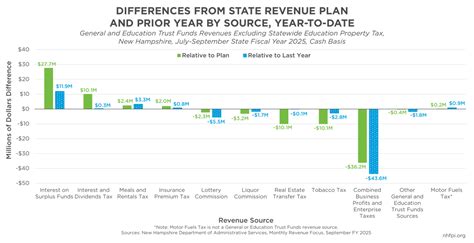

Additionally, the state's sales tax laws can be subject to frequent changes and updates, further complicating the compliance process. Businesses must stay informed about any legislative changes and adjust their systems and processes accordingly to ensure accurate tax collection and remittance.

Future Implications and Potential Changes

The landscape of sales tax is ever-evolving, and New Hampshire is no exception. While the state has maintained its unique sales tax structure for years, there are ongoing discussions and debates about potential changes. Here are some key future implications and considerations:

Online Sales Tax Fairness

The rise of e-commerce and online shopping has sparked debates about the fairness of sales tax laws across states. New Hampshire’s absence of a general sales tax has drawn attention, with some advocating for a more uniform approach to online sales tax collection. The state may face pressure to implement measures that ensure a level playing field for local businesses and prevent tax evasion by online retailers.

Economic Impact and Revenue Generation

The absence of a general sales tax has implications for the state’s revenue generation. While it provides a competitive advantage for businesses, it also means that New Hampshire relies heavily on other sources of revenue, such as property taxes and income taxes. As the state’s economy evolves, there may be discussions about the need for a balanced approach to taxation, ensuring sufficient revenue for public services and infrastructure.

Tax Reform and Modernization

With the rapid pace of technological advancement and changing consumer behaviors, sales tax systems are often subject to modernization efforts. New Hampshire may explore ways to streamline its sales tax laws, improve compliance, and adapt to the evolving nature of commerce, including the rise of digital services and subscription-based models.

Conclusion: Navigating the New Hampshire Sales Tax Landscape

Understanding the intricacies of the New Hampshire Sales Tax is essential for both businesses and consumers. The state’s unique tax structure, with its absence of a general sales tax, provides a competitive advantage for online retailers and a tax-free shopping experience for consumers. However, it also presents compliance challenges and requires careful attention to exemptions and special considerations.

As the state continues to evolve, businesses and individuals should stay informed about potential changes to sales tax laws. The ongoing discussions surrounding online sales tax fairness and economic impact highlight the need for a balanced approach to taxation, ensuring a sustainable and competitive business environment for New Hampshire.

What is the current general sales tax rate in New Hampshire?

+

The general sales tax rate in New Hampshire is 0% as of [current year]. This unique feature sets the state apart from many others in the US.

Are there any items exempt from sales tax in New Hampshire?

+

Yes, New Hampshire exempts clothing, footwear, groceries, and prescription drugs from sales tax. These exemptions provide benefits to consumers and support certain industries.

How does New Hampshire’s sales tax structure impact online retailers?

+

Online retailers benefit from New Hampshire’s absence of a general sales tax, as it allows them to offer competitive pricing without the added tax burden. This can lead to increased sales and market share for these businesses.