Prince George's County Property Tax

Welcome to a comprehensive guide on understanding and navigating the world of property taxes in Prince George's County, Maryland. Property taxes are an essential aspect of homeownership and can significantly impact your financial planning. In this article, we will delve into the specifics of Prince George's County property taxes, providing you with valuable insights and practical information.

Understanding Prince George’s County Property Taxes

Property taxes in Prince George’s County are an annual assessment levied on real estate property owners. These taxes are a vital source of revenue for the county, contributing to the funding of various public services, including education, infrastructure, and community development. Understanding how property taxes work and how they are calculated is crucial for homeowners and prospective buyers alike.

The property tax system in Prince George's County operates based on a combination of factors, including the assessed value of the property, the tax rate, and any applicable exemptions or credits. Let's break down each of these components to gain a clearer understanding.

Assessed Value of Property

The assessed value of a property is determined by the Prince George’s County Department of Finance through a process known as property assessment. This assessment takes into account various factors, such as the property’s location, size, condition, and recent sales data of similar properties in the area. The assessed value serves as the basis for calculating the property tax liability.

It's important to note that the assessed value may differ from the market value of the property. The assessed value is used specifically for tax purposes and is not an indicator of the property's resale value. Property owners can access their assessment records and appeal the assessed value if they believe it to be inaccurate.

| Assessment Year | Average Assessed Value Increase |

|---|---|

| 2022 | 3.5% |

| 2021 | 4.2% |

| 2020 | 2.7% |

Tax Rate and Calculation

The property tax rate in Prince George’s County is determined by the County Council and is subject to change annually. The tax rate is expressed as a percentage and is applied to the assessed value of the property to calculate the tax liability. For the current tax year, the general tax rate stands at 1.0617% for residential properties and 1.3271% for commercial properties.

To illustrate, let's consider an example. If a residential property has an assessed value of $300,000, the property tax liability for that property would be calculated as follows:

$300,000 (assessed value) x 1.0617% (tax rate) = $3,185.10 (annual property tax)

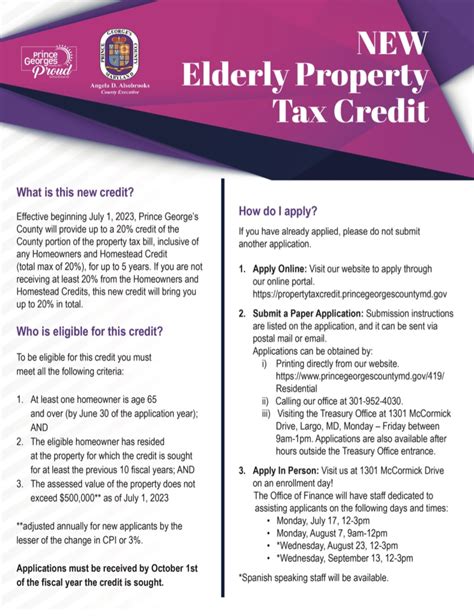

Exemptions and Credits

Prince George’s County offers various exemptions and credits to eligible property owners, which can reduce their tax liability. These exemptions and credits are designed to provide relief to specific groups, such as senior citizens, veterans, and individuals with disabilities. Here are some of the commonly available exemptions and credits:

- Homestead Tax Credit: This credit reduces the taxable assessed value of a property by up to $2,000 for eligible homeowners.

- Senior Citizen Property Tax Credit: Senior citizens who meet certain income requirements may qualify for a credit that reduces their property tax liability.

- Veterans' Property Tax Exemption: Eligible veterans can receive an exemption from a portion of their property's assessed value, reducing their tax liability.

- Disabled Persons' Property Tax Credit: Individuals with disabilities may be eligible for a credit based on their income and disability status.

Property Tax Payment Options and Deadlines

Prince George’s County offers several convenient payment options for property taxes. Property owners can choose from the following methods:

- Online Payment: The most popular option, allowing property owners to pay their taxes securely through the Prince George's County Online Payment Portal. This method provides real-time confirmation of payment and is accessible 24/7.

- Mail-In Payment: Property owners can mail their tax payments to the Prince George's County Treasury Division. It's important to ensure that the payment is received before the deadline to avoid penalties.

- In-Person Payment: Payments can be made in person at the Treasury Division offices during regular business hours. This option provides immediate confirmation of payment.

The property tax payment deadlines are typically divided into two installments. The first installment is due by July 1st, while the second installment is due by November 1st. Failure to pay by the deadline may result in penalties and interest charges.

