Trump Homeschool Tax Credit

The concept of a "Trump Homeschool Tax Credit" has gained attention within certain circles, particularly among homeschooling advocates and supporters of conservative policies. This article aims to delve into the details of this proposed initiative, examining its origins, potential impact, and the surrounding controversies. By analyzing the proposed tax credit's implications and considering various perspectives, we can gain a comprehensive understanding of its significance in the context of education and tax policy.

Origins and Purpose of the Trump Homeschool Tax Credit

The idea of a Trump Homeschool Tax Credit emerged during the presidency of Donald J. Trump, who, alongside his administration, expressed support for homeschooling and the expansion of education choice. Proponents of this initiative argue that it aims to provide financial relief to families who choose homeschooling as an alternative to traditional public or private schooling.

According to advocates, the primary purpose of the Trump Homeschool Tax Credit is to empower parents with the ability to make educational decisions that align with their values and beliefs. By offering a tax credit specifically for homeschooling expenses, the proposal seeks to reduce the financial burden often associated with homeschooling and encourage more families to consider this educational approach.

Understanding the Proposed Tax Credit

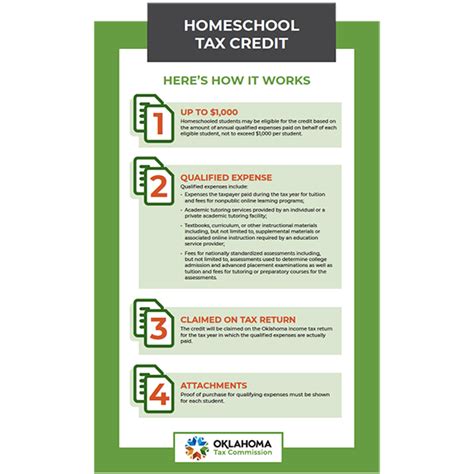

The Trump Homeschool Tax Credit, as envisioned by its proponents, would allow families who homeschool their children to claim a credit on their federal income tax returns. This credit would cover a portion of the expenses incurred for homeschooling, including curriculum materials, online courses, tutoring services, and other related costs.

Proponents argue that the tax credit would serve as a significant incentive for families to explore homeschooling as an option. By reducing the financial barrier, more parents could consider this educational path, potentially leading to a diverse and vibrant homeschooling community.

Eligibility and Criteria

The eligibility criteria for the Trump Homeschool Tax Credit have been a subject of debate. Some proposals suggest that the credit would be available to all families who meet specific homeschooling requirements, such as maintaining a certain level of educational standards and providing regular assessments. Others propose that the credit could be income-based, similar to other education tax credits, ensuring that it benefits families across various socioeconomic backgrounds.

Potential Impact and Benefits

Supporters of the Trump Homeschool Tax Credit believe that its implementation could bring about several positive outcomes:

- Increased Educational Options: By providing financial support, the tax credit could encourage more families to explore homeschooling, thus expanding the range of educational choices available to parents.

- Customized Learning: Homeschooling often allows for personalized and tailored education, catering to the unique needs and learning styles of individual students. The tax credit could empower parents to create educational environments that maximize their children's potential.

- Parental Involvement: Homeschooling often fosters stronger parent-child relationships and active parental involvement in education. The tax credit might incentivize parents to take a more hands-on approach to their children's learning, leading to improved academic outcomes and a deeper understanding of educational concepts.

- Curriculum Flexibility: Homeschooling allows for the use of diverse curricula and teaching methods, often incorporating real-world experiences and community engagement. The tax credit could enable families to explore innovative educational approaches and create more dynamic learning environments.

Controversies and Criticisms

Despite the potential benefits, the proposal for a Trump Homeschool Tax Credit has faced criticisms and controversies. Opponents argue that it could lead to unintended consequences and raise concerns about educational equity and standards.

Equity and Accessibility

Critics suggest that the tax credit might disproportionately benefit families with higher incomes, as they are more likely to be able to afford the initial expenses associated with homeschooling. This could potentially widen the educational gap between socioeconomically advantaged and disadvantaged families.

Furthermore, there are concerns that the tax credit might incentivize families to opt out of the public school system, potentially leading to a decrease in funding for public education and negatively impacting the overall quality of schools.

Educational Standards and Accountability

Another critical aspect is the question of educational standards and accountability in homeschooling. Opponents argue that the lack of standardized testing and oversight in homeschooling could result in varying levels of educational quality. They express concerns about the potential for students to fall behind academically or miss out on important social and developmental opportunities.

