Free Tax Usa 2023

Welcome to the ultimate guide on Free Tax USA, a comprehensive tax preparation and filing platform designed to simplify the often daunting process of filing your taxes. As we navigate the complexities of the tax landscape, it's essential to have reliable tools at our disposal to ensure accuracy and ease of use. With Free Tax USA, you can expect a user-friendly interface, expert guidance, and the peace of mind that comes with knowing your taxes are being handled efficiently.

In this in-depth exploration of Free Tax USA, we'll delve into the key features, benefits, and real-world examples that make this platform a go-to choice for individuals and small businesses alike. From its intuitive design to its robust security measures, we'll uncover why Free Tax USA is a trusted partner for millions of taxpayers each year. Whether you're a seasoned tax filer or a novice, this guide will provide you with the insights and confidence to tackle your taxes with ease.

Streamlined Tax Preparation: A User-Friendly Approach

At the heart of Free Tax USA’s success is its commitment to creating a seamless and intuitive user experience. The platform is designed with the understanding that tax filing can be complex, and thus, it aims to simplify the process without compromising on accuracy or functionality.

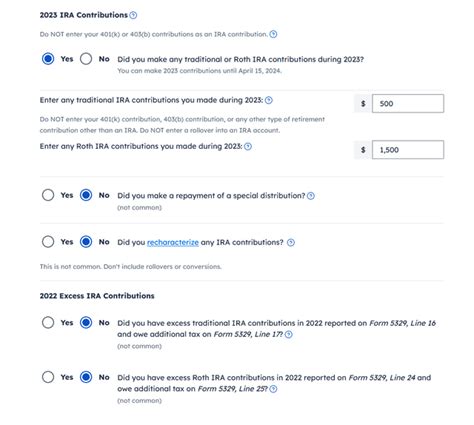

Simplified Data Entry

Free Tax USA boasts a straightforward data entry process, allowing users to input their information quickly and efficiently. Whether it’s W-2 forms, 1099s, or other tax documents, the platform guides users through each step, ensuring that all relevant data is captured accurately.

One unique feature is the ability to import data from previous tax years, saving users valuable time and effort. This import functionality ensures that users can quickly populate their tax forms with the necessary information, making the entire process more efficient.

Interactive Questionnaire

For those who prefer a more guided approach, Free Tax USA offers an interactive questionnaire. This feature walks users through a series of simple questions, helping them identify deductions, credits, and other tax-saving opportunities. The questionnaire is tailored to each user’s unique situation, ensuring that no stone is left unturned when it comes to maximizing their tax refund or minimizing their tax liability.

By answering a few straightforward questions, users can uncover potential tax benefits they may have otherwise overlooked. This feature is particularly valuable for those who are new to tax filing or who want to ensure they're taking advantage of every available deduction and credit.

Real-Time Error Checking

Free Tax USA employs advanced error-checking technology to ensure the accuracy of user inputs. As users progress through the filing process, the platform continuously scans for errors, providing real-time feedback and suggestions to correct any mistakes. This feature not only helps users avoid common pitfalls but also gives them the confidence that their tax return is being prepared correctly.

Additionally, the platform offers a comprehensive review process, allowing users to thoroughly check their return before submission. This final review step ensures that users have a complete understanding of their tax situation and gives them the opportunity to make any necessary adjustments.

Maximizing Tax Benefits: Expert Guidance at Your Fingertips

Free Tax USA goes beyond basic tax preparation by offering expert guidance and insights to help users maximize their tax benefits. The platform is designed to empower users with the knowledge and tools they need to make informed decisions about their taxes.

Deduction and Credit Optimization

One of the key strengths of Free Tax USA is its ability to identify and optimize deductions and credits. The platform utilizes advanced algorithms and tax expertise to analyze user data and suggest strategies for maximizing tax benefits. Whether it’s claiming the standard deduction or uncovering eligible tax credits, Free Tax USA ensures that users receive the full extent of their entitled tax savings.

For example, the platform may suggest strategies such as contributing to a retirement account or taking advantage of education credits. By providing these tailored recommendations, Free Tax USA helps users make the most of their tax situation and potentially increase their refund or reduce their tax liability.

Personalized Tax Strategies

Free Tax USA understands that every taxpayer’s situation is unique, and thus, it offers personalized tax strategies based on individual circumstances. Whether it’s optimizing investments, managing rental properties, or navigating self-employment taxes, the platform provides tailored guidance to help users navigate these complex areas.

Through a combination of advanced algorithms and expert tax advice, Free Tax USA offers a customized approach to tax planning. This ensures that users receive the most relevant and beneficial strategies for their specific tax scenario, helping them make the most informed decisions about their financial future.

Tax Law Updates and Alerts

Staying up-to-date with the ever-changing tax landscape can be a challenge. Free Tax USA takes this burden off users’ shoulders by providing real-time updates on tax law changes and alerts on potential tax savings opportunities. Whether it’s a new tax credit or an updated deduction, users can rely on Free Tax USA to keep them informed and ensure they’re taking advantage of the latest tax benefits.

