Food Tax In Texas

In the realm of taxation, the discussion surrounding a Food Tax in Texas is an intriguing and relevant topic, particularly given the state's diverse culinary landscape and its impact on residents and businesses alike. While Texas is renowned for its rich culinary heritage and diverse food culture, the idea of implementing a tax on food items has sparked debate among policymakers, economists, and the general public.

This comprehensive exploration delves into the intricacies of the Food Tax in Texas, shedding light on its potential implications, the current legislative landscape, and the unique challenges and opportunities it presents. By examining real-world examples, industry data, and expert insights, we aim to provide a holistic understanding of this complex issue, ensuring that readers are equipped with the knowledge to form their own informed opinions.

Understanding the Food Tax Proposal

The concept of a Food Tax in Texas is not a new phenomenon; it has been a subject of discussion and occasional legislative consideration for several years. At its core, the proposal advocates for the imposition of a tax on various food items sold within the state, with the primary aim of generating additional revenue for the government.

Proponents of the Food Tax argue that it could serve as a significant source of funding for essential state programs and infrastructure development. They suggest that the tax could be levied on a wide range of food products, from processed snacks to fresh produce, with the potential for different tax rates depending on the type of food and its nutritional value.

However, the proposal has also faced criticism and skepticism. Opponents argue that a Food Tax could disproportionately affect low-income households, who already face challenges in accessing nutritious and affordable food. Additionally, the potential impact on the state's thriving food industry, including farmers, grocers, and restaurateurs, has been a central concern in the debate.

Real-World Examples: Food Taxation Around the Globe

To gain a broader perspective on the potential implications of a Food Tax, it is instructive to examine how other regions have implemented similar policies. For instance, several countries in Europe have introduced sugar taxes on sugary beverages, with the aim of combating obesity and funding healthcare initiatives.

In the United Kingdom, the Soft Drinks Industry Levy, commonly known as the "sugar tax," has been in effect since 2018. This tax applies to manufacturers and importers of sugary drinks, with the proceeds being used to fund children's sports and healthy eating initiatives. While the tax has had a positive impact on reducing sugar consumption, it has also sparked debates about its effectiveness and potential impact on small businesses.

| Country | Food Tax Type | Implementation Date |

|---|---|---|

| United Kingdom | Sugar Tax on Soft Drinks | 2018 |

| Finland | Fat Tax on Certain Foods | 2011 |

| Hungary | Food Packaging Tax | 2018 |

Similarly, Finland implemented a fat tax in 2011, targeting foods high in saturated fat. This tax was designed to encourage healthier dietary choices and generate revenue for healthcare services. However, the tax was met with resistance from the food industry and was eventually repealed in 2016.

The Impact on Texas Residents and Businesses

A Food Tax in Texas would have a direct impact on residents’ purchasing power and food choices. For many households, especially those with limited incomes, the added tax could make it more challenging to afford nutritious food, potentially leading to increased reliance on cheaper, less healthy options.

Small businesses in the food industry, such as local grocers and family-owned restaurants, might face significant challenges. These establishments often operate on thin margins, and an additional tax could squeeze their profitability, potentially leading to higher prices for consumers or even business closures.

Potential Solutions and Mitigation Strategies

Recognizing the potential drawbacks of a blanket Food Tax, policymakers and economists have proposed alternative approaches to address the state’s revenue needs while minimizing negative impacts.

- Targeted Taxation: Instead of taxing all food items, a more nuanced approach could involve taxing specific categories of food, such as sugary drinks or highly processed snacks. This strategy aims to influence consumer choices while minimizing the impact on essential food items.

- Nutrition-Based Incentives: Implementing tax incentives or rebates for nutritious foods could encourage healthier eating habits without penalizing consumers. For instance, offering tax breaks for the purchase of fresh produce or whole grains could make healthy options more affordable.

- Revenue Allocation: If a Food Tax is implemented, careful consideration should be given to how the proceeds are allocated. Directing funds towards initiatives that support food security, nutrition education, and access to healthy foods could mitigate some of the negative impacts on vulnerable populations.

