San Jose Ca Sales Tax

When doing business in San Jose, California, understanding the sales tax landscape is crucial for both businesses and consumers. The sales tax in San Jose is a complex system that varies based on the type of goods or services being sold, the location of the transaction, and the purpose of the purchase. This comprehensive guide will delve into the intricacies of San Jose's sales tax, providing valuable insights for those navigating the local tax environment.

Understanding San Jose’s Sales Tax Structure

The sales tax in San Jose, like the rest of California, is composed of several tax rates that add up to the total tax paid by consumers. This composite rate is made up of three main components: the state sales tax rate, the county sales tax rate, and the city sales tax rate.

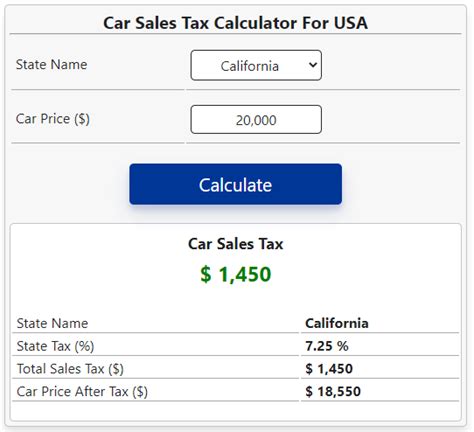

The state sales tax rate in California is set at 7.25%. This rate is applied uniformly across the state and forms the foundation of the sales tax structure. However, it is important to note that this is just the base rate, and additional taxes can be added on top of this by counties and cities.

The county sales tax rate for Santa Clara County, where San Jose is located, is currently set at 0.90%. This rate is applied on top of the state sales tax rate, bringing the total tax rate up to 8.15% for all sales within the county.

The city sales tax rate for San Jose is an additional 0.25%, making the total sales tax rate for the city 8.40%. This rate applies to all sales within the city limits of San Jose.

Therefore, the total sales tax rate for a transaction in San Jose is the sum of these three rates: 7.25% (state) + 0.90% (county) + 0.25% (city) = 8.40%.

Exceptions and Exemptions

It’s important to note that not all goods and services are subject to the full sales tax rate. California has a range of exemptions and special tax rates for certain types of transactions. These can include sales of prescription drugs, certain groceries, and manufacturing equipment, among others.

Additionally, sales tax rates can vary depending on the purpose of the purchase. For example, sales tax may be lower or even exempt for purchases made for resale or certain business-to-business transactions.

Businesses operating in San Jose should be aware of these exemptions and special rates, as they can significantly impact the tax liability of their operations.

Sales Tax for Online Sales

With the rise of e-commerce, it’s crucial to understand how sales tax applies to online transactions. In San Jose, online sales are subject to the same sales tax rates as in-person transactions. This means that businesses selling goods or services online to San Jose residents must collect and remit the appropriate sales tax.

The complexity of online sales tax compliance has led to the development of various software tools and services to help businesses navigate these waters. These solutions can help calculate the correct tax rate based on the location of the customer and the nature of the transaction, ensuring compliance with local tax laws.

Sales Tax Registration and Compliance

Businesses operating in San Jose are required to register for a seller’s permit with the California Department of Tax and Fee Administration (CDTFA). This permit allows businesses to collect and remit sales tax on behalf of the state, county, and city.

Registration typically involves providing basic business information, such as the business name, address, and contact details, as well as details about the nature of the business and the goods or services being sold.

Once registered, businesses must collect the appropriate sales tax from customers at the point of sale and remit these taxes to the CDTFA on a regular basis. The frequency of these remittances can vary depending on the business's sales volume and other factors.

Sales Tax Filing and Payment

Businesses are responsible for filing sales tax returns with the CDTFA on a regular basis. The frequency of these filings can range from monthly to quarterly, depending on the business’s sales volume and other factors. These returns must include a detailed report of the sales tax collected during the reporting period, along with the payment of the taxes due.

Businesses can file and pay their sales tax returns online through the CDTFA's website, which offers a secure and convenient platform for tax compliance. This online system allows businesses to track their tax obligations, view previous filings, and make payments easily.

Sales Tax Audits and Penalties

The CDTFA regularly conducts audits to ensure compliance with sales tax laws. These audits can range from simple desk audits, where the business provides documentation to support its tax filings, to more comprehensive field audits, where CDTFA representatives visit the business premises to review records and conduct interviews.

Non-compliance with sales tax laws can result in significant penalties and interest charges. These penalties can include late payment penalties, underpayment penalties, and penalties for failing to register or file tax returns.

To avoid these penalties, businesses should ensure they are properly registered, collect the correct sales tax from customers, and file accurate and timely tax returns.

Sales Tax and the Consumer

For consumers in San Jose, understanding sales tax is essential for making informed purchasing decisions. The sales tax rate can significantly impact the total cost of a purchase, especially for larger ticket items.

When shopping in San Jose, consumers should be aware of the total sales tax rate of 8.40%. This rate is typically included in the displayed price of goods or services, but it's always a good idea to confirm the final price, including tax, before making a purchase.

Additionally, consumers should be aware of their rights when it comes to sales tax. If a business fails to collect the correct sales tax or provides incorrect information about the tax rate, consumers can report these issues to the CDTFA. The CDTFA takes these reports seriously and may investigate the business for potential non-compliance.

Sales Tax on Specific Items

The sales tax rate can vary depending on the type of goods or services being purchased. For example, certain types of food, clothing, and footwear are exempt from sales tax in California. However, these exemptions can vary based on the price and type of item, so it’s important for consumers to be aware of the specific rules.

Additionally, there are special tax rates for certain types of transactions, such as purchases made for resale or certain business-to-business transactions. Consumers involved in these types of transactions should understand the specific tax rules that apply to them.

Future of Sales Tax in San Jose

The sales tax landscape in San Jose, like the rest of California, is constantly evolving. As the state and local governments continue to face budgetary challenges, there is a possibility of future sales tax rate increases or changes to the structure of the tax.

Additionally, with the increasing focus on e-commerce and online sales, there may be further developments in the way sales tax is applied to these transactions. This could include changes to the way online sales are taxed or the introduction of new reporting and filing requirements for online businesses.

Businesses and consumers alike should stay informed about these potential changes and be prepared to adapt their operations or purchasing strategies accordingly.

How often do businesses need to file sales tax returns in San Jose?

+

The frequency of sales tax return filings can vary based on a business’s sales volume. Generally, businesses with higher sales volumes are required to file more frequently, often on a monthly basis. Businesses with lower sales volumes may file on a quarterly basis. However, it’s important for businesses to consult with a tax professional or the CDTFA to determine their specific filing requirements.

Are there any sales tax holidays in San Jose or California?

+

Yes, California does have sales tax holidays. These are designated periods where certain types of purchases, such as back-to-school supplies or energy-efficient appliances, are exempt from sales tax. These holidays are typically announced by the state government in advance and can be a great opportunity for consumers to save money on specific purchases.

What happens if a business fails to collect or remit sales tax in San Jose?

+

Businesses that fail to collect or remit sales tax in San Jose can face significant penalties and interest charges. These penalties can include late payment penalties, underpayment penalties, and penalties for failing to register or file tax returns. In some cases, businesses may also be subject to criminal charges for tax evasion.