Kanawha County Tax

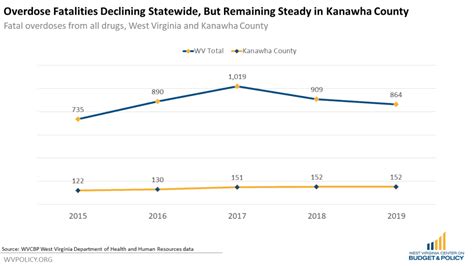

Welcome to an in-depth exploration of the Kanawha County Tax system. This article will delve into the various aspects of taxation within Kanawha County, West Virginia, providing a comprehensive guide for residents, businesses, and anyone interested in understanding the financial obligations and opportunities within this region. With a rich history and a unique tax structure, Kanawha County offers a compelling case study for those looking to navigate the complexities of local taxation.

Understanding the Kanawha County Tax System

The tax system in Kanawha County is a complex yet well-defined structure that plays a vital role in the county’s financial stability and development. Here’s an overview of the key components and their significance.

Property Taxes

Property taxes form the backbone of Kanawha County’s revenue generation. The county assesses property values annually, with the primary tax rate applied to the assessed value. This tax is levied on both residential and commercial properties, with rates varying based on the property’s classification and location within the county.

For instance, consider the case of a residential property owner in Charleston, the county seat. The assessed value of their home is subject to a tax rate of 0.85%, which is among the highest in the county. This rate translates to a significant financial obligation for homeowners, impacting their annual budgets and long-term financial planning.

| Property Type | Tax Rate |

|---|---|

| Residential | 0.85% |

| Commercial | 0.9% |

| Agricultural | 0.7% |

To illustrate the impact, let's consider a hypothetical scenario: a homeowner with a property valued at $250,000. At the 0.85% residential tax rate, they would owe $2,125 in property taxes annually. This figure highlights the substantial contribution that property owners make to the county's revenue stream.

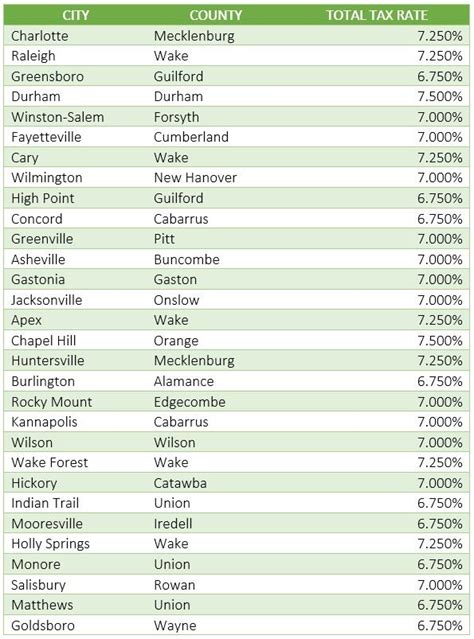

Sales and Use Taxes

Sales and use taxes are another significant revenue source for Kanawha County. The county imposes a 6% sales tax on most tangible personal property sold at retail, with certain exemptions. This tax applies to a wide range of goods, from groceries to electronics, impacting the purchasing power of residents and businesses alike.

Additionally, Kanawha County levies a 1% use tax on the storage, use, or consumption of tangible personal property in the county. This tax is particularly relevant for online purchases, ensuring that all goods brought into the county are subject to taxation.

| Tax Type | Rate |

|---|---|

| Sales Tax | 6% |

| Use Tax | 1% |

For businesses operating within the county, these taxes can significantly impact their bottom line. A local retailer, for example, must collect and remit the 6% sales tax on all eligible transactions, which can amount to a substantial sum over the course of a year. Similarly, the 1% use tax applies to any goods purchased online and shipped to the county, further contributing to the county's revenue.

Business and Occupation (B&O) Taxes

Kanawha County also imposes Business and Occupation (B&O) taxes on businesses operating within its boundaries. These taxes are based on the gross income or revenue generated by the business, with rates varying depending on the business’s primary activity.

For instance, businesses engaged in manufacturing or wholesale trade are subject to a 0.471% B&O tax rate, while those involved in retail trade face a slightly higher rate of 0.484%. This differentiation allows the county to tailor its tax structure to the specific economic activities within its jurisdiction.

| Business Activity | B&O Tax Rate |

|---|---|

| Manufacturing | 0.471% |

| Wholesale Trade | 0.471% |

| Retail Trade | 0.484% |

A local manufacturing company, for example, with an annual revenue of $5 million would incur a B&O tax liability of $23,550 at the 0.471% rate. This tax obligation is a significant consideration for businesses when planning their financial strategies and forecasting their expenses.

Special Taxes and Fees

In addition to the core taxes, Kanawha County levies various special taxes and fees to support specific initiatives and services. These include a hotel/motel tax of 6%, a restaurant tax of 1%, and a vehicle registration fee that varies based on the vehicle’s weight and usage.

These special taxes and fees are essential for funding infrastructure projects, tourism promotion, and other county-wide initiatives. For instance, the hotel/motel tax generates revenue for the county’s tourism bureau, which promotes the region as a destination, attracting visitors and their spending.

| Special Tax/Fee | Rate |

|---|---|

| Hotel/Motel Tax | 6% |

| Restaurant Tax | 1% |

| Vehicle Registration Fee | Varies |

Tax Administration and Collection

Efficient tax administration and collection are crucial for Kanawha County’s financial health. The county employs a dedicated team of tax professionals responsible for assessing property values, collecting taxes, and enforcing compliance.