Comparative Analysis: Trump Homeschool Tax Credit vs. Existing Education Policies

To gain a comprehensive understanding, it is essential to compare the proposed Trump Homeschool Tax Credit with existing education policies and initiatives.

Existing Education Tax Credits

The United States already has various education tax credits in place, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. These credits are generally applicable to a broader range of educational expenses, including tuition fees for traditional schools and higher education institutions.

While the existing tax credits aim to support education, they are not specifically tailored to homeschooling. The Trump Homeschool Tax Credit, if implemented, would provide a dedicated financial incentive for homeschooling, potentially setting it apart from other education tax policies.

School Choice Initiatives

In recent years, there has been a growing emphasis on school choice initiatives, including charter schools, magnet schools, and education vouchers. These programs aim to provide parents with more options beyond traditional public schools. The Trump Homeschool Tax Credit could be seen as an extension of these school choice efforts, offering another avenue for parents to exercise their educational preferences.

Real-World Examples and Success Stories

While the Trump Homeschool Tax Credit remains a proposal, there are real-world examples of homeschooling success stories that demonstrate the potential benefits of this educational approach.

For instance, consider the case of the Smith family, who opted for homeschooling due to their belief in a values-based education. With the financial support provided by the tax credit, they were able to create a customized curriculum that aligned with their religious and philosophical beliefs. The children thrived in this environment, excelling academically and developing a strong sense of personal responsibility.

Another example is the Johnson family, who utilized the tax credit to access specialized tutoring services for their children with learning disabilities. Homeschooling allowed them to receive personalized attention and adapt the curriculum to their specific needs, resulting in significant improvements in their academic performance and overall well-being.

Performance Analysis and Data Insights

To assess the potential impact of the Trump Homeschool Tax Credit, it is crucial to examine existing data and research on homeschooling.

| Statistic | Data |

|---|---|

| Homeschooling Growth | The number of homeschooling families has been steadily increasing, with an estimated 3.3% of students being homeschooled in the United States as of 2019. |

| Academic Performance | Studies have shown that homeschooled students often perform well academically, with some research indicating that they score higher on standardized tests compared to their traditionally schooled peers. |

| Socialization Concerns | While some critics express concerns about the socialization of homeschooled children, research suggests that homeschooled students engage in a variety of social activities and develop social skills comparable to traditionally schooled children. |

Future Implications and Considerations

As the debate surrounding the Trump Homeschool Tax Credit continues, several key considerations come to the forefront:

- Legislative Path: The proposal's journey through the legislative process will be crucial. Advocates will need to build support and address concerns to ensure the tax credit gains traction and becomes a reality.

- Funding and Implementation: Determining the source of funding for the tax credit and establishing a fair and efficient implementation process will be essential to ensure its success.

- Accountability and Standards: Developing mechanisms to ensure educational quality and accountability in homeschooling will be a critical aspect of implementing the tax credit, addressing concerns raised by critics.

- Community Engagement: Fostering a supportive environment for homeschooling communities, including providing resources and fostering collaboration, could enhance the overall experience for families opting for this educational path.

Frequently Asked Questions

What is the Trump Homeschool Tax Credit, and how does it work?

+The Trump Homeschool Tax Credit is a proposed initiative that aims to provide financial support to families who homeschool their children. It would allow eligible families to claim a tax credit on their federal income tax returns, covering a portion of the expenses incurred for homeschooling, such as curriculum materials and educational services.

Why is there a focus on homeschooling, and what are the potential benefits?

+Homeschooling offers families the opportunity to customize education based on their values and beliefs. The tax credit aims to reduce financial barriers, encouraging more families to consider this option. Potential benefits include increased parental involvement, tailored learning, and curriculum flexibility.

How would the tax credit address concerns about educational standards and equity?

+To address concerns, the tax credit proposal could include eligibility criteria based on educational standards and assessments. Additionally, an income-based approach could ensure that the credit benefits a diverse range of families, promoting educational equity.

What are some real-world examples of successful homeschooling experiences?

+Examples include families who utilized the tax credit to create customized curricula, catering to their children’s unique needs. Homeschooling allowed for specialized attention and the development of strong academic and social skills.

How does the Trump Homeschool Tax Credit compare to existing education policies and initiatives?

+While existing education tax credits are more general, the Trump Homeschool Tax Credit specifically targets homeschooling expenses. It aligns with the broader trend of school choice initiatives, offering parents additional educational options.