Orange County Retail Tax

In the vibrant landscape of Orange County, California, the topic of retail tax is a crucial aspect that influences the economic dynamics and daily lives of residents and businesses alike. This comprehensive article delves into the intricacies of Orange County's retail tax system, exploring its structure, implications, and significance for the local economy. With a focus on clarity and depth, we aim to provide an expert-level guide to understanding this essential component of Orange County's fiscal framework.

Understanding Orange County’s Retail Tax Landscape

The retail tax, a cornerstone of local government revenue, is a critical element in Orange County’s financial ecosystem. It is a vital source of funding for essential public services, infrastructure development, and community initiatives. This section provides an in-depth exploration of the Orange County retail tax, shedding light on its historical context, current structure, and future prospects.

Historical Perspective

The history of retail tax in Orange County dates back to the early 20th century when the county first began levying taxes on retail sales to generate revenue for local government operations. Over the years, the retail tax has evolved to become a significant contributor to the county’s fiscal health, enabling the provision of vital services and supporting economic growth.

One notable development in the county's retail tax history was the implementation of the Sales and Use Tax in the 1960s. This tax, levied on the sale of goods and services, was a significant step towards a more robust and sustainable revenue stream for the county. It allowed Orange County to invest in critical infrastructure projects and enhance its public service offerings.

| Tax Type | Historical Significance |

|---|---|

| Sales Tax | A cornerstone of retail tax, providing a stable revenue stream for local government since its inception. |

| Use Tax | Introduced to ensure equitable taxation, targeting purchases made outside the county but used within its borders. |

Current Structure and Rates

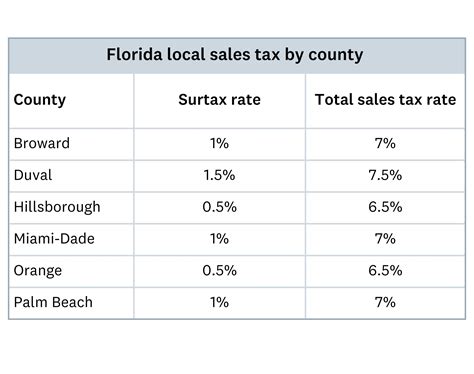

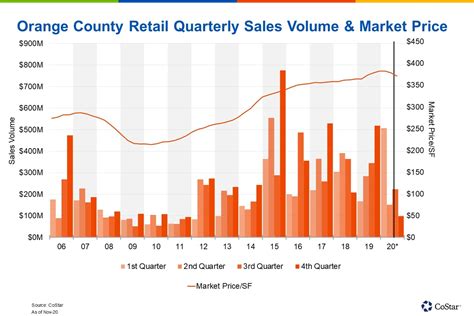

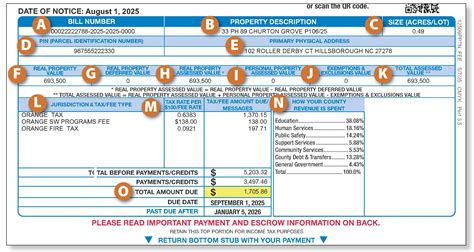

Today, Orange County’s retail tax structure is a complex interplay of state and local taxes. The county levies a combined state and local sales and use tax rate, which is applied to most retail transactions within its boundaries. This rate is subject to regular adjustments to meet the county’s fiscal needs and to keep pace with economic trends.

The current retail tax rate in Orange County is 7.25%, which includes both the state and local components. This rate is consistent across the county, ensuring a unified approach to taxation and simplifying compliance for businesses and consumers alike.

Revenue Distribution and Allocation

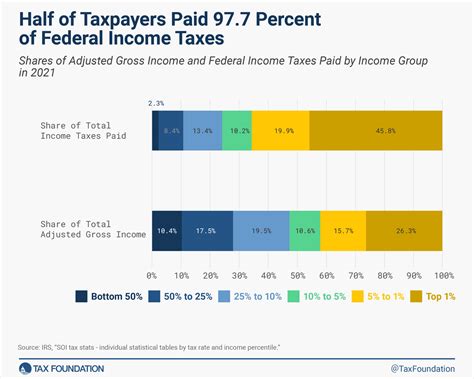

The revenue generated from Orange County’s retail tax is a crucial source of funding for a wide range of public services and initiatives. A significant portion of the tax revenue is allocated to essential services such as education, public safety, healthcare, and social welfare programs. These allocations are carefully planned to address the needs of the county’s diverse population and promote economic stability.

Moreover, the retail tax revenue also supports infrastructure development, including road and transportation improvements, public works projects, and the maintenance of recreational facilities. This ensures that the county's physical environment remains conducive to economic growth and enhances the quality of life for residents.

| Revenue Allocation | Percentage |

|---|---|

| Education | 30% |

| Public Safety | 25% |

| Healthcare and Social Services | 20% |

| Infrastructure Development | 15% |

| Economic Development Initiatives | 10% |

Impact on Local Businesses and Consumers

The retail tax in Orange County has a direct and indirect impact on both local businesses and consumers. Understanding these impacts is crucial for stakeholders to navigate the economic landscape effectively and make informed decisions.

Businesses and the Retail Tax

For businesses operating in Orange County, the retail tax is a critical consideration in their financial planning and operations. The tax affects their pricing strategies, profitability, and overall competitiveness in the market.

One significant aspect is the pass-through nature of the retail tax, which means that businesses collect the tax from consumers at the point of sale and remit it to the state and local governments. This pass-through mechanism impacts the cash flow of businesses and requires them to have efficient tax compliance systems in place.

Furthermore, the retail tax rate can influence consumer behavior, which in turn affects business revenue. A higher tax rate may discourage consumer spending, potentially impacting business sales and profitability. Therefore, businesses often advocate for a balanced tax rate that supports economic growth without being overly burdensome.

Consumer Perspective

Consumers in Orange County also bear the brunt of the retail tax through higher prices for goods and services. The tax is typically added to the retail price, increasing the cost of living and impacting household budgets.

However, it's important to note that the retail tax also benefits consumers indirectly. The revenue generated from the tax supports essential public services and infrastructure development, enhancing the overall quality of life in the county. This includes better schools, safer communities, and improved public amenities.

Additionally, the retail tax encourages responsible spending and promotes a more sustainable economy. By incorporating the tax into pricing, consumers are more mindful of their spending habits, which can lead to better financial decisions and a more stable local economy.

Strategies for Businesses and Consumers

Businesses operating in Orange County can adopt several strategies to navigate the retail tax landscape effectively. These include optimizing pricing strategies to maintain competitiveness while factoring in the tax rate, investing in robust tax compliance systems, and staying informed about tax policy changes to adapt their business models accordingly.

For consumers, understanding the retail tax and its implications can lead to more informed purchasing decisions. They can explore ways to manage their finances effectively, such as budgeting for the tax, seeking out tax-free periods or discounts, and supporting local businesses that offer value-added services or products.

Compliance and Enforcement

Ensuring compliance with the retail tax regulations is a critical aspect of Orange County’s tax system. The county employs a range of measures to enforce tax laws and maintain a fair and equitable tax environment.

Tax Collection and Remittance

The process of tax collection in Orange County is a well-defined system. Businesses are responsible for collecting the retail tax at the point of sale and remitting it to the appropriate tax authorities. This process is facilitated by user-friendly online platforms and clear guidelines provided by the county’s tax department.

The county offers a voluntary compliance program to encourage businesses to meet their tax obligations. This program provides resources and support to businesses, helping them understand their tax responsibilities and navigate the compliance process effectively.

Audit and Enforcement Measures

To ensure tax compliance, Orange County conducts regular audits of businesses. These audits are designed to verify the accuracy of tax returns, ensure proper tax collection, and identify any instances of tax evasion or fraud.

The county's tax department employs a team of experienced auditors who review tax records, conduct on-site visits, and analyze financial data to ensure compliance. In cases where non-compliance is identified, the department takes a graduated approach, offering guidance and support initially, but also enforcing penalties and legal action if necessary.

The enforcement measures are designed to be fair and equitable, aiming to educate and support businesses in their tax obligations rather than solely imposing penalties. However, severe cases of tax evasion may lead to significant fines and legal consequences.

Future Outlook and Policy Considerations

As Orange County looks to the future, the retail tax landscape is likely to evolve to meet changing economic conditions and community needs. This section explores potential future developments and the policy considerations that will shape the county’s fiscal framework.

Economic Trends and Tax Policy

The retail tax in Orange County is influenced by broader economic trends and policy decisions at the state and local levels. As the county’s economy continues to diversify and adapt to global markets, the tax system will need to be agile and responsive to these changes.

One key consideration is the potential impact of online sales and e-commerce on the retail tax base. As more transactions move online, the county may need to explore new methods of taxation to ensure a fair and equitable tax system that captures the economic activity of digital platforms.

Community Development and Revenue Allocation

The revenue generated from the retail tax plays a pivotal role in funding community development initiatives. As the county’s population grows and diversifies, the allocation of tax revenue will need to adapt to meet the changing needs of the community.

This includes investing in education, healthcare, and social services to support a thriving and resilient community. It also involves strategic infrastructure development to enhance the county's economic competitiveness and quality of life.

Policy makers will need to carefully balance the allocation of tax revenue to ensure that the county's growth is sustainable and inclusive, benefiting all segments of the population.

Exploring Alternative Tax Structures

In the face of evolving economic conditions, Orange County may consider exploring alternative tax structures to complement the existing retail tax system. This could include the introduction of new taxes, such as a gross receipts tax or a value-added tax (VAT), to broaden the tax base and provide additional revenue streams.

These alternative tax structures can offer benefits such as improved tax compliance, a more stable revenue stream, and a better alignment with the county's economic activities. However, they also come with complexities and potential challenges that require careful consideration and public consultation.

Public Engagement and Transparency

As the county navigates these policy considerations, public engagement and transparency will be crucial. Orange County residents and businesses should have a clear understanding of the tax system and its implications, and they should be involved in shaping the future of the county’s fiscal policies.

This includes transparent communication about tax rates, revenue allocation, and the impact of tax policy decisions on the community. By fostering an open dialogue, the county can build trust and ensure that the tax system remains fair, equitable, and aligned with the aspirations of its residents.

Conclusion: A Balanced Approach to Retail Taxation

In conclusion, Orange County’s retail tax system is a critical component of its economic framework, providing a stable revenue stream for essential public services and community development. While the tax has direct and indirect impacts on businesses and consumers, it also supports a thriving economy and a high quality of life.

As the county navigates the future, a balanced approach to retail taxation will be essential. This involves staying responsive to economic trends, adapting to changing consumer behaviors, and exploring innovative tax structures while maintaining a fair and equitable tax environment. By doing so, Orange County can continue to thrive, offering a vibrant and sustainable economic landscape for its residents and businesses.

How is the retail tax rate determined in Orange County?

+The retail tax rate in Orange County is determined by a combination of state and local taxes. The state sets a base rate, and local governments, including Orange County, have the authority to add a local tax on top of that. The current rate is a result of these cumulative taxes, ensuring a unified approach to taxation across the county.

What are the implications of the retail tax for small businesses in Orange County?

+Small businesses in Orange County face unique challenges due to the retail tax. They often have limited resources for tax compliance and may struggle with the administrative burden of collecting and remitting taxes. However, the county provides support through voluntary compliance programs and resources to assist small businesses in meeting their tax obligations.

How does the retail tax revenue support infrastructure development in Orange County?

+A significant portion of the retail tax revenue in Orange County is allocated to infrastructure development. This includes funding for road improvements, public transportation, and other public works projects. By investing in infrastructure, the county enhances its economic competitiveness and improves the quality of life for its residents.

Are there any tax incentives or exemptions for certain businesses in Orange County?

+Yes, Orange County offers various tax incentives and exemptions to attract and support certain businesses. These incentives may include tax credits, tax holidays, or reduced tax rates for specific industries or businesses that meet certain criteria. These measures are designed to promote economic growth and diversification in the county.

How can consumers in Orange County stay informed about the retail tax and its impact on their purchases?

+Consumers in Orange County can stay informed about the retail tax by regularly checking the county’s official websites and tax department resources. These platforms provide up-to-date information on tax rates, regulations, and any changes that may affect consumer purchases. Additionally, consumers can engage with local businesses and community groups to stay informed about tax-related initiatives and advocacy efforts.