By providing timely updates and alerts, Free Tax USA ensures that users are always working with the most accurate and advantageous tax strategies. This proactive approach to tax planning helps users stay ahead of the curve and make the most of their tax situation year after year.

Secure and Reliable: Protecting Your Sensitive Information

Free Tax USA prioritizes the security and privacy of user data, employing state-of-the-art encryption and security measures to safeguard sensitive information. The platform understands the importance of trust and confidentiality when it comes to tax filing, and thus, it has implemented robust security protocols to protect user data at every stage of the filing process.

Advanced Encryption Technology

Free Tax USA utilizes advanced encryption technology to secure user data during transmission and storage. This ensures that sensitive information, such as social security numbers and financial details, remains protected from potential threats. By employing industry-leading encryption standards, the platform provides users with the peace of mind that their data is safe and secure.

Two-Factor Authentication

To enhance security further, Free Tax USA offers two-factor authentication. This additional layer of protection requires users to provide a unique code, in addition to their password, to access their account. By implementing this security measure, the platform significantly reduces the risk of unauthorized access, ensuring that only the intended user can access their tax information.

Secure Data Storage

Free Tax USA’s data storage infrastructure is designed with security as a top priority. The platform utilizes secure servers and data centers, ensuring that user data is stored in a highly protected environment. Regular security audits and penetration testing further reinforce the platform’s commitment to data security, providing users with the assurance that their information is safeguarded at all times.

Privacy Policy and Data Protection

Free Tax USA is committed to transparency and user privacy. The platform has a comprehensive privacy policy in place, detailing how user data is collected, used, and protected. Users can rest assured that their information is handled with the utmost care and respect, and that their privacy rights are fully upheld.

Efficient Filing and Quick Refunds: Maximizing Your Time and Money

Free Tax USA is dedicated to making the tax filing process as efficient as possible, ensuring that users can file their taxes quickly and receive their refunds promptly. The platform’s streamlined approach to filing, combined with its efficient processing systems, enables users to navigate the tax landscape with ease and confidence.

E-Filing and Direct Deposit

Free Tax USA offers electronic filing (e-filing) as the default method for submitting tax returns. This modern approach to filing is not only faster and more convenient but also reduces the risk of errors and delays. Additionally, users can opt for direct deposit, allowing their refund to be deposited directly into their bank account, further expediting the refund process.

By leveraging e-filing and direct deposit, users can expect their tax return to be processed more quickly, often within a matter of days. This efficient filing process ensures that users can receive their refunds promptly, providing them with the financial flexibility they need.

Quick Turnaround Times

Free Tax USA is committed to providing users with quick turnaround times for their tax returns. The platform’s efficient processing systems and expert tax team work together to ensure that returns are reviewed and submitted promptly. This dedication to speed ensures that users can receive their refunds as soon as possible, without unnecessary delays.

On average, Free Tax USA aims to have tax returns processed and submitted within 24 hours of receiving complete and accurate information. This rapid turnaround time is a testament to the platform's commitment to efficiency and user satisfaction.

Refund Advance Options

For users who require immediate access to their refund, Free Tax USA offers refund advance options. This feature allows users to receive a portion of their expected refund as a loan, providing them with the financial support they need while their tax return is being processed. This innovative solution ensures that users can access their refund quickly, without having to wait for the full refund amount.

Refund advances are particularly beneficial for those facing financial challenges or unexpected expenses. By providing this option, Free Tax USA demonstrates its understanding of the unique financial needs of its users and its commitment to supporting them through the tax filing process.

Support and Resources: A Dedicated Team by Your Side

Free Tax USA understands that tax filing can be a complex and sometimes confusing process. To ensure users have the support they need, the platform offers a dedicated team of tax experts and a wealth of resources to guide users through every step of the way.

Tax Expert Support

Users of Free Tax USA have access to a team of experienced tax professionals who are available to answer questions and provide guidance. Whether it’s a simple clarification or a complex tax scenario, the tax experts are on hand to offer personalized support and ensure that users receive the best possible outcome for their tax situation.

Through a combination of live chat, email, and phone support, users can connect with tax experts quickly and easily. This dedicated support system ensures that users can navigate the tax landscape with confidence, knowing that they have a team of experts ready to assist them.

Comprehensive Help Center

For those who prefer to explore resources independently, Free Tax USA offers a comprehensive help center. This online repository is packed with articles, tutorials, and FAQs, covering a wide range of tax-related topics. Users can search for specific information or browse through categories to find the guidance they need.

The help center is regularly updated with the latest tax information and resources, ensuring that users have access to accurate and up-to-date content. This self-service support option empowers users to take control of their tax filing journey and find the answers they need quickly and conveniently.

