Wilco Property Tax

In the realm of property ownership and financial obligations, understanding the intricacies of property tax is essential. Wilco Property Tax, a system designed to generate revenue for local governments and fund essential services, is a complex topic that warrants in-depth exploration. This comprehensive guide aims to unravel the various aspects of Wilco Property Tax, providing a detailed analysis for property owners and stakeholders.

The Wilco Property Tax Landscape

Wilco Property Tax, implemented by the Wilcox County Tax Commissioner, is a vital component of the local government’s revenue stream. It plays a crucial role in financing public services, infrastructure development, and maintaining the overall well-being of the community. The tax is calculated based on the assessed value of properties, ensuring a fair and equitable distribution of financial responsibilities among property owners.

The process begins with the annual property assessment, where trained assessors evaluate the value of each property within the county. This assessment considers various factors such as the property's size, location, improvements, and market trends. The assessed value is then used as the basis for calculating the property tax liability for the upcoming year.

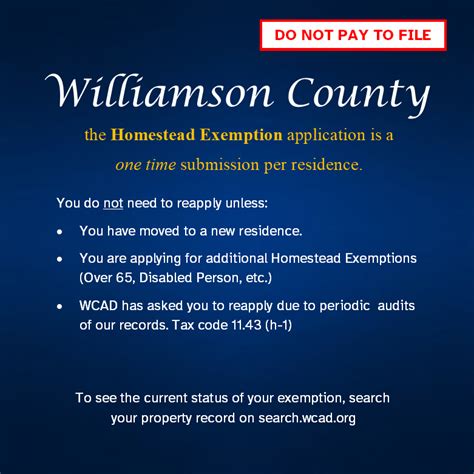

One of the unique features of Wilco Property Tax is its homestead exemption program. This initiative aims to provide relief to homeowners by reducing the taxable value of their primary residence. Eligible homeowners can apply for this exemption, which can significantly lower their property tax burden. The homestead exemption not only benefits individual homeowners but also encourages homeownership and stability within the community.

The Impact of Wilco Property Tax on Local Businesses

Wilco Property Tax also extends to commercial properties, impacting businesses of all sizes. While the tax contributes to the overall economic health of the county, it is essential for businesses to understand their tax obligations and explore potential relief programs. The county offers various incentives and abatements to attract and support local businesses, promoting economic growth and job creation.

For instance, the Wilcox County Economic Development Authority (WICEDA) works closely with businesses to navigate the property tax landscape. WICEDA provides resources and guidance to help businesses understand their tax responsibilities and take advantage of available incentives. This support ensures that businesses can thrive while contributing to the county's revenue base.

| Wilcox County Property Tax Rate (per $1000) | 2023 |

|---|---|

| Residential | 45.00 |

| Commercial | 50.00 |

The table above illustrates the current property tax rates for Wilcox County. These rates are subject to change annually, influenced by factors such as the county's budget needs and economic conditions.

Understanding the Assessment and Appeal Process

Wilcox County recognizes the importance of a fair and transparent assessment process. Property owners have the right to review their assessment and understand the factors contributing to their property’s value. If a property owner disagrees with the assessed value, they can initiate an appeal. The Wilcox County Board of Equalization oversees these appeals, ensuring a thorough and impartial review.

The appeal process involves several steps, including a formal request for review, an informal meeting with the assessor, and, if necessary, a formal hearing. Property owners are encouraged to gather supporting documentation, such as recent sales data and property condition reports, to strengthen their case. It is essential to understand the timeline and requirements for each stage of the appeal process to ensure a successful outcome.

The Role of Technology in Wilco Property Tax

Wilco Property Tax has embraced technological advancements to enhance efficiency and transparency. The Wilcox County Tax Commissioner’s office has implemented an online platform, allowing property owners to access their tax information, view assessment details, and even pay their taxes securely online. This digital transformation not only improves convenience but also reduces administrative burdens for both property owners and tax officials.

Additionally, the use of geographic information systems (GIS) has revolutionized the assessment process. GIS technology enables assessors to create detailed maps and analyze spatial data, ensuring accurate and consistent assessments. This technology has improved the overall accuracy of property tax calculations, leading to a more equitable distribution of tax liabilities.

The Future of Wilco Property Tax

As Wilcox County continues to evolve and grow, the Wilco Property Tax system must adapt to meet the changing needs of the community. The county’s leadership is committed to maintaining a fair and sustainable tax system, striking a balance between generating revenue and supporting economic development.

Looking ahead, the focus is on further streamlining the tax assessment and collection process. This includes exploring additional online services, such as digital property tax records and automated valuation models. These initiatives aim to reduce administrative costs, improve accuracy, and enhance the overall taxpayer experience.

Furthermore, the county is actively engaging with property owners and businesses to gather feedback and address concerns. This collaborative approach ensures that the Wilco Property Tax system remains responsive to the needs of the community, fostering trust and transparency.

How often are property assessments conducted in Wilcox County?

+Property assessments in Wilcox County are conducted annually to ensure accurate and up-to-date valuation of properties. This ensures fairness and equity in the property tax system.

What are the key factors considered in the property assessment process?

+The property assessment process considers various factors, including property size, location, improvements, market trends, and recent sales data. These elements collectively determine the property’s assessed value.

How can property owners stay informed about changes in Wilco Property Tax?

+Property owners can stay informed by regularly visiting the Wilcox County Tax Commissioner’s website, subscribing to their newsletter, and attending community meetings or workshops. Staying connected ensures access to the latest updates and changes in the property tax landscape.