Sales Tax In Florida Orlando

Understanding the sales tax system in Florida, particularly in the vibrant city of Orlando, is crucial for both residents and visitors alike. Sales tax is an essential component of the state's revenue generation, contributing significantly to funding public services and infrastructure. This guide will delve into the intricacies of Florida's sales tax structure, with a specific focus on Orlando, to provide a comprehensive understanding of this important economic mechanism.

The Florida Sales Tax Landscape

Florida is one of the few states in the US that imposes a sales and use tax on nearly all tangible personal property and certain services. The state’s sales tax system is relatively straightforward, with a uniform state sales tax rate applicable across the state. However, it’s important to note that counties and municipalities can also impose additional sales tax, creating a layered tax structure.

The current state sales tax rate in Florida is 6%. This rate is applicable to most transactions, including the sale of goods and some services. However, there are certain exceptions and exemptions to this general rule, which we will explore in detail later.

Local Taxes in Florida

In addition to the state sales tax, local governments in Florida are authorized to levy additional sales surtaxes, creating a unique tax landscape across the state. These local taxes are often used to fund specific community projects, such as schools, transportation, and local infrastructure development.

For instance, Orange County, where Orlando is located, has a 1% additional sales tax to support the county's general fund. This means that, in addition to the state sales tax, consumers in Orange County pay a total sales tax of 7% on most purchases. The revenue from this local tax goes towards essential services like public safety, health, and social services.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Florida | 6% |

| Orange County | 1% |

| Orlando (City) | 1% |

| Total Tax in Orlando | 8% |

Sales Tax Exemptions in Florida

While the sales tax in Florida applies to a broad range of goods and services, there are certain categories that are exempt. These exemptions are designed to encourage specific behaviors, support certain industries, or assist specific populations. Understanding these exemptions is crucial for both consumers and businesses to navigate the sales tax landscape effectively.

Exemptions for Goods

Florida’s sales tax does not apply to a number of specific goods, including:

- Prescription medications and certain medical devices are exempt from sales tax. This exemption aims to reduce the financial burden on individuals requiring medical treatment.

- Food and drinks for home consumption are also exempt. This exemption is a significant benefit for households, especially those with a large family, as it can substantially reduce their grocery bills.

- Clothing is exempt from sales tax in Florida, providing a significant saving for residents and visitors alike. This exemption can make a notable difference, particularly when purchasing a new wardrobe or seasonal clothing.

- Certain agricultural equipment and supplies are exempt to support the state's agricultural industry.

Exemptions for Services

Florida also provides sales tax exemptions for certain services, including:

- Professional services such as legal, accounting, and consulting services are exempt from sales tax.

- Healthcare services, including doctor's visits, hospital stays, and medical procedures, are also exempt.

- Education services like tuition fees for public schools, universities, and vocational training are not subject to sales tax.

Sales Tax for Online Purchases

With the rise of e-commerce, the collection of sales tax on online purchases has become a significant issue. In Florida, the sales tax applies to online purchases in the same way as it does to in-store purchases. This means that, if you’re an Orlando resident buying goods online, you will generally be charged the same sales tax rate as you would in a physical store.

However, there are certain exceptions, particularly for out-of-state purchases. If an online retailer does not have a physical presence in Florida, they are not required to collect sales tax from Florida residents. In such cases, the onus is on the buyer to self-report and pay the use tax, which is equivalent to the sales tax rate, to the Florida Department of Revenue.

Use Tax in Florida

The use tax is essentially a self-assessed sales tax. It applies to purchases made outside of Florida but used within the state. If you, as a Florida resident, buy goods online from a retailer without a physical presence in Florida, you are responsible for paying the use tax on those purchases. This ensures that all purchases made by Florida residents, regardless of the point of sale, are subject to the same tax rate.

Impact of Sales Tax on the Economy

Sales tax plays a critical role in Florida’s economy, particularly in funding public services and infrastructure development. The revenue generated from sales tax contributes significantly to the state’s budget, allowing for the provision of essential services and the maintenance and improvement of public facilities.

In Orlando specifically, the additional local option tax provides a substantial source of revenue for the city. This revenue is used to enhance the city's infrastructure, maintain its world-class attractions, and support its thriving tourism industry. The sales tax, therefore, not only benefits the state and local governments but also indirectly benefits residents and visitors through the provision of quality public services and an improved standard of living.

Sales Tax and Tourism

Orlando, as one of the most visited tourist destinations in the world, relies heavily on tourism for its economic prosperity. The sales tax on tourist spending is a significant contributor to the city’s economy. Visitors to Orlando, whether they’re staying in the city’s renowned resorts or enjoying its numerous attractions, contribute to the sales tax base, helping to fund essential services and infrastructure that benefit both residents and visitors alike.

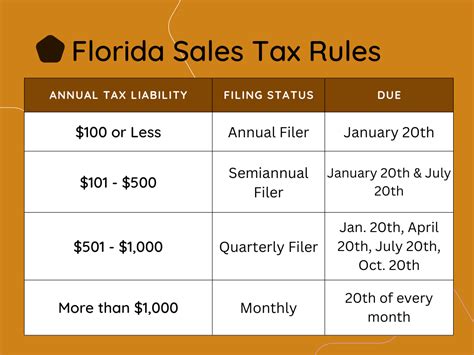

How often are sales tax rates reviewed and adjusted in Florida?

+Sales tax rates in Florida are typically reviewed annually by the Florida Department of Revenue. Adjustments can be made to the state sales tax rate, as well as local option taxes, based on economic conditions, budgetary needs, and public policy considerations.

Are there any sales tax holidays in Florida?

+Yes, Florida occasionally has sales tax holidays, usually around back-to-school time or major holiday seasons. During these periods, certain categories of goods are exempt from sales tax, providing a significant saving for consumers. These holidays are a great way for residents to save on essential purchases like school supplies or holiday gifts.

How can I stay updated on sales tax rates and exemptions in Florida?

+The Florida Department of Revenue provides regular updates and notifications on its website. You can also sign up for their newsletter or follow their social media channels to stay informed about any changes to sales tax rates or exemptions.

Understanding the sales tax landscape in Florida, and specifically in Orlando, is essential for both residents and businesses. It allows individuals to make informed purchasing decisions and businesses to accurately collect and remit sales tax. The sales tax system in Florida is a critical component of the state’s economy, funding public services and infrastructure that benefit all residents and visitors.