Community Support and Forums

Free Tax USA recognizes the value of community support and has established online forums and community platforms where users can connect with one another. These community spaces provide a place for users to share experiences, offer advice, and seek guidance from fellow taxpayers. It’s a valuable resource for users to learn from each other’s unique tax situations and gain insights into common tax challenges.

By fostering a sense of community, Free Tax USA creates an environment where users can feel supported and connected throughout the tax filing process. This peer-to-peer support system complements the expert guidance offered by the platform, providing users with a well-rounded support network.

A Trusted Companion: Real-World Success Stories

Free Tax USA is more than just a tax preparation platform; it’s a trusted companion to millions of taxpayers. With a proven track record of success, the platform has helped countless individuals and businesses navigate the complexities of tax filing with ease and confidence.

Case Study: Small Business Success

John, a small business owner, had always struggled with the complexities of filing his business taxes. He often spent countless hours researching tax laws and trying to navigate the intricate world of business deductions and credits. However, since discovering Free Tax USA, his tax filing process has become significantly easier and more efficient.

With the platform's intuitive interface and expert guidance, John was able to quickly and accurately prepare his business tax return. The platform's personalized tax strategies helped him maximize his deductions and credits, resulting in a substantial tax savings. Additionally, the secure and reliable nature of Free Tax USA gave John the peace of mind that his sensitive business information was protected.

John's experience with Free Tax USA not only saved him valuable time and effort but also provided him with the confidence to focus on growing his business, knowing that his tax obligations were being handled efficiently and securely.

Case Study: Maximizing Tax Benefits

Sarah, a working professional with a young family, was looking for ways to maximize her tax refund. She wanted to ensure that she was taking advantage of every available deduction and credit to ease the financial burden of raising a family. After hearing about Free Tax USA from a friend, she decided to give it a try.

Using the platform's interactive questionnaire, Sarah was able to uncover a range of tax benefits she had never considered. From education credits to child tax credits, Free Tax USA helped her maximize her refund and reduce her tax liability. The platform's real-time error checking and comprehensive review process gave Sarah the confidence that her tax return was accurate and complete.

Thanks to Free Tax USA, Sarah was able to receive a larger-than-expected refund, providing her with the financial flexibility she needed to support her growing family. The platform's user-friendly approach and expert guidance made the tax filing process a stress-free experience, allowing her to focus on what matters most – her family.

Future Implications: Staying Ahead in the Ever-Changing Tax Landscape

As the tax landscape continues to evolve, Free Tax USA remains committed to staying at the forefront of tax technology and innovation. The platform is dedicated to providing users with the tools and resources they need to navigate the complexities of tax filing, ensuring they remain compliant and take advantage of every available tax benefit.

Continuous Platform Updates

Free Tax USA understands the importance of staying up-to-date with the latest tax laws and regulations. The platform’s team of tax experts continuously monitors legislative changes and updates the platform accordingly. This ensures that users always have access to the most accurate and current tax information, enabling them to make informed decisions about their taxes.

Emerging Tax Technologies

The platform is also focused on incorporating emerging tax technologies to enhance the user experience and improve efficiency. From artificial intelligence (AI) and machine learning to blockchain and biometric authentication, Free Tax USA explores and integrates these technologies to provide users with the most advanced and secure tax filing experience.

By embracing these cutting-edge technologies, Free Tax USA ensures that users can benefit from increased automation, improved accuracy, and enhanced security measures. This dedication to innovation positions the platform as a leader in the tax industry, providing users with a future-proof tax filing solution.

Community Engagement and Feedback

Free Tax USA values the input and feedback of its users and actively engages with the community to shape the platform’s future development. Through user surveys, focus groups, and community forums, the platform gathers insights and suggestions to improve its services and enhance the overall user experience.

By listening to its users, Free Tax USA ensures that the platform remains relevant, user-friendly, and responsive to the evolving needs of taxpayers. This commitment to community engagement and continuous improvement positions Free Tax USA as a trusted partner for taxpayers, helping them navigate the ever-changing tax landscape with confidence and ease.

Is Free Tax USA suitable for complex tax situations, such as self-employment or multiple streams of income?

+Absolutely! Free Tax USA is designed to handle a wide range of tax scenarios, including self-employment and multiple sources of income. The platform’s expert guidance and personalized tax strategies ensure that users can accurately and efficiently prepare their tax returns, regardless of the complexity of their tax situation.

How secure is my personal and financial information on Free Tax USA?

+Free Tax USA takes the security of user data extremely seriously. The platform utilizes advanced encryption technology, two-factor authentication, and secure data storage to protect sensitive information. Additionally, the platform has a comprehensive privacy policy in place, ensuring that user data is handled with the utmost care and respect.

Can I import data from other tax preparation software or services?

+Yes, Free Tax USA supports data import from a variety of tax preparation software and services. This feature saves users time and effort by allowing them to easily transfer their tax data from one platform to another. However, it’s important to ensure that the data is in a compatible format for seamless import.