Appealing Property Tax Assessments

If a property owner believes that their assessed value is inaccurate or unfair, they have the right to appeal the assessment. The Prince George’s County Office of Administrative Hearings handles property tax assessment appeals. Here’s a step-by-step guide to the appeal process:

- Review the Assessment Notice: Upon receiving the assessment notice, carefully review the details, including the assessed value and any changes from the previous year.

- Gather Evidence: Collect relevant documentation and evidence to support your case, such as recent sales data of similar properties, property condition reports, or expert appraisals.

- File an Appeal: Property owners have a limited time frame, typically 45 days from the assessment notice, to file an appeal. The appeal can be submitted online or by mail.

- Hearing: If the appeal is accepted, a hearing will be scheduled. During the hearing, both parties present their cases, and a decision is made by an administrative law judge.

- Decision: The decision of the administrative law judge is final, but property owners have the option to appeal further to the Maryland Tax Court within a specified timeframe.

Impact of Property Taxes on Homeownership

Property taxes play a significant role in the overall cost of homeownership. When considering purchasing a property in Prince George’s County, it’s essential to factor in the property tax liability. Here are some key points to consider:

- Budgeting: Property taxes are a recurring expense that homeowners must plan for annually. Including property taxes in your budget ensures financial stability and avoids unexpected surprises.

- Comparison with Other Counties: Prince George's County property taxes may vary compared to other counties in Maryland. Comparing tax rates and assessed values can provide valuable insights when considering a move or investment.

- Impact on Housing Market: Property taxes can influence the housing market in Prince George's County. Areas with lower tax rates may be more attractive to homebuyers, potentially impacting property values and demand.

- Exemptions and Credits: Understanding the available exemptions and credits can provide significant savings for eligible homeowners. It's beneficial to explore these options and determine eligibility to reduce tax liability.

Future Outlook and Potential Changes

The property tax landscape in Prince George’s County is subject to change based on various factors, including economic conditions, county budget requirements, and political decisions. Here are some potential future developments to consider:

- Tax Rate Adjustments: The County Council may propose changes to the tax rate to address budget needs or economic fluctuations. Property owners should stay informed about any proposed adjustments.

- Assessment Reforms: Efforts to improve the accuracy and fairness of property assessments are ongoing. Future reforms may impact the assessment process and potentially reduce assessment disparities.

- Exemption and Credit Expansions: The county may explore expanding existing exemptions or introducing new ones to provide relief to a broader range of property owners.

- Digital Transformation: Prince George's County is continuously enhancing its online services, including property tax payment portals and assessment databases. Future improvements may streamline the tax process and enhance transparency.

Conclusion

Understanding and navigating the property tax system in Prince George’s County is essential for both current and prospective property owners. By familiarizing yourself with the assessment process, tax rates, payment options, and available exemptions, you can effectively manage your property tax obligations. Remember, staying informed and seeking professional advice when needed can make a significant difference in your financial planning and overall homeownership experience.

Frequently Asked Questions

How can I estimate my property tax liability before purchasing a home in Prince George’s County?

+To estimate your property tax liability, you can use the county’s online property tax calculator. This tool allows you to input the property’s assessed value and tax rate to estimate the annual tax. Additionally, consulting with a local real estate agent or tax professional can provide accurate estimates based on recent sales data and market trends.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline may result in penalties and interest charges. It’s important to note that these penalties can accumulate over time, so it’s best to make timely payments to avoid additional costs. If you encounter financial difficulties, contact the Treasury Division to discuss potential payment plans or extensions.

Are there any property tax relief programs available for low-income homeowners in Prince George’s County?

+Yes, Prince George’s County offers the Circuit Breaker Program, which provides property tax relief to eligible low-income homeowners. To qualify, homeowners must meet certain income and property value requirements. The program can significantly reduce the tax liability for those who meet the criteria.

How often are property assessments conducted in Prince George’s County?

+Property assessments in Prince George’s County are conducted on a triennial basis, meaning they occur every three years. The most recent assessment cycle was completed in 2022. However, it’s important to note that property owners can appeal their assessments if they believe them to be inaccurate or unfair.

Can I pay my property taxes early, and are there any benefits to doing so?

+Yes, you can pay your property taxes early without any penalties. In fact, paying early can provide some benefits, such as avoiding potential late fees and interest charges. Additionally, early payment ensures peace of mind and helps with financial planning.