The Role of Technology and Data

In today’s digital age, technology and data analytics play a crucial role in shaping tax policies. Advanced analytics can provide valuable insights into consumer behavior, allowing policymakers to understand the potential impact of a Food Tax on different demographic groups and income levels.

For instance, by analyzing purchase data from loyalty programs or grocery store transactions, researchers can identify patterns in food consumption and assess the potential effectiveness of different tax scenarios. This data-driven approach ensures that policies are informed by real-world evidence rather than assumptions.

Case Study: Tax-Preparation Software and Compliance

One notable aspect of tax policy implementation is the role of technology in facilitating compliance. In the context of a potential Food Tax, tax-preparation software and point-of-sale systems would need to be adapted to accurately calculate and collect the tax. This presents an opportunity for technology companies to innovate and develop solutions that streamline the process for businesses and government agencies alike.

Additionally, data-driven insights can inform the design of user-friendly tax forms and interfaces, making it easier for businesses and individuals to understand and comply with the tax requirements.

Future Implications and Policy Considerations

The debate surrounding a Food Tax in Texas is far from settled, and its future trajectory will depend on a complex interplay of political, economic, and social factors.

As the state continues to grow and face evolving challenges, such as an aging population and rising healthcare costs, the need for sustainable revenue sources becomes increasingly pressing. A Food Tax, if implemented thoughtfully and with careful consideration of its potential impacts, could be one piece of the puzzle in addressing these challenges.

However, policymakers must also weigh the potential benefits against the risks, including the risk of driving away businesses and burdening residents, particularly those already facing financial challenges. Striking the right balance will require ongoing dialogue, evidence-based decision-making, and a commitment to serving the best interests of all Texans.

The Path Forward: A Holistic Approach

Moving forward, a comprehensive and holistic approach to tax policy is essential. This includes exploring a range of revenue-generating options, from traditional sources like property taxes to innovative solutions like carbon taxes or tourism levies. By diversifying the state’s revenue streams, policymakers can reduce the reliance on any single tax measure, such as a Food Tax, and ensure a more resilient and equitable fiscal landscape.

Additionally, engaging in open and transparent dialogue with stakeholders, including industry representatives, community leaders, and the general public, is crucial. This collaborative approach can lead to more inclusive and effective policy solutions that reflect the diverse needs and perspectives of Texans.

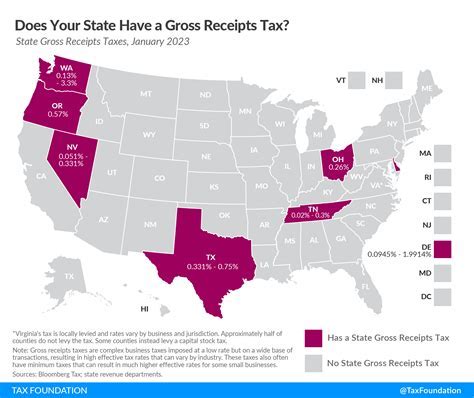

How does the proposed Food Tax in Texas compare to other states’ tax policies on food items?

+The proposed Food Tax in Texas is unique in its scope and potential impact. While some states have implemented taxes on specific food categories, such as sugary drinks or snack foods, Texas’ proposal aims to cover a broader range of food items. This makes it more akin to certain European countries’ approaches, where a tax is applied to a wide array of food products. However, the potential rate and exemptions could vary significantly, making direct comparisons challenging.

What are the potential benefits of implementing a Food Tax in Texas?

+Proponents argue that a Food Tax could generate significant revenue for the state, which could be used to fund essential services and infrastructure. Additionally, it could potentially influence consumer behavior, encouraging healthier eating habits and reducing the consumption of less nutritious foods. However, the benefits must be carefully weighed against potential drawbacks, such as the impact on low-income households and small businesses.

How can the potential negative impacts of a Food Tax be mitigated?

+Mitigation strategies could include targeted taxation on specific food categories, providing tax incentives for nutritious foods, and carefully allocating the tax revenue to initiatives that support food security and nutrition. Additionally, ensuring that the tax system is transparent and easy to understand for businesses and consumers can help mitigate potential confusion and compliance issues.