Solano Tax Collector

Welcome to an in-depth exploration of the Solano Tax Collector's Office, a vital administrative body in Solano County, California. This office plays a crucial role in the county's financial management, ensuring that residents and businesses comply with tax obligations while also offering essential services to the community. With a commitment to transparency and efficiency, the Solano Tax Collector's Office navigates the complex world of taxation, providing an invaluable public service.

An Overview of Solano Tax Collector’s Office

The Solano Tax Collector’s Office, a division of the County Administration, serves as the custodian of public funds for Solano County. Headquartered in Fairfield, California, the office is led by an elected Tax Collector-Treasurer, a position that holds significant responsibility and accountability. This individual, alongside a dedicated team of professionals, manages the intricate process of collecting various taxes, fees, and assessments mandated by state and local laws.

The office's jurisdiction covers the entire Solano County, including cities like Vacaville, Fairfield, Suisun City, Dixon, and Rio Vista, each with its unique tax considerations. From personal property taxes to vehicle license fees, the Solano Tax Collector's Office ensures that all financial obligations are met, contributing to the county's fiscal stability and growth.

In addition to tax collection, the office offers a range of services to facilitate compliance and support residents. This includes providing information on tax payments, offering payment plans, and handling inquiries related to tax assessments. The Solano Tax Collector's Office also plays a critical role in educating the public about tax obligations, ensuring that taxpayers understand their responsibilities and rights.

The office's operations are governed by a set of principles that prioritize transparency, fairness, and accountability. This includes maintaining accurate records, providing accessible information, and treating all taxpayers with respect and integrity. By adhering to these principles, the Solano Tax Collector's Office ensures that the tax collection process is efficient, equitable, and aligned with the best interests of the community.

Key Responsibilities and Services

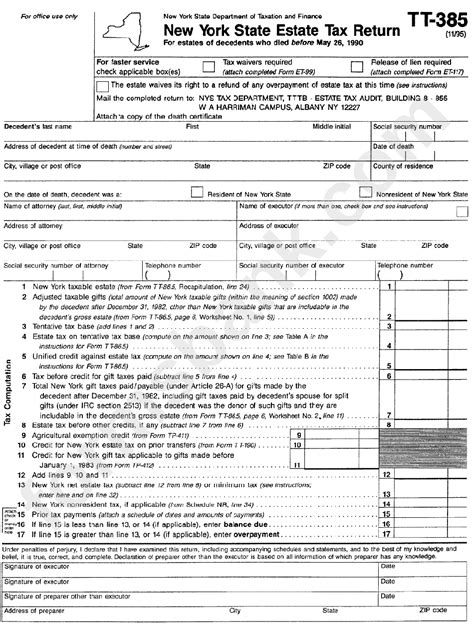

Tax Collection

The primary responsibility of the Solano Tax Collector’s Office is the collection of various taxes, which forms a significant portion of the county’s revenue. This includes property taxes, which are a major source of funding for local services and infrastructure. The office ensures that all property owners in Solano County pay their taxes on time, sending out tax bills and facilitating online payments for convenience.

Another important tax category is vehicle license fees. The office handles the collection of these fees, which are essential for maintaining roads and transportation infrastructure. Vehicle owners are required to pay these fees annually, and the Solano Tax Collector's Office provides a streamlined process for payment, including online options for ease of use.

In addition to these, the office also collects various special assessments and fees related to specific services or improvements. These assessments and fees are levied to fund specific projects or maintain certain facilities, ensuring that the county can provide high-quality services and infrastructure to its residents.

Payment Options and Support

The Solano Tax Collector’s Office offers a range of payment options to accommodate different preferences and needs. Taxpayers can choose to pay their taxes and fees online, through a secure portal that accepts major credit cards and electronic checks. For those who prefer traditional methods, the office also accepts payments by mail or in person at their office locations.

Understanding that tax payments can be a financial burden, especially for those facing challenging circumstances, the office provides payment plans. These plans allow taxpayers to pay their taxes in installments, making it more manageable and reducing the risk of late fees or penalties. The office works closely with taxpayers to establish realistic payment schedules, ensuring that everyone has an opportunity to meet their tax obligations.

