Wisconsin Income Tax Refund

In Wisconsin, income tax refunds are a significant financial consideration for residents and taxpayers. The state's tax system, while offering certain benefits, can also lead to overpayment of taxes, resulting in the need for refunds. This article aims to provide an in-depth analysis of Wisconsin's income tax refund process, shedding light on the intricacies and offering valuable insights for taxpayers.

Understanding Wisconsin’s Income Tax System

Wisconsin’s income tax system operates on a progressive rate structure, with rates varying based on taxable income. The state’s tax brackets range from 3.58% to 7.65% for individuals and 7.9% for corporations. These rates can significantly impact taxpayers’ financial planning, especially when considering the state’s relatively high top tax bracket compared to other states.

Additionally, Wisconsin allows for various deductions and credits, which can reduce taxable income and potentially increase the likelihood of a refund. Common deductions include those for dependent children, higher education expenses, and property taxes. Understanding these deductions is crucial for taxpayers to maximize their refund opportunities.

The Income Tax Refund Process in Wisconsin

The process of obtaining a refund in Wisconsin is straightforward and accessible. Taxpayers are required to file their income tax returns, either through electronic filing or traditional paper methods, by the annual deadline. The Wisconsin Department of Revenue (DOR) processes these returns and, if applicable, issues refunds to taxpayers.

Wisconsin offers several refund options to taxpayers. The most common method is a direct deposit, which is fast and secure, with refunds typically appearing in taxpayers' accounts within a few weeks. Taxpayers can also opt for a check refund, although this method may take slightly longer. Additionally, Wisconsin provides the option to apply for a refund anticipation loan, which provides an advance on the expected refund amount, though this option comes with associated fees.

Key Considerations for Maximizing Refunds

To ensure a substantial refund, taxpayers should carefully review their deductions and credits. The DOR provides a comprehensive list of deductions and credits available to Wisconsin residents. Some deductions, such as those for charitable contributions and medical expenses, may be overlooked but can significantly impact the refund amount.

Additionally, taxpayers should be aware of potential tax credits, such as the Earned Income Tax Credit (EITC) and the Child and Dependent Care Credit. These credits can provide substantial refunds, especially for low- and moderate-income taxpayers. It is essential to understand the eligibility criteria for these credits and ensure that all necessary documentation is provided to claim them.

| Deduction/Credit | Description |

|---|---|

| Dependent Deduction | Allows taxpayers to claim deductions for eligible dependents. |

| Higher Education Deduction | Provides a deduction for qualified higher education expenses. |

| Property Tax Deduction | Permits taxpayers to deduct a portion of their property taxes. |

| Earned Income Tax Credit (EITC) | A refundable tax credit for low- to moderate-income workers. |

| Child and Dependent Care Credit | Offers a credit for childcare expenses incurred to allow the taxpayer to work or look for work. |

Wisconsin’s Refund Timeline and Tracking

The Wisconsin DOR aims to process refunds as promptly as possible. In most cases, taxpayers can expect their refunds within 2-4 weeks from the filing deadline. However, certain factors, such as the complexity of the return or errors in the filing, can delay the refund process.

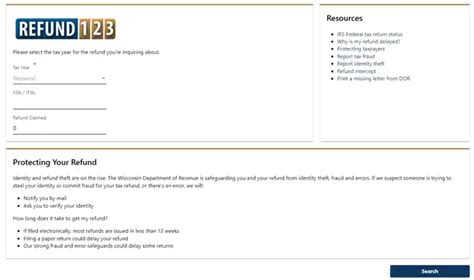

To track the status of their refunds, taxpayers can utilize the DOR's online refund status tool. This tool provides real-time updates on the processing of the refund, allowing taxpayers to stay informed and plan their finances accordingly.

Common Issues and Resolutions

While the refund process is generally smooth, taxpayers may encounter issues such as delayed refunds or discrepancies in the refund amount. Common reasons for delays include missing or incorrect information on the tax return, errors in calculations, or ongoing audits. In such cases, the DOR may require additional documentation or clarification from the taxpayer.

If taxpayers notice discrepancies in their refund amount, they should carefully review their tax return and compare it with their records. In some cases, taxpayers may need to file an amended return to rectify errors and ensure they receive the correct refund amount.

Future Implications and Changes to Wisconsin’s Refund System

Wisconsin’s tax system is subject to ongoing revisions and updates. While the state aims to maintain a fair and efficient tax system, changes in tax laws and regulations can impact taxpayers’ refund opportunities.

For instance, the introduction of new tax credits or the modification of existing ones can significantly affect taxpayers' financial planning. Additionally, changes in tax rates or brackets can impact the amount of tax owed, potentially leading to larger or smaller refunds.

It is essential for taxpayers to stay informed about any legislative changes that may impact their tax obligations and refund expectations. The Wisconsin DOR provides regular updates and resources to help taxpayers navigate these changes effectively.

Tax Planning Strategies for Wisconsin Residents

To maximize refund opportunities and minimize tax liabilities, Wisconsin residents can employ various tax planning strategies. These strategies may include:

- Contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs, to reduce taxable income.

- Taking advantage of tax-deductible medical expenses, especially for those with significant healthcare costs.

- Exploring tax credits, such as the EITC or the Child Tax Credit, to potentially increase the refund amount.

- Considering tax-efficient investment strategies, such as investing in municipal bonds or utilizing tax-loss harvesting techniques.

By implementing these strategies, taxpayers can optimize their financial situation and potentially increase their refund amounts.

Conclusion

Wisconsin’s income tax refund process offers residents an opportunity to reclaim overpaid taxes. By understanding the state’s tax system, deductions, and credits, taxpayers can maximize their refund potential. The DOR’s commitment to efficient refund processing and the availability of online tracking tools further enhance the taxpayer experience.

As with any tax-related matter, staying informed and seeking professional guidance can help Wisconsin residents navigate the complexities of the tax system and make the most of their refund opportunities.

Frequently Asked Questions

When can I expect my Wisconsin income tax refund?

+

Typically, Wisconsin income tax refunds are issued within 2-4 weeks from the filing deadline. However, various factors, such as the complexity of the return or errors, can impact the processing time.

How can I track the status of my Wisconsin tax refund?

+

You can track the status of your Wisconsin tax refund using the DOR’s online refund status tool. This tool provides real-time updates on the processing of your refund.

What if I don’t receive my Wisconsin income tax refund on time?

+

If you don’t receive your refund within the expected timeframe, it’s advisable to check the status using the online tool. If the refund is delayed, you can contact the Wisconsin DOR for further assistance and clarification.

Are there any penalties for claiming deductions or credits incorrectly on my Wisconsin tax return?

+

While there are no penalties specifically for claiming deductions or credits incorrectly, it’s important to ensure accuracy to avoid potential audits or complications. It’s recommended to consult with a tax professional if you have any doubts or questions.

How can I maximize my Wisconsin income tax refund?

+

To maximize your Wisconsin income tax refund, thoroughly review all eligible deductions and credits. Consider factors such as dependent deductions, education expenses, and tax credits like the EITC. Consulting with a tax professional can also help identify additional strategies to increase your refund.