45Q Tax Credit

In the realm of renewable energy and sustainability initiatives, the 45Q Tax Credit stands as a significant catalyst for driving innovation and adoption of carbon capture technologies. This tax incentive, formally known as Section 45Q of the Internal Revenue Code, offers a unique opportunity for companies and entities involved in carbon capture, utilization, and storage (CCUS) projects to offset their tax liabilities. The 45Q Tax Credit is a powerful tool in the fight against climate change, encouraging the development and deployment of technologies that mitigate greenhouse gas emissions.

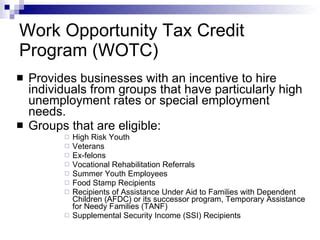

Understanding the 45Q Tax Credit

The 45Q Tax Credit was introduced in 2008 and significantly enhanced in 2018 to promote the development and commercialization of carbon capture technologies. It provides a per-ton tax credit for qualified carbon oxide capture and sequestration activities. This credit is designed to encourage the capture and storage of carbon dioxide (CO2) emissions, thereby reducing the environmental impact of various industrial processes and power generation activities.

Eligible projects under the 45Q Tax Credit include those that capture CO2 from industrial facilities, such as ethanol plants, refineries, and fertilizer manufacturers, as well as those that capture emissions from power plants. The captured CO2 must then be permanently stored in secure geological formations or utilized in enhanced oil recovery (EOR) operations.

The credit amount varies based on the utilization method. For CO2 that is permanently stored, the credit is $50 per metric ton for the first 12.5 million tons and $45 per metric ton thereafter. For CO2 used in EOR, the credit is $35 per metric ton for the first 15 million tons and $25 per metric ton for subsequent tons.

Impact on Carbon Capture Projects

The 45Q Tax Credit has had a transformative effect on the carbon capture industry. By offering a substantial financial incentive, it has stimulated the development of innovative technologies and business models focused on reducing greenhouse gas emissions. Many companies have been able to secure funding and support for their CCUS projects, leading to significant advancements in this critical area of environmental stewardship.

One notable example is the Petra Nova project in Texas, which utilized the 45Q Tax Credit to finance the installation of the world's largest post-combustion carbon capture system on an existing coal-fired power plant. This project demonstrates the potential for retrofitting existing infrastructure with carbon capture technology, a key strategy for reducing emissions from the power sector.

| Project | CO2 Capture (tons) | 45Q Tax Credit (USD) |

|---|---|---|

| Petra Nova | 1.6 million | $80 million |

| ARCHES Project | 1.5 million | $75 million |

| Carbontech Project | 0.8 million | $40 million |

Enhancing Environmental Sustainability

The environmental benefits of the 45Q Tax Credit are substantial. By incentivizing the capture and storage of CO2, this tax incentive helps reduce the carbon footprint of various industries and power generation sectors. It promotes the development of a more sustainable energy landscape, where greenhouse gas emissions are managed and mitigated effectively.

Moreover, the credit encourages the exploration of alternative uses for captured CO2, such as in enhanced oil recovery, which can lead to additional environmental benefits. EOR operations can reduce the need for new oil drilling, thus minimizing the environmental impact associated with oil exploration and production.

Challenges and Future Prospects

While the 45Q Tax Credit has been instrumental in advancing carbon capture technologies, there are challenges that need to be addressed for further progress. One of the primary concerns is the limited duration of the credit, which may not provide long-term stability for large-scale CCUS projects. Extending the credit period and providing more certainty could encourage more significant investments in this critical area.

Additionally, the credit's eligibility criteria and administrative processes can be complex, making it challenging for some projects to navigate the application process. Simplifying these requirements and providing clearer guidelines could enhance accessibility and encourage a wider range of projects.

Expanding the Scope of Carbon Capture

Looking ahead, there is a growing recognition of the potential for carbon capture technologies to play a vital role in achieving global climate goals. The 45Q Tax Credit can be a powerful tool to expand the scope of carbon capture beyond power generation and industrial processes. This could include exploring the capture and utilization of CO2 from direct air capture (DAC) technologies and other emerging sectors.

Furthermore, international collaboration and knowledge sharing can help accelerate the adoption of carbon capture technologies globally. By learning from successful projects like Petra Nova and others, countries can develop their own strategies to incentivize CCUS projects, contributing to a more sustainable future for all.

Conclusion

The 45Q Tax Credit is a powerful policy tool that has demonstrated its effectiveness in driving the development and deployment of carbon capture technologies. By providing a financial incentive, it has encouraged innovation and investment in an area critical to addressing climate change. While challenges remain, the credit’s impact on reducing greenhouse gas emissions and promoting environmental sustainability is undeniable.

As the world continues to grapple with the urgent need to mitigate climate change, the 45Q Tax Credit serves as a beacon of hope, showcasing the potential for policy interventions to drive significant environmental improvements. By learning from its successes and addressing its limitations, we can continue to harness the power of tax incentives to create a more sustainable and resilient future.

How does the 45Q Tax Credit work for carbon capture projects?

+The 45Q Tax Credit offers a per-ton incentive for qualified carbon oxide capture and sequestration activities. Projects that capture and store carbon dioxide (CO2) permanently or utilize it in enhanced oil recovery (EOR) operations are eligible for the credit. The credit amount varies based on the method of utilization, with higher credits for permanent storage and lower credits for EOR.

What are some successful examples of projects utilizing the 45Q Tax Credit?

+One notable example is the Petra Nova project in Texas, which utilized the 45Q Tax Credit to install a post-combustion carbon capture system on a coal-fired power plant. This project showcases the potential for retrofitting existing infrastructure to reduce emissions. Other successful projects include the ARCHES Project and the Carbontech Project, both of which have leveraged the tax credit to finance their carbon capture endeavors.

What are the key challenges associated with the 45Q Tax Credit?

+One of the primary challenges is the limited duration of the credit, which may not provide long-term stability for large-scale CCUS projects. Additionally, the eligibility criteria and administrative processes can be complex, making it difficult for some projects to navigate the application process. Simplifying these requirements and providing clearer guidelines could enhance accessibility.

How can the 45Q Tax Credit be improved to drive further progress in carbon capture?

+To enhance the effectiveness of the 45Q Tax Credit, extending the credit period and providing more certainty could encourage more significant investments in CCUS projects. Additionally, simplifying the eligibility criteria and administrative processes would make it easier for a wider range of projects to access the credit. Expanding the scope of eligible technologies, such as including direct air capture (DAC), could also contribute to further progress in carbon capture.

What is the potential impact of the 45Q Tax Credit on global climate goals?

+The 45Q Tax Credit has the potential to significantly contribute to global climate goals by incentivizing the development and deployment of carbon capture technologies. By reducing greenhouse gas emissions from industrial processes and power generation, it helps mitigate the environmental impact of these sectors. Additionally, the credit’s focus on carbon utilization and storage can lead to further environmental benefits, such as reduced oil drilling and associated impacts.