The Solano Tax Collector's Office also recognizes the importance of education and outreach. They provide taxpayer resources, including guides and FAQs, to help residents understand their tax obligations and navigate the payment process. Additionally, the office offers assistance for taxpayers who may be facing financial hardships or have complex tax situations, ensuring that everyone receives the support they need to comply with tax laws.

Record Keeping and Transparency

Maintaining accurate records is a cornerstone of the Solano Tax Collector’s Office’s operations. The office utilizes advanced technology and secure systems to track and manage tax payments, ensuring that all transactions are properly recorded and accessible. This transparency allows taxpayers to verify their payments and provides accountability for the office’s operations.

The office also publishes regular financial reports and tax collection data, ensuring that the public has access to information about how their tax dollars are being collected and spent. These reports provide transparency and build trust with the community, demonstrating the office's commitment to fiscal responsibility and effective stewardship of public funds.

Furthermore, the Solano Tax Collector's Office is proactive in addressing any issues or concerns that arise. They have established feedback mechanisms, including a dedicated customer service line and online inquiry forms, to ensure that taxpayers can easily communicate their questions or complaints. By promptly addressing these, the office can resolve issues, improve services, and maintain a high level of satisfaction among taxpayers.

The Impact and Future of Solano County’s Tax Collection

The Solano Tax Collector’s Office plays a pivotal role in shaping the financial health and well-being of Solano County. By effectively collecting taxes and fees, the office contributes significantly to the county’s revenue stream, which in turn supports essential services such as education, public safety, healthcare, and infrastructure development.

The office's commitment to transparency and accessibility has fostered a culture of trust and engagement with the community. Residents feel empowered to participate in the tax process, knowing that their contributions are being managed responsibly and are benefiting the county as a whole. This engagement is vital for the long-term sustainability and growth of Solano County.

Looking ahead, the Solano Tax Collector's Office is poised for continued success and innovation. With an eye on technological advancements, the office is exploring new ways to streamline processes, enhance security, and improve the overall taxpayer experience. This includes the potential adoption of cutting-edge payment systems and digital tools that will further simplify tax payments and interactions with the office.

Furthermore, the office is dedicated to staying abreast of changing tax laws and regulations at the state and federal levels. This ensures that Solano County remains compliant with the latest requirements and that taxpayers are provided with accurate information and guidance. By staying proactive, the Solano Tax Collector's Office can navigate any potential challenges and continue to deliver exceptional service to the community.

Conclusion: A Pillar of Solano County’s Financial Stability

The Solano Tax Collector’s Office is an indispensable component of Solano County’s administrative landscape. Through its efficient tax collection processes, commitment to transparency, and dedication to serving the community, the office ensures the county’s financial health and the well-being of its residents. As the county continues to evolve and grow, the Solano Tax Collector’s Office will remain a steadfast partner, contributing to its prosperity and resilience.

How often are property taxes assessed in Solano County?

+

Property taxes in Solano County are typically assessed annually, with tax bills sent out in late November. However, if there are changes to the property or adjustments to tax rates, reassessments may occur at different times.

What payment methods does the Solano Tax Collector’s Office accept?

+

The Solano Tax Collector’s Office offers a variety of payment methods, including online payments (credit card, eCheck), payments by mail (check, money order), and in-person payments (check, cash, credit card) at their office locations.

How can I get assistance if I’m facing financial hardship and unable to pay my taxes on time?

+

The Solano Tax Collector’s Office understands that financial difficulties can arise. They offer payment plans and can work with taxpayers on a case-by-case basis to find a solution. You can contact their office to discuss your situation and explore available options.

Are there any tax relief programs available for senior citizens or veterans in Solano County?

+

Yes, Solano County does offer tax relief programs for eligible senior citizens and veterans. These programs provide property tax exemptions or reductions based on certain criteria. You can contact the Solano Tax Collector’s Office or visit their website for more information on eligibility and application processes.

How can I stay updated on tax-related news and announcements from the Solano Tax Collector’s Office?

+

You can stay informed by subscribing to the Solano Tax Collector’s Office newsletter, following their social media accounts (if available), or regularly checking their official website for updates and important announcements.