Assessment Process

The assessment process is a critical component of the tax system. The county’s assessors are tasked with determining the fair market value of all taxable properties within the county. This value is then used as the basis for calculating property taxes, ensuring that each property owner contributes fairly to the county’s revenue.

The assessment process involves a thorough examination of market trends, property sales, and other relevant factors. For instance, the assessor might consider the recent sale of similar properties in the area to determine the fair market value of a specific property. This approach ensures that the assessed value is accurate and reflective of the property’s true worth.

Collection and Enforcement

Once taxes are assessed, the collection process begins. Kanawha County employs a range of methods to ensure timely and accurate tax payments. This includes sending out tax bills, accepting online payments, and offering payment plans for those who may struggle to meet their tax obligations in a single installment.

In cases of non-payment, the county has a range of enforcement measures at its disposal. These can include liens on properties, wage garnishments, and even legal action. The county aims to balance the need for revenue collection with a fair and equitable approach, offering support and assistance to taxpayers facing financial difficulties.

Impact on the Community

The Kanawha County tax system has a profound impact on the community it serves. It funds essential services, infrastructure development, and social programs, shaping the county’s overall quality of life.

Funding Essential Services

Tax revenues are the primary source of funding for a wide range of essential services in Kanawha County. These include law enforcement, fire protection, emergency medical services, and public health initiatives. The taxes collected ensure that residents have access to vital services that contribute to their safety and well-being.

For instance, the property taxes paid by residents and businesses fund the county’s fire department, ensuring that fire protection services are readily available. Similarly, sales and use taxes contribute to the county’s public health initiatives, supporting programs that promote healthy living and disease prevention.

Infrastructure Development

Kanawha County’s tax system plays a pivotal role in funding infrastructure projects. These projects include road and bridge construction and maintenance, public transportation improvements, and utility upgrades. By investing in infrastructure, the county enhances its economic competitiveness and improves the daily lives of its residents.

Consider the impact of a major road construction project funded by the county’s tax revenues. This project not only improves transportation efficiency but also creates jobs during the construction phase, stimulating the local economy. Once completed, the improved road network benefits commuters, businesses, and emergency services, enhancing the overall quality of life in the county.

Social Programs and Initiatives

Beyond essential services and infrastructure, tax revenues support a range of social programs and initiatives aimed at improving the well-being of Kanawha County’s residents. These programs include education funding, healthcare assistance, and social safety net programs for vulnerable populations.

For example, the county’s education system benefits from property taxes, which fund schools, teacher salaries, and educational resources. This investment in education has a long-term impact, shaping the future workforce and the overall prosperity of the county. Additionally, tax-funded healthcare assistance programs ensure that residents have access to quality healthcare, regardless of their financial situation.

Challenges and Opportunities

While the Kanawha County tax system has many strengths, it also faces challenges and opportunities for improvement.

Tax Equity and Fairness

Ensuring tax equity and fairness is a continuous challenge for the county. With a diverse range of property types and income levels, creating a tax system that is perceived as fair by all taxpayers is a complex task. The county must strike a balance between generating sufficient revenue and ensuring that the tax burden is distributed equitably among its residents and businesses.

One approach to addressing this challenge is through regular tax rate reviews and adjustments. By analyzing the impact of tax rates on different segments of the population, the county can make informed decisions to ensure that the tax system remains fair and sustainable.

Economic Development and Tax Incentives

Kanawha County’s tax system also plays a crucial role in economic development. The county can offer tax incentives and abatements to attract new businesses and encourage existing businesses to expand. These incentives can take the form of reduced tax rates, tax holidays, or other tax-related benefits.

For instance, the county might offer a reduced B&O tax rate for a period of time to attract a new manufacturing facility. This incentive could be a significant factor in the decision-making process for businesses considering relocation or expansion. By offering such incentives, the county can stimulate economic growth and create jobs, benefiting the entire community.

Technology and Tax Administration

The adoption of technology in tax administration can greatly enhance efficiency and accuracy. Kanawha County can explore digital solutions for tax assessment, collection, and compliance. These technologies can streamline processes, reduce administrative costs, and improve taxpayer services.

For example, implementing an online tax assessment and payment platform can make it easier for taxpayers to understand their obligations and pay their taxes. This platform can also provide real-time updates on tax balances and due dates, reducing the likelihood of late payments and associated penalties.

Conclusion

The Kanawha County tax system is a complex yet essential component of the county’s financial landscape. It funds vital services, drives economic development, and shapes the community’s quality of life. While challenges exist, the county’s commitment to fair and efficient taxation ensures a stable and prosperous future for its residents and businesses.

By understanding the intricacies of the tax system, residents and businesses can make informed decisions, plan their finances effectively, and contribute to the continued success of Kanawha County.

How often are property values assessed in Kanawha County?

+Property values are assessed annually in Kanawha County. This ensures that the assessed value of properties remains current and reflects market trends.

Are there any tax relief programs for senior citizens in Kanawha County?

+Yes, Kanawha County offers tax relief programs for eligible senior citizens. These programs provide a reduction in property taxes for those who meet the income and residency requirements.

What is the process for appealing a property tax assessment in Kanawha County?

+If a property owner believes their assessment is inaccurate, they can file an appeal with the Kanawha County Assessor’s Office. The appeal process involves a review of the property’s value and the assessment methodology.

How does Kanawha County use the revenue generated from sales and use taxes?

+The revenue from sales and use taxes is used to fund various county services and initiatives. This includes funding for public safety, infrastructure projects, and social programs.

Are there any tax incentives for businesses considering relocation to Kanawha County?

+Yes, Kanawha County offers a range of tax incentives to attract new businesses. These incentives can include reduced tax rates, tax holidays, and other benefits to support economic development.