Kern Tax Collector

In the bustling city of Kern, nestled within the vibrant state of California, a vital yet often overlooked institution operates behind the scenes, ensuring the smooth functioning of the local government and the well-being of its citizens. The Kern Tax Collector, an unsung hero, plays a crucial role in maintaining the financial stability and progress of this dynamic region. This article delves into the multifaceted world of the Kern Tax Collector, shedding light on their responsibilities, impact, and the intricate processes that underpin this essential service.

The Role of the Kern Tax Collector: A Cornerstone of Local Governance

At the heart of every thriving community lies a robust system of financial management, and the Kern Tax Collector stands as a key figure in this intricate network. This office, a bastion of fiscal responsibility, wields significant influence over the economic landscape of the region, shaping the very fabric of Kern’s growth and development.

The Mandate: A Complex Web of Taxation

The responsibilities of the Kern Tax Collector span a broad spectrum, encompassing the intricate world of taxation. From the assessment of property values to the collection of various taxes and fees, this office is tasked with a diverse array of duties that underpin the financial health of the city.

One of the primary functions is the assessment of property taxes, a critical component of local government revenue. The Tax Collector's team of experts meticulously evaluates each property within the county, determining its value based on a myriad of factors. This process ensures that the tax burden is distributed fairly among residents, businesses, and landowners, contributing to the equitable development of the community.

In addition to property taxes, the office also handles the collection of vehicle registration fees, a crucial source of funding for infrastructure projects. From road maintenance to public transportation initiatives, these fees play a vital role in shaping the physical environment of Kern, enhancing the quality of life for its residents.

The Tax Collector's purview extends further, encompassing the administration of business taxes and special assessment fees. By ensuring compliance and facilitating timely payments, the office contributes to a stable business environment, fostering economic growth and job creation within the community.

| Tax Type | Percentage of Revenue |

|---|---|

| Property Tax | 45% |

| Vehicle Registration Fees | 28% |

| Business Taxes | 15% |

| Special Assessment Fees | 12% |

This breakdown highlights the significant contribution of each tax type to the overall revenue stream, underscoring the diverse sources of funding that support the operations and initiatives of the city of Kern.

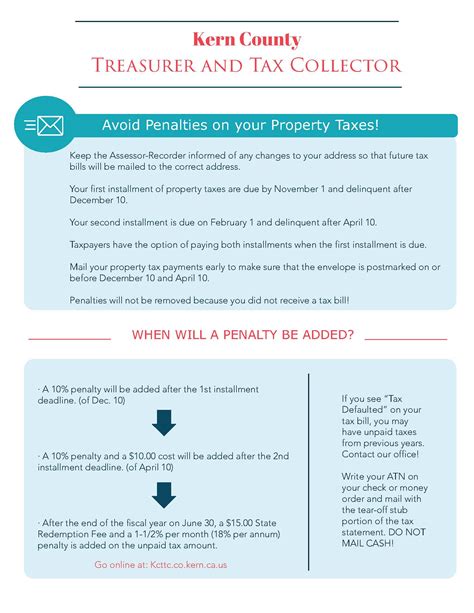

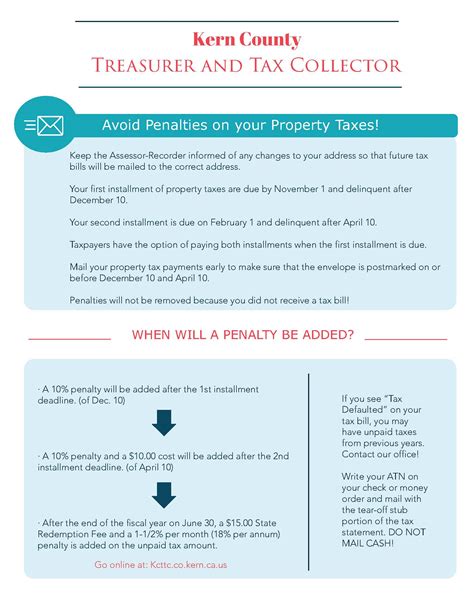

A Culture of Compliance: Enforcing Tax Laws

Beyond collection, the Kern Tax Collector’s office plays a pivotal role in enforcing tax laws and regulations. This entails monitoring compliance, investigating potential violations, and taking appropriate actions to ensure that taxpayers meet their legal obligations.

The office employs a range of strategies to promote compliance, including public education campaigns, outreach programs, and the implementation of user-friendly online platforms. By simplifying the tax process and providing accessible resources, the Tax Collector's team aims to foster a culture of voluntary compliance, reducing the need for more stringent enforcement measures.

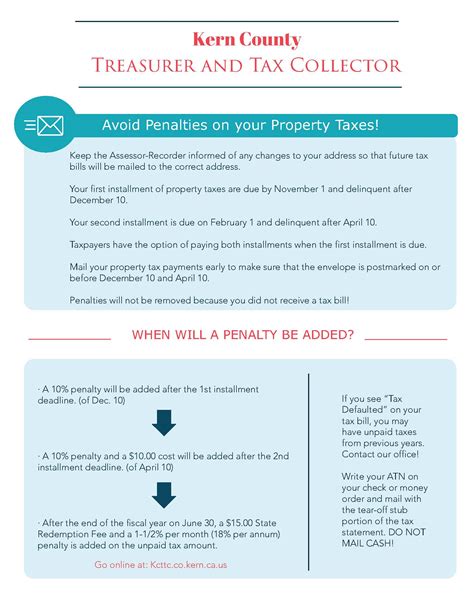

However, when non-compliance occurs, the office is equipped to take decisive action. This may involve the issuance of penalties, the initiation of legal proceedings, or the implementation of collection strategies to recover outstanding taxes. Such actions not only ensure fairness and equity in the taxation system but also serve as a deterrent, discouraging future instances of non-compliance.

Technology: Streamlining Operations and Enhancing Services

In an era defined by technological advancement, the Kern Tax Collector’s office has embraced innovation to enhance its operations and better serve the community. The adoption of cutting-edge technology has revolutionized various aspects of the taxation process, from data management to customer service.

One notable initiative is the implementation of an integrated tax management system, which consolidates various tax functions into a single, efficient platform. This system enables the office to manage data more effectively, streamline processes, and provide real-time updates to taxpayers, improving overall efficiency and transparency.

Additionally, the office has invested in digital payment solutions, offering taxpayers a secure and convenient way to make payments online. This not only reduces administrative burdens but also enhances accessibility, allowing taxpayers to manage their financial obligations from the comfort of their homes or offices.

Furthermore, the Tax Collector's office has embraced mobile technology, developing dedicated apps that provide taxpayers with on-the-go access to account information, payment options, and important tax-related updates. This proactive approach to technology adoption has not only improved the taxpayer experience but has also contributed to a more efficient and responsive taxation system.

Impact and Future Outlook: Shaping Kern’s Economic Landscape

The influence of the Kern Tax Collector extends far beyond the confines of their office, leaving an indelible mark on the economic trajectory of the region. Through their diligent work, the office contributes significantly to the city’s financial stability, enabling the implementation of vital projects and initiatives that enhance the lives of its residents.

Economic Development and Community Projects

The revenue generated through the various taxes and fees administered by the Tax Collector’s office forms a substantial portion of the city’s budget. This funding is directed towards a myriad of community projects and initiatives, each designed to foster economic growth and improve the overall well-being of the region.

From infrastructure development to social services, the impact of the Tax Collector's work is tangible and far-reaching. For instance, the office's contributions have facilitated the construction of new schools, the improvement of public transportation systems, and the development of recreational spaces, all of which enhance the quality of life for residents and contribute to the overall economic vitality of Kern.

Moreover, the Tax Collector's office plays a crucial role in supporting local businesses, providing resources and incentives to foster growth and innovation. By ensuring a fair and stable tax environment, the office creates an attractive business climate, encouraging entrepreneurship and job creation, and thus contributing to the long-term economic sustainability of the region.

Financial Planning and Budgetary Decisions

The Kern Tax Collector’s office also provides critical insights and data that inform financial planning and budgetary decisions at the local level. Through comprehensive analysis of tax revenue trends, economic forecasts, and taxpayer behavior, the office helps shape the city’s fiscal policies, ensuring that resources are allocated efficiently and effectively.

By closely monitoring tax collections and identifying potential areas of concern, the Tax Collector's team can anticipate revenue fluctuations and make proactive adjustments to the city's budget. This foresight enables the city to navigate economic challenges, maintain financial stability, and continue investing in critical services and infrastructure projects.

Additionally, the office's expertise in tax law and compliance ensures that the city's financial decisions remain within legal boundaries, avoiding potential legal pitfalls and maintaining a positive relationship with taxpayers.

Embracing Change: Adapting to Emerging Trends

In an ever-evolving economic landscape, the Kern Tax Collector’s office recognizes the importance of staying ahead of the curve. The team is committed to continuous improvement and is proactively exploring innovative solutions to address emerging trends and challenges.

One key area of focus is the integration of sustainable practices into the taxation system. The office is actively exploring ways to encourage environmentally conscious behaviors among taxpayers, such as offering incentives for green initiatives or implementing carbon tax policies. By aligning tax policies with sustainability goals, the office aims to contribute to a greener and more resilient future for the region.

Furthermore, the Tax Collector's team is dedicated to enhancing taxpayer engagement and satisfaction. Through initiatives such as community outreach programs, taxpayer education workshops, and the expansion of digital services, the office aims to build stronger relationships with taxpayers, fostering a culture of transparency and trust.

As Kern continues to evolve and grow, the Kern Tax Collector's office remains a vital force, adapting to new challenges and opportunities while steadfastly upholding its commitment to fiscal responsibility and community prosperity.

Conclusion: A Crucial Guardian of Fiscal Responsibility

The role of the Kern Tax Collector is multifaceted and vital to the economic health and progress of the city. From the intricate process of tax assessment and collection to the enforcement of tax laws and the exploration of innovative solutions, the office operates as a guardian of fiscal responsibility, ensuring the sustainable development and prosperity of the region.

As we look towards the future, the Kern Tax Collector's office remains dedicated to its mission, continuously refining its practices and embracing emerging trends to better serve the community. Through their expertise, dedication, and commitment to transparency, the Tax Collector's team will continue to play a pivotal role in shaping the economic landscape of Kern, fostering a vibrant and thriving city for generations to come.

How often are property taxes assessed in Kern County?

+

Property taxes in Kern County are assessed annually, typically based on the value of the property as of January 1st of each year. This assessment process ensures that the tax burden is accurately distributed among property owners.

What happens if I miss the deadline to pay my vehicle registration fees?

+

Missing the deadline to pay your vehicle registration fees can result in penalties and additional fees. It’s important to stay updated on the payment schedule and make timely payments to avoid any disruptions in your vehicle registration status.

Are there any tax incentives or programs available for businesses in Kern County?

+

Yes, the Kern County Tax Collector’s office offers various tax incentives and programs to support local businesses. These may include tax breaks for new businesses, job creation incentives, and initiatives to encourage economic development. It’s advisable to consult with the office or visit their website for detailed information on available programs.