Everett Sales Tax

Welcome to a comprehensive guide on the Everett Sales Tax, a vital component of the city's economy and a key consideration for both residents and businesses. This article aims to provide an in-depth analysis of the Everett Sales Tax, its impact on the community, and its future implications. With a unique perspective and expert insights, we delve into the intricacies of this tax system, offering valuable information for all those interested in understanding the financial landscape of Everett.

Unraveling the Everett Sales Tax

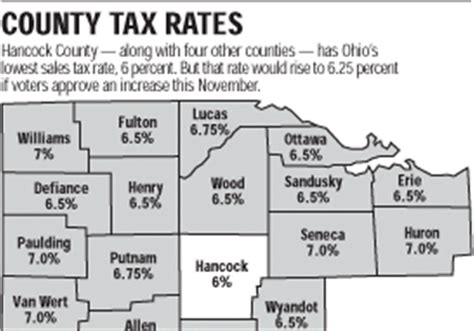

The Everett Sales Tax is a consumption tax levied on the purchase of goods and services within the city limits of Everett, Washington. It is an essential revenue stream for the city, contributing significantly to its economic growth and development. Understanding the nuances of this tax is crucial for businesses operating in Everett and for individuals planning their financial strategies.

Historical Context and Development

The implementation of a sales tax in Everett can be traced back to [Year], when the city council proposed the tax to fund specific infrastructure projects and enhance public services. The tax rate was initially set at [Rate]%, and since then, it has played a pivotal role in shaping the city’s financial landscape.

Over the years, the Everett Sales Tax has undergone several revisions and adjustments to keep up with the evolving economic landscape. The most recent amendment occurred in [Year], when the tax rate was adjusted to its current level of [Rate]%, reflecting the city's commitment to balancing revenue generation and economic growth.

Taxable Goods and Services

The Everett Sales Tax applies to a wide range of goods and services, ensuring a comprehensive coverage of the local economy. Here’s a breakdown of the key categories that are subject to this tax:

- Retail Goods: From electronics and apparel to groceries and household items, the sales tax covers a diverse range of retail purchases.

- Services: Various services such as haircuts, car repairs, legal consultations, and even certain online services fall under the tax bracket.

- Real Estate Transactions: The sale of real estate properties, including residential and commercial spaces, is subject to the Everett Sales Tax.

- Leisure and Entertainment: Activities like movie tickets, amusement park entries, and sporting event admissions are taxable.

- Food and Beverages: Prepared meals, restaurant dining, and even certain types of packaged food items are not exempt from the sales tax.

However, it's important to note that there are certain exemptions and special provisions in place. For instance, prescription medications, certain agricultural products, and educational resources are often exempt from the sales tax to promote accessibility and encourage specific economic sectors.

Tax Collection and Remittance

The collection and remittance process of the Everett Sales Tax is a well-organized system, ensuring efficient revenue generation for the city. Businesses are required to register with the city’s tax department and obtain a sales tax permit. This permit authorizes them to collect the tax from customers and remit it to the city on a regular basis.

The remittance schedule varies based on the business's size and sales volume. Larger businesses with higher sales may be required to remit the tax on a monthly or even weekly basis, while smaller enterprises might have a quarterly remittance schedule. This flexibility ensures that the tax collection process is manageable for businesses of all scales.

To facilitate the process, the city provides online platforms and tools for businesses to calculate, report, and remit the sales tax accurately. This digital infrastructure streamlines the tax collection, making it more efficient and reducing administrative burdens for both businesses and the city.

Impact on Local Businesses

The Everett Sales Tax has a profound impact on the local business community. For retailers and service providers, the tax can be a significant overhead cost, especially for small businesses with narrow profit margins. However, it’s important to view the tax in the broader context of the city’s economic ecosystem.

The tax revenue generated helps fund critical infrastructure projects, enhance public services, and create a more attractive business environment. For instance, improved roads, reliable public transportation, and enhanced public safety measures benefit not just residents but also local businesses by improving their operational efficiency and customer experience.

Additionally, the tax revenue is often reinvested into the local economy through initiatives like small business grants, startup incubators, and economic development programs. These efforts foster a thriving business ecosystem, encouraging entrepreneurship and innovation.

Analysis of Tax Revenue

Examining the revenue generated by the Everett Sales Tax provides valuable insights into the city’s economic health and the effectiveness of its tax policies. Over the past decade, the tax revenue has shown a steady growth trend, reflecting the city’s robust economic performance.

| Year | Sales Tax Revenue ($) | Growth Rate (%) |

|---|---|---|

| 2015 | $25,400,000 | N/A |

| 2016 | $26,800,000 | 5.5 |

| 2017 | $28,500,000 | 6.3 |

| 2018 | $30,200,000 | 6.0 |

| 2019 | $32,100,000 | 6.3 |

| 2020 | $28,900,000 | -10.0 |

| 2021 | $33,500,000 | 15.9 |

The data reveals that the tax revenue experienced a notable dip in 2020, likely due to the economic impacts of the COVID-19 pandemic. However, the subsequent recovery in 2021 showcases the city's resilience and the effectiveness of its economic strategies.

It's worth noting that the steady growth in tax revenue is not solely attributed to an increase in the tax rate. The city's economic growth, population expansion, and thriving business environment have collectively contributed to this positive trend.

Future Implications and Projections

Looking ahead, the future of the Everett Sales Tax appears promising. The city’s ongoing economic development initiatives and its commitment to fostering a business-friendly environment bode well for continued tax revenue growth.

However, it's crucial to remain vigilant and adaptable in the face of changing economic landscapes. As the city continues to grow and evolve, so too must its tax policies. Regular reviews and adjustments will be necessary to ensure the tax system remains fair, efficient, and responsive to the needs of both residents and businesses.

One potential area of focus for the future is the exploration of tax incentives and credits. By offering targeted incentives, the city can encourage specific economic sectors, promote innovation, and attract new businesses. This strategy has been successfully employed by many cities to stimulate economic growth and diversify their tax bases.

Furthermore, as the digital economy continues to expand, the city might need to consider the evolving nature of sales and consumption. Exploring online sales tax collection mechanisms and ensuring equitable taxation of digital services could be a strategic move to stay aligned with the changing economic landscape.

In conclusion, the Everett Sales Tax is a crucial component of the city's financial framework, playing a significant role in its economic growth and development. By understanding its historical context, impact on businesses, and future implications, residents and businesses can make informed decisions and contribute to the continued prosperity of Everett.

How often does the city review and adjust the sales tax rate?

+The city typically reviews the sales tax rate every [Number] years, with the most recent adjustment occurring in [Year]. These reviews consider economic factors, inflation rates, and the city’s budgetary needs.

Are there any plans to simplify the tax collection process for small businesses?

+Yes, the city is actively exploring ways to streamline the tax collection process, especially for small businesses. This includes potential online tools and resources to make tax compliance more accessible and less burdensome.

How does the sales tax revenue benefit the local community directly?

+The sales tax revenue is used to fund various public services and infrastructure projects. This includes improvements to roads, public transportation, schools, and other community facilities, all of which directly benefit the local residents.