Marin Property Tax

Understanding property taxes is crucial for homeowners, especially in regions like Marin County, California, where the real estate market is vibrant and diverse. Property taxes can significantly impact a homeowner's financial planning, and a deep dive into the intricacies of the Marin County property tax system is essential for informed decision-making.

Unraveling the Marin County Property Tax Landscape

The property tax system in Marin County is a comprehensive framework designed to assess and collect taxes based on the value of real estate properties. This system is governed by state and local regulations, ensuring a fair and transparent process for both homeowners and the county.

The Assessment Process: A Detailed Breakdown

Property assessment in Marin County is an annual event where the Marin County Assessor's Office evaluates the value of each property. This value, known as the Assessed Value, is crucial as it determines the tax liability for the year. The Assessor's Office employs a variety of methods, including market value analysis, to ensure an accurate valuation.

Marin County utilizes a base year value system, where the assessed value is typically based on the property's purchase price or construction cost. This value is then adjusted annually by the Consumer Price Index (CPI) to account for inflation. However, Proposition 13, a California law, caps the annual increase in assessed value at 2% or the inflation rate, whichever is lower.

| Assessment Type | Description |

|---|---|

| Original Assessment | The initial assessed value based on the purchase price. |

| Annual Adjustment | Inflation-based increases up to a maximum of 2% per year. |

| Proposition 8 Reassessment | Reassessment in case of a decline in market value due to economic conditions. |

| Change in Ownership Reassessment | Reassessment when property ownership changes. |

Calculating Property Taxes: A Step-by-Step Guide

Property taxes in Marin County are calculated based on the assessed value of the property and the applicable tax rate. The tax rate, also known as the tax rate area, is determined by the various taxing agencies in the county, including the county itself, cities, schools, and special districts.

The tax rate is expressed as a percentage of the assessed value and can vary significantly depending on the location and type of property. On average, the tax rate in Marin County hovers around 1% to 1.5% of the assessed value. However, it's essential to note that this rate can be higher or lower in certain areas.

| Taxing Agency | Tax Rate (%) |

|---|---|

| Marin County | 0.76 |

| San Rafael | 0.76 |

| Ross School District | 1.00 |

| Central Marin | 0.78 |

To calculate the property tax, multiply the assessed value by the tax rate. For instance, a property with an assessed value of $1,000,000 in an area with a 1.2% tax rate would have an annual property tax bill of $12,000.

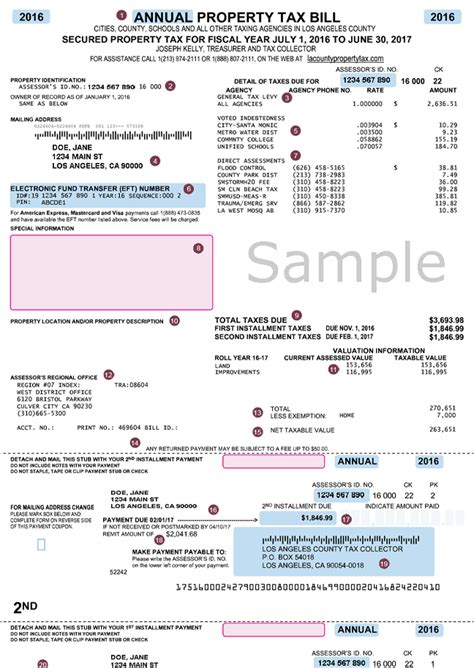

Tax Bills and Payment Schedule

Property tax bills in Marin County are typically sent out in two installments, due in the fall and spring. The Marin County Treasurer-Tax Collector's Office is responsible for issuing these bills and collecting the taxes. Homeowners have the option to pay their taxes online, by mail, or in person.

It's crucial for homeowners to keep up with their tax payments to avoid penalties and interest charges. Late payments can result in a 10% penalty and an additional 1.5% interest charge per month.

Exemptions and Discounts: Maximizing Savings

Marin County offers various exemptions and discounts to eligible homeowners, which can significantly reduce their property tax liability. Some of these include:

- Homeowner's Exemption: A $7,000 reduction in the assessed value for owner-occupied properties.

- Senior Citizen Exemption: Eligible seniors can receive a reduction in assessed value based on their income.

- Veteran's Exemption: Veterans may be eligible for a reduction in assessed value or a complete exemption.

- Early Payment Discount: A 2% discount for paying the first installment by December 10th.

Homeowners should explore these options to determine their eligibility and maximize their savings.

Future Implications and Market Impact

The property tax system in Marin County is an integral part of the real estate market. It influences buying decisions, investment strategies, and overall financial planning for homeowners and investors alike. As the county continues to evolve, so too will the property tax landscape.

The introduction of new laws and regulations, such as Proposition 19, which changed the rules for parent-child property transfers, demonstrates the dynamic nature of the system. Homeowners and real estate professionals must stay informed about these changes to navigate the market effectively.

Potential Changes and Challenges

Looking ahead, there are several potential changes that could impact the Marin County property tax system. These include:

- Adjustments to Proposition 13: While Proposition 13 provides stability, there have been discussions about modifying it to allow for more frequent reassessments.

- New Taxing Agencies: As the county grows, new special districts or agencies may be formed, leading to potential changes in tax rates.

- Economic Fluctuations: Economic downturns or booms can impact property values, which in turn affect tax assessments.

Homeowners and investors should stay abreast of these potential changes to ensure they can adapt their strategies accordingly.

Conclusion: A Complex Yet Crucial System

The Marin County property tax system is a complex mechanism that requires a deep understanding of the various laws, assessments, and rates. However, with the right knowledge and resources, homeowners can navigate this system effectively and make informed decisions about their real estate investments.

As the real estate market in Marin County continues to thrive, staying informed about property taxes will remain a critical aspect of financial planning and investment strategy.

What is the average property tax rate in Marin County?

+The average property tax rate in Marin County is approximately 1% to 1.5% of the assessed value. However, this rate can vary depending on the specific location and type of property.

How often are property taxes assessed in Marin County?

+Property taxes in Marin County are assessed annually. The Marin County Assessor’s Office evaluates the value of each property every year, and this value is used to calculate the tax liability for the upcoming year.

Are there any exemptions or discounts available for property taxes in Marin County?

+Yes, Marin County offers several exemptions and discounts to eligible homeowners. These include the Homeowner’s Exemption, Senior Citizen Exemption, Veteran’s Exemption, and an Early Payment Discount. Homeowners should explore these options to determine their eligibility and reduce their tax liability.

What happens if I don’t pay my property taxes on time in Marin County?

+Late payment of property taxes in Marin County can result in a 10% penalty and an additional 1.5% interest charge per month. It’s crucial to stay up to date with your tax payments to avoid these penalties and maintain a good standing with the county.

How can I stay informed about changes to the property tax system in Marin County?

+To stay informed about changes to the property tax system in Marin County, homeowners and real estate professionals should regularly check the websites of the Marin County Assessor’s Office and the Marin County Treasurer-Tax Collector’s Office for updates and announcements. Additionally, subscribing to local news sources and following relevant real estate blogs can provide valuable insights into potential changes and their impact.