Montana Property Tax Rebate

In a bid to ease the financial burden on property owners and stimulate economic growth, the state of Montana has implemented a property tax rebate program. This initiative, a key policy move by the state government, aims to provide relief to taxpayers and boost investment in the region. Understanding the intricacies of this program is essential for property owners and investors alike, as it offers a unique opportunity to navigate the financial landscape of Montana's real estate market.

The Montana Property Tax Rebate Program: An Overview

The Montana Property Tax Rebate program is a state-sponsored initiative designed to return a portion of the property taxes paid by homeowners and investors. This program, enacted by the Montana Legislature, serves as a direct financial incentive to property owners, providing them with a rebate check based on their tax payments. The primary objective is to promote homeownership, encourage investment in real estate, and ultimately, drive economic development across the state.

This rebate program is particularly significant for Montana, a state known for its vast natural resources, vibrant communities, and diverse real estate market. By offering this financial relief, the state government aims to attract and retain residents, fostering a sense of community and economic stability.

Eligibility Criteria and Application Process

Eligibility for the Montana Property Tax Rebate program is determined by a set of specific criteria outlined by the state government. To qualify, property owners must meet the following conditions:

- Residency Status: Applicants must be legal residents of Montana, with their primary residence located within the state.

- Property Ownership: The property for which the rebate is claimed must be owned by the applicant and serve as their primary residence.

- Income Level: The program sets income thresholds; applicants' household income must fall within a specified range to be eligible.

- Tax Payment: Applicants must have paid their property taxes in full and on time for the designated tax year.

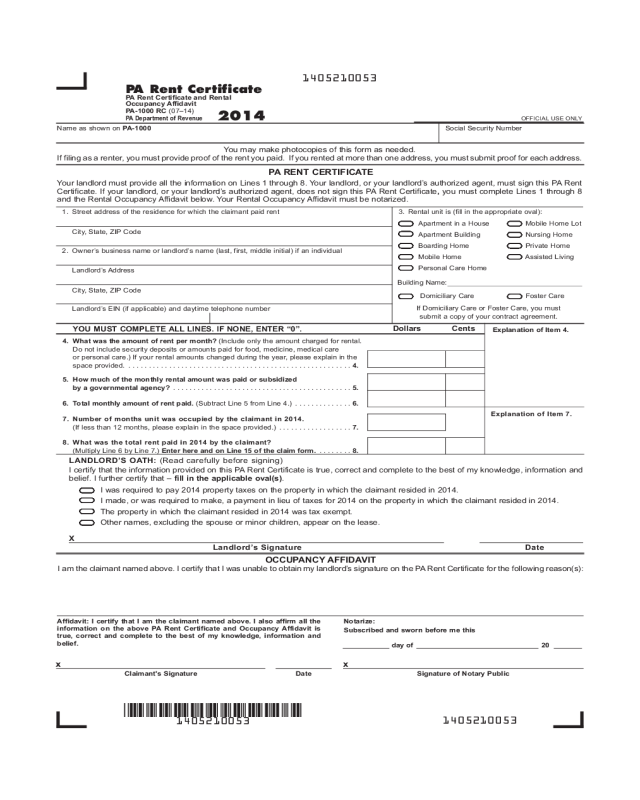

The application process for the Montana Property Tax Rebate is straightforward and accessible. Applicants are required to submit the following documentation:

- Application Form: A completed application form, available on the Montana Department of Revenue's website, must be submitted. This form includes details about the applicant's property, income, and tax payment.

- Proof of Residency: Applicants must provide valid documentation, such as a driver's license or state-issued ID, to prove their Montana residency.

- Property Tax Statement: A copy of the property tax statement for the relevant tax year is necessary to demonstrate tax payment.

- Income Verification: Applicants may need to provide income tax returns or other income verification documents to meet the income eligibility criteria.

Once the application is submitted, it undergoes a review process by the Department of Revenue. This review ensures that all eligibility criteria are met and that the application is complete. Upon approval, applicants can expect to receive their rebate check within a specified timeframe, typically a few weeks to a month.

Rebate Amounts and Calculation

The amount of the Montana Property Tax Rebate varies based on several factors, including the assessed value of the property, the tax rate, and the income level of the applicant. The state government has established a rebate calculation formula to determine the exact amount each eligible applicant will receive.

The rebate amount is designed to provide meaningful financial relief to property owners. For instance, consider a homeowner with a property valued at $250,000 and a tax rate of 1.5%. With an income within the eligible range, this homeowner could potentially receive a rebate of several hundred dollars, significantly offsetting their tax burden.

| Property Value | Tax Rate | Estimated Rebate |

|---|---|---|

| $200,000 | 1.2% | $240 |

| $300,000 | 1.6% | $480 |

| $450,000 | 1.8% | $810 |

These estimated rebates illustrate the potential financial benefit for property owners in Montana. By implementing this program, the state government aims to provide a tangible incentive for homeowners and investors to maintain their property ownership and continue contributing to the local economy.

The Impact of the Property Tax Rebate on Montana’s Real Estate Market

The Montana Property Tax Rebate program has had a significant impact on the state’s real estate market, shaping the investment landscape and influencing property ownership trends. By offering a financial incentive to homeowners and investors, the program has contributed to a more dynamic and accessible market, attracting both first-time homebuyers and seasoned investors.

Stimulating Homeownership

One of the primary goals of the Montana Property Tax Rebate program is to encourage homeownership. By providing a rebate on property taxes, the state government makes homeownership more affordable and attractive. This incentive has had a direct impact on the housing market, particularly for those who might otherwise struggle to enter the market due to financial constraints.

For instance, consider a young couple in Montana looking to purchase their first home. With the promise of a property tax rebate, they can now consider a wider range of properties, potentially moving from a rental to ownership. This transition not only benefits the couple but also contributes to the local economy by increasing property values and generating additional tax revenue.

Attracting Investors

The Property Tax Rebate program has also proven to be a significant draw for real estate investors. By offering a rebate on taxes, the state creates an environment conducive to investment. Investors, seeking to maximize their returns, are attracted to Montana’s real estate market, knowing that their tax burden will be offset by the rebate program.

Take, for example, a real estate developer considering a large-scale residential project in Montana. The property tax rebate program could significantly reduce their financial outlay, making the project more feasible and potentially increasing their profit margin. This, in turn, leads to more investment opportunities, job creation, and economic growth for the state.

Stimulating Economic Growth

The Montana Property Tax Rebate program’s impact extends beyond the real estate market, contributing to the overall economic growth of the state. By encouraging homeownership and attracting investors, the program generates a ripple effect of economic benefits.

- Increased Property Values: As more people enter the housing market, whether as homeowners or investors, property values tend to rise. This increase in property values not only benefits existing homeowners but also enhances the state's tax base, providing additional revenue for public services and infrastructure.

- Job Creation: The real estate industry, including construction, development, and property management, is a significant employer. By stimulating investment and homeownership, the Property Tax Rebate program indirectly creates jobs, reducing unemployment rates and boosting the state's economy.

- Enhanced Community Development: With more residents and a thriving real estate market, communities across Montana can experience positive development. This includes improved infrastructure, enhanced public services, and a stronger sense of community.

In essence, the Montana Property Tax Rebate program is a strategic initiative with far-reaching effects. By offering financial relief to property owners, the state government has created a virtuous cycle of economic growth, making Montana an even more attractive place to live, work, and invest.

Maximizing the Benefits of the Property Tax Rebate

To fully leverage the advantages offered by the Montana Property Tax Rebate program, property owners and investors must understand the nuances of the program and employ strategic planning. Here are some key considerations to maximize the benefits:

Understanding the Rebate Timeline

The timing of the property tax rebate is an essential aspect to consider. While the rebate is a significant financial benefit, it’s important to understand when it will be received and how it can be best utilized. Property owners should plan their finances accordingly, taking into account the timing of the rebate to ensure they can make the most of this incentive.

Optimizing Property Value

The value of the property is a key factor in determining the rebate amount. Property owners can take steps to maximize their property’s value, such as investing in improvements or upgrades. By enhancing the property’s value, owners can potentially increase their rebate amount, further offsetting their tax burden.

Strategic Tax Planning

Effective tax planning is crucial to maximizing the benefits of the Property Tax Rebate program. Property owners should work with tax professionals to understand the tax implications of their real estate holdings and how the rebate can be integrated into their overall tax strategy. This may involve considering tax-efficient investment strategies or optimizing tax deductions to reduce the overall tax burden.

Staying Informed about Program Updates

The Montana Property Tax Rebate program may undergo changes and updates over time. To ensure they receive the maximum benefit, property owners should stay informed about any program modifications, eligibility criteria updates, or changes in the rebate calculation formula. Staying up-to-date ensures that property owners can adapt their strategies and continue to leverage the program effectively.

Conclusion

The Montana Property Tax Rebate program is a strategic initiative designed to stimulate economic growth, encourage homeownership, and attract investment. By offering a financial incentive to property owners, the state government has created a positive feedback loop, benefiting both residents and the state’s economy. As Montana continues to evolve and adapt to changing economic landscapes, programs like the Property Tax Rebate showcase the state’s commitment to fostering a vibrant and prosperous community.

For property owners and investors, understanding the intricacies of this program and leveraging its benefits is key to navigating the financial landscape of Montana's real estate market. By staying informed, employing strategic planning, and taking advantage of the rebate, they can position themselves for success, contributing to the state's growth and their own financial well-being.

How often does the Montana Property Tax Rebate program occur?

+The Montana Property Tax Rebate program is typically an annual occurrence, with rebates issued based on the previous year’s tax payments. Property owners can expect to receive their rebate check in the following tax year.

Are there any income restrictions for eligibility?

+Yes, the Montana Property Tax Rebate program has income thresholds. Applicants must meet specific income requirements to be eligible. These thresholds may vary based on household size and other factors.

Can the rebate amount change from year to year?

+The rebate amount can vary depending on several factors, including changes in property values, tax rates, and income levels. It’s essential for property owners to stay updated on any changes to the rebate